Tax On Social Security Benefits

You may have to pay taxes on your Social Security benefit, depending on your income level. If your retirement income is over a certain amount, then part of your Social Security benefits may be taxable.

Single-filers with an income between $25,000 and $34,000 will have to pay income tax on up to 50% of their benefits. If they make more than $34,000, then up to 85% of the benefits may be taxable.

Keep this in mind when filing your tax return. You may also be able to withhold your taxes from your Social Security benefits payments, so you arent stuck with a large tax bill on Tax Day. Check your SSA account online or visit your local Social Security office for more information.

When Social Security Claimants Will Get Paid In December Explained

In the new year, people will see a larger check because of the 5.9% cost-of-living increase.

With the COLA increase, the average monthly Social Security benefit for 2022 will rise to $1,657 from $1,565.

The remaining payments for 2021 will be paid out regularly.

Whatever you’ve been receiving throughout the year will continue to be the amount for this final check of 2021.

Some Federal Benefit Recipients Already Have Received An Economic Impact Payment

The IRS emphasizes that federal benefit recipients in these groups who file tax returns already started to receive Economic Impact Payments earlier this month, along with other taxpayers.

Because some federal benefit recipients do not file tax returns, the IRS did not have in its tax systems the current information needed to generate the Economic Impact Payments. Last year, the IRS took the unprecedented step to receive and review data from other federal agencies and use that data to deliver payments automatically to these recipients. This action which had never occurred in previous stimulus efforts minimized risk and burdens for the American public during the pandemic. Due to regular changes in the federal benefits population, the IRS needed to receive updated information this month from other government agencies. With these critical updates, eligible federal benefit recipients who don’t normally file an income tax return will get a payment automatically in the next few weeks.

Making these automatic payments to federal beneficiaries involves a complex, multi-step process to handle recipient data from the other agencies. For the first round of Economic Impact Payments last year, recipients in these groups received payments within four to six weeks after the CARES Act was signed into law. For the American Rescue Plan signed March 11, the IRS projects that it is on track to deliver Economic Impact Payments to federal beneficiaries at the same or faster speed.

Recommended Reading: New Jersey Stimulus Check 2022

Indiana: $325 Rebate Payments

Like Georgia, Indiana found itself with a healthy budget surplus at the end of 2021, and it has authorized two rebates to its residents.

In Dec. 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by Jan. 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to a state information page.

Taxpayers who filed jointly will receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit, and the second payments started rolling out in late August. If you changed banks or dont have direct deposit information on file, youll receive a paper check. A printing delay put mailing the first round on hold for several months, but mailing resumed in mid-August. Checks mailed after that point contain payments for both rebates, for a total of $325 per taxpayer.

Distribution of printed checks is expected to take place through early October. If you did not file your 2021 tax return by the April deadline, you can claim your $125 rebate on your 2022 taxes.

For more information, visit the state Department of Revenue website.

Recommended Reading: When Is The Latest Stimulus Check Coming

Massachusetts: Up To 7% Of Income May Be Returned

Massachusetts taxpayers will receive rebate checksbut how much theyll receive wont be officially announced until September 20. Massachusetts Governor Charlie Baker will use a 1986 law to return $3 billion to state taxpayers.

The state auditors office declared the state surplus to be some $2.3 billion. And under Chapter 62Fthe 1986-era law, tax rebates are allowed when theres a revenue surplus.

Residents are expected to receive about 7% of the amount of income tax they paid to Massachusetts in 2021. For someone with a $75,000 income, that would mean a rebate of about $250, state officials told WBUR.

Recommended Reading: When Will South Carolina Receive Stimulus Checks

Recommended Reading: Irs Gov Stimulus Payment Status

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Read Also: Is The $1 200 Stimulus Check Taxable

What If I Receive Both Social Security And Ssi

If you received Social Security benefits before May 1997, or if you receive both Social Security and SSI, the payment schedule is different. Instead of getting your payments on a Wednesday, you’ll receive your Social Security payment on the third day of each month and your SSI on the first day of each month.

However, those payment dates change if the first or third day of the month falls on a weekend. For instance, Oct. 1 fell on a Saturday this year, so SSI recipients received their October payments a day early on Sept. 30 and their Social Security payment on Monday, Oct. 3. The same will apply in December for January 2023 payments.

Also Check: Stimulus Check For Healthcare Workers

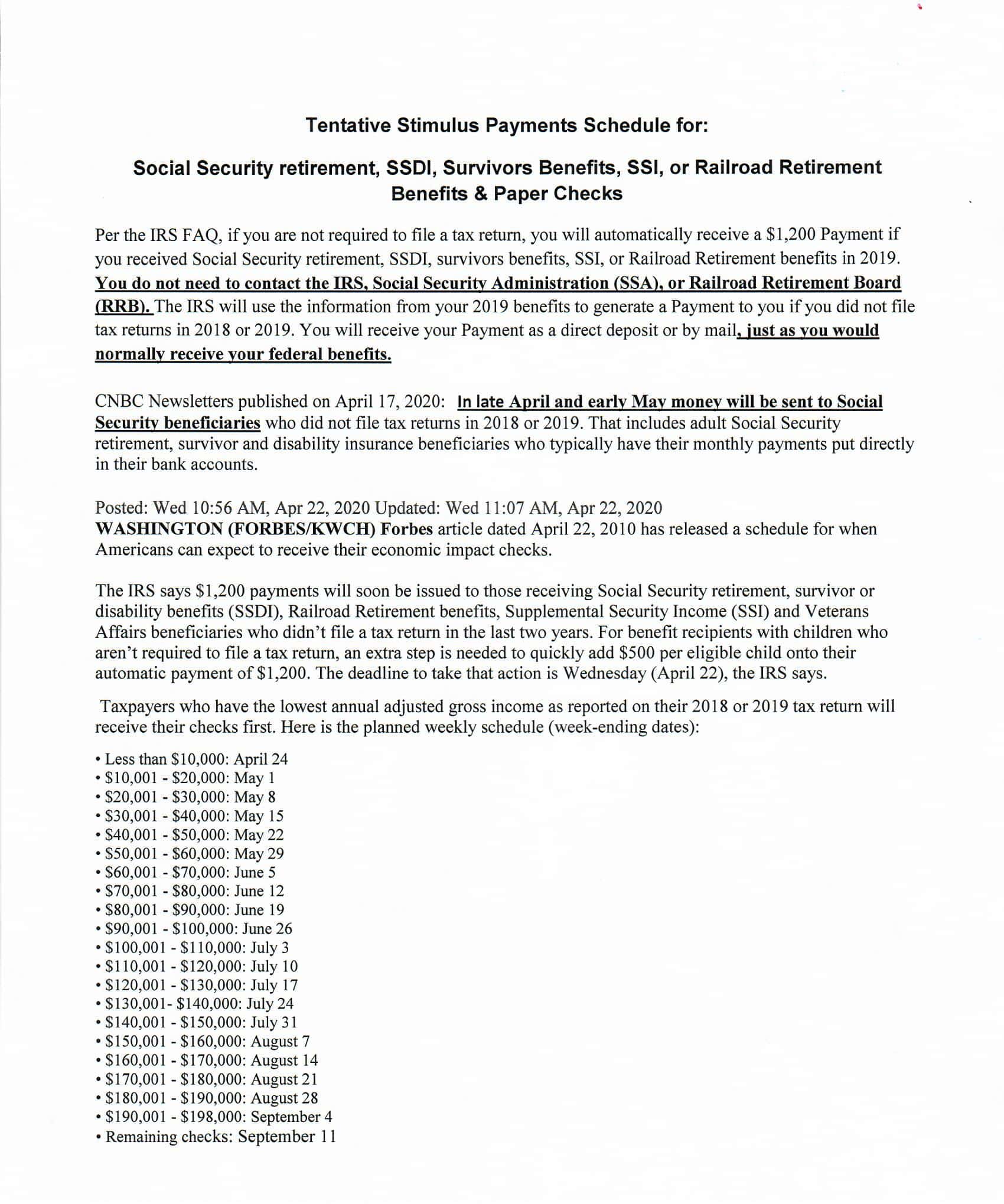

Key Stimulus Payment Dates As Deadline Set For Social Security Recipients

More stimulus payments are being sent out under the American Rescue Plan.

The federal government began processing a third round of economic impact payments in late March, the Internal Revenue Service said ahead of the Easter weekend.

Individuals earning less than $75,000 are eligible for the full $1,400 payments. Those earning between $75,000 and $80,000 get smaller payments, and they cut out completely for those earning upwards of $80,000.

This week, the agency said more than 130 million payments worth around $335 billion have been sent out so far.

However, there was a delay in payments for Social Security recipients and other federal beneficiaries who did not file a 2019 or 2020 tax return or did not use the tool made available on IRS website for non-filers.

Where Is My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can request a trace of your stimulus check. You should only request a payment trace if you received IRS Notice 1444-B showing that your second stimulus check was issued or if your IRS account shows your payment amount and you havent received your second stimulus check.

Learn more about requesting a payment trace here.

You May Like: How To Get Stimulus Check Without Filing Taxes

Other Work Continues On Economic Impact Payments Watch Mail For Checks Eip Cards

In addition to work for federal benefit recipients, the IRS also continues to prepare and deliver additional Economic Impact Payments for other eligible individuals as well as deliver tax refunds.

For those receiving payments in the mail, the IRS urges these taxpayers to continue to watch their mail for these payments, which could include a paper Treasury check or a special prepaid debit card called an EIP Card.

Taxpayers should note that the form of payment for the third Economic Impact Payment, including for some Social Security and other federal beneficiaries, may be different than earlier stimulus payments. More people are receiving direct deposits, while those receiving payments in the mail may receive either a paper check or an EIP Card which may be different than how they received their previous Economic Impact Payments.

Was There A 3rd Stimulus Check

In the majority of cases, the third stimulus installments were sent to taxpayers bank accounts automatically or by mail last spring. The American Rescue Plan approved the payments in March 2021 with the intention of assisting those who were suffering financially as a result of the Covid-19 outbreak.

You May Like: How Can I Apply For Stimulus Check

You May Like: How Are Stimulus Checks Distributed

How Can I Increase My Social Security Disability Payments

Working for at least 35 years before to retiring, being aware of the advantages of working beyond retirement age, and avoiding Social Security taxes may all help you enhance your Social Security Disability payouts. Married applicants might increase their disability payments by claiming their spouses benefits in order to maximize their income.

Federal Benefit Payments Automatic No Action For Most

Most Social Security retirement and disability beneficiaries, railroad retirees and recipients of veterans benefits who are eligible for an Economic Impact Payment do not need to take any action to receive a payment. These payments will be automatic. Like the previous Economic Impact Payments, Social Security and other federal beneficiaries will generally receive this third payment the same way that they receive their regular benefits.

Some federal benefit recipients may need to file a 2020 tax return, even if they don’t usually file, to provide information the IRS needs to send payments for any qualified dependent. Eligible individuals in this group should file a 2020 tax return to be considered for an additional payment for their qualified dependent as quickly as possible.

Recommended Reading: Can I Still Claim My First Stimulus Check

Va Beneficiaries Could Receive Payments By Mid

Those who receive benefit payments from Veterans Affairs may be waiting until the middle of April for their stimulus checks.

“The IRS continues to review data received for Veterans Affairs benefit recipients and expects to determine a payment date and provide more details soon,” the agency said on April 1.

“Currently, the IRS estimates that Economic Impact Payments for VA beneficiaries who do not regularly file tax returns could be disbursed by mid-April. VA beneficiary payment information will be available in the Get My Payment tool at a future date.”

What If My Income Is Lower Than When I Filed My Last Tax Return

If you had decreased income in 2020 due to starting disability benefits and/or losing a job, you might be eligible for the money but you might not get a third stimulus check in 2021. This might happen if you filed a tax return for 2019 income thatâs above the $75,000 or $150,000 thresholds, but you made less income in 2020. You should be able to get the stimulus payment as a rebate if you file a 2020 tax return.

Read Also: Stimulus Check 1 And 2

Is There Any Stimulus For Senior Citizens

There are certain protections for seniors even if it does not include a fourth stimulus check for them. The law makes it simpler for the government to negotiate medication pricing while also extending Medicare to cover hearing services. Although the measure wasnt approved in 2021, theres still hope for it in 2022.

How To Claim Your $1400 Stimulus Check In 2022

- 10:37 ET, Dec 29 2021

SOME Americans can claim a $1,400 stimulus check in the new year.

However, there is specific criteria to follow to receive the cash in 2022.

The new payment will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but havent yet received them.

The last lot of checks are due to go out when eligible taxpayers file their 2021 tax return next year.

Don’t Miss: Information About The Second Stimulus Check

Social Security Payments For November: Where’s Your Money

There’s only one more check to be sent for Social Security beneficiaries in November. Here’s how the schedule works.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Only one more payment is left to be disbursed to Social Security beneficiaries this month. You’ll then receive one more payment next month before you see your increased benefit amount on your check, which starts in January 2023. For SSI recipients, you’ll get your increase in December. We’ll explain why below and how the timing of Social Security payments works.

You’ll get a letter in the mail in December about your Social Security benefits increase for 2023. It’ll have details about your individual benefit rate increase for next year — or you can also check your benefits online if you signed up for a My Social Security account by Nov. 15.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents

Rhode Island: $250 Rebate Per Child

Rhode Island will send a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate checks will be issued automatically starting in October 2022. Taxpayers filing their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December.

Also Check: Stimulus Check Lost In Mail

Also Check: Change Address For Stimulus Check

California Stimulus Check For Ssi Recipients: Are The Social Recipients In Line For A 4th Stimulus Payment In 2022

Around 70 million Americans will benefit from the 5.9 increase in Social Security and Supplemental Security Income benefits in 2022. The 5.9% Cost of Living Adjustment starts with benefits going out to over 64M Social Security beneficiaries this month. The increased payment to around 8M beneficiaries started on December 30. There is also the additional support of the California stimulus check for SSI recipients.

The Golden State Grant for seniors and people having a disability who receive SSI benefits will get a one-time stimulus check of $600. It is part of the COVID-19 relief bill and provides direct aid to people severely impacted by the pandemic.

This relief includes a single grant of $600 to SSI disabled people and seniors. This should help partially to meet the high costs SSI recipients are struggling with during the pandemic. Most California stimulus checks for SSI recipients are going out in paper checks through the US postal service, hence the delay in some cases. The payment started for the SSI recipients is going out on a rolling basis.

California stimulus check for SSI recipients became necessary even as 1.2M older adults and disabled peoples conditions went from bad to worse. Due to the cuts back in 2009 for SSI recipients, the poorest of Californias oldest adults and people with disabilities are hanging on by a thread.

Recommended Reading: Is There More Stimulus Money Coming Out

Stimulus Check Update: These States Are Sending Out Final 2022 Payments

As the holiday season gets into gear, some Americans will be struggling financially more than ever due to high inflation.

Increased prices continue to stretch many families’ budgets, with a recent poll finding that a majority of Americans are concerned about how they’ll afford gifts this year.

While another federal stimulus check remains unlikely, some states are sending out direct payments to help their residents cope with rising costs.

Don’t Miss: Did Not Receive California Stimulus Check

Stimulus Payments 202: Your State Could Still Owe You A Check

South Carolina and Massachusetts are just two of the states issuing payments to taxpayers.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

As the holidays roll in, we could all use some extra money. South Carolina has started issuing for up to $800 to eligible taxpayers. The income tax rebates were approved by state lawmakers as part of this year’s $8.4 billion budget, according to the state Department of Revenue, and payments will continue to go out through December.

South Carolina isn’t the only state issuing residents tax refunds, though: Illinois is still sending out $50 and $100 rebates and Massachusetts began returning $3 billion in surplus tax revenue this month.

Your state could be sending out a rebate or stimulus check, too. Below, see if you qualify and how much you could be owed. For more on taxes, see if you qualify for additional stimulus or child tax credit money.