A New Stimulus Check Update

As noted, this comes at a time when such an effort is nonexistent at the federal level. Which could turn into a political time bomb for Democrats in a few months time, when the midterm elections arrive. Thats because stimulus checks could mitigate the effects of some nettlesome macroeconomic challenges, like soaring inflation and rising gas prices.

Regarding the latter, White House Correspondents Dinner headliner Trevor Noah joked about that very thing over the weekend. And even drew some chuckles from President Biden himself when he told the president not to worry, that things are looking up. Inflation is looking up, gas prices are looking up, rent prices keep going up

Having said that, this is why were seeing efforts like these in different states around the US right now. Along with the relief checks in Maine, of course:

- California: A gas tax rebate of up to $400 per car for up to two vehicles is under consideration.

- Georgia: A tax rebate is coming. It will mean $250 for single filers, $375 for heads of household, and $500 for married filing jointly.

- Hawaii: A tax rebate for every Hawaii taxpayer is under consideration $300 if you make less than $100,000, and $100 if you make over $100,000.

Rhode Island: $250 Rebate Per Child

Rhode Island will send a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate checks will be issued automatically starting in October 2022. Taxpayers filing their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December.

Easy Ways To Manage Your Finances From Home

Uses our online and mobile banking tools to watch your balances, check your accounts, pay your bills, and deposit checks. It is easy, safe, and secure. Check out these videos to receive all the excellent features available to use 24/7 from your home.

Online Banking Overview

How to Register for Online Banking

Mobile Banking Overview

How to Use Mobile Deposit

Also Check: I Still Haven’t Gotten My First Stimulus Check

Maine Tax Relief Credit

Maine Relief Tax Credit

The Maine Revenue Service is available to assist with the application. The process usually takes approximately 15 minutes, with little to no waiting time. The telephone number to call the State of Maine Revenue for assistance is 624-9924.

Maine residents need to file State of Maine 2021 Tax forms in order to be eligible for the recently approved $850 relief credit. Filing federal forms IS NOT required for applying for the $850 relief fund. For more information go to:

These forms are also available on the Maine Revenue Services website.

Tax Filing Assistance

The AARP and the United Way are offering free filing assistance throughout the Greater Portland area. To learn more contact the AARP at 518-8579 or the United Way of Southern Maines CA$H Maine program by dialing 211 or 207-347-2335

Federal and State Tax Forms

Portland Public Library and all of its branches make 1040 Federal Tax Form, Federal 1040 instruction booklets available every tax season.

The most recent U.S. Tax filing season ended on Friday, April 15, 2022. The State of Maine will receive tax forms throughout the summer of 2022.

If you need forms go to www.irs.gov/forms-instructions or www.irs.gov/orderforms to view, order or download the form, or call 800-829-3676 to place an order by phone.

Annual Tax Forms & Schedules

Federal Forms

Maine State Forms

States Step In With Inflation Relief Payments In Absence Of Federal Stimulus Checks

Even though the federal government has stepped out of the stimulus support system, other states have stepped in and are going ahead with their stimulus proposals. Though not as generous as the federal stimulus checks, they could be enough to pull people through the ravages of the high prices on all fronts.

Over a dozen states have moved to get their proposals approved though not all will be approved given the Republican opposition to more stimulus support in an election year. But some states have gone ahead with it and have already passed the bill.

Most states are falling back on huge surplus revenues collected during the boom periods of the last two quarters of 2021. This has been supplanted by the generous funds they received under the American Rescue Plan Act signed by President Biden in March 2021. The third stimulus check or the Economic Impact Payment is part of that act.

You May Like: Who Is Getting The New Stimulus Checks

Georgia: $250 Rebate Payments

Thanks to a historic state budget surplus, Georgia residents who filed both their 2020 and 2021 tax returns were eligible to receive rebate payments based on their tax filing status:

- Single filers: Maximum $250

- Head of household: Maximum $375

If you owed income tax or other payments to the state such as delinquent child support payments, you may have received a smaller rebate. Partial-year residents may have also received a smaller rebate.

Residents who filed their taxes before Gov. Brian Kemp signed the legislation received their rebates via a separate payment. The state expected to send all rebates for returns filed by April 18 by early August.

Georgia taxpayers can learn more via the Georgia Department of Revenue.

What Is The Maine Direct Relief Payment

Maineâs relief plan offers direct payments of $850 to individuals and $1,700 to joint filers.

These payments are meant to help residents cover necessities like groceries, gas and utilities, according to the governorâs office, but residents can use the money for any purpose they choose.

Per the governorâs announcement, Maine residents must meet the following requirements to qualify for the relief payment:

- File a Maine individual income tax return as a full-time resident by October 31, 2022.

- Canât be claimed as a dependent on another residentâs tax return

- Have a federal adjusted gross income of less than:

- $100,000 if filing single or married and filing separately

- $150,000 if filing as head of household

- $200,000 for couples filing jointly

You May Like: How Much Were Stimulus Checks In 2021

When Will Maine Revenue Services Send The $850 Relief Checks

According to the state, Mainers can expect to start seeing the first round of checks arrive in their mailboxes in June 2022. Maine Revenue Services will send out subsequent rounds on a rolling basis through the end of the year as tax returns are received.

Residents can use the money for whatever they need to so that they can navigate the rising costs being pushed by disruptions in the supply-chain and other pandemic-related disruptions. The hope is that this one-time cash infusion will help position Maines economy for continued post-pandemic prosperity.

Hope Floats Through Other Forms Of Federal Payments

Though several pockets of the economy continue to grow at a healthy pace, the unemployment rate remains way above the pre-pandemic mark. The end of the unemployment stimulus checks and the enhanced child tax credit stimulus check has further pushed families into uncertain times.

Numerous proposals continue for another stimulus check and the extension of the enhanced CTC stimulus check for children. But they remain a distant dream till the economy begins to turn around.

Read Also: Taxes On Stimulus Check 2021

Who Will Get It

To be eligible for the stimulus checks from Maine, residents must have filed their state individual income tax returns as full-time residents. Also, they must not be claimed as a dependent by any other taxpayer.

Moreover, the adjusted gross income of single filers should be less than $100,000. The income limit for head of household filers is $150,000, while for couples filing jointly, it is $200,000.

Those who havent yet filed their 2021 Maine individual income tax return, either due to their financial situation or they are late in doing so, have until Oct. 31, 2022 to file their tax return and claim their $850 stimulus check.

You can view the status of your check at . If you have any questions regarding the stimulus checks from Maine, you can visit Maine.gov/reliefchecks, or call Maine Revenue Services at 624-9924.

Minnesota: $750 Payments For Frontline Workers

Some frontline workers could receive a one-time payment of $750, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021, and were not eligible for remote work. Workers with direct Covid-19 patient-care responsibilities must have had an annual income of less than $175,000 between Dec. 2019 and Jan. 2022 workers without direct patient-care responsibilities must have had an income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Walz recently proposed using the states $7 billion budget surplus to fund a generous relief package, proposing that Minnesotans receive tax rebate checks of $1,000 per person. Doing so would require action from the state legislature.

Recommended Reading: What Is The Third Stimulus Check

Who Is Eligible For The $850 Inflation Relief Checks

Unlike last years relief program, which was a thank you to Mainers who worked during the early days of the pandemic, there is no wage requirement this time around. The state expects to send out checks to approximately 333,000 more residents through this program.

Only full-time Maine residents that file a 2021 Maine individual income tax return and meet the income thresholds will receive the $850 inflation relief checks. Although the tax filing deadline has passed, Mainers can still submit a tax return to access the boost to their finances. However, they only have until 31 October 2022.

For those who dont normally file a Maine individual income tax return and need assistance the state provides the following information to identify free tax help.

Maines Legislature Passed A Budget Which Includes $850 Checks For Over 850000 Mainers Who Are Grappling With The Cost Of Pandemic

Inflation has been rising at a clip not seen in four decades, pushing up prices on just about everything, eating into household finances. To help residents grappling with the increased costs as a result of pandemic-driven inflation, the Maine legislature passed a budget that included relief checks for Mainers.

An estimated 858,000 residents will be eligible for the extra cash to help cover the increased cost of things ranging from higher energy costs to increased prices of everyday goods. Governor Janet Mills proposal was passed overwhelmingly by the state legislature which will return half the budget surplus to the taxpayers for a total of $729.3 million.

Don’t Miss: Nc $500 Stimulus Check Update

Maine: $850 Direct Relief Payments

Gov. Janet Mills signed a supplemental budget on April 20 to authorize direct relief payments of $850 for Maine taxpayers.

Full-time residents with a federal adjusted gross income of less than $100,000 are eligible. Couples filing jointly will receive one relief check per taxpayer for a total of $1,700.

Taxpayers are eligible for the payment regardless of whether they owe income tax to the state.

Residents who did not file a state tax return for 2021 can file through Oct. 31 to claim their payment.

The one-time payments, which are being funded by the states surplus, started rolling out via mail in June to the address on your 2021 Maine tax return.

The supplemental budget also includes an increased benefit for Maines earned income tax credit recipients.

Read more: Everything You Need To Know About Maine Stimulus Checks

What Other Relief Is Available

The Mills Administration is encouraging Maine people to carefully examine their eligibility for up to $1,400 in additional tax relief available per person this filing season, thanks to laws already enacted specifically aimed at supporting low- and middle-income Maine families. Learn more about the Homestead Exemption Program, and consider claiming the State Property Tax Fairness Credit, the Maine Earned Income Tax Credit, and the Sales Tax Fairness Credit.

Recommended Reading: Could There Be Another Stimulus Check

Maine Gives A Generous State Stimulus Check: Inflation Relief Payments From Other States In 2022

The pandemic brought a wave of stimulus checks to the American people, businesses, and other entities that were unprecedented and finally worked out to around $5 T As the COVID-19 pandemic struck, the federal administration moved in quickly to send out the first of the stimulus payments in March 2020.

The world economy went into a total shutdown and the government realized that people would soon find it tough to even put food on the table.

And as the lockdown period extended it appeared that the administration would go on indefinitely to bail the economy out of the desperate situation.

The introduction of vaccines, the strict travel restriction, and the widespread mask mandate improved the situation and the US economy reveled in a rapid and sharp recovery. Pooled with the trillions in stimulus money pumped into the economy, inflation finally exploded in the last quarter of 2021 to a level not witnessed in decades.

Massachusetts: Up To 7% Of Income May Be Returned

Massachusetts taxpayers will receive rebate checksbut how much theyll receive wont be officially announced until September 20. Massachusetts Governor Charlie Baker will use a 1986 law to return $3 billion to state taxpayers.

The state auditors office declared the state surplus to be some $2.3 billion. And under Chapter 62Fthe 1986-era law, tax rebates are allowed when theres a revenue surplus.

Residents are expected to receive about 7% of the amount of income tax they paid to Massachusetts in 2021. For someone with a $75,000 income, that would mean a rebate of about $250, state officials told WBUR.

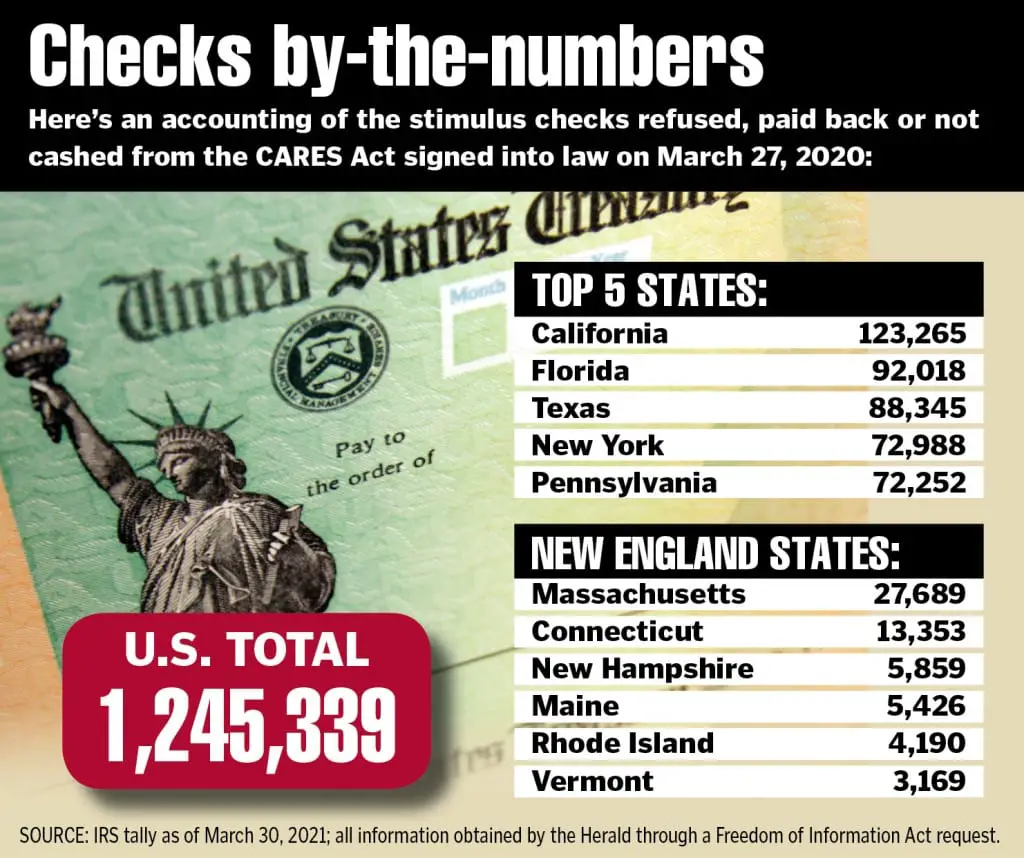

Recommended Reading: Are Stimulus Checks Part Of The Cares Act

New Jersey: $500 Rebate Checks

In fall 2021, Gov. Phil Murphy and the New Jersey state legislature approved budget measures to send one-time rebate checks of up to $500 to nearly 1 million families.

New Jersey is also sending $500 payments to those who file taxes using a taxpayer identification number instead of a Social Security number. The Excluded New Jerseyans Fund applies to nonresident and resident aliens, their spouses and dependents.

State To Begin Issuing $850 Checks This Week But Envelopes In Short Supply

The Mills administration rejected the idea of using direct deposits to issue the checks, in part to avoid errors associated with people changing bank accounts or having their taxes filed by a professional who provided a different bank account. The state has the mailing address of all taxpayers but doesnt have bank account numbers for a large number of them.

To be eligible, individuals must file a Maine individual tax return as a full-time resident by Oct. 31, 2022, not be claimed as a dependent on anothers tax return and have a federal adjusted gross income of less than $100,000 as individuals , less than $150,000 as head of household or less than $200,000 for couples filing jointly.

Anyone who is eligible but has not already filed a return must do so by Oct. 31, 2022, to claim the $850 check. This could include people who are late in filing or people in a financial situation that does not require them to file, such as certain low-income Social Security recipients.

Read Also: Is There Anymore Stimulus Checks Coming

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022 can expect to receive their returns in September or October. For residents filing their 2021 return between Aug. 1 and Dec. 31, you can expect your payment up to 12 weeks after filing.

Here Is Some Information To Help You Understand The Stimulus Check Process

How Much Will You Receive?

The amount of your check will depend on several factors. Click here to use this calculator to see how much you may receive.

When Will I receive my Stimulus Check?

Checks will be directly deposited starting on April 15 in order of income level . The checks will put into the same accounts used for tax refunds.

Paper checks will be mailed out based on income level starting on April 20 and will go through September 11.

Can I register for Electronic Payments and Check on My Payment Status?

Yes, the IRS is in the process of setting up a website that allows you to check your status as well as update your electronic and mailing information. Click here for more the link and more information.

Will I Be Notified that I Received My Check?

Yes, 15 days after your check was deposited or mailed, you will receive a notice from the IRS that will show the method of payment as well as the amount. The IRS will also include a phone number for you to call with any questions.

For more information about the stimulus check, please visit the IRS website by clicking here.

Be Aware of Scammers

The IRS will not call, text, email, or reach out to you via Social Media for your account information. Also, be aware of clicking on any links or attachments that state they have information regarding your stimulus checks or that ask for personal and bank related information.

Don’t Miss: Who Is Eligible For 4th Stimulus Check

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Read more: California Families To Receive Stimulus Checks Up To $1,050