When Is The Deadline For Claiming Stimulus Or Child Tax Credit Money

The deadline for claiming your money depends on if youre required to file a tax return or not. Youre generally not required if you file single and earn less than $12,550 per year.

You have until Tuesday, Nov. 15, to complete a simplified tax return to claim your missing stimulus or child tax credit money if youre not typically required to file taxes. Thats roughly one month away. To help, the IRS is keeping the free file site open available until .

If you filed a tax extension earlier this year or havent filed yet, your deadline to submit your tax return if youre required to file was . That was also the last day to file Form 1040 to avoid a late-filing penalty.

If you were affected by one of the recent natural disasters, such as Hurricane Ian, you have until Feb. 15, 2023, to file. If you live in an area covered by Federal Emergency Management Agency disaster declarations, like Kentucky or Missouri, you have until to file.

You could soon miss out on your stimulus and child tax credit money.

What Does Payment Status Not Available Mean

According the stimulus check FAQ , you might see Payment Status Not Available if you are required to file a tax return but havent yet, the IRS hasnt finished processing it if you have, or youre not eligible.

Be patient and check back in with the Get My Payment app if youve recently filed your returns. If youve received your tax return payment and still see the Payment Status Not Available, message, call 800-919-9835 for the Economic Impact Payment information line.

Looking for more financial resources? Heres how to file for unemployment online.

- The best all-in-one printers to help keep your paperwork in order

Also Check: Irs Stimulus Check Sign Up

Heres What Veterans And Ssi Ssdi Beneficiaries Should Know

The IRS tracking tool Get My Payment is designed to tell you the status of your third stimulus check. People who receive Social Security benefits like SSDI and SSI and veterans who dont file taxes can also see their payment status in the tracker tool. Tens of millions of Social Security recipients and veterans should have already received their $1,400 payment.

Also Check: Who Qualified For Stimulus Checks In 2021

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Don’t Miss: When Did We Get The Third Stimulus Check

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments ended at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2022.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Also Check: Is There Talk About Another Stimulus Check

Advance Child Tax Credit

Even if you dont pay any taxes, you may qualify for a refund of the CTC.

The CTC was expanded under the American Rescue Plan Act of 2021 for tax year 2021 only. If you are eligible, you should have begun receiving advance Child Tax Credit payments on July 15. The payments will continue monthly through December 2021. Under ARPA, families are eligible to receive:

- Up to $3,000 per qualifying child between ages 6 and 17

- Up to $3,600 per qualifying child under age 6

The Internal Revenue Service began sending out letters in early June to more than 36 million families who may be eligible for the monthly payments. Most families do not need to do anything to get their payments, as long as theyve filed their 2020 or 2019 tax return. Learn more about the letter and how it can help you determine your eligibility.

Do You Apply My Tax Rebates To Other Amounts I Owe

Don’t Miss: What Were The Three Stimulus Payments

Can I Check The Status Of My Third Stimulus Check

Taxpayers can track the status of their payments using the IRSs Get My Payment tool, which is updated once a day. You will likely receive one of three types of messages: Payment Status will show you the date your payment was processed and will tell you if you will receive funds via direct deposit or in the mail.

Read Also: Stimulus Check Change Direct Deposit

What Do Federal Benefit Recipients Who Dont File Taxes Need To Get Payment

No further action will be needed to receive a direct payment for most beneficiaries of Social Security retirement and disability, railroad retirees and those who received veterans benefits last year. Like the first two rounds of stimulus checks, the new payments will be sent out the same way benefits are normally paid.

But there are instances where some people receiving the automatic third payment based on their federal benefits information will need to file a 2020 tax return, regardless of whether they normally dont file one.

For instance, if your payment doesnt include a check for your qualified dependent, and that person didnt get one, the federal benefits recipient would need to file a 2020 tax return to be considered for the additional payment.

Also, those who are eligible but didnt get the first or second stimulus check or got less than the full amount may need to file a 2020 tax return to be eligible for the 2020 Recovery Rebate Credit. More information on that can be found here.

Recommended Reading: Recovery Rebate Credit Third Stimulus

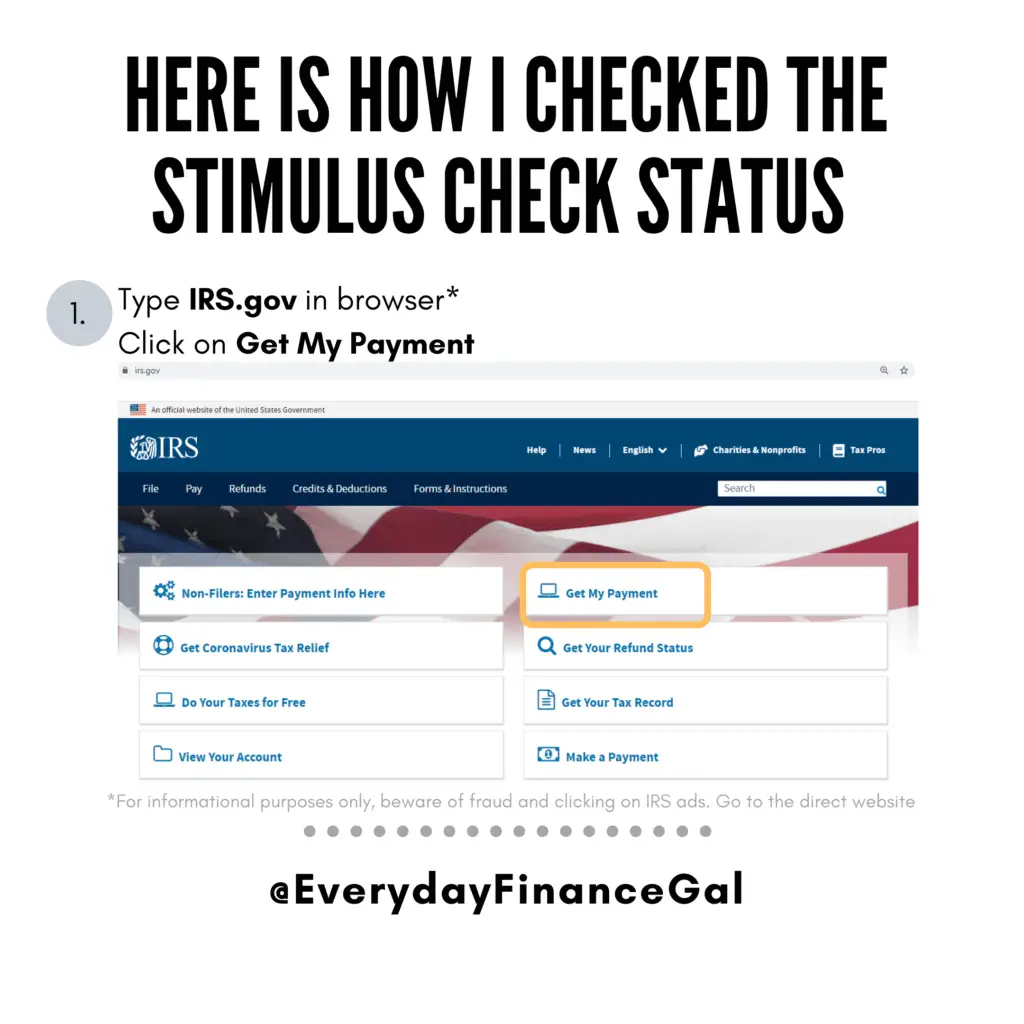

Irs Get My Payment: How To Use The Online Tracker Tool

To get an update on your third stimulus check using Get My Payment, enter your Social Security number, date of birth, street address and ZIP or postal code. The tool will display a message with information about your payment. You can see things like whether your money was sent or is scheduled to be sent, the payment method and the date your stimulus money was issued. The tool may also say it cant yet determine your status see more below about error messages.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

You May Like: When Will The Stimulus Check Come Out

Will Tax Refunds Be Delayed Longer For Americans As The Irs Tries To Implement Tax Code Changes In The Midst Of Tax Season

Roughly 7.6 million returns havent been processed yet so far this tax season, according to IRS filing statistics through the week ended March 12. That’s nearly three times the number in the same period last year, when 2.7 million faced delayed processing.

Experts say that most Americans shouldnt expect a major delay in their refunds.

IRS has said there are no delays in tax refunds, unless tax returns trigger a closer look with information that warrants additional consideration as with significant changes from prior returns on information different than on IRS systems, says Steber.

Still, some Americans who made sure to file electronically on Feb. 12 when tax season kicked off contacted USA TODAY this month and said they were still waiting for the IRS to process their returns.

The IRS has said that the typical turnaround time for refunds is 21 days.

Some tax professionals are worried that millions of filers could face significant processing delays, especially those who already filed their taxes if they end up having to file an amended return to take advantage of new tax breaks on unemployment and dependent children from the latest relief package passed last week.

What If I Didnt Get The Right Amount

Some people may get their checks quickly, yet discover that the payment amount is incorrect that could most likely be due to their dependents or changes in income.

The law provides $1,400 per adult and dependent, as long as the household income falls below the income threshold for eligibility. In the current bill, single people whose adjusted gross income was below $75,000 and married couples with income below $150,000 will receive their full payments, as well as their dependents. Payments decline for earnings above that, cutting off entirely for single people earning $80,000 and $160,000 for married couples.

But some people may not get the right amount, especially if they havent yet filed their 2020 tax returns. For instance, if a family had a baby last year but hasnt yet filed their 2020 returns, the IRS would base their payments on their 2019 returns which wouldnt include their new baby. In that case, the family would receive $2,800 for themselves, but not the extra $1,400 for their child.

The IRS said people who are paid less than they should receive due to changes in their tax situation in 2020 will eventually receive the extra money. When they file their 2020 tax return, the IRS will check if they are owed more, such as in the case of a baby born last year. If that happens, the IRS will automatically issue the additional $1,400 check to the family, officials said.

Article source: https://www.cbsnews.com/news/stimulus-check-irs-payments-tracking-2021-03-18/

Also Check: Did Not Receive California Stimulus Check

Who Qualifies For A Stimulus Check And How Much Will I Receive

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

How The Former Stimulus Check Portal Worked

The old “Get My Payment” tool that was taken down allowed you to:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

To access the tool, you were asked to provide a:

- Social Security Number or Individual Tax ID Number

- Street address and

- Five-digit ZIP or postal code.

If you filed a joint tax return, either spouse could access the portal by providing their own information for the security questions used to verify a taxpayer’s identity. Once verified, the same payment status was shown for both spouses.

If you submit information that didn’t match the IRS’s records three times within a 24-hour period, you were locked out of the portal for 24 hours. You were also locked out if you previously accessed the system five times within a 24-hour period.

For third-round stimulus checks, the “Get My Payment” tool displayed one of the following:

1. Payment Status. If you got this message, a payment been issued. The status page showed a payment date, payment method , and account information if paid by direct deposit.

2. Need More Information. This message was displayed if your 2020 tax return was processed but the IRS didn’t have bank account information for you and your payment had not been issued yet. It also may have meant that your payment was returned to the IRS by the Post Office as undeliverable.

Don’t Miss: I Didn’t Receive My 3rd Stimulus Check

Recovery Rebate Credit Topic A: General Information

These updated FAQs were released to the public in Fact Sheet 2022-27PDF, April 13, 2022.

If you didn’t get the full amount of the third Economic Impact Payment, you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don’t usually file taxes – to claim it. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program. The fastest way to get your tax refund is to file electronically and have it direct deposited , contactless and free, into your financial account. You can have your refund direct deposited into your bank account, prepaid debit card or mobile app and will need to provide routing and account numbers.

If you didn’t get the full amounts of the first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t usually file taxes – to claim it. DO NOT include any information regarding the first and second Economic Impact Payments or the 2020 Recovery Rebate Credit on your 2021 return.

Q A1. How does the 2021 Recovery Rebate Credit differ from the 2020 Recovery Rebate Credit?

A2. Some eligible individuals received more than one third Economic Impact Payment.

The IRS sent additional or plus-up payments to people who:

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Also Check: Where Can I Cash Stimulus Check