What Information Do You Need To Claim The Recovery Rebate Credit

The worksheet mentioned above asks whether you can be claimed as a dependent and whether you have a valid Social Security number. Then it wants to know your EIP 1 and EIP 2 amounts.

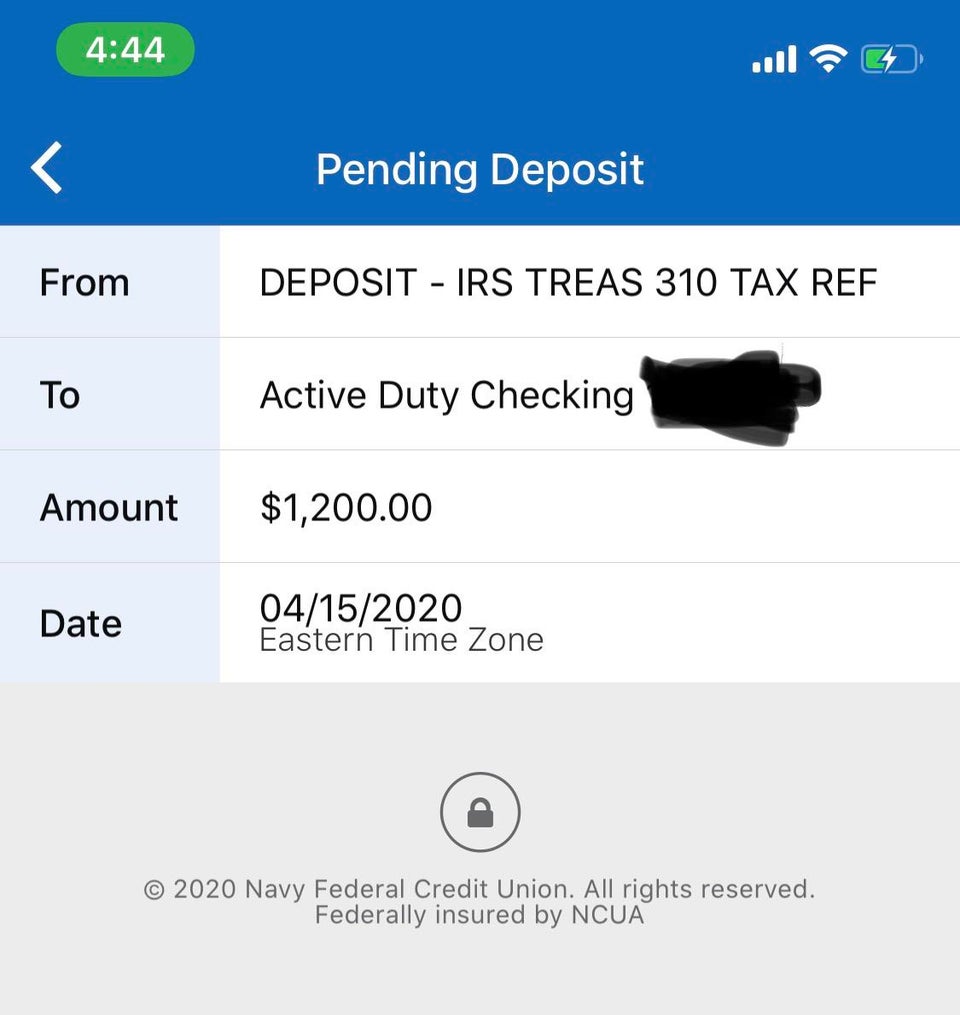

Don’t remember how big those stimulus checks were? You’ll need to pull the information from the letters the IRS sent you in 2020 and 2021 . Sent 15 days after your payments were made, IRS Notice 1444 and Notice 1444-B contain details about your stimulus check amounts.

If you accidentally threw away the stimulus check letters, no biggie.

“A lot of people opened that letter and tossed it out. They’re like, ‘Oh no, now what do I do?'” Pickering says. “If you received a direct deposit, you have a bank statement that shows how much money you received. That’s all you need in order to do the reconciliation.”

You can also get the information by making an IRS account here.

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

Will People Receive A Paper Check Or A Debit Card

The IRS encourages people to check Get My Payment for additional information the tool on IRS.gov will be updated on a regular basis starting Monday, March 15. People who don’t receive a direct deposit should watch their mail for either a paper check or a debit card. To speed delivery of the payments to reach as many people as soon as possible, some payments will be sent in the mail as a debit card. The form of payment for the third stimulus payment may differ from the first two.

People should watch their mail carefully. The Economic Impact Payment Card, or EIP Card, will come in a white envelope prominently displaying the U.S. Department of the Treasury seal. It has the Visa name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card. Information included with the card will explain that this is an Economic Impact Payment. More information about these cards is available at EIPcard.com.

Also Check: I Never Received Any Stimulus Check

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Read Also: Get My Stimulus Payment 1400

I Got My Stimulus Check On A Debit Card And Lost It Or Threw It Out How Can I Get A New One

You can request a replacement by calling 800-240-8100. Select option 2 from the main menu. Your card will arrive in a plain envelope which displays the U.S. Treasury seal and Economic Impact Payment Card in the return address. It will be issued by Meta Bank, N.A. The envelope will include instructions to activate the card, information on fees, and a note from the U.S. Treasury.

How Long It Will Take To Get A Stimulus Check After Filing Taxes

The IRS sends out most tax refunds within 21 days, or three weeks, of accepting your return. If your taxes are incomplete, impacted by fraud, require close review or contain errors, you may have to wait a while for your refund.

The fastest way to get your refund and any remaining EIP funds is to file digitally and select direct deposit as your refund method. You can check the Where’s My Refund? page, which refreshes daily, starting 24 hours after sending in an electronic return and four weeks after mailing your paper return.

Recommended Reading: Amount Of All Stimulus Checks

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Should I File My 2020 Taxes Now

The IRS already began issuing stimulus payments based on your latest filed tax return between 2018 and 2019. If you are required to file a tax return and havent filed your 2020 taxes, you may want to consider filing since you may be eligible for a tax refund. Last tax season about 72% of taxpayers received a tax refund and the average tax refund was close to $3,000.

Also Check: Who’s Eligible For The Third Stimulus Check

What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments – by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

Do I Qualify For The Child Tax Credit

Nearly all families with kids qualify. Some income limitations apply. For example, only couples making less than $150,000 and single parents making less than $112,500 will qualify for the additional 2021 Child Tax Credit amounts. Families with high incomes may receive a smaller credit or may not qualify for any credit at all. For more detail on the phase-outs for higher income families, see How much will I receive in Child Tax Credit payments?

If you have any questions about your unique circumstances, visit irs.gov/childtaxcredit2021.

Read Also: Can Stimulus Check Be Taken For Back Taxes

How Much Will I Receive In Child Tax Credit Payments

Most families will receive the full amount: $3,600 for each child under age 6 and $3,000 for each child ages 6 to 17. To get money to families sooner, the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of $300 per child under age 6 and $250 per child between the ages of 6 and 17.

This amount may vary by income. These people qualify for the full Child Tax Credit:

- Families with a single parent with income under $112,500

- Everyone else with income under $75,000

These people qualify for at least $2,000 of Child Tax Credit, which comes out to $166 per child each month:

- Families with a single parent with income under $200,000

- Everyone else with income under $200,000

Families with even higher incomes may receive smaller amounts or no credit at all.

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couple’s total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individual’s online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

You May Like: How Do I Apply For The 4th Stimulus Check

Is There A Deadline To Get My Stimulus Check

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement. You must use GetCTC.org

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

Can You File Taxes With No Income To Get Stimulus

Asked by: Tre VonRueden

Non-Filer, Zero Income: If you have zero or no income and are not normally required to file a tax return, you can just file a 2021 Tax Return to claim the 2021 Recovery Rebate Credit and be done. Instructions on how to file a zero income 2021 Tax Return to claim the third stimulus payment.

You May Like: How To Check Your Stimulus Check

Recovery Rebate Credit Topic A: Claiming The Recovery Rebate Credit If You Arent Required To File A 2020 Tax Return

These updated FAQs were released to the public in Fact Sheet 2022-26PDF, April 13, 2022.

If you didn’t get the full first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return to claim it.

Q A1. I used the Non-Filers: Enter Payment Info Here tool in 2020 and dont usually file a tax return. How can I claim a 2020 Recovery Rebate Credit?

A1. If you’re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit, even if you usually dont file a tax return.

You will need the amount of all first and second Economic Impact Payments to calculate the 2020 Recovery Rebate Credit. You can find the amounts you received in your IRS Online Account.

Tax year 2020 returns can be filed electronically only by paid or volunteer tax return preparers. If you prepare a prior year tax return yourself, you must print, sign and mail your return. There are various types of tax return preparers, including certified public accountants, enrolled agents, attorneys, and others who can assist you in filing your return. For more information about these and other return preparers who might be right for you, visit Need someone to prepare your tax return? on IRS.gov/filing.

The safest and fastest way to get a tax refund is to use direct deposit.

The safest and fastest way to get a tax refund is with direct deposit.

DO NOT file an amended tax return.

How Do I Get My Stimulus Check

If youve filed a tax return for tax year 2019 or 2018 or submitted your information to the 2020 IRS Non-filer portal, you dont need to do anything. The IRS shouldve automatically sent your payment. Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security Insurance and Veterans Affairs beneficiaries shouldve also automatically received a check.

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or by using GetCTC.org if you dont have a filing requirement.

To use GetCTC.org, youll need a phone number or email address. Youll also need to provide your full name , mailing address, date of birth, Social Security Number, bank account information , 2019 Adjusted Gross Income , and details for any qualifying children you have.

9. What if I dont have an email address?

Recommended Reading: Didnt Get Any Stimulus Checks

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Also Check: Who Qualified For Stimulus Checks In 2021

What If I Dont Have A Bank Account

If you dont have a bank account, a paper check will be sent to the address you listed on your tax return.

Direct deposit is the quickest and safest way to get payments. Alternatives to receiving a paper check are opening a bank account or using a prepaid debit card. Once you get a card, you may need to contact the company directly to find the account and routing numbers needed for direct deposit. To find a bank, you can view this list of accounts offered by financial institutions that meet national standards. You can also use payment apps like CashApp, Venmo, or PayPal.

Do not provide the bank account information for someone else. Different names on the tax return and bank account will trigger a reject of the deposit, causing the IRS to send you a paper check which will delay the delivery of your payment.

I Received $1800 In Stimulus Checks After Filing My Taxes Wrong Im Still Going To Keep The Cash

- 4:36 ET, Nov 30 2021

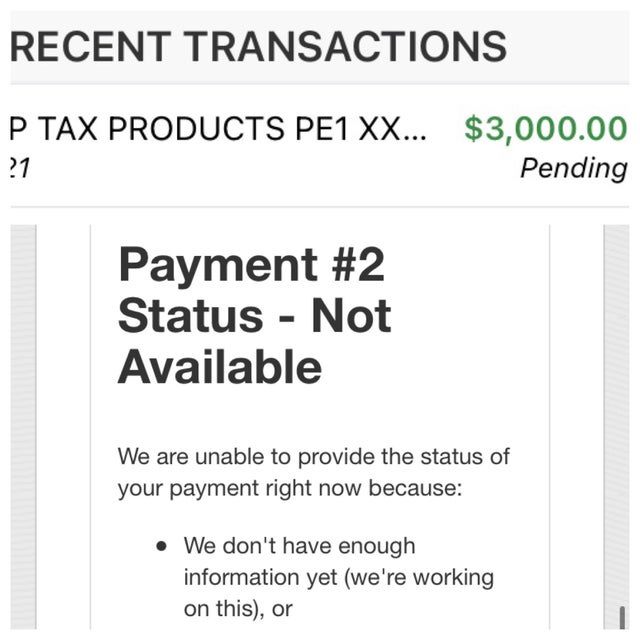

A TAXPAYER claimed they received $1,800 in stimulus checks that they weren’t entitled to after submitting their returns incorrectly.

The unnamed Reddit user, 20, said they made an error when completing their W-2 form in February 2020 – a month before the first round of stimulus checks was introduced.

Employers are required to send out the W-2 form, known as the Wage and Tax Statement, by January 31. Workers have around two months to complete the document before their tax returns are due.

The Reddit user said: “When I filed taxes, I mistakenly clicked that I was not a dependent.”

They claimed they received $1,800 in stimulus payments just ten months later in December.

The user added: I suppose the government just saw my initial tax filing and put me on the list for stimulus checks.

I was afraid they were going to ask for the $1200 back but I just received the second $600 today. This means they havent realized the mistake yet.

The taxpayer was contemplating whether to report the mistake but thought it would cause more trouble than it would solve.

You May Like: Second And Third Stimulus Checks