What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Sign Up For Direct Deposit Or Update Your Information

Once you choose an option, the next question or an answer will appear below.

Select your payment for direct deposit:

Employment Insurance benefits and leave

Sign up or change your direct deposit information.

- Online:

- 1-800-206-7218

- Find a Service Canada Office close to your home.

Goods and services tax / Harmonized sales tax credit or provincial equivalent

Sign up or change bank information for direct deposit for Canada Revenue Agency payments.

- Online:

- 1-8009598281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in signing up for direct deposit for one or several of your Government of Canada payments.

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Enrolling for this payment will automatically enrol you for any other Canada Revenue Agency payment you are entitled to receive /Harmonized sales tax credit or provincial equivalent).

Climate Action Incentive Payment

Sign up or change bank information for direct deposit for Canada Revenue Agency payments.

- Online:

- 1-800-959-8281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in signing up for direct deposit for one or several of your Government of Canada payments.

- :

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Income tax refund

Canadian

What Do I Do If There’s A Problem With Direct Deposit Should I Call The Irs

The IRS has made it extremely clear: It does not want you to call. We recommend some steps you can take to confirm and address problems with direct deposit, including how to request a payment trace if either the IRS tracker tool or the confirmation letter tells you the IRS sent you stimulus money to your bank account that you didn’t receive.

Don’t Miss: How Can I Apply For Stimulus Check

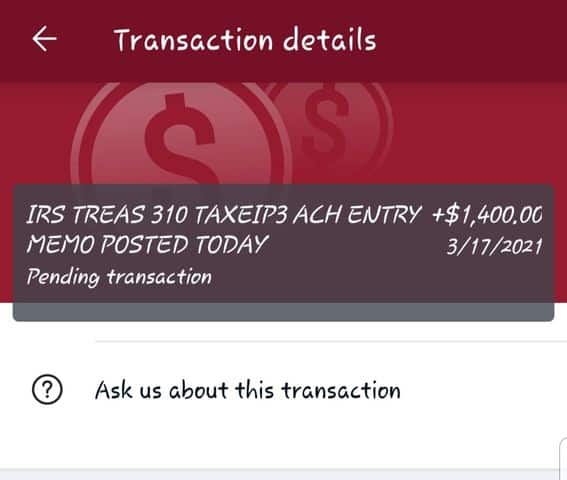

Some Taxpayers Reported A Pending

Now that President Biden has signed the $1.9 trillion pandemic relief bill into law, millions of desperate Americans are wondering the same thing: When will I get my money?

Some people got their answer Friday. Just one day after Biden signed the legislation into law, a reader in Alexandria, Va., found a pending post in his bank account labeled IRS TREAS 310 TAXEIP3 for $6,892.90 for his family of five.

The IRS refers to the stimulus money as an economic impact payment, or EIP.

I was wondering if Biden was overpromising, the reader said in an interview. But I looked. And, wow, its actually there.

The notation on his pending post says the stimulus funds will be available to him on March 17.

The fast turnaround is laudable considering the IRS is in the middle of the 2021 tax season and is also still processing millions of 2019 returns.

But the devil is in the details, and not all people will get their money that quickly.

As in previous rounds, the IRS will eventually post answers to many of your questions at irs.gov. But Ive put together some information on when you can expect a payment, including what might delay your stimulus funds.

The first wave of electronic payments went out to those who had received a refund and this was key had their refund direct-deposited into a bank account.

File Your Tax Returns Says Irs

Hes also encouraging taxpayers to file their tax returns as soon as possible if they havent already, even though the deadline to submit tax returns has been delayed to July 15 from April 15, so the IRS has up-to-date direct deposit information on file.

In this environment we dont want people to get checks, Mnuchin said. We want to put money directly in their account.

The document produced by the House committee indicates that the stimulus paymentsincluded in the $2.2 trillion economic rescue bill passed last week to combat the fallout of the coronaviruscould take months to circulate into the economy, potentially blunting the effect of a quick infusion of cash. Lawmakers have urged the IRS to process the payments quickly so that unemployed workers can use them to pay bills.

The law included payments of $1,200 for each adult earning as much as $75,000, or couples collectively making $150,000, plus $500 for each child under 17. Those amounts are reduced for people with higher incomes, and individuals with $99,000 in earnings get nothing, even if they have children.

The Treasury Department has said that Social Security beneficiaries who arent required to file a tax return dont need to do anything to receive their payment, but the House document indicates those who arent required to file taxes annually might want to submit a simple tax return and include direct deposit information if they want to receive their payments faster.

Recommended Reading: Irs.gov 2nd Stimulus Check

What You Should Do If Your Income Increased In 2020 Vs 2019

Undoubtedly, a whole separate camp of Americans saw their incomes rise in 2020 versus 2019, meaning they would no longer be considered eligible for a stimulus check if they were to submit their return today.

You could still wait to file your tax return and claim a stimulus check. The IRS wouldnt attempt to recoup that payment, and it also shouldnt open you up to any penalties or fines, according to the current text of the bill. Economic Impact Payments also arent considered taxable income.

But beware: You dont want to risk incurring late fees by waiting so long that you submit your tax return past the April 15 deadline .

Do You Pay Taxes On Your Stimulus Check

The short answer is no, you do not have to pay taxes on your stimulus check.

The stimulus check is recognized a tax credit, therefore it is not considered taxable income. Rather, no matter how much your payment is worth, you can deduct it from the total taxes you owe next year.

It will be reflected on your 2020-2021 tax return in your total refund amount, but you won’t collect it then because you’ve already received the advance. If you haven’t received your payment, check that you’re eligible and have fulfilled the requirements.

Don’t Miss: How Do I Get My Second Stimulus Check

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Where My Second Stimulus Check

The Irs Tool Might Say Your Payment Was Sent To You

If the IRS online tool says the agency has issued your stimulus money, but you have no record of it in your bank account and it never arrived in your mailbox, you may need to take one of these steps, including possibly filing a stimulus check payment trace. Youll need to have the letter the IRS sent you.

You May Like: File For The First Stimulus Check

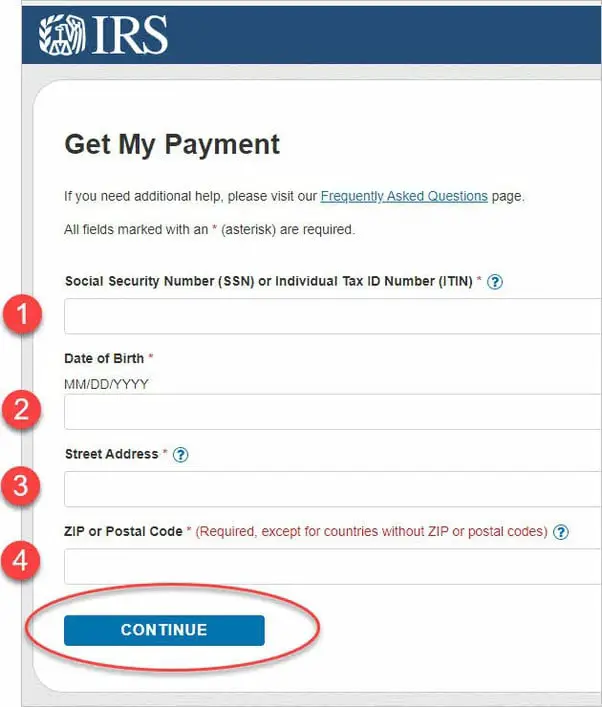

Can You Track The New Stimulus Check

Yes. The IRS’s Get My Payment tool, which updated over the weekend, allows you to do just that. You can submit your information here to find out what your stimulus payment date is and the form it’ll come in.

If Get My Payment returns a message that says “Payment Status Not Available,” it means you either don’t qualify for the third stimulus or the IRS hasn’t yet processed your check. If it says “Need More Information,” it tried to send your money but there was a problem with delivery.

That said, even Get My Payment nods to the wide range of payment dates. Though the first cache of this round of stimulus checks has already gone out, it notes that “additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card.”

Bottom line: Try to be patient. Your $1,400 is on the way.

How Will Ssdi And Ssi Recipients Get Their Stimulus Checks

SSDI and SSI recipients who receive their monthly benefit payments by Direct Express debit card should receive their stimulus payments by Direct Express. This was not necessarily true for the first and second payments, but the IRS says most disability recipients should receive their third payments by Direct Express. Others might either receive a direct deposit , a paper check, or a prepaid Visa debit card.

The debit cards, issued by MetaBank, are called Economic Impact Payment cards. After activating the card, you can use your EIP card for purchases or use it to withdraw cash . You can also transfer the funds from your EIP card directly into your own bank account, after you register for online access.

Recommended Reading: Amount Of Stimulus Check 2021

What If Im Not Required To File Taxes

If you havent filed your taxes for 2019 or 2020 and werent planning to, you can still receive a third stimulus payment if youre eligible.

- If you receive Social Security or Railroad Retirement benefits, youll receive your Economic Impact Payment automatically without providing further information. However, if you have eligible dependents and did not provide this information to the IRS in connection with the first or second stimulus, you will not receive the supplemental $1,400-per-child payment as part of the third stimulus.

- Note that eligibility for supplemental payments for dependents has changed. If you have dependents over the age of 18 who did not qualify for the first or second stimulus, they may still qualify for the third. To claim a supplemental payment for which you qualify under the third stimulus, you will likely need to claim a Recovery Rebate Credit the next time you file federal taxes.

Social Security 2017 Trustees Report

On July 13, 2017, the Social Security Board of Trustees released its annual report on the current and projected financial status of the Old-Age and Survivors Insurance and Disability Insurance trust funds.

The combined asset reserves of the OASDI trust funds are projected to become depleted in 2034, the same as projected last year, with 77 percent of benefits payable at that time.

In the 2017 Report to Congress, the trustees also announced:

- The combined trust fund reserves are still growing and will continue to do so through 2021. Beginning in 2022, the total annual cost of the program is projected to exceed income.

- The DI trust fund will become depleted in 2028, extended from last years estimate of 2023, with 93 percent of benefits still payable.

- The projected actuarial deficit over the 75-year long-range period is 2.83 percent of taxable payroll 0.17 percentage point larger than in last years report.

sThe longevity of our programs relies on the accurate, up-to-date data provided in these yearly reports. You can view the full 2017 Trustees Report at www.socialsecurity.gov/OACT/TR/2017/.

You May Like: I Want To Sign Up For The Stimulus Check

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return

- Received your Golden State Stimulus payment by check

- Received your tax refund by check regardless of filing method

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

Direct Express Stimulus Check Deposit Date As Social Security Recipients Await Payment

Stimulus funds for Direct Express cardholders and federal benefit recipients being paid via direct deposit are expected to be available by 9 a.m. local time on the payment date. On Tuesday, the Internal Revenue Service said it projects “the majority of these payments” would be received on April 7.

Federal benefits are usually distributed via Direct Express card accounts and most recipients will generally get their stimulus funds in “the same way that they receive their regular benefits,” the IRS said Tuesday.

Speaking to Newsweek on Thursday, a spokesperson for NACHA said, as with the previous stimulus payments made on March 17, banks and credit unions are required to make the latest batch of funds available to account holders by 9:00 a.m. local time on the settlement date, which in this round is April 7.

NACHA manages the ACH Network, the national automated clearing house for electronic funds transfers.

The IRS said Tuesday: “Because the majority of these payments will be disbursed electronicallythrough direct deposits and payments to existing Direct Express cardsthey would be received on the official payment date of April 7.”

Those expecting to receive stimulus funds can check the status of their payment using the Get My Payment tool at the IRS website.

Don’t Miss: Spectrum Stimulus Internet Credit Application

Irs Reminders For Missing Payments

As part of its directive the IRS has started letters/notices to those who appear to qualify for a variety of the government tax credits and stimulus checks, but have yet to claim them by filing an applicable tax year return.

The IRS estimates nearly 9 million households may be eligible to claim some or all of the RRC/economic impact payments , expanded child tax credits and Earned Income Tax Credits .

The is one IRS letter you should be happy to receive and will require action to claim one or more of these free government tax credits or payments.

Many of these potential claimants would not normally need to file a tax return, as their earned income could be too low for filing, but many of the expanded benefits over the last year dont require any minimum income thresholds to get them.

Those earning less than $73,000 can also can also file for free under the IRS Free File program, which will remain open this year, until November 17, 2022. By doing so they will be able to claim one or more of the credits above at no additional cost to themselves.

Get the latest money, tax and stimulus news directly in your inbox

Can My Stimulus Payment Be Garnished

Like the last stimulus check payments the third stimulus check cannot be offset to pay various past-due federal debts or back taxes. This does not apply to child support payments that are in arrears. If youre behind on child support your stimulus check can be fully or partially garnished either wont get a stimulus check or will receive a reduced one.

Note, if you claim your stimulus check via your 2021 tax return, it will be paid via your refund and subject to broader offsets.

Don’t Miss: What States Are Getting Stimulus Check

Latest Irs Payment Status

The IRS have announced that they have sent out over 180 million EIP/Stimulus check payments worth over $420 billion, including the latest batch. Payments are primarily being sent based on 2019 or 2020 tax return data, or information the IRS has sourced for non-filers. The status and method for these payments is available on the GMP tool. Some payments also include tax credits related to the $10,200 unemployment income tax break provided under the ARPA bill. The IRS also said that they are now processing all payments, including for non-filers and for recipients getting paid by paper check or prepaid debit card. Those who are getting their stimulus payment in the mail should start seeing their money now. Pay close attention to their mail delivery so you dont inadvertently throw out the IRS envelope.