Stimulus Check Payout Schedule

The IRS has confirmed that the distribution of economic impact payments has started and millions of Americans should have their stimulus check payment by now. Note that this will likely only apply to those receiving the payment via direct deposit . You can see the status of your stimulus check payment on the IRS Get My Payment portal.

- Direct Deposit payments will generally be deposited 2 to 3 days after the IRS confirms income eligibility for the payout.

- Physical checks will take at least 6 to 8 weeks to be mailed out.

Social Security Retirees and Disability recipients who are eligible for the payment will get the stimulus checks/payments deposited the same way they currently get their payments.

Given over 120 million Americans could be eligible for the payment, it will take a while to process the stimulus checks.

Get the latest money, tax and stimulus news directly in your inbox

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Families Who Qualified For But Did Not Claim The Monthly Child Tax Credit Payments

There were a significant number of families who should have qualified for the monthly Child Tax Credit payments did not receive them in 2021. In some cases, this was due to having non-filer status, which meant that there was a lack of information on file with the IRS. Without recent tax information on file, the IRS could not automatically determine the household’s eligibility for the Child Tax Credit, so no monthly payments were issued.

These households are now owed the monthly Child Tax Credit payments and the second half of the tax credit money — which is worth a maximum of $3,600 per qualifying child in total. This money can be claimed when filing taxes this tax season. So, if you’re a non-filer who missed out on your monthly tax credit payments, a significant payday could be headed your way when you file your taxes.

And, the same is true for the parents who purposely opted out of the monthly payments. If you decided to opt out of the monthly payments for tax or other reasons, you are eligible to claim the full amount of the tax credit when you file your 2021 taxes.

Read Also: 4th Stimulus Check For Single Person

Newborn Upfront Payment And Newborn Supplement

A lump sum and an increase to your Family Tax Benefit Part A payment when you start caring for a baby or child that’s recently come into your care.

To get this you must:

- care for a baby or child whos recently come into your care

- be eligible for Family Tax Benefit Part A

- not be getting Parental Leave Pay for the same child.

Kroger Store Becomes First To Make Change Impacting Every Shopper On Monday

Farmers and meatpackers should check the USDA site this summer to find out which organizations received funding.

Eligible workers may use that list to identify and contact the appropriate awardee for more information regarding how to request a relief payment and when relief payments will be available.

Note that once awarded, grantees may need time to establish their respective programs.

Relief payments may not be available immediately after the USDA AMS funding announcement.

Also Check: When Can Social Security Recipients Expect The Stimulus Check

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Mayor Bowser Announces $15 Million Direct Cash Assistance Program To Support New And Expectant Moms

Today,Mayor Muriel Bowser and the Office of the Deputy Mayor of Planning and Economic Developmentannounced a new $1.5 milliondirect cash transfer pilot program, Strong Families, Strong Future DC, tosupport maternal health and advance economic mobility.The nonprofit organization Marthas Table will implement the program, which willprovide$900 per month for one year to 132new and expectant mothersin Wards 5, 7, and 8.

Having a newborn is a big life change, and we also know how critical those first months and years are to a babys life. This program is about supporting new and expectant moms with cash so that they can have the autonomy and flexibility to make the best choices for them and their baby, said Mayor Bowser. The Strong Families, Strong Future DC pilot builds on the work weve done to address disparities in maternal health outcomes, make high-quality child care more affordable and accessible, and ensurewomenareat the heart of ourequitable economic recovery strategy.

Strong Families, Strong Future DC aims to improve maternal and child health outcomes in disproportionately affected areas in DC. Marthas Table intends to utilize qualitative and quantitative methods to track the pilot and evaluate how direct cash assistance impacts the participating mothers and their childrens physical, mental, and health outcomes.

The Strong Families, Strong Future DC programwill launch in February 2022.Please visit for additional program updates.

Also Check: Free File Taxes For Stimulus

A Fourth Round Of Checks Could Do More Harm Than Good

Its also not lost on policymakers that the highest rate of inflation in 40 years came immediately on the heels of the last round of checks and more disposable income could turn up the heat even more.

Injecting more federal stimulus into the economy could stoke the flames of inflation even further, Adams said. With people having more income available, consumer demand might pick up and exacerbate an already stressed supply chain.

More From GOBankingRates

How To Receive Your Payment

Grant recipients will be announced this summer by the USDA’s Agricultural Marketing Service .

Once the entities receive funding, they will be in charge of distributing the $600 relief payments to frontline farmworkers and meatpacking workers.

The awards the organizations will receive range from $5million to $50million.

Also Check: How Can I Apply For Stimulus Check

Without Congressional Intervention The Benefits Many Families Receive From The Child Tax Credit May Change

Earlier this year, President Joe Biden delivered on his promise to provide significant help to American families. On July 15, his new coronavirus stimulus package went into effect, giving up to $300 per month per child to parents across the country. However, as the year comes to a close, many American families are wondering: what now? What comes next? Here’s everything you need to know about the child tax credit and if the benefit will be extended into 2022.

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Read Also: Ssdi Stimulus Checks Deposit Date

Those Who Qualified But Missed Out On The Third Stimulus Payment

There may have been other issues with receiving your third stimulus payment, like a glitch that caused a missing check or having the incorrect bank information on file. If you qualified for the third stimulus payment but did not receive it in 2021, you can claim it on your taxes this spring.

According to the IRS, you will need to include any information on the total amount of the third Economic Impact Payment you received on your tax filings. You will also need to include information about any plus-up payments you received to avoid processing delays — but if you file your tax return correctly, you should receive the missing money as part of your tax return for 2021.

How Does The Child Tax Credit Work

Payments for the child tax credit came from a preexisting system, i.e. parents received monthly payments from the Internal Revenue Service . Unlike one-time coronavirus payments, this program continued for an extended period of time, running from July to December 2021. It helped many make ends meet in a period of instability and uncertainty. Research on the expanded credit suggested that the plan could cut child poverty in half in the United States. And President Biden stated he wants Congress to approve the American Families Plana $1.8 trillion economic package that will extend the paymentsfor four more years.

“While the American Rescue Plan provides for this vital tax relief to hard working families for this year, Congress must pass the American Families Plan to ensure that working families will be able to count on this relief for years to come,” Biden said in the statement. “For working families with children, this tax cut sends a clear message: help is here.”

Don’t Miss: What Were The Stimulus Amounts

Are Ssi Recipients Getting Extra Money In April 2022

The Social Security Administration recently shared a link to its Schedule of Social Security Benefit Payments for 2022 on Twitter. May 2022 SSI benefits will arrive in bank accounts Friday, April 29, since May 1 is a Sunday. October 1, 2022, falls on a Saturday, so SSI payments will be made on September 30, 2022.

Pregnant Women Due In 2021 Eligible For Additional Stimulus Check

I was wondering! Thanks for the article

Wait, so how do they know were pregnant? Lol

you wont be able to claim it until you file ur taxes in 2022 and claim the additional dependent

lol thank you! I wasnt seeing that

believe it or not I had a first kid in 2020 , which dropped my income substantially and added a dependent. didn’t qualify for stimulus based on 2019 taxes, but when we filed this year it corrected and we got quite a bit in a refund. expect some extra dough in 2022!!

Is this different though than the additional tax credit we will receive in 2022?

this is talking about the 1400 stimulas that is hitting banks right now when you file your taxs in 2022 you will claim baby and get the 1400 for baby.

its in addition to the tax credit

I had a baby in 2020 and her stimulus was applied to what we owed this year. Moms in that birth month group who got refunds got the amount with their refunds.

It was super simple to file!

Haha I have yet to receive any stimulus for my first born in 2020

haha same issue for my dec 30 2019 baby!

did you file your taxes?

yes. Weeks ago . But IRS hasnt processed sounds like IRS behind

Yes! I just saw this on Facebook

You May Like: Will Social Security Get The Fourth Stimulus Check

Injured Spouse Claim And Spousal Claims

The IRS also stated that If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return , half of the total payment will be sent to each spouse and your spouses stimulus check payment will be offset only for past-due child support. There is no need to file another injured spouse claim for the payment. I have received dozens of comments on this this, so hopefully this answers the questions many have had based on official IRS guidance.

Note that if you were current with your child support payments at the time of the stimulus eligibility determination but fell behind afterwards due to a COVID-19 related job loss, you would still be eligible to get the full stimulus payment.

Updating Direct Deposit Information

This question has come up a lot in the hundreds of comments to this article. The IRS has setup a portal for individuals to provide their updated banking information to receive payments via direct deposit as opposed to checks in the mail. The IRS does recommend that 2018 Filers who need to change their account information or mailing address, file 2019 taxes electronically as soon as possible. That is the only way to let us know your new information. You can file for free via TurboTax.

$1000 Monthly Stimulus Check

In a recently published article in The U.S. Sun, in the form of cash, New York City women are getting some assistance. Each month, a panel of experts chooses 100 expectant women with a baby under a year old to participate. There are no conditions to participating in the guaranteed income scheme, and it is expected to be continued indefinitely.

Since July, families have received up to $300 a month in federal child tax credits, which Congress refused to renew. There is a belief that the money will be used to buy needs like newborn formula or diapers, and even to pay for rent or daycare.

Findings from the Bridge Project show that 60% of New York City pre-schoolers are beneath the 200 percent poverty limit. Families in Washington Heights, Harlem, and Inwood, New York, made up the majority of the sample population. For the next three years, 50 moms will get $500 each two-week period.

Recommended Reading: When Was The Third Stimulus Check Sent Out In 2021

When Will You Get A 2022 Stimulus Payment

However, parents shouldnt expect to receive the new stimulus check until 2022 after they file their 2021 tax returns, per Nasdaq.com.

- It will be important to file a tax return next year to claim the extra money, according to Nasdaq.com. This will be necessary even for parents who do not normally have to file a tax return, as they dont want to leave the $1,400 check on the table.

Whats More Likely To Happen Instead

But right now, there does not seem to be much appetite for another stimulus check.

However, there has been another push to bring back the enhanced $3,600 federal Child Tax Credit.

When exacted during 2021, millions of American families received monthly payments of up to $300 from July to December.

This helped cut child poverty by 46%, new data from the Census Bureau shows.

However, as a result of failing to extend the boosted credit, its on track to revert to $2,000 for 2022.

In particular, West Virginia Senator Joe Manchin, who fancies himself as a so-called conservative Democrat, has refused to sign onto it because there isnt a work requirement attached.

However, Axios reports that the White House is attempting a hail mary to bring back an enhanced version of the CTC.

In efforts to get Republican support, Democrats might be willing to add corporate tax credits to a package.

Its unclear if this will work or if the size would be $3,600, but the boosted CTC has been a major part of Mr Bidens economic agenda and it could be his last chance to get it if the Democrats lose control of the House or the Senate in the midterms.

Don’t Miss: What To Do If I Never Got My Stimulus Check

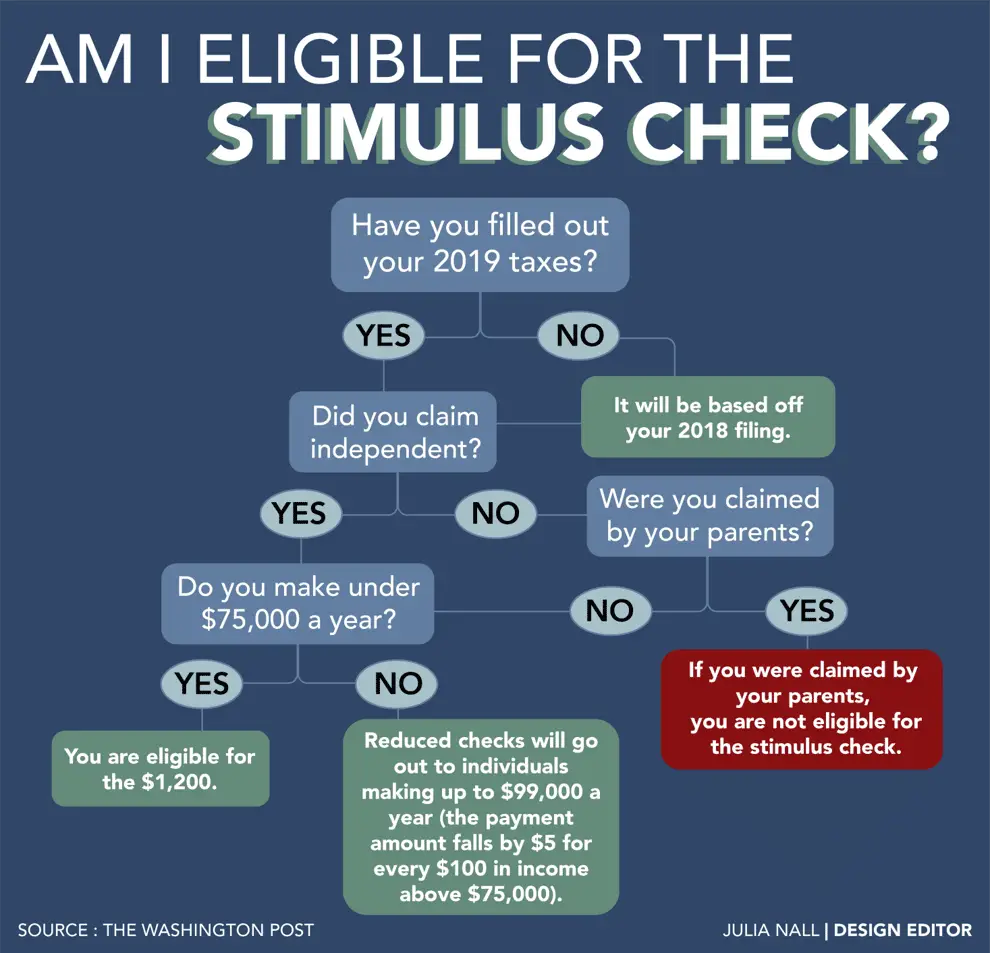

Why You Did Not Qualify For A Stimulus Check

Several people have commented that they have not received or not gotten the correct amount on their stimulus checks. The IRS has provided the following reasons

- Your adjusted gross income in your most recent tax filing approved by the IRS was greater than than the limits shown above, which are $99,000 $136,500 $198,000

- You CANNOT be claimed as a dependent on someone elses return. This includes as a child child, student or older dependent.

- You dont have a valid Social Security number and/or are a nonresident alien.

- You filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019. These are quick filing forms, but you need a standard filing

More Stimulus Payments In The Inflation Reduction Act

President Biden and the Democrat controlled Congress narrowly passed a scaled down version of the Build Build Better act, known as the Inflation Reduction Act .

While this includes funding for several groups and additional taxes for corporations, it does not include another stimulus payment in 2022 or in 2023.

While many individuals and families could have benefited from some form of government support, especially in a high inflation environment, there simply was not enough political support for further payments or tax credit expansions.

Get the latest money, tax and stimulus news directly in your inbox

Recommended Reading: When Was The 3rd Stimulus Check 2021