Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full.

The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

How Should I Have Received The Stimulus Payment

You should have received the automatic payment the same way you normally receive your monthly disability or pension paymentâby direct deposit, Direct Express debit card, or paper check. Your stimulus payment, however, will come from the Treasury Department, not the Social Security Administration.

If you received the first or second check by direct deposit or Direct Express, you should have received your third payment the same way, but there are no guarantees.

If you received your first or second payment by EIP Debit Card, you should have received a new debit card in the mail in a white envelope with “Economic Impact Payment Card” in the return address.

If you’ve moved since last filing your taxes, you should file a change of address with the IRS on Form 8822.

Stimulus Check Missing Payment Issues Or Errors

The IRS will also be mailing Stimulus Payment letters to each eligible recipients last known address 15 days after the payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment. Note that the IRS or other government departments will not contact you about your stimulus check payment details either.

Why didnt I get a stimulus check? Remember that the IRS has to have your direct deposit details, which is normally only provided if you received a 2018 or 2019 refund. If you file a return and they cannot use their portal to add direct deposit details, then your payment will come via check which could take several weeks. At this checks will likely start arriving at your IRS registered address from the end of April.

Finally you will also likely be able to claim any missing payments in your 2020 tax return as a tax credit. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

Recommended Reading: Never Received My Third Stimulus Check

How Much Will I Get In My Second Stimulus Check If I Am Receiving Social Security Disability

In December new stimulus payments in the amount of $600 were signed into law.

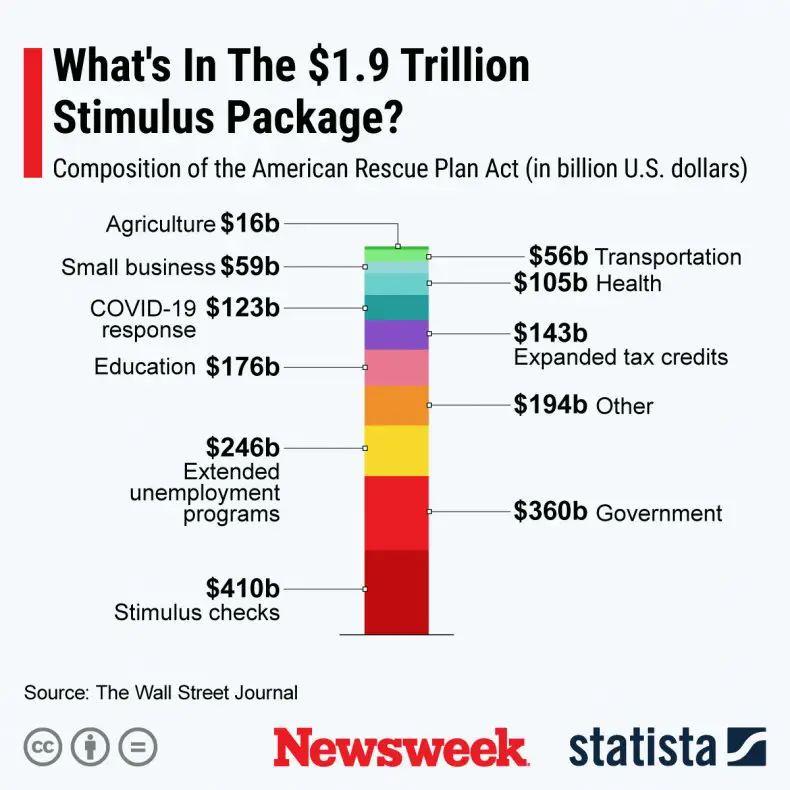

In December there was also a lot of talk by congress-people of $2,000 payments. But those are not happening, as of January 1, 2020 because the last Senate didnt vote on any bill to replace the $600 stimulus check with a $2,000 payment. A new Senate and House will be sworn in Jan. 3 so there is still a possibility that a third stimulus check will happen in early 2021.

Change In Income Can Affect How Much Stimulus Money You Receive

Many Americans lost their jobs or had their hours reduced dramatically, which is likely going to impact their total income for tax year 2020. This is noteworthy because your 2019 tax return may not be reflective of your current income status. For example, someone may have made $125,000 during tax year 2019, but suddenly lost their job in early April 2020 causing their total income for 2020 to take a nosedive. Unfortunately, if the IRS uses the 2019 tax return, this individual might be disqualified from receiving a COVID-19 stimulus check or will receive a greatly reduced amount. If you find yourself in this situation, make sure to file your 2020 tax return and pursue a stimulus payment rebate in 2021.

Also Check: Who Qualify For The Stimulus Check

Social Security Combined Trust Funds Projection Remains The Same Says Board Of Trusteesprojections In 2020 Report Do Not Reflect The Potential Effects Of The Covid

The Social Security Board of Trustees today released its annual report on the long-term financial status of the Social Security Trust Funds. The combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance Trust Funds are projected to become depleted in 2035, the same as projected last year, with 79 percent of benefits payable at that time.

The OASI Trust Fund is projected to become depleted in 2034, the same as last years estimate, with 76 percent of benefits payable at that time. The DI Trust Fund is estimated to become depleted in 2065, extended 13 years from last years estimate of 2052, with 92 percent of benefits still payable.

In the 2020 Annual Report to Congress, the Trustees announced:

- The asset reserves of the combined OASI and DI Trust Funds increased by $2.5 billion in 2019 to a total of $2.897 trillion.

- The total annual cost of the program is projected to exceed total annual income, for the first time since 1982, in 2021 and remain higher throughout the 75-year projection period. As a result, asset reserves are expected to decline during 2021. Social Securitys cost has exceeded its non-interest income since 2010.

- The year when the combined trust fund reserves are projected to become depleted, if Congress does not act before then, is 2035 the same as last years projection. At that time, there would be sufficient income coming in to pay 79 percent of scheduled benefits.

Other highlights of the Trustees Report include:

Lawmakers Alarmed By Delay

The delay in delivering stimulus payments to Social Security recipients and others on government assistance drew attention from lawmakers earlier this week. On March 22, members of the House Ways & Means Committee wrote to IRS Commissioner Chuck Rettig and Social Security Administration Commissioner Andrew M. Saul to express concern and demand an update on the delivery of checks to these groups by Friday.

They followed with the letter on Wednesday, demanding “that you immediately provide the IRS with this information by tomorrow, March 25, 2021.”

In the March 22 letter, they noted, “Some of our most vulnerable seniors and persons with disabilities, including veterans who served our country with honor, are unable to pay for basic necessities while they wait for their overdue payments.”

We are giving the trump-appointed heads of the Social Security Admin **24 Hours** to get off their backsides and stop delaying sending stimulus checks to 30,000,000 Americans.

Bill Pascrell, Jr.

The IRS and Treasury have so far issued 127 million payments, with a value of $325 billion. Many of those checks are paper checks or pre-paid debit cards that will be mailed to recipients. It’s possible that some Social Security recipients will receive mailed checks from those earlier rounds of payments or subsequent rounds of payment.

Recommended Reading: When Should We Get Our Stimulus Check

Other Work Continues On Economic Impact Payments Watch Mail For Checks Eip Cards

In addition to work for federal benefit recipients, the IRS also continues to prepare and deliver additional Economic Impact Payments for other eligible individuals as well as deliver tax refunds.

For those receiving payments in the mail, the IRS urges these taxpayers to continue to watch their mail for these payments, which could include a paper Treasury check or a special prepaid debit card called an EIP Card.

Taxpayers should note that the form of payment for the third Economic Impact Payment, including for some Social Security and other federal beneficiaries, may be different than earlier stimulus payments. More people are receiving direct deposits, while those receiving payments in the mail may receive either a paper check or an EIP Card which may be different than how they received their previous Economic Impact Payments.

Social Security Expedites Decisions For People With Severe Disabilities Agency Adds To Compassionate Allowances List

Andrew Saul, Commissioner of Social Security, today announced five new Compassionate Allowances conditions: Desmoplastic Small Round Cell Tumors, GM1 Gangliosidosis – Infantile and Juvenile Forms, Nicolaides-Baraister Syndrome, Rubinstein-Tybai Syndrome, and Secondary Adenocarcinoma of the Brain. Compassionate Allowances is a program to quickly identify severe medical conditions and diseases that meet Social Securitys standards for disability benefits.

Social Securitys top priority is to serve the public, and we remain committed to improving the disability determination process for Americans, said Commissioner Saul. Our Compassionate Allowances program gets us one step closer to reaching our goals by helping us accelerate the disability process for people who are likely to get approved for benefits due to the severity of their condition.

The Compassionate Allowances program quickly identifies claims where the applicants condition or disease clearly meets Social Securitys statutory standard for disability. Due to the severe nature of many of these conditions, these claims are often allowed based on medical confirmation of the diagnosis alone. To date, more than 600,000 people with severe disabilities have been approved through this accelerated, policy-compliant disability process. Over the last decade, the list has grown to a total of 242 conditions, including certain cancers, adult brain disorders, and a number of rare disorders that affect children.

Don’t Miss: Can I Still Get Stimulus Check

How Stimulus Checks Will Be Distributed To Disability Benefit Recipients

Social Security disability benefit recipients who were not required to submit a federal income tax return in 2018 or 2019 will receive the stimulus check automatically based on data contained within a 1099 benefit statement. This means no additional documentation will be required for most disability benefit recipients in order to receive the stimulus payment. The payment could very well be directly deposited into your account.

The automatic disbursement was not the original plan for these stimulus checks. In fact, the IRS initially planned to require individuals, including those who rely exclusively on disability benefit income, to complete a form to receive a stimulus check. However, after public pressure, the IRS agreed to simply use the 1099 benefit statements to retrieve the information needed to send out the stimulus payments.

What To Do If You Did Not Receive A Payment

If you searched and cannot find a stimulus payment that you know you were eligible to receive, the IRS no longer offers a tracing service for any of the three rounds of stimulus payments. According to its website, the IRS processed and issued payments to all people eligible for stimulus payments in all three rounds, but that does not mean that you cannot benefit from a lost payment.

Missing payments for Economic Impact Payments in the first and second rounds can be claimed as a Recovery Rebate Credit, but you must file a 2020 federal income tax return to do so. If you already filed a return for that year, you must file an amended return and claim the Recovery Rebate Credit for the amount of the missing stimulus payment.

A third-round payment that you have not received can be claimed as a Recovery Rebate Credit on your 2021 federal income tax return. The IRS website lets you look up the amount of payments that you were eligible to receive in each of the three rounds. This information is important because you need to include the correct amount on your tax return in order to receive the credit.

Read Also: Do I Have To Claim Stimulus Check On 2021 Taxes

Stimulus Check Eligibility When You Have Ssi Benefits

Checking your eligibility for a stimulus check can be done by visiting the IRS main website. The IRS has stated that people receiving SSI benefits are still eligible for the stimulus check. One important thing to note is that the following information only applies to people who started receiving SSI benefits before January 1st of 2020.

The IRS will look at your 2018 or 2019 income tax return to see how much money you made during that span. Do not worry if you did not file an income tax return during those years because the IRS will still issue you a payment. You should receive your stimulus check money the same way you usually receive your SSI benefits. This might be through direct deposit to your bank or through a paper check, depending on how you have your SSI payments set up.

How much money you receive from the stimulus check depends on whether you have children and how many children you have. Without children, you should receive $1,200 for your stimulus check. If you have children, you should be given an extra $500 per child. Your child must be a qualifying child who was listed on your income tax return for this to happen.

Other Help For Social Security Claimants

The Social Security Administration looks at the cost of living and makes any necessary increases to Social Security benefits.

This practice has been going on since the 1950s to offset inflation for people living on a fixed income.

The COLA increase impacts at least 70million Americans.

Despite the increases each year, high inflation has lowered Social Security claimant’s buying power by about 40 percent since 2000.

In other Social Security news, 33 states have bumped up Supplemental Security Income so recipients will get payments of $841.

Plus, we explain how to get the most out of Social Security when you retire, including ways to boost your payments.

Recommended Reading: How To Check Stimulus Payment History

How Should Ssdi And Ssi Recipients Have Gotten Their Stimulus Checks

SSDI and SSI recipients who receive their monthly benefit payments by Direct Express debit card should have received their stimulus payments by Direct Express. The IRS says most disability recipients should have received their third payments by Direct Express. Others might have received a direct deposit , a paper check, or a prepaid Visa debit card. The debit cards, issued by MetaBank, were called Economic Impact Payment cards.

Will My Stimulus Check Arrive As An Eip Card

The IRS projects that 5 million stimulus payments will be made by Economic Impact Payment debit card, but checks going out to Social Security recipients won’t take the form of an EIP card. According to the SSA support website: “The IRS does not plan to issue prepaid debit cards to beneficiaries for this third round of EIPs … The Social Security Administration does not administer the EIP debit card program, and did not decide who received an EIP debit card instead of a paper check.”

Read Also: How Much Was Stimulus Check

Here Are Some Questions And Answers Around This New Stimulus Payment:

If I didnt file taxes in 2019/2020 will I receive the stimulus ? Unlike the first stimulus payment where those who didnt need to file a tax return could update the IRS non-filer tool, this time around due to the speed of roll-out of the second stimulus check and with tax season around the corner the IRS has said the non-filer tool is closed for updates.

The IRS will be using information they have as of Nov 21, 2020 or from your first stimulus check payment . Otherwise they are encouraging you to the stimulus by filing a 2020 1040 or 1040-SR tax return. Free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

How will I get paid? Like the first stimulus payment in 2020, the IRS will facilitate payment of these checks based on your 2019 tax information. You will also get the dependent stimulus payment for eligible dependents claimed on your tax return. For other groups who dont file taxes the IRS will work with other government departments or the Get My Payment tool. Direct deposit will still be the fastest way to get your payment.

Dependents in 2020? Households who added dependents in 2020 might not qualify for full payments immediately, since based on 2019 tax return information. But they can request additional money as part of the 2020 tax returns they will file in early 2021. See more in this articles for dependent qualification income thresholds.

Act Now Go To Irsgov A Message From Social Security Commissioner Andrew Saulaction Needed For Social Security Beneficiaries With Dependents And Who Do Not File Tax Returns To Receive $500 Per Child Payment

Social Security beneficiaries and Supplemental Security Income recipients who dont file tax returns will start receiving their automatic Economic Impact Payments directly from the Treasury Department soon. People receiving benefits who did not file 2018 or 2019 taxes, and have qualifying children under age 17, however, should not wait for their automatic $1,200 individual payment. They should immediately go to the IRSs webpage at www.irs.gov/coronavirus/non-filers-enter-payment-info-here and visit the Non-Filers: Enter Payment Info Here section to provide their information. Social Security retirement, survivors, and disability insurance beneficiaries with dependent children and who did not file 2018 or 2019 taxes need to act by Wednesday, April 22, in order to receive additional payments for their eligible children quickly. SSI recipients need to take this action by later this month a specific date will be available soon.

I urge Social Security and SSI recipients with qualifying children who do not normally file taxes to take action now. Immediately go to IRS.gov so that you will receive the full amount of the Economic Impact Payments you and your family are eligible for.

People with Direct Express debit cards who enter information at the IRSs website should complete all of the mandatory questions, but they may leave the bank account information section blank as Treasury already has their Direct Express information on file.

Read Also: Is There Another Stimulus Check Coming For Seniors