Feds Regulation Changes And Policy Updates

The Fed made regulation changes to further add liquidity to the markets. For instance, the Fed made a number of technical changes to hold on to less capital so that it could lend more. It temporarily removed the asset restrictions placed on Wells Fargo after its fake-accounts scandal, so that Wells Fargo could lend more.

On Dec. 16, 2020, the Fed announced that its QE policy would continue âuntil substantial further progress has been madeâ toward inflation and employment goals. The Fed expects this progress to take years, based on projections it also released that day.

On March 19, 2021, the Fed announced that it was letting its policy of relaxing bank reserve requirements expire on March 31, 2021, as scheduled. The policy, originally announced on May 15, 2020, temporarily allowed banks to exclude Treasuries and deposits with Fed banks from their balance sheets for the purpose of calculating reserve requirements, allowing them to lend more.

On March 25, 2021, the Fed announced that the temporary restrictions on dividends and buybacks that it placed on banks in 2020 would end after June 30, 2021, for banks that meet capital requirements during the 2021 stress tests. Restrictions were extended for banks that fail to meet capital requirements.

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Who Qualifies For The Recovery Rebate Credit And Stimulus Payments

You qualify for the recovery rebate credit only if the IRS didnât give you a stimulus payment, or if you received a partial payment.

To find out you whether you missed out on money you were entitled to, you can contact the IRS, review your IRS online account or use the tax agencyâs Get My Payment tool.

Three rounds of pandemic stimulus checks were issued in 2020 and 2021. Hereâs a refresher.

Read Also: How To Get Your Stimulus Checks

How Much Was The Second Stimulus Check

The second stimulus check was $600 per adult and $600 per child.

$600 , plus

an amount equal to the product of $600 multiplied by the number of qualifying children ) of the taxpayer.

-SEC. 6428A. ADDITIONAL 2020 RECOVERY REBATES FOR INDIVIDUALS.

The second stimulus checks got sent out starting around December 29th, 2020.

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

You May Like: Where Is My Stimulus Refund

Don’t Miss: Essential Worker Stimulus Check 2021

Florida Michigan Tennessee And Georgia Are Giving $1000 To Teachers

Florida will be distributing stimulus payments in December for first responders and educators who work with students. Teachers and principals are eligible for payments of up to $1,000.

Georgia has implemented a similar policy, giving teachers and principals $1,000 in stimulus cash for their work during the pandemic.

Michigan is giving $1,000 bonuses to every full-time child care professional as part of its Child Care Stabilization Grant. Licensed child care providers are eligible to apply and should visit Michigan.gov/childcare to apply. Child care professionals will be awarded bonuses directly from their employer and do not need to apply.

Tennessee will be doling out $1,000 of hazard pay bonus to full-time teachers and $500 to part-time educators. They should expected to receive their checks before Jan. 1. The hazard pay came at the cost of an expected 2% raise that educators had been expecting in a bill passed in June.

Michelle Shen is a Money & Tech Digital Reporter for USA TODAY. You can reach her @michelle_shen10 on Twitter.

Other Benefits Wont Go Out Until Next Year

Certain tax benefits provided by the latest relief package cant be claimed until next year. Filing a 2021 tax return will be key to receiving the money.

More workers without children will qualify for the earned income tax credit for 2021, and the maximum amount they can receive will nearly triple. It will be the largest expansion to earned income tax credit in more than a decade but theyll have to wait until next year to claim it.

The relief package also beefed up the child and dependent care tax credit to cover half of care costs up to $4,000 for one child or dependent and $8,000 for two or more children or dependents. But again, those credits will have to be claimed on the 2021 return.

CNNs Tami Luhby contributed to this report.

Don’t Miss: How Are Stimulus Checks Distributed

Reconciling Your Covid Stimulus Payment On Your Tax Return

The COVID stimulus payment provided earlier this year brought financial relief to many who were struggling near the beginning of the pandemic. But it also brought some confusion to tax payers about how this stimulus check would be handled when it was time to file taxes. While we have touched on this topic in the past, we wanted to provide you with some more specific information regarding how this income is reported on your return, as well as addressing some other common questions about the stimulus payments.

Do You Need to Report Your Stimulus Payment?

Because your COVID stimulus check was non-taxable income, you do not need to report it on your 2020 tax return. The amount you received was not an advance on your tax refund, and will not reduce any refund you get in 2021 or increase any amount you may owe.

There will be an additional worksheet available for some tax filers this year for reporting your total Economic Impact Payment. However, the IRS has advised that this worksheet is only for those who did not receive a stimulus payment or who received less than the maximum payment amount.

Receiving Additional Stimulus Payments

Fill out the new worksheet and submit it along with Notice 1444. If you qualify for any additional stimulus payments, the Recovery Rebate Credit will be applied to your tax return. Note that, if you owe taxes, this may simply reduce your tax bill otherwise, any extra amount you qualify for will be distributed with your tax refund.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: $1 400 Stimulus Check When Is It Coming

St And 2nd Rounds Of Stimulus Payments

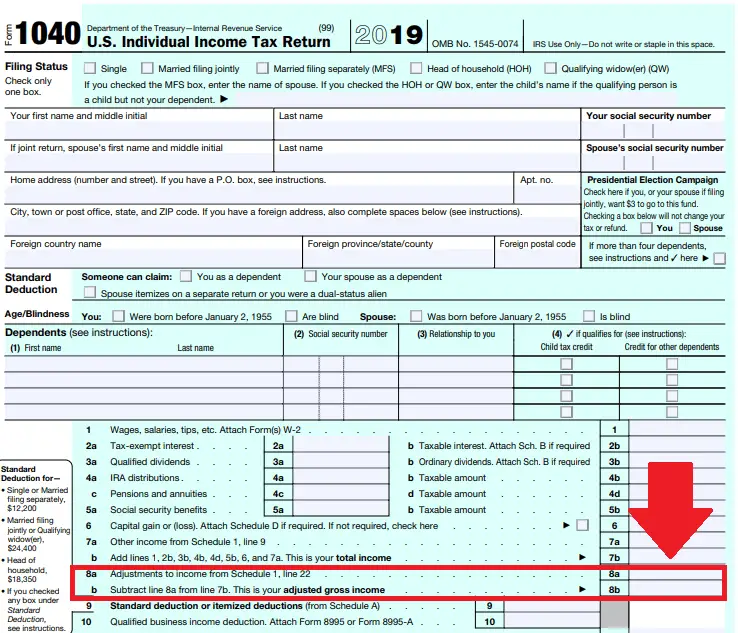

The first two payments were based on your 2018 or 2019 tax information. Individuals qualified for full stimulus payments if their adjusted gross income , which is income minus certain deductions, was $75,000 or less . The IRS reduced the stimulus payments by $5 for every $100 earned above the income thresholds.

The first full stimulus payment was $1,200 for single individuals, $2,400 for married couples and $500 per qualified dependent. The second full stimulus payment was $600 for single individuals, $1,200 for married couples and $600 per dependent.

If you earned more than $99,000 , you got no first stimulus payment. With the second stimulus check, your payment was reduced to $0 once your AGI reached $87,000 for individuals and $174,000 for married couples.

What Do I Do With Letter 6475

Hold onto it until you or your tax preparer are ready to file your 2021 federal return, then use the amount shown on your Recovery Rebate Worksheet to determine if any credit applies.

Having the wrong amount on your return could trigger a manual review,according to the H& R Block website, which could delay a refund for weeks.

Read Also: Irs.gov Stimulus Check Deceased Person

You May Like: H& r Block Stimulus Tracker

How Do You Track Your Payments

You can check the status of your stimulus payment on IRS.gov using the Get My Payment tool. If you receive the notice Payment Status Not Available, it indicates one of the following situations:

- The IRS does not have enough information

- Your payment has not been processed yet

- Youre not eligible for a payment

If you believe you are eligible for a payment, check the Get My Payment tool over the coming weeks, as the IRS continues to process payments.

You May Like: How Much Was 3rd Stimulus Check 2021

State And Local Aid $745 Billion

Non-public

$0.4 bil.

At the outset of the pandemic, governments used the funds largely to cover virus-related costs.

As the months dragged on, they found themselves covering unexpected shortfalls created by the pandemic, including lost revenue from parking garages and museums where attendance dropped off. They also funded longstanding priorities like upgrading sewer systems and other infrastructure projects.

K-12 schools used early funds to transition to remote learning, and they received $122 billion from the American Rescue Plan that was intended to help them pay salaries, facilitate vaccinations and upgrade buildings and ventilation systems to reduce the viruss spread. At least 20 percent must be spent on helping students recover academically from the pandemic.

While not all of the state and local aid has been spent, the scope of the funding has been expansive:

Utah set aside $100 million for water conservation as it faces historic drought conditions.

Texas has designated $100 million to maintain the Bob Bullock Texas State History Museum in Austin.

The San Antonio Independent School District in Texas plans to spend $9.4 million on increasing staff compensation, giving all permanent full-time employees a 2 percent pay raise and lifting minimum wages to $16 an hour, from $15.

Alabama approved $400 million to help fund 4,000-bed prisons.

Summerville, S.C., allocated more than $1.3 million for premium pay for essential workers.

What was the impact?

Recommended Reading: Irs.gov Direct Deposit Form Stimulus Check

Can I Still Get A Stimulus Check

If you think youre eligible for a COVID stimulus payment or the 2021 child tax credit, and didnt already receive those funds, you can file a simple tax return by visiting ChildTaxCredit.gov.

But youll need to move quickly. Thats because if youre not required to file a tax return, this year’s deadline to file a simplified return is November 15. If you are required to file, but missed the April 18 filing deadline, you have until on ChildTaxCredit.gov and see if youre eligible to receive a stimulus payment or child tax credit.

However, if you don’t owe taxes to the IRS, the IRS has said that you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. But because that can get confusing, it’s probably best to file for the 2021 tax year as soon as you can.

According to the Government Accountability Office, groups that were most likely to have missed out on pandemic relief stimulus payments or the child tax credit , were people who never filed a tax return or who filed for the first time during the pandemic. The federal government also had difficulty getting stimulus checks and child tax credits to people without bank accounts or reliable internet access, and people who were experiencing homelessness in 2020 and 2021.

Six Stimulus Checks And Direct Payments Worth Up To $1700 Going Out This Month

The latest round of cash begins to be phased out for individual taxpayers who earn $75,000 a year.

But once you hit the $80,000 annual gross income limit, you wont be eligible for the help at all.

Like the single-taxpayer cut-off, theres a $120,000 AGI cap on how much heads of households can earn to be eligible for the help.

A head of household is a single taxpayer who claims a dependent.

You May Like: Income Limits For Stimulus Checks 2021

Also Check: Spectrum Stimulus Internet Credit Application

Second Stimulus Checks & Us Expats: What You Should Know

Q. What was the second stimulus check?

A. The second stimulus check was part of a December 2020 government relief package to provide financial relief to Americans during the pandemic. The relief package included $600 direct payments to each person with a Social Security Number who cannot be claimed as a dependent and earned under a certain amount of income. It also included up to $600 payments for each qualifying child under age 17.

Q. Did I get a second stimulus check if Im an American living overseas?

A. Yes, expats qualified for the second stimulus check. You qualified if you fall within the income threshold, have a social security number, and file taxes even if you live overseas.

Q. Did I need to sign up for it or sign off on it?

A. Most people didnt need to do anything to receive the second stimulus because the IRS based the payments off of 2019 tax returns. If you didnt file a 2019 return, you may be able to claim it on your 2020 tax return as a Recovery Rebate Credit.

Q. If I live abroad, when should I have gotten my second stimulus check if I qualified?

A. All of the second stimulus payments have gone out. Most people got a direct deposit.

I Received The Child Tax Credit For A Child On My 2020 Taxes But They No Longer Live With Me What Should I Do

If you will not be eligible to claim the Child Tax Credit on your 2021 return , then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update Portal. Receiving monthly payments now could mean that you have to return those payments when you file your tax return next year. If things change again and you are entitled to the Child Tax Credit for 2021, you can claim the full amount on your tax return when you file next year.

If you have any questions about your unique circumstances, you should visit irs.gov/childtaxcredit2021.

Also Check: $600 Stimulus Check Not Received

How Many Stimulus Checks Did Americans Get

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?

Also Check: How To Look Up Stimulus Check