When Will You Get The Third Stimulus Check

Officials at the Treasury Department and Internal Revenue Service said Friday that processing of the new round of stimulus payments has already begun, with the aim of having the first payments start showing up in bank accounts this weekend.

The IRS said Friday that additional waves of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The agency added that contacting the IRS or your financial institutions won’t get you your check any sooner.

A date has yet to be set for when those receiving Social Security and other federal beneficiaries will get their money. Though the IRS said those Americans will generally receive the third payment the same way as their regular benefits.

Here’s How Income Limits Will Work For The Third Check

by Christy Bieber |Updated July 25, 2021 – First published on Feb. 10, 2021

Image source: Getty Images

Will you be eligible for the third coronavirus stimulus payment based on your income?

This week, lawmakers took a crucial step forward in fulfilling their promise to deliver $1,400 stimulus checks to most Americans. President Joe Biden promised this money during his campaign, indicating it would combine with the recently-delivered $600 to provide $2,000 checks .

The House Committee on Ways and Means has now drafted a legislative proposal that puts the president’s plans into legislation that the full House of Representatives will soon vote on.

In the legislative proposal, they’ve kept the income limits to receive the full payment the same as with the first two checks. However, eligibility will phase out more quickly, and individuals with incomes above a certain threshold will not be eligible for payments at all.

Important: Third Stimulus Check Qualification Details

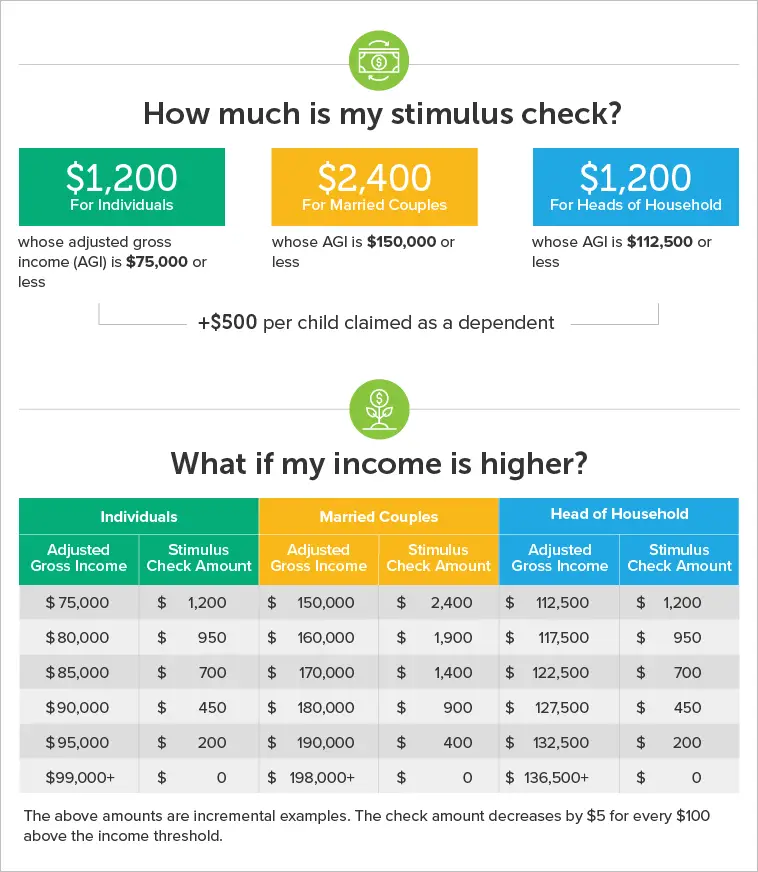

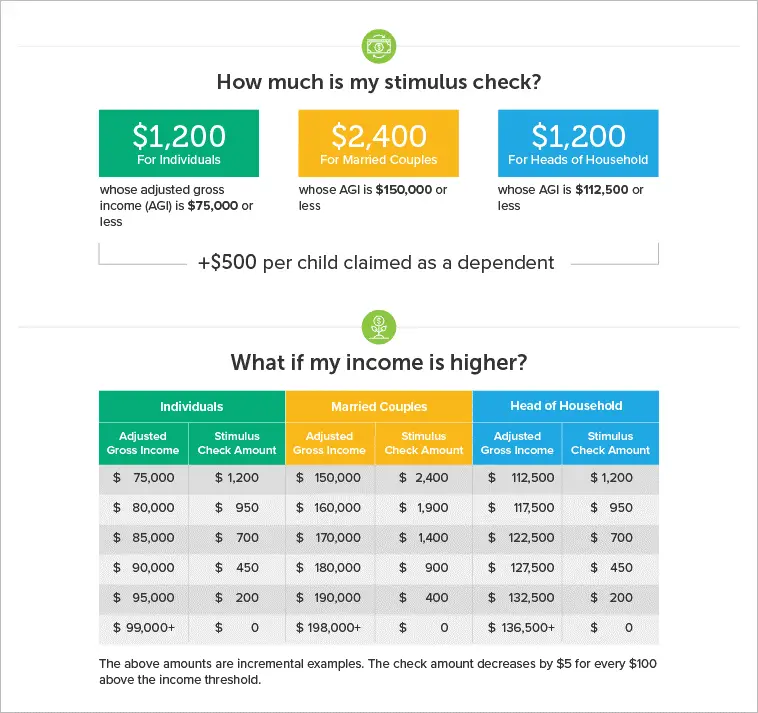

The third stimulus checks now going out open up more avenues for people to claim a payment so long as their yearly earnings in 2019 or 2020 fall within the brackets for receiving the third check. These new payments come with changes to the income limit for individuals and families whod qualify for a full stimulus payment it isnt the same as it was for the first two rounds of checks approved in 2020. Check out the chart below for more and use our stimulus calculator to estimate how much you could get.

Read Also: Stimulus Check I Didn’t Get It

Stimulus Checks: Marriages And Divorce

Q. We got married in 2020 how does that affect the amount we will get?A. Filing as jointly married versus separate for 2020 wont change the total maximum stimulus amount and you wont have to repay any stimulus you already received. However, now that youre married, you should determine whether it makes more sense to file jointly or separately, and its possible that one spouse with a higher income could affect eligibility for the recovery rebate credit.

For example, lets say you and your spouse had AGI amounts of $35,000 and $105,000 respectively. As single filers, youd receive the full stimulus payment because your AGI of $35,000 is below the threshold, but your spouses AGI of $105,000 would be over the limit and wouldnt qualify for a stimulus payment. However, if you file jointly for 2020, your combined AGI of $140,000 is below the threshold for joint filers, so you could claim your spouses portion as the recovery rebate credit.

Those who get married in 2021 will have a similar situation when they file their 2021 return.

Q. How does a recent divorce affect my stimulus check?A. What if you were married and filed jointly on your tax return and have since become separated or divorced? If the IRS issued a payment based on a jointly filed return, you will allocate half of each payment to each spouse when you calculate your credit on your single status returns.

I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and youll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didnt seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. Youll be able to claim the rest of the stimulus payment when you file your next tax return.

Also Check: Who Do I Contact About My Stimulus Check

If I’m Receiving A Payment By Mail What Should I Do

IRS and Treasury urge eligible people who don’t receive a direct deposit to watch their mail carefully during this period.

Some taxpayers will receive an envelope from the U.S. Department of the Treasury containing a paper check. For people who receive tax refunds by mail, this check will look similar, though it will note that it is an Economic Impact Payment.

Others will receive a prepaid debit called, called the EIP Card. This card will come in a white envelope prominently displaying the U.S. Department of the Treasury seal. The card has the Visa name on the front of the card and the issuing bank, MetaBank, N.A. on the back of the card. Information included with the card will explain that this is an Economic Impact Payment. Each mailing will include instructions on how to securely activate and use the card. It is important to note that none of the EIP cards issued for any of the three rounds is reloadable recipients will receive a separate card and will not be able to reload funds onto an existing card.

The IRS does not determine who receives a prepaid debit card. More information about these cards is available at EIPcard.com.

Increasing the use of direct deposit payments and prepaid debit cards will provide more recipients with their stimulus payments more rapidly than would otherwise be the case. It will provide faster relief to millions of Americans during the pandemic. Recipients may check the status of their payment at IRS.gov/getmypayment.

Stimulus Checks: No Taxable Income Or Address

Q. Im a single person that has a valid SSN, but I do not file a tax return because I do not have any taxable income. What should I do if I didnt receive any stimulus money?

A. For the first two rounds of economic impact payments, the taxpayer will need to file a 2020 tax return with the IRS and claim the recovery rebate credit. Eligible taxpayers who did not receive the maximum amount of advance payments and taxpayers who missed receiving the first or second stimulus payments altogether can claim a credit on their tax return for the amount they qualified for but did not receive as an advance payment. For example, a single taxpayer who was eligible for but did not receive either economic impact payment would be eligible to claim a recovery rebate credit in the amount of $1,800 .

If this same eligible taxpayer did not receive the third economic impact payment, they should receive that from the IRS after their 2020 tax return is processed. Once the IRS processes the taxpayers 2020 tax return, the IRS will use the information from the 2020 tax return to determine eligibility for the third round of payments. In this case, if the IRS determines the taxpayer is eligible for the full third economic impact payment and no payment has been made to that taxpayer, the IRS will issue an additional $1,400 to that individual. The FAQs available on this IRS webpage help explain the process someone should follow in this situation to complete their tax return.

Recommended Reading: Is Maine Getting Another Stimulus Check

How Much Is My Third Economic Impact Payment

Eligible individuals for whom the IRS has information to make a payment will automatically receive an Economic Impact Payment of up to $1,400, or $2,800 for married couples filing jointly, plus $1,400 for each qualifying dependent. Unlike EIP1 and EIP2, families will get a payment for all their qualifying dependents claimed on a tax return, not just their qualifying children under 17. Normally, a taxpayer will qualify for the full amount if they have an adjusted gross income of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household and up to $150,000 for married couples filing joint returns and surviving spouses. Payment amounts are reduced for taxpayers with AGI above those levels.

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced — above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

Recommended Reading: What Does The Stimulus Debit Card Look Like

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Who Else Is Eligible To Receive A Stimulus Payment

As with the previous pandemic-related stimulus payments, gig economy workers, self-employed individuals and Americans on unemployment, disability, Social Security or other federal aid are also generally eligible for stimulus checks, provided they filed federal income taxes in 2020 or 2019 and meet the income thresholds.

Read Also: Stimulus Check For Ssi And Ssdi

When Will The Payments Be Disbursed

Biden said some of the payments could be disbursed later in March. The IRS began sending out the previous round of stimulus payments within a few days of the last relief bills passage in December.

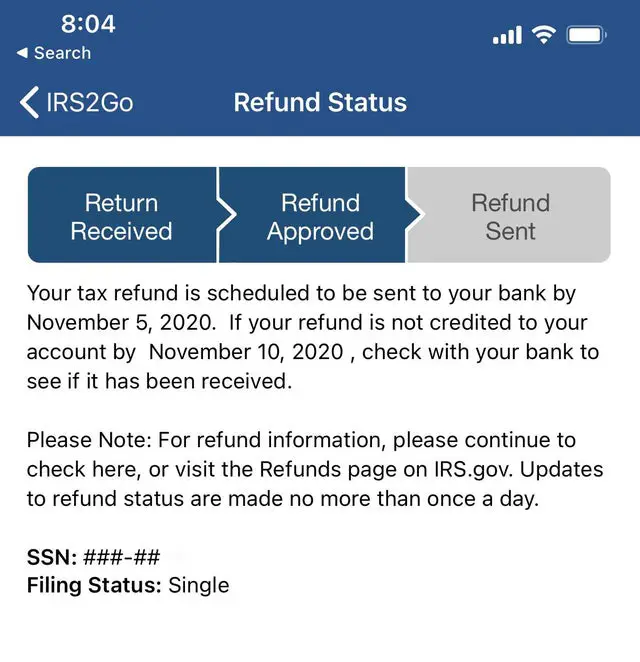

Like the other two payments, taxpayers can track the status of their payments with IRS Get My Payment tool. Just note that that tool has been glitchy in the past, and can be overwhelmed when too many people try to use it at once.

How Much Is The Stimulus Payment

Eligible individuals can receive a stimulus check of up to $1,400. Couples who file joint tax returns can receive up to $2,800. Families with dependents can receive an additional $1,400 per dependent. People who are American citizens but filing jointly with someone who is not a citizen will be eligible for the stimulus check. People without a Social Security number generally cannot get a check. Stimulus checks are not taxable.

You May Like: Haven’t Received Any Stimulus Checks

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

What If My Bank Account Information Changed How Will I Get My Second Stimulus Check

Unfortunately, if your second stimulus check is sent to an account that is closed or no longer active, the IRS will not reissue the payment to you by mail. Instead, if you are eligible to get a payment, you can claim the stimulus check on your 2020 tax return as the Recovery Rebate Credit or use GetCTC.org if you dont have a filing requirement.

Dont Miss: Stimulus Check In May 2021

Don’t Miss: Someone Stole My Stimulus Check

Tips For Individuals During The Coronavirus Pandemic

- If you dont need to use your stimulus check for anything urgent, consider investing or saving the money. A financial advisor can help you get started if you need help managing your money or investments. SmartAssets free tool can match you with financial advisors in your area in just five minutes. Get started now.

- If you are struggling to keep up with loan or credit card payments, you can take steps to protect your credit score and speak with your bank directly to see whether you can defer loan payments or waive certain fees.

- If you can afford it, investing in index funds during a recession is a safe option. But if youre looking for a slightly more aggressive approach, check out some free investment classes to learn more.

Senate Vs House Income Caps

| Senate check income limits | |

| Full payment below $150,000 cutoff at $160,000 | Full payment below $150,000 cutoff at $200,000 |

According to the Institute on Taxation and Economic Policy, 60% of Americans would receive a full payment under both the House and the Senate plans. The Senate change, however, would affect the highest earners, where more than 11 million adults and over 4 million children would be blocked from receiving a check for any amount.

The new income cap limits are lower than that for the $600 check at $87,000 for an individual, $124,500 for a head of household and $174,000 for families but the amount of money that people who qualify could receive might be more than twice the amount of that second check.

You May Like: Where Can I Cash Stimulus Check

When Will Stimulus Payments Be Sent

Your stimulus payment may already be on its wayor you may have already received it. On March 12, the IRS announced that the $1,400 stimulus check will reach Americans within the week.

The first payments were sent by direct deposit and were scheduled to arrive on March 17. The IRS will continue to send additional batches of direct deposits, as well as mailing checks and debit cards, over the next several weeks.

Who Qualifies For A Payment

Taxpayers must have a Social Security number to be eligible for a payment and meet the income requirements detailed above.

While the steeper income phase out reduces the number of taxpayers qualifying for this stimulus payment, all dependents of eligible taxpayers will also receive a payment for the first time. That includes millions of college students, disabled adults and elderly Americans. Mixed-status families in which some members have Social Security numbers and some do not are also eligible, as they were for the second payment.

Like the second stimulus payment, those who owe child support should not have any of their stimulus money withheld.

Don’t Miss: What Stimulus Payments Did I Receive

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Will The Stimulus Affect My Taxes For This Year Or Next Year

None of the three stimulus checks are considered income, and therefore arent taxable. They wont reduce your refund or increase what you owe when you file your taxes this year, or next. They also wont affect your eligibility for any federal government assistance or benefits.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Recommended Reading: Stimulus Checks Gas Prices 2022