File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

States Sending Stimulus Checks In December 2022

Almost half of the states have sent stimulus checks in 2022. While these state payments generally arent as big as the stimulus checks paid by the federal government last year, they can still be an important source of additional support for families dealing with higher inflation and other economic hardships.

As the year winds down, most state stimulus payments have already been paid to eligible residents. But there are a few states where payments will continue in December. This is particularly helpful for qualified recipients who have extra expenses at the end of the year or during the holidays. Heres a look at the states sending stimulus checks in December and answers to some of the who, what, and when questions about those payments.

What Does A Check From The Us Treasury Look Like

The U.S. Treasury check has three areas where microprinting is used. All U.S. Treasury checks are printed on watermarked paper. The watermark reads U.S. TREASURY and can be seen from both the front and back of the check when held up to a light. The watermark is light and cannot be reproduced by a copier.

Dont Miss: Second Stimulus Check Jackson Hewitt

Read Also: Filing 2020 Taxes For Stimulus Check

What To Know If You Missed The Deadline To Claim Your Money

If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, dont worry. You can still claim that money when you file your taxes in 2023 you just wont receive it this year.

The final cutoff day for claiming the money will be on Tax Day in 2025, but we recommend filing as soon as possible.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Don’t Miss: Haven’t Got My Stimulus

Tax Stimulus Check: This Is How You Can Get One Last Stimulus Check

A third stimulus check is still available if you havent received it yet

While the deadlines for the first two Economic Impact Payments have passed, the third stimulus check, worth up to $1,400 per person, is still available if you havent already gotten it.

According to CNBC.com, the majority of qualified beneficiaries of the payments permitted by the American Rescue Plan in March 2021 had already received stimulus payments via direct deposit or mailed checks as of January 2022. If you havent gotten a payment, your only option is to file a 2021 tax return, which is due on April 18.

The 2021 Recovery Rebate Credit, the third stimulus check, was issued based on your income and the number of dependents stated on your 2020 or 2019 tax return. As a result, if you have qualified dependents in 2021, you may owe money. You may also be entitled for a stimulus credit if you did not file a return in 2019 or 2020.

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couples total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individuals online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

You May Like: Is There Anymore Stimulus Checks Coming

Im Not A Us Citizen But I Pay Taxes Can I Get A Third Stimulus Check

Under the , non-US citizens, including those who pay taxes, werent eligible to receive the $600 payment, unlike with the first round of checks. Under the CARES Act of March 2020, all US citizens and non-US citizens with a Social Security number who live and work in America were eligible to receive stimulus payments. That included people the IRS refers to as resident aliens, green card holders and workers using visas such as H-1B and H-2A.

If your citizenship status has changed since you first got a Social Security number, you may have to update the IRS records to get your check. US citizens living abroad were also eligible for a first payment.

For the third payment, the new law includes checks for mixed-status citizenship families families with members with different immigration statuses who were left out of the first two checks.

What counts as income? That depends on your personal circumstances.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Also Check: Did They Pass The Stimulus Check

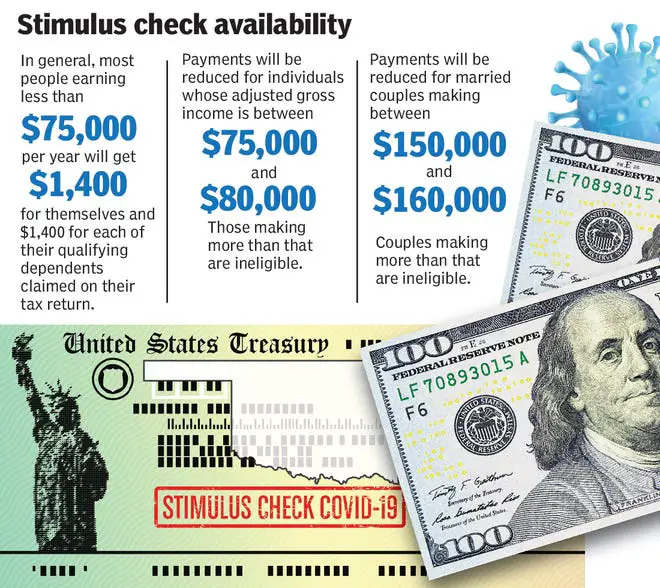

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Recommended Reading: Get My Stimulus Payment Phone Number

But You Won’t Have To Give Money Back Just Because You Received Too Much

The third stimulus check was issued to most people last year as an advancement of a 2021 tax credit. According to NerdWallet, this means that because the IRS did not have access to your 2021 tax information yet when sending this payment, they likely relied on your 2020 or 2019 tax return to determine if you were eligible. As a result, taxpayers might realize that they don’t actually qualify for all the money they received for the third economic impact payment when filing their 2021 return.

But fortunately, the IRS has a no harm, no foul outlook on recipients in this case. According to the tax agency, you don’t have to pay back money from your third stimulus check, even if you received too much. “If you qualified for a third payment based on your 2019 or 2020 tax return, the law doesn’t require you to pay back all or part of the payment you received based on the information reported on your 2021 tax return,” the IRS explains.

Your Third Stimulus Check: How Much When And Other Faqs

The IRS is sending out another round of stimulus payments. Here’s what you need to know about the third stimulus check with your name on it.

The IRS started sending third stimulus check payments in batches shortly after President Biden signed the American Rescue Plan Act on March 11. And, so far, the tax agency has sent over 150 million payments. But many Americans especially those who haven’t received a check yet still have a lot of questions about the third-round stimulus checks. At the top of the list: How much will I get? And when will I get it?

Fortunately, we have answers to these and other frequently asked questions about your third stimulus check. We also have a nifty Third Stimulus Check Calculator that tells you how much money you should get . Read on to get the answers you need to the questions you have. Once you know more about your third stimulus check, you can start figuring out how you can use the money to your advantage.

. It’s FREE!)

Don’t Miss: Change Address For Stimulus Check

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

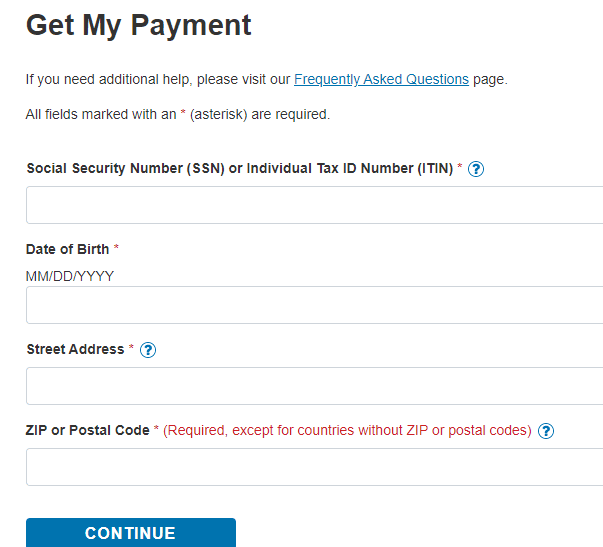

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

I Didn’t File A 2019 Or 2020 Tax Return And Didn’t Register With The Irsgov Non

Yes, if you meet the eligibility requirements. While you won’t receive an automatic payment now, you can still get all three payments. File a 2020 return and claim the Recovery Rebate Credit.

The IRS urges people who don’t normally file a tax return and haven’t received any stimulus payments to look into their filing options. The IRS will continue reaching out to non-filers so that as many eligible people as possible receive the stimulus payments they’re entitled to.

The IRS encourages people to file electronically, and the tax software will help figure the correct stimulus amount, which is called the Recovery Rebate Credit on 2020 tax forms. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in the community or finding a trusted tax professional.

You May Like: Check Status On Stimulus Check

Democrats Celebrate Stimulus Checks With Times Square Billboards

President Biden is looking to press home the success in passing the $1.9 trillion American Rescue Plan and is doing so with a series of public billboards. Here MSNBC presenter Rachel Maddows runs through some of the self-publicising being done by the Democrats at the moment, having fought to get the stimulus bill passed without any Republican support.

Republicans in the Florida state Senate have proposed a new bill that would provide a considerable increase to the current unemployment support. Some states have opted to provide their own stimulus checks for residents, but Florida currently has some of the stingiest jobless benefits in the country so lawmakers are prioritising that.

The Democrats have tabled some amendments which would widen eligibility, but Republican senators have so far blocked these attempts. Heres everything you need to know about the new unemployment benefits in Florida.

What To Do If You Missed The Deadline To Claim Your Money

If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, don’t worry. You can still claim that money when you file your taxes in 2023 — you just won’t receive it this year.

The final cutoff day for claiming the money will be on Tax Day in 2025, but we recommend filing as soon as possible.

You May Like: How To Check If You Received 3rd Stimulus Check

Which Tax Return Will The Irs Base My Third Stimulus Payment On

Q. I used the Recovery Rebate Credit on my 2020 tax return because my 2020 income was lower than 2019. Will the 2020 figures be used for the new $1,400 stimulus payment?

Need the money

A. Yes.

But timing is everything.

When the IRS processes your tax return is what will make the difference in determining what year the agency will use to calculate your stimulus payments, said Steven Gallo, a certified public accountant and personal financial specialist with U.S. Financial Services in Fairfield.

He said the worst case scenario is that you will have to wait until it processes your 2020 tax return to see your third stimulus payment.

It is our understanding that the current checks would be cut based on the most current tax return information the IRS has in their system, therefore if your 2020 tax return had not been processed prior to the first round of checks being issued they would still be using 2019 information, Gallo said. Once your 2020 return is processed and if it determines that you are eligible for stimulus relief, the IRS has until the end of 2021 to issue your check.

The IRS has not yet given guidance on how taxpayers will be able to make adjustments in the future.

The agency is still backed up with some 2019 returns that havent yet been processed, so its possible that 2020 returns may also take longer to process.

Email your questions to .

If you purchase a product or register for an account through one of the links on our site, we may receive compensation.