What About Social Security Beneficiaries

Many federal beneficiaries who filed 2019 or 2020 returns or used the Non-Filers tool last year were included in the first two batches of payments, if eligible, according to the IRS.

For federal beneficiaries who didnt file a 2019 or 2020 tax return or didnt use the Non-Filers tool, the IRS said it is working directly with the Social Security Administration, the Railroad Retirement Board and the Veterans Administration to obtain updated 2021 information to ensure that as many people as possible are sent automatic payments.

Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits, according to the agency.

More information about when these payments will be made will be provided on IRS.gov as soon as it becomes available, the IRS said.

Contributing: Kelly Tyko, USA TODAY

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Millions Of People May Still Be Eligible For Covid

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some peopleespecially those with lower-incomes, limited internet access, or experiencing homelessness. Based on IRS and Treasury data, there could be between 9-10 million eligible individuals who have not yet received those payments.

Relief might be in sight for more families and individuals. Individuals with little or no income, and therefore not required to pay taxes, have until to complete a simplified tax return to get their payments. Taxpayers who missed the April 15 deadline have until . These IRS pages, irs.gov/coronavirus/EIP and ChildTaxCredit.gov, have more information on how to complete and submit a tax return.

Todays WatchBlog post looks at our work on COVID-19 payments to individuals, including the Child Tax Credit and next steps for people who may still be eligible to receive theirs.

Who can get a COVID-19 stimulus payment or a Child Tax Credit?

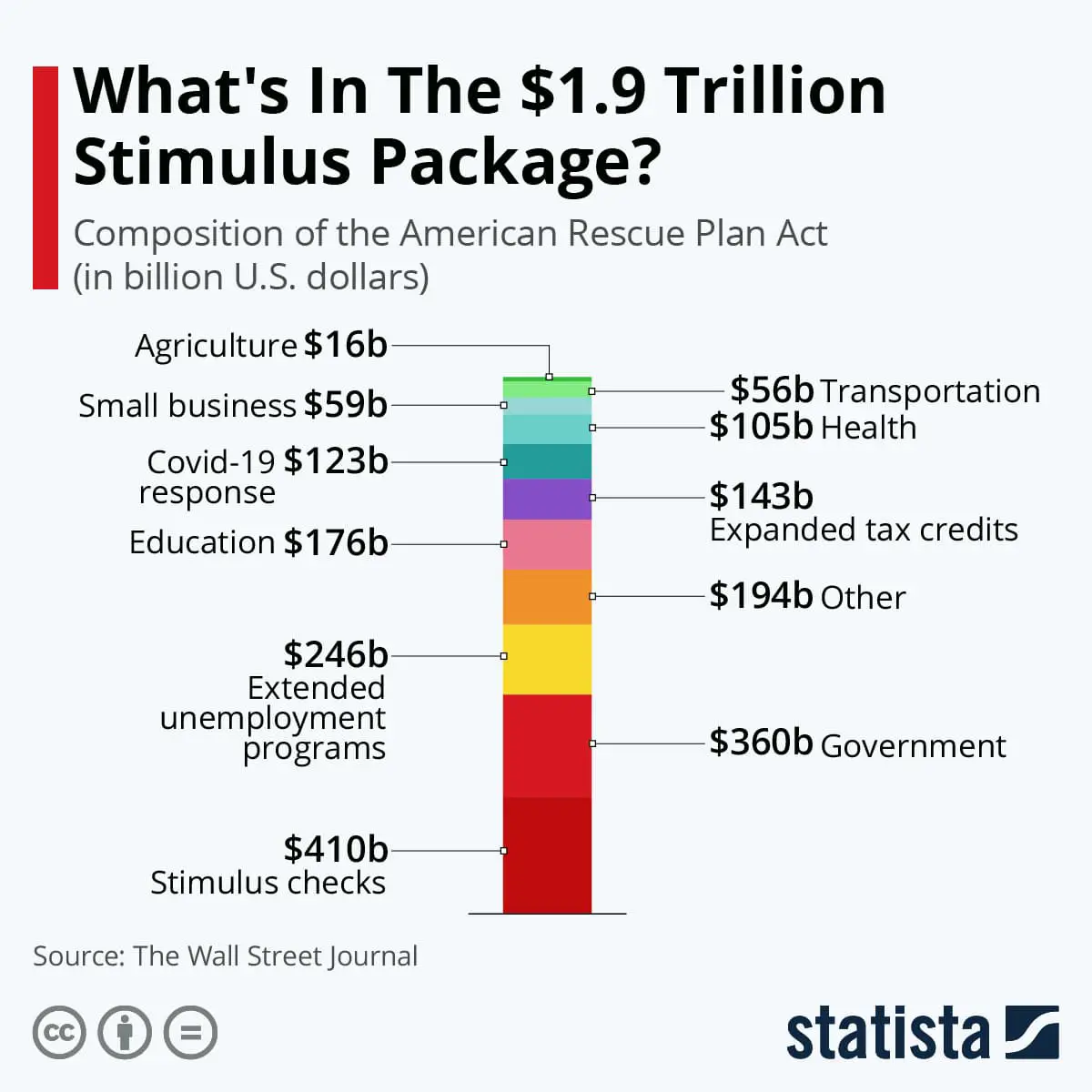

From April 2020 to December 2021, the federal government made direct COVID-19 stimulus payments to individuals totaling $931 billion. Congress authorized three rounds of payments that benefited an estimated 165 million eligible Americans. Generally, U.S. citizens with income below $75,000 or married couples with an income below $150,000 were eligible for all three payments and the full amount of each payment.

What more can Treasury and IRS do to get the word out about how eligible individuals can get their payments?

Read Also: Gas Stimulus Checks 2022 Ohio

How Do I Find Out How Many Stimulus Checks I Received In 2021

Asked by: Mr. Devante West

To find the amounts of your Economic Impact Payments, check: Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

If I’m Eligible How Much Of A Stimulus Payment Can I Expect To Receive

Roughly 85% of Americans will receive a $1,400 payment, including:

- Americans who earn less than $75,000 annually

- Americans who earn up to $112,500 as a heads of households

- Couples filing jointly who earn up to $150,000

In addition, households may receive an additional $1,400 for each qualifying dependent, including college students, older adult dependents, and individuals of all ages with disabilities.

You May Like: Who Will Get Stimulus Checks

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

Also Check: How Many Federal Stimulus Checks Were Issued In 2021

Who Else Is Eligible To Receive A Stimulus Payment

As with the previous pandemic-related stimulus payments, gig economy workers, self-employed individuals and Americans on unemployment, disability, Social Security or other federal aid are also generally eligible for stimulus checks, provided they filed federal income taxes in 2020 or 2019 and meet the income thresholds.

The Stimulus Became Political

Part of the problem is that the last rounds of stimulus the checks that went out in December 2020 and March 2021 may actually have been too big. But the decision to send an extra $2,000 to most Americans wasnt backed by evidence or economic calculations. It was shaped by politics.

Though the CARES Act passed on a near-unanimous, bipartisan basis in March 2020, when former President Donald Trump was in office, a much different story played out in the transition from his administration to now-President Bidens. Toward the end of 2020, Trump pushed for additional $2,000 payments, which House Democrats supported and later passed, but that effort was blocked by Republicans in the Senate who were alarmed by the price tag. Ultimately, direct payments of just $600 were greenlit despite broad-based support for the bigger checks among voters of both parties.

But Democrats, with control of the Senate hanging in the balance, decided to campaign for larger stimulus checks in the run-up to the Georgia run-off elections. Its impossible to know whether support for the checks gave now- Sens. Raphael Warnock and Jon Ossoff their respective edges, but Democrats did end up winning both seats and passing the American Rescue Plan two months later, which included $1,400 checks to meet the desired $2,000 target.

Instead of helping Biden and his party, then, the stimulus could end up hurting them in the 2022 midterm elections.

You May Like: Where Do I Put Stimulus Money On Tax Return

The First Round Of Stimulus Checks

The first round of stimulus payments were authorized under the Coronavirus Aid, Relief, and Economic Security Act. In 2020, the IRS had issued 162 million payments totaling $271 billion. The Congressional Budget Office estimates that those first-round payments will eventually cost a total of $292 billion.

Those initial payments issued earlier in 2020 were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child. The payments began phasing out at the same income levels as the current payments, but since the payments authorized under the CARES Act were larger, the maximum income levels to receive a payment were also larger:

- $99,000 for single taxpayers

- $136,500 for taxpayers filing as head of household

- $198,000 for married couples filing jointly

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Don’t Miss: How Can I Get My Stimulus Checks I Never Received

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

What Was The Third Stimulus Check For

How the Third Stimulus Check Became Law. The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000 …

You May Like: How To Fill Out Non Filers Form For Stimulus Check

How Many Stimulus Checks Did Americans Get

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Fourth Stimulus Check Possible Timeline

Right now, there is no fourth stimulus check timeline or fourth stimulus check release date. Until legislation is in motion, we cant say how soon more relief money might arrive. We cant say whether more relief money is coming, at all.

That said, the third stimulus check timeline happened rather quickly following Bidens inauguration Jan. 20. It only took a few weeks for Congress to debate his American Rescue Plan. Once the president signed the bill on March 11, $1,400 checks were put in motion.

The IRS can begin sending out possible fourth stimulus checks in the same manner it sent the previous stimulus payments. Since the framework is already in place, Americans could begin receiving the fourth stimulus checks about two weeks after a relief bill allowing another round of direct payments is approved.

You May Like: Haven’t Got My Stimulus

Can Get I More Of The Child Tax Credit In A Lump Sum When I File My 2021 Taxes Instead Of Getting Half Of It In Advance Monthly Payments

Yes, you can opt out of monthly payments for any reason. To opt-out of the monthly payments, or unenroll, you can go to the IRS Child Tax Credit Update Portal. If you do choose not to receive any more monthly payments, youll get any remaining Child Tax Credit as a lump sum next year when you file your tax return.

Dont Miss: Irs Phone Number For Stimulus Check 2021

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Also Check: I Still Haven’t Gotten My First Stimulus Check

We Will Likely Learn The Wrong Lessons From The Stimulus

The lessons we draw from the response to the COVID-19 recession are important, because theyll almost certainly shape how we respond to the next economic downturn. In the wake of the Great Recession, policymakers shot too low. Now, they appear to have shot too high. If this were the story of Goldilocks, wed be poised to get things just right next time but politics is not a fairy tale, and its very possible that well overcorrect whenever another recession hits.

In many ways, were still figuring out what the lessons are as the pandemic still isnt over. And its, of course, hard to disentangle what could have happened had the governments response not been so aggressive. One clear lesson of the COVID-19 pandemic, though, is that Americas social safety net wasnt prepared to deal with a crisis of this magnitude, which is a big part of the reason why the response had to be so massive.

Our social safety net wasnt ready to catch everyone who needed it, so it was very difficult to figure out who really needed relief and when the tap should be turned off, according to Sinclair. Rickety state unemployment insurance systems couldnt be recalibrated to replace peoples incomes, so many people ended up being paid much more after they lost their jobs. It wasnt easy to target direct payments to people in specific income brackets, so the payments went out to some families who didnt need them.

Santul Nerkar is a copy editor at FiveThirtyEight. @santulN

Filed under

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a Recovery Rebate Credit. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Also Check: What Month Was The Third Stimulus Check

Read Also: How Many Stimulus Checks Were There In 2020

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Read Also: How To Check If Received Stimulus Check