If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

The Latest On $1400 Stimulus Checks

This tax season, the government is also issuing a third tranche of third stimulus checks for up to $1,400 per individual, plus $1,400 per eligible dependent.

Last week, the IRS and other agencies said about 127 million checks have been sent to date, for a total of approximately $325 billion.

Those $1,400 payments are generally based on 2019 or 2020 tax returns, whichever was most recently filed and processed by the IRS. Those who used the IRS non-filer tool last year should also automatically get their payments.

There are also advantages to filing a 2020 return in order to receive the $1,400 payment, according to the IRS.

If your income dropped from 2019 to 2020, you could be eligible for a larger payment. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed.

Filing a 2020 tax return also lets you update your direct deposit information.

This tax season, non-filers are also required to file a tax return in order to get their payment, provided they have not already submitted their information to the government.

Of note, people who receive federal benefits such as Social Security, Supplemental Security Income, Railroad Retirement Board and Veterans Affairs will generally receive their stimulus checks automatically, though there have been delays in processing some of those payments.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Don’t Miss: H& r Block Stimulus Tracker

Are $2000 Monthly Stimulus Checks Possible

In response to President Biden’s American Jobs Plan proposal, a group of 21 senators on March 30 sent a letter urging the inclusion of stimulus checks in the legislation. The group called for recurring payments as long as the pandemic lockdown continued, meaning people would get monthly checks from the government. No amount for the payments was specified.

We urge you to include recurring direct payments and automatic unemployment insurance extensions tied to economic conditions in your Build Back Better long-term economic plan, wrote the group, which consisted of Sen. Elizabeth Warren, D-Massachusetts, Sen. Bernie Sanders, I-Vermont, and others.

An earlier stimulus check proposal, put forward during the early days of the American Rescue Plan in late January, also suggested monthly payments until the pandemic is over, but did not mention an amount. However, Rep. Ilhan Omar , D-Minnesota, tweeted earlier in January that she wanted to see $2,000 per month.

If that amount sounds familiar, it’s because now-Vice President Kamala Harris threw her support behind $2,000 recurring checks during the negotiations for the second stimulus check legislation in the summer of 2020.

The proposal has also gained plenty of support outside of Congress: Six online petitions calling for $2,000 monthly stimulus checks until the end of the pandemic have been posted. The biggest petition, on Change.org, has been signed by more than 2.8 million people and has a stated goal of reaching 3 million.

Theres A New Check Coming In July For Families Will It Be Permanent

This May 8, 2008, file photo shows blank checks on an idle press at the Philadelphia Regional Financial Center, which disburses payments on behalf of federal agencies in Philadelphia.

Matt Rourke, Associated Press

A new report suggests that the new child tax credit payments coming in July might be more permanent than we think.

Also Check: How Much 2021 Stimulus Check

Who Else Is Eligible To Receive A Stimulus Payment

As with the previous pandemic-related stimulus payments, gig economy workers, self-employed individuals and Americans on unemployment, disability, Social Security or other federal aid are also generally eligible for stimulus checks, provided they filed federal income taxes in 2020 or 2019 and meet the income thresholds.

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

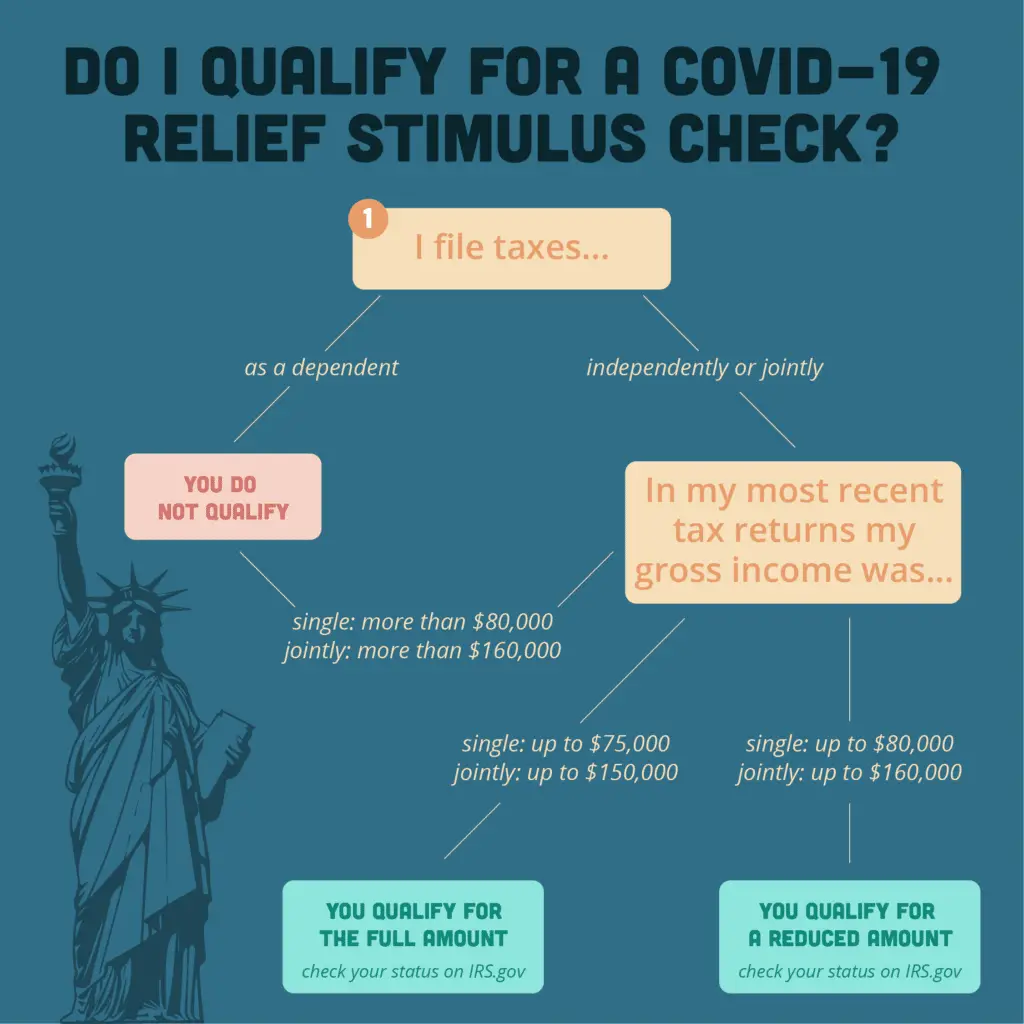

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

Recommended Reading: How To Check For Stimulus Checks

Fourth Stimulus Check Update

Biden’s American Rescue Plan Act, which created the third stimulus checks, did boost tax credits for most parents with children under 18, but only for the year 2021. Most parents and legal guardians will receive a tax credit of $3,600 for children under six, and $3,000 per child aged six through 17.

Half of that credit is coming in the form of monthly advance payments to parents beginning July 15 $300 per month for younger kids, and $250 for older ones. That’s similar to the monthly recurring checks that some legislators have called for.

The same law also retroactively exempted a large chunk of unemployment benefits paid out in 2020 from federal income tax. People who collected unemployment in 2020 and paid tax on it are getting thousands of dollars in tax-refund checks.

The American Rescue Plan Act also offers tax credits that cover all or most of the cost of a “Silver” health-insurance plan for six months under the Affordable Care Act, aka Obamacare. You’re eligible for this if you filed for unemployment benefits at any time in 2021, and if you don’t currently get health insurance through Medicare, Medicaid or someone else’s health plan.

Biden’s American Families Plan, which is separate from the American Jobs Plan, will seek to extend those tax credits, including the advance payments, through the end of 2025.

The American Families Plan would also mandate up to 12 weeks of paid parental leave and subsidies for childcare.

Three Rounds Of Stimulus Checks See How Many Went Out And For How Much

While you may have heard them referred to as stimulus checks, the Economic Impact Payments were for the most part direct deposited into bank accounts or sent out as bank cards. More than 472 million payments totaling $803 billion in financial relief went to households impacted by the pandemic. The Internal Revenue Service based the amounts that individuals received on income, tax filing status, and number of children .

NOTE: If you did not receive an Economic Impact Payment in 2020 or 2021, or you have questions about the payments, please visit the Internal Revenue Service for more information.

Also Check: Who Is Eligible For 4th Stimulus Check

First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into people’s bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

Will I Get A Stimulus Payment For My Spouse Who Died Last Year

A spouse who died in 2020 is not eligible for a stimulus payment under the American Rescue Plan. According to the IRS website, “a payment made to someone who died before they received the payment should be returned to the IRS.If the payment was issued to both spouses, and one spouse has died, the check should be returned, and the IRS will issue a new Economic Impact Payment to the surviving spouse.”

You May Like: Free File Taxes For Stimulus

Stimulus Check Scams And Hoaxes

Of course, popular demand for widely distributed stimulus payments, and the confusing political maneuvering that goes into crafting stimulus bills, creates an information gap that’s easily exploited by scammers.

Even with the first wave of stimulus checks in 2020, we saw bogus email messages that pretended to be from the IRS, promising “an important update on your Covid relief fund.” But they just took you to phishing sites that wanted your Social Security number and other sensitive bits of information.

Following the second stimulus bill at the beginning of 2021, those email phishing attempts were joined by scam phone calls demanding your personal details so that you could be “cleared” to receive more stimulus checks.

In March, as President Biden’s American Rescue Plan was making its way through Congress, new phishing emails promised the moon: a $4,000 stimulus check, a boost in the minimum wage, free meals and, best of all, priority treatment that let you skip lines at COVID-19 vaccination sites.

Most recently, cruel pranksters have been passing around posts on Facebook that a fourth stimulus check worth $2,500 is coming by the end of July. Don’t believe it, and don’t believe the phishing websites that claim to register you for child-tax-credit advance payments.

In fact, most parents and legal guardians don’t need to do anything to get the payments they’ll just show up in your mailbox or bank account.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Also Check: When Did The 1st Stimulus Checks Go Out

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Will There Be A Fourth Stimulus Check

US Agriculture Secretary Tom Vilsack made this announcement a few weeks ago that a fourth stimulus payment is indeed coming for some people. The funding that makes it possible? It actually came from the so-called American Rescue Plan, the $1.9 trillion legislation from earlier this year that authorized the $1,400 stimulus checks everyone got several months ago.

That legislation also supported a $700 million program thats funding this fourth stimulus check. The money is going to farmworkers, meatpacking workers, and grocery store employees, though its unclear at this point how much exactly the latter will get.

We recognize that our farmworkers, meatpacking workers, and grocery workers overcame unprecedented challenges and took on significant personal risk to ensure Americans could feed and sustain their families throughout the pandemic, Vilsack said in a news release about the forthcoming payment. They deserve recognition for their resilience.

Recommended Reading: Did They Pass The Stimulus Check

Where Is My Stimulus Check

You can see what economic impact payments were issued to you by accessing your Internal revenue Service account on the agency’s Your Online Account portal. You can also use this service to view your tax history, make payments, or make payment arrangements. You’ll need your Social Security number and other information to verify your identity.

When Will I Start Receiving My Monthly Payments

People who receive payments by direct deposit got their first payment on July 15, 2021. After that, payments continue to go out on the 15th of every month. If you havent provided the IRS with your bank account information on a recent tax return, a check will be sent out to you around the same time to the address the IRS has for you.

Don’t Miss: File Taxes To Get Stimulus

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Recommended Reading: Get My Stimulus Payment Phone Number

Financial Crisis Of 2008

One example of the use of stimulus checks occurred when the U.S. economy entered a severe recession after the financial crisis of 2008. The incoming Obama administration estimated that sending out checks would prevent unemployment rates from going beyond 8%.

The payments were part of the Economic Stimulus Act of 2008, which was enacted during the administration of President George W. Bush. The government sent out checks to those with at least $3,000 in qualifying income from, or in combination with, Social Security benefits, Veterans Affairs benefits, Railroad Retirement benefits, and earned income. The checks amounted to:

- Eligible Individuals: Between $300 and $600

- Between $600 and $1,200

- With Eligible Children: An additional $300 for each qualifying child

Fourth Stimulus Check Approval: Here’s What It’ll Take

The White House hasn’t responded to any of the proposals for additional stimulus checks, and the general sentiment is that a fourth stimulus check isn’t likely. Economists have suggested we’ve already moved past the pandemic’s worst financial woes, although there are signs that Americans could still use relief.

Experts certainly seem in agreement that there won’t be a fourth stimulus check. The latest stimulus package, the American Rescue Plan, is “gonna be the last on that front,” Deutsche Bank senior U.S. economist Brett Ryan told Fortune . “No more checks.”

Ed Mills, Washington policy analyst at Raymond James, agreed, telling CNBC recently “I think its unlikely at this time. D.C. has largely started to pivot towards the recovery and an infrastructure bill.”

Many economists and financial experts are worried that the third stimulus checks have contributed to a growing inflation rate. In June 2021, the core inflation rate, stripped of energy and food prices, rose 4.5% at an annual rate vs. the Dow Jones estimate of 3.8%. The overall consumer price index rose at an annualized 5.4% rate in June.

Read Also: Stimulus Checks Status Phone Number