% Americans Back The Concept Of New Stimulus Checks To Fight Sky

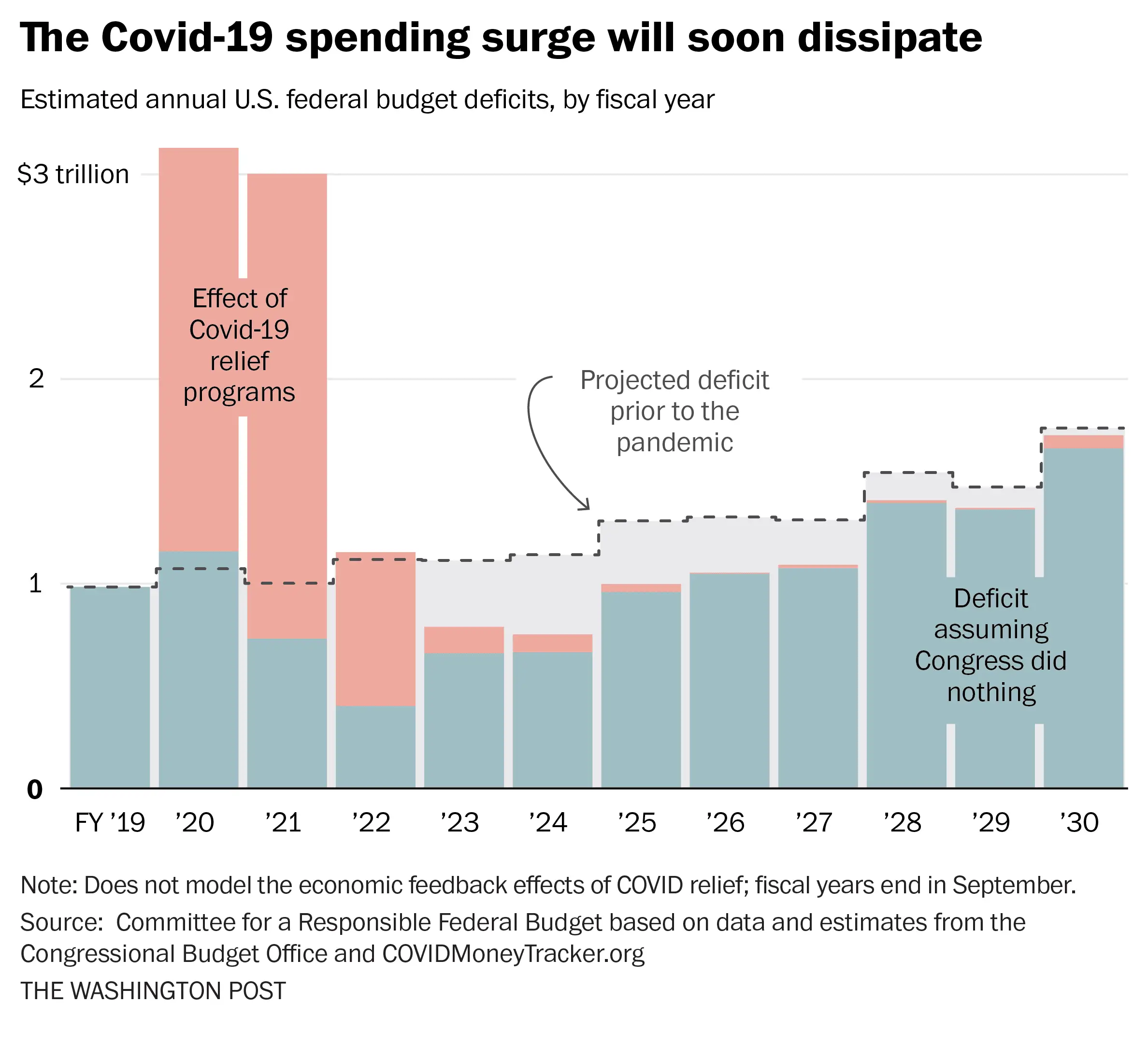

Many professionals and economists are concerned about an impending recession due to high inflation, rising interest rates, and labor shortages.

What is confident amid all this ambiguity is that American households need immediate assistance and are struggling.

According to a Newsweek poll, 63% of Americans want the federal government to issue new stimulus payments to fight inflation.

However, there is no sign that Washingtons politicians intend to approve the fourth batch of stimulus payments. Additionally, some analysts claim that it will make matters worse.

This October, Beth Akers, a senior fellow at the American Enterprise Institute, wrote in a blog post, Handing away cash in an inflationary atmosphere would only make things worse by driving prices up further.

But that doesnt necessarily mean youre out of luck. Your assistance might come from a more minor, more regional administration.

Am I Eligible For A State Stimulus Check

Eligibility requirements for state stimulus checks vary by state. Most states, however, require that residents have filed taxes and meet certain income criteria. Typically, if your individual or household income is too high, you wont qualify for a stimulus check. But in some states, income doesnt matter, and all residents are eligible.

You May Like: How Much Should I Have Received In Stimulus Checks

Further Details On These Expanded Tax Benefits

The three credits include:

- An expanded Child Tax Credit: Families can claim this credit, even if they received monthly advance payments during the last half of 2021. The total credit can be as much as $3,600 per child.

- A more generous Earned Income Tax Credit: The law boosted the EITC for childless workers. There are also changes that can help low- and moderate-income families with children. The credit can be as much as $1,502 for workers with no qualifying children, $3,618 for those with one child, $5,980 for those with two children and $6,728 for those with at least three children.

- The Recovery Rebate Credit: Those who missed out on last year’s third round of Economic Impact Payments may be eligible to claim the RRC. Often referred to as stimulus payments, this credit can also help eligible people whose EIP3 was less than the full amount, including those who welcomed a child in 2021. The maximum credit is $1,400 for each qualifying adult, plus $1,400 for each eligible child or adult dependent.

Besides these three credits, many filers may also qualify for two other benefits with a tax return filed for 2021:

Further details on all these benefits are available in a fact sheet, FS-2022-10, posted earlier this year on IRS.gov.

Don’t Miss: Is The 1400 Stimulus Taxable

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Budget Surpluses: Up to 20 states are using their excess funds to help taxpayers deal with rising costs. But some economists worry that the payments could fuel inflation.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

Other states offering some type of rebate or credit are Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Oregon, Pennsylvania, Rhode Island and Virginia.

Here are some questions and answers about state relief payments:

Best Things To Say To Your Former Teachers

Admit it. Back in the day, you probably rolled your eyes at that one teacher who nagged you to do better. But now you understand the bigger lessons they were trying to teach you. Look up one of your old instructors and tell them how they made an impact on your life. Here are some things you can say:

1. I wouldnt be where I am without you. Running your own business. Thriving in a career you love. Getting out of debt. Starting a charity. What teacher wouldnt get a kick out of knowing they motivated you to achieve those things?

2. I never forgot this one thing you said to me. Educators love to hear how a phrase they utteredlike double-check your work or learn from your mistakes instead of dwelling on themstuck in your mind. Theyll also be happy the words didnt go in one ear and out the other.

3. You saw something in me that I didnt see in myself. Award-winning actress Hilary Swank told the Academy of Achievement that she found her calling when her fifth-grade teacher, Mr. Sellereit, had her write and perform a skit for her class.1 Imagine how good Mr. Sellereit felt when he heard that! Hilary said she was so grateful for his influence that shes even gone back to visit his classroom and speak to his students.2 Talk about a compliment!

Also Check: Can You Still Receive Stimulus Check

Recommended Reading: Social Security Recipients Stimulus Checks

Th Stimulus Check Update 2022 14 States To Send Direct Payments To Residents See If Yours Is On The List

FOURTEEN states are sending direct payments to millions of residents over the course of this summer.

As millions of Americans feel the effects of inflation, 14 states will issue payments to their residents in the form of tax rebates.

For instance, Maine has also been sending out rebate checks worth $850 per individual and $1,700 for the average family. The state mailed nearly 200,000 rebate checks per week throughout June.

Finally, Governor Gavin Newson of California announced 23million Californians will benefit from direct payments of up to $1,050, with payments going out soon.

Read our stimulus live blog for the latest news and updates

Costco Reveals Store Closure But Customers Wont Be Disappointed By $133m Change

And its possible that could happen soon.

Some economists are fearing that the Federal Reserves action on interest rates could lead to a recession.

So far, the Fed has hiked interest rates four times this year in an effort to tame inflation.

And more hikes are likely on the way.

Unless we see a rapid decline in the month-over-month inflation rate, well likely see the Fed raise interest rates again this year, Laura Adams, a personal finance expert from Finder.com told The Sun in July.

Higher interest rates make most types of credit such as credit cards, mortgages, and other business and personal loans cost more, which could lead to a recession, she added.

As of August, the unemployment rate was sitting at 3.7% right around pre-pandemic levels but that could change.

Should the numbers tick up, this could force Biden and his Democratic to push publicly for another round of stimulus.

Read Also: Stimulus Checks Gas Prices 2022

Stimulus Checks 202: State Relief Checks Tax Implications And More Of The Biggest Topics Of 2022

Although the federal government did not issue any economic impact payments aka stimulus checks in 2022, some states took it upon themselves to offer financial relief to eligible residents to offset the effects of inflation and rising gas prices. These inflation relief checks were issued in 17 states in 2022: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Maine, Massachusetts, New Jersey, New Mexico, New York, Pennsylvania, South Carolina and Virginia. Payment amounts ranged from $50 to $1,050 for individuals, depending on the state and income level of the recipient.

See: States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Given the tough economic times, its no surprise GOBankingRates readers looked for information on future stimulus payments they may be receiving, which states are offering inflation relief payments and when they might expect to receive these payments. These topics and more were among our most-read stimulus stories of the year.

Heres a look at the top 10 most-read stimulus stories of 2022.

State Stimulus Checks 202: See If Payments Are Coming Your Way Before The Year Ends

Nearly 20 states approved stimulus payments in one form or another in 2022, and residents in a dozen of them are still waiting for their money. If you live in one of the following 12 states and you havent yet received a payment you qualified for, dont panic the check might be in the mail.

Take a look below for more payment information from these state governments.

Recommended Reading: Is Economic Impact Payment Same As Stimulus

Who Is Eligible For A Tax Credit

Applications open February 1, 2023 for the 2022 tax year and are accepted through December 31, 2023. Individuals and families are eligible for the Working Families Tax Credit if they meet all of the following requirements:

- Have a valid Social Security Number or Individual Taxpayer Identification Number .

- Lived in Washington a minimum of 183 days in 2022 .

- Are at least 25 and under 65 years of age OR have a qualifying child in 2022.

- Filed a 2022 federal tax return.

- Eligible to claim the federal Earned Income Tax Credit on their 2022 tax return .

- Go to www.irs.gov/EITC to learn more.

Stimulus Check 202: How To Check If You Are Eligible For New Direct Payments

States across the country are issuing stimulus payments in response to rising inflation, but which groups receive checks differs by state. Here is how to see if you are eligible:

Recent state relief payments vary in their reasoning, but all aim to help citizens with the cost of living either through new spending or using leftover state funds. The goal of the payments is to stimulate the economy, providing the origin for the term “stimulus.”

Eligibility varies greatly by state, with some offering wide-ranging relief payments, while others push for more targeted payments and some are not doling out any form of payment.

Some states, such as Georgia, Massachusetts, and Virginia, are offering tax rebates paid for by budget surplus or other methods, while other states are taking more selective approaches, such as Florida’s payments to low-income families.

To check for which programs states are implementing and who is eligible, check your state government’s website or see what the latest updates are in several states here.

The total amount for the relief checks also varies greatly by state. States such as Georgia are offering taxpayers rebates for as little as $250 and as much as $375, while states such as Colorado are offering taxpayers rebates that range from $750 to $1,500.

Also Check: Recovery Rebate Credit Third Stimulus

What Is The Alaska Permanent Fund

In 1976, Alaska voters amended their state constitution to establish the Permanent Fund and require that at least 25% of the stateâs oil and mineral royalties be deposited into it. Money from the fundâs earnings is used to supplement the stateâs general fund as well as pay dividends to eligible residents.

The Alaska Permanent Fund Corporation oversees management of the fund while the Permanent Fund Dividend Division within the state Department of Revenue distributes money to residents. However, neither is responsible for setting the annual payment amount.

âWhile APFCâs 60 professionals invest the portfolio to protect the principal and maximize returns, the Legislature has the power of appropriation, including the appropriation of the fundâs earnings,â an APFC spokesperson told Forbes Advisor in an email.

Minnesota: $750 Payments For Frontline Workers

Some frontline workers could receive a one-time payment of $750, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021, and were not eligible for remote work. Workers with direct Covid-19 patient-care responsibilities must have had an annual income of less than $175,000 between Dec. 2019 and Jan. 2022 workers without direct patient-care responsibilities must have had an income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Walz recently proposed using the states $7 billion budget surplus to fund a generous relief package, proposing that Minnesotans receive tax rebate checks of $1,000 per person. Doing so would require action from the state legislature.

Read Also: Irs 4th Stimulus Check Update

Chances Of Federal Stimulus On The Decline

The chances of a federal stimulus payment are expected to decline in 2023.

The new Congress will be sworn in on January 3 and now that the House of Representatives is controlled by Republicans, experts warn a federal stimulus is unlikely.

Texas Representative Kevin Brady told CNN that House Republicans are looking at a plan for, less government spending, taxes and regulation that is fueling higher prices, more made-in-America energy, more workers reconnected to their job and innovation that can reduce the drivers of inflation.

Since the House plans on decreasing federal spending, the likelihood of a federal stimulus is low.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Don’t Miss: How Many Stimulus Checks In 2020

Free File To Stay Open Until November 17

To help people claim these benefits, without charge, Free File will remain open for an extra month this year, until November 17, 2022. Available only at IRS.gov/freefile, Free File enables people whose incomes are $73,000 or less to file a return online for free using brand-name software. Free File is sponsored by the Free File Alliance, a partnership between the IRS and the tax-software industry.

People can also visit ChildTaxCredit.gov to file a 2021 income tax return. Individuals whose incomes are below $12,500 and couples whose incomes are below $25,000 may be able to file a simple tax return to claim the 2021 Recovery Rebate Creditwhich covers any stimulus payment amounts from 2021 they may have missedand the Child Tax Credit. Individuals do not need to have children in order to use Get Your Child Tax Credit to find the right filing solution for them.

Federal Stimulus Checks Wont Be Coming Before The Election

The current Congress is not going to provide another stimulus check. The last payment, authorized by the American Rescue Plan Act, was passed along party line votes through a special process called reconciliation. There is no further opportunity to pass legislation this way until after the election, and there is not broad enough support to get a bill through that would authorize a fourth payment.

You May Like: Credit Card Debt Stimulus Program

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022 can expect to receive their returns in September or October. For residents filing their 2021 return between Aug. 1 and Dec. 31, you can expect your payment up to 12 weeks after filing.

You May Like: What Is Congress Mortgage Stimulus Program

Here’s What Else You Should Know

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Families can also receive $1,400 per dependent, regardless of the dependent’s age.

The Child Tax Credit was also temporarilyextended by Congress to consider more families and increase how much they can receive.

Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. You can check the IRS’s site to determine if you qualify.

Tax returns can also be completed and submitted through CTC’s site, including the simplified filing tool which was updated on Wednesday.

GAO discovered that people within certain groups may have faced difficulty receiving their payments.

This includes those who:

You May Like: How Can I Apply For Stimulus Check

New Mexico Stimulus Checks

New Mexico “stimulus” payments for eligible residents come in the form of two tax rebates in 2022. The first tax rebate amount is $500 for joint filers, head-of-household filers, and surviving spouses with incomes under $150,000, and $250 for single filers and married people filing separate tax returns. The second tax rebate is worth $1,000 for joint filers, head-of-household filers, and surviving spouses, and $500 for single filers and married residents filing separately.

The first-round of tax rebates began in July, while the second-round payments began in June. However, payments will continue to be sent to people who file a 2021 New Mexico tax return by May 23, 2023. As a result, some New Mexicans will receive rebate checks in December. If you filed a 2021 return but haven’t received a rebate, you can all the New Mexico Department of Taxation and Revenue at 866-285-2996.

For New Mexico taxes in general, see the New Mexico State Tax Guide.