First Stimulus Check Payment In 2020

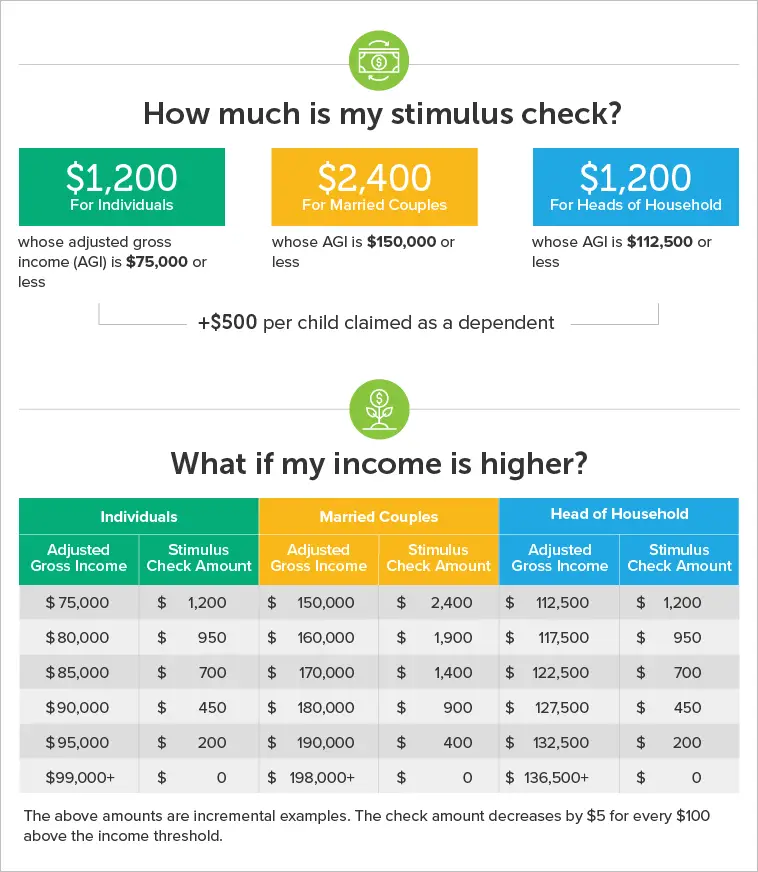

The $2.2 trillion dollar stimulus bill has now been signed into law. Under this bill there is the widely reported economic stimulus payment checks of $1,200 per adult and $2400 for couples. For families they would provide $500 for every eligible child. The full stimulus check would be made to those earning less than $75,000 and would phase out to zero for those earning more than $99,000 . Head of household tax filers will get the full payment if they earned $112,500 or less.

In the phase out range for every $100 you earn above the lower limit payment drops by $5 until you reach the maximum limit .

Example If Brian made $67,000 last year based on his latest filed tax return, he would get the full $1200 payment. If he had made $90,000 he would only be eligible for $450 . If he had made $110,000 he wouldnt be eligible at all.

| 2019 or 2018 Filing Status | Income Below Which FULL Stimulus is Paid | Maximum Income To Qualify for Partial Stimulus |

|---|---|---|

| Single or married filing separate | $75,000 | |

| $198,000 |

Example My wife and I made $185000. We filed jointly. Are we eligible to get anything from the 2020 stimulus? Answer You would be eligible to get $650.00 under the direct payment program. Up to $150,000, you get 100% of the $2,400 stimulus payment. Anything over 150,000, you would subtract 5% of the amount over $150,000. So in your scenario, 35k over 150k. 5% of 35k is $1750, So $2400- $1750=$650.00

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

What Information Will The Trace Provide Me

The IRS will process your claim for a missing payment in one of two ways:

- If the check was not cashed, they will reverse your payment and notify you. If you find the original check, you must return it as soon as possible. You will need to claim the 2020 Recovery Rebate Credit on your 2020 tax return to receive credit for EIP 1 and EIP 2, and then claim the 2021 Recovery Rebate Credit on your 2021 tax return for EIP 3, if eligible.

- If the check was cashed, the Treasury Departments Bureau of the Fiscal Service will send you a claim package that includes a copy of the cashed check. Follow the instructions. The Treasury Departments Bureau of the Fiscal Service will review your claim and the signature on the canceled check before determining whether the payment can be reversed. If reversed, you will need to claim the Recovery Rebate Credit on your 2020, or 2021 return depending on what EIP payment in reference, if eligible.

Also Check: How Much Stimulus Did We Get In 2021

A Fourth Stimulus Check In 2022 To Deal With Inflation Pressures

There has plenty of talk of a fourth stimulus check in 2022, originally as a relief payment in Bidens build Back Better Bill and now as a way to offset higher costs many consumers are seeing due to record inflation.

However progress on a 4th stimulus check has stalled in Congress due to lack of agreement among Democrats and Republicans and what they can sell to their constituents ahead of the upcoming mid-term elections.

A 2022 Gas Stimulus?

With rising gas prices, many states are providing gas tax holidays which save drivers a few cents at the pump. Some states and even Congress are also considering a gas relief stimulus check which will pay families up to $400 p/month through 2022.

With the economy rebounding strongly, higher inflation and unemployment claims falling, it was hard for most Democrats in Congress to justify spending billions of dollars on even more stimulus payments.

Some states like California however, are making state specific stimulus payments to provide inflation relief for lower income workers which may be replicated in other states.

These are being done via additional tax rebates and immediate payment for lower income workers who filed a recent tax return.

The IRS has also completed making millions ofplus-up or catch-up stimulus payments to those who have filed a recent tax returns.

All plus-up and catch-up payments for past credits has now completed. You will need to claim them via filing a tax return.

How Can I Check My Stimulus Check Status

The IRS has created a website where you can check the status of your stimulus payment.

The Get My Payment tool is no longer updating for either the first or second stimulus check. However, you can use it to see the status of your third check.

- If your payment has been processed. the IRS will specify its status including whether it has been sent, the date issued, and whether the money will be directly deposited or mailed.

- If your status reads “Payment Not Available.” The IRS either hasn’t yet processed your payment or you aren’t eligible for one.

- If it reads “Need More Information.” Your check was returned to the IRS after an attempted delivery. Give the IRS your bank information to receive your money.

If you did not get your first or second check, you’ll need to file a 2020 tax return to get the payment.

You May Like: Can Stimulus Check Be Taken For Back Taxes

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

What If I Get Government Benefits Will These Payments Count Against Eligibility Or Unemployment Insurance

Economic Impact Payments dont count against means-tested programs like SNAP, TANF, or Medicaid. The payments are not counted as income during the month they are received and the following month and they are not counted as a resource for 12 months.

You will receive the check regardless of your employment status. The check will not impact your eligibility for unemployment payments.

You May Like: Is The Homeowners Stimulus Real

Injured Spouse Claim And Spousal Claims

The IRS also stated that If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return , half of the total payment will be sent to each spouse and your spouses stimulus check payment will be offset only for past-due child support.

There is no need to file another injured spouse claim for the payment. I have received dozens of comments on this this, so hopefully this answers the questions many have had based on official IRS guidance.

Note that if you were current with your child support payments at the time of the stimulus eligibility determination but fell behind afterwards due to a COVID-19 related job loss, you would still be eligible to get the full stimulus payment.

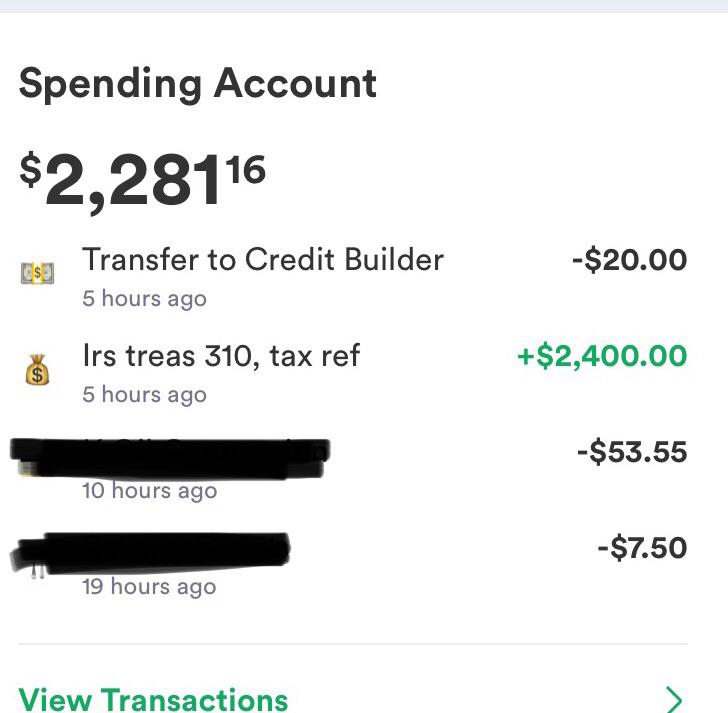

Updating Direct Deposit Information

This question has come up a lot in the hundreds of comments to this article. The IRS has setup a portal for individuals to provide their updated banking information to receive payments via direct deposit as opposed to checks in the mail.

The IRS does recommend that 2018 Filers who need to change their account information or mailing address, file 2019 taxes electronically as soon as possible. That is the only way to let us know your new information..

Rd Stimulus Check Eligibility: Who Gets The Third Stimulus Check

The American Rescue Plan is a $1.9 trillion relief package to help alleviate the hardship that millions of Americans feel right now including checks directly to families and individuals like you. Here are the details about who qualifies for the third stimulus checks. Visit our other blog post for more details about other benefits.

Recommended Reading: When Should I Get My Stimulus Check

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

What Was The Third Stimulus Check For

How the Third Stimulus Check Became Law. The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000 …

Don’t Miss: Get My 2nd Stimulus Payment

Second $600 Stimulus Check Details

While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. The IRS however has confirmed has issued all first and second Economic Impact Payments it is legally permitted to issue, based on information on file for eligible people.

Get My Payment was last updated on Jan. 29, 2021, to reflect the final payments and will not update again for first or second Economic Impact Payments.

If you havent yet received your payment and GMP is not showing payment details then the IRS is recommending you claim this via a recovery rebate credit in your 2020 tax return that you will file this year. Major tax software providers have updated their software to allow tax payers to claim their missing first or second stimulus payment as a recovery rebate with their 2020 tax filing.

Under the COVID-related Tax Relief Act of 2020, the IRS has delivered more than 147 million EIPs totaling over $142 billion. Due to the lower income qualification thresholds and smaller payments this was lower than the 160 million payments made via the first stimulus check.

President Biden also recently signed an Executive Order for the IRS to provide a new tool to claim missing stimulus checks and conduct more analysis to ensure those who were unable to get their first or second check are notified around their eligibility.

Get The Information You Need

The stimulus guide includes an FAQ section for understanding important info, including:

- Who is eligible to receive a stimulus check?

- How will the IRS determine income for the stimulus payment?

- How much money you will receive.

- Will the stimulus money be considered income that has to be claimed on taxes?

- How will you get the stimulus payment?

- The stimulus checks impact on other benefits or if debts are owed to other agencies.

Recommended Reading: Where My Golden State Stimulus

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the Recovery Rebate Credit are found on pages 57 59.

South Carolina Stimulus Checks

South Carolina is sending tax rebate payments this year to people who file a 2021 South Carolina income tax return showing a state tax liability by February 15, 2023. The amount you receive depends on your 2021 South Carolina income tax liability, but it won’t be more than $800.

If you filed your 2021 South Carolina tax return by October 17, 2022, your rebate will be issued by the end of 2022. If you file after October 17 but before February 15, 2023, your payment will be issued by March 31, 2023.

The South Carolina Department of Revenue has an online tool to track the status of your rebate.

For South Carolina taxes in general, see the South Carolina State Tax Guide.

Recommended Reading: When Was The Second Stimulus Check Sent Out

What If I Don’t Receive My Check On The Expected Date

If your check doesn’t arrive on the date listed above based on your birth date or other circumstances, the Social Security Administration says to wait three additional mailing days before calling. If you still haven’t received it, you can then call 800-772-1213 to speak with a representative.

The SSA notes that wait times to speak with a representative are shorter Wednesday through Friday and later in the day .

Social Security Payments For December: When Is Your Money Coming

Social Security payments for December started going out this week. See when your payment will arrive.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The Social Security Administration this week started disbursing December payments. In , you’ll get your first increased benefit amount. For those who receive Supplemental Security Income, you’ll get your first increase in December. We’ll explain why below and how the timing of Social Security payments works.

This month, keep an eye out for a letter in the mail about your Social Security benefits increase for 2023. It’ll have details about your individual benefit rate increase for next year — or you can also check your benefits online using your My Social Security account.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents

Also Check: $2 000 Monthly Stimulus Check Update

Stimulus Check Update: Havent Gotten Your Third Stimulus Payment Heres How The Irs Wants You To Claim The $1400

by Angelica Leicht |Updated July 25, 2021 First published on April 27, 2021

Image source: Getty Images

Waiting on the arrival of your third stimulus payment? Heres what the IRS wants you to do to claim the money.

The stimulus checks that were part of President Joe Bidens American Rescue Plan first started rolling out in March, shortly after the third stimulus bill was signed into law. Over the last month or so, payments from the third round of stimulus checks have been making their way to bank accounts and mailboxes across the nation. In total, the IRS has delivered about 161 million stimulus checks to Americans who qualify, totaling more than $379 billion in direct payments.

But, while this round of checks has been issued at a record pace, there are still millions of Americans who are waiting for their payment to arrive. This round of stimulus money, which includes $1,400 payments for qualifying adults and their dependents, is meant to help Americans who continue to struggle due to the pandemic.

Revealed today: Access our experts topcash-back credit card pick that could earn you upwards of $1,300, all with no annual fee.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Read Also: How To Get Stimulus Check Without Filing Taxes

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

What If Ive Had Changes Since Filing My 2019 Tax Return

The IRS used information on your 2019 tax return to determine your payment amount if you didnt file a 2020 tax return or if it wasnt processed in time.

If you had a child, you will be able to get the additional $500 for them when you file your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you moved and the first stimulus check was not delivered to you, you may need to request a payment trace so the IRS can determine if your payment was cashed . If your payment wasnt cashed, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or by using GetCTC.org if you dont have a filing requirement.

If you got divorced and no longer live at the address on your tax return or included direct deposit information for a joint account and you are no longer married, this may be a complex matter that should be discussed with a tax professional.

Unfortunately, if the first stimulus check was issued, the IRS treats the payment as being received by both spouses, even if both people didnt get the money. If the payment went only to your ex-spouse, the IRS views this as a personal legal matter that you should discuss with your divorce attorney. You can also contact your local Low Income Taxpayer Clinic or local Taxpayer Advocate Service for help.

Recommended Reading: Why Have I Not Received My 3rd Stimulus Check