Irs Begins Delivering Third Round Of Economic Impact Payments To Americans

IR-2021-54, March 12, 2021

WASHINGTON The Internal Revenue Service announced today that the third round of Economic Impact Payments will begin reaching Americans over the next week.

Following approval of the American Rescue Plan Act, the first batch of payments will be sent by direct deposit, which some recipients will start receiving as early as this weekend, and with more receiving this coming week.

Additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The vast majority of these payments will be by direct deposit.

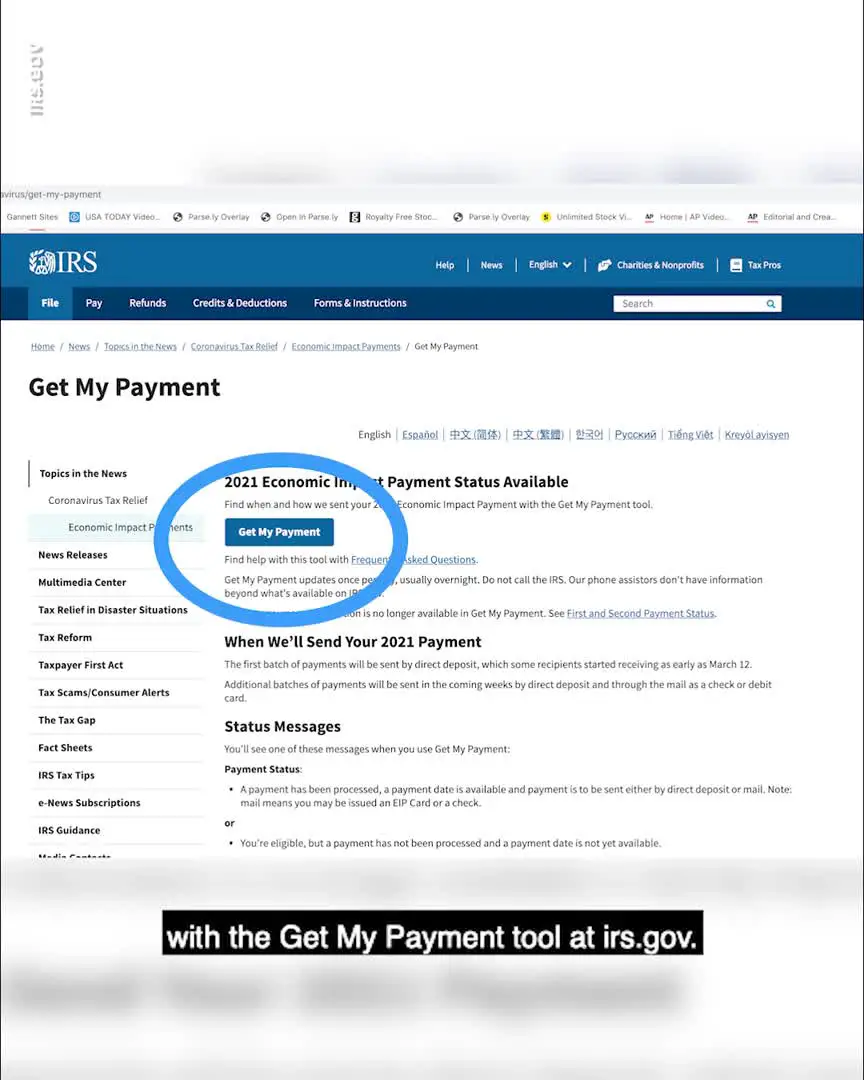

No action is needed by most taxpayers the payments will be automatic and, in many cases, similar to how people received the first and second round of Economic Impact Payments in 2020. People can check the Get My Payment tool on IRS.gov on Monday to see the payment status of the third stimulus payment.

“Even though the tax season is in full swing, IRS employees again worked around the clock to quickly deliver help to millions of Americans struggling to cope with this historic pandemic,” said IRS Commissioner Chuck Rettig. “The payments will be delivered automatically to taxpayers even as the IRS continues delivering regular tax refunds. We urge people to visit IRS.gov for the latest details on the stimulus payments, other new tax law provisions and tax season updates.”

When Should I Receive The Stimulus Check

For those who have e-filed tax returns with the IRS in the past or otherwise provided the IRS with their direct deposit information, the IRS started to direct-deposit stimulus money last weekend.

Other individuals will receive their payments by mail. The IRS will start mailing some checks in mid-March. If you received the first or second stimulus check by direct deposit, theres no guarantee youll receive the third check by direct deposit, especially if you filed your tax return after your first or second stimulus payment and didnt use direct deposit for your tax refund.

First Round Of Economic Stimulus Checks: April 2020

The CAREs Act included a provision for a round of stimulus payments eligible tax-paying adults received a check of up to $1,200 while eligible dependents under 16 years of age received $500 each .

The payments were made to everyone earning under the income limits, which were set at Adjusted Gross Income of $75,000 with the stimulus check value reducing in a tapered fashion up to a maximum of $99,000 . The very first stimulus checks were paid into people’s bank accounts over the weekend of the 11 and 12 of April, either via direct deposit into individuals bank accounts, paper checks sent through the post or in some cases, through a prepaid debit card, the Economic Impact Payment Card which were sent out in late May/early June last year.

Read Also: Fed Stimulus Pays Off Mortgage

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

When Will I Get My Stimulus Check

The IRS has begun distributing stimulus payments. The first batch of stimulus payments could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks.

For information on when you can expect your stimulus payment, check the IRS Get My Payment tool, which will be live starting March 15th.

Don’t Miss: Will We Be Getting Another Stimulus Check In 2022

Third Stimulus Checks: 31 Million Massachusetts Households Will Receive Payments Totaling Nearly $74 Billion

More than 3.1 million Massachusetts households will receive COVID-19 stimulus checks totaling nearly $7.4 billion in the coming weeks thanks to President Joe Bidens $1.9 trillion American Rescue Plan.

According to a congressional research memo and data shared by the offices of Sens. Ed Markey and Elizabeth Warren, the comprehensive relief bill set for Bidens signature Friday will spread about $7.36 billion among 3,108,170 households across the commonwealth.

Stimulus checks of $1,400 or more should wind up in many Massachusetts residents bank accounts within a week or two, so long as they already have their banking information on file with the Internal Revenue Service, lawmakers and experts say.

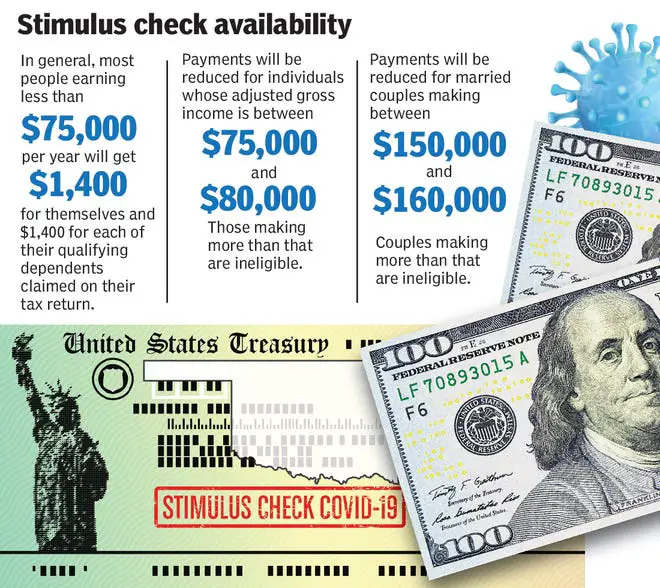

The direct payments $1,400 for adults earning less than $75,000 and couples less than $150,000, as well as $1,400 for dependents could amount to $5,600 for many families of four, Biden told reporters at the White House after the U.S. Senate passed the comprehensive aid package in a party-line vote last Saturday. The Democratic-led House passed the legislation in a nearly party-line vote on Wednesday.

California looks to receive the most payments, with more than $45 billion spread among 17 million households. Florida and Texas also will see more than 10 million households receive payments. All told, the Senate Budget Committee estimated at least 145 million American households will receive payments for a combined total of almost $380 billion.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Don’t Miss: How Many Stimulus Checks Were Issued In 2021

How Much Will The Third Stimulus Be Worth

Those who qualify for the stimulus will receive up to $1,400 per person in their household including $1,400 for each dependent.

As with the previous stimulus checks, the amount youll receive depends on your household AGI.

- Single taxpayers who earn less than $75,000 and married couples earning less than $150,000 are eligible for the full stimulus.

- Families with dependents can receive an additional $1,400 for each dependent in the household. There is no age limit for dependents this time, so college students and adult dependents are also eligible for the $1,400.

- Families with mixed citizenship also qualify.

Projected Timeline For Sending Third Stimulus Checks

The IRS delivered virtually all of the second round of stimulus checks in less than a month, starting Dec. 29, 2020, two days after then-President Donald Trump signed the $900 billion bill into law.

Congress gave the IRS until Jan. 15, 2021, to issue the bulk of the 147 million payments so that the agency could quickly pivot to preparing for tax-filing season. After that, taxpayers were instructed to claim any missing stimulus money from the first or second rounds on their 2020 tax returns in the form of a tax credit.

The third round of payments hit at the height of the 2020 tax-filing season, and it was difficult for the IRS to ship all of the stimulus checks in less than a month and process millions of returns at the same time. To give itself some breathing room, the IRS moved the deadline for filing and paying federal income taxes to May 17.

The third stimulus payments are being rolled out in tranches, or groups, by direct deposit and through the mail as a check or debit card. The vast majority of all economic impact payments will be issued by direct deposit, the IRS says, and it will continue to send batches of EIPs every week.

The IRS, via the Treasury, sent the first tranche of payments on March 12, a total of 90 million payments worth about $242 billion. Most of these payments went to people who had filed 2019 or 2020 federal income taxes, or who had used the online IRS Non-Filers Tool.

May 5

May 12

May 26

Read Also: Update On Fourth Stimulus Check

State And Local Aid $745 Billion

Non-public

$0.4 bil.

At the outset of the pandemic, governments used the funds largely to cover virus-related costs.

As the months dragged on, they found themselves covering unexpected shortfalls created by the pandemic, including lost revenue from parking garages and museums where attendance dropped off. They also funded longstanding priorities like upgrading sewer systems and other infrastructure projects.

K-12 schools used early funds to transition to remote learning, and they received $122 billion from the American Rescue Plan that was intended to help them pay salaries, facilitate vaccinations and upgrade buildings and ventilation systems to reduce the viruss spread. At least 20 percent must be spent on helping students recover academically from the pandemic.

While not all of the state and local aid has been spent, the scope of the funding has been expansive:

Utah set aside $100 million for water conservation as it faces historic drought conditions.

Texas has designated $100 million to maintain the Bob Bullock Texas State History Museum in Austin.

The San Antonio Independent School District in Texas plans to spend $9.4 million on increasing staff compensation, giving all permanent full-time employees a 2 percent pay raise and lifting minimum wages to $16 an hour, from $15.

Alabama approved $400 million to help fund 4,000-bed prisons.

Summerville, S.C., allocated more than $1.3 million for premium pay for essential workers.

What was the impact?

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Dont Miss: How Do I Apply For The 4th Stimulus Check

Recommended Reading: How Much Third Stimulus Check

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Your New Social Security Payment Won’t Necessarily Be Exactly 87% More Than What You Currently Receive

Out with the old, in with the new. Many Americans will be glad to move past 2022 and begin a new year. And they only have a week left before they’ll do so.

Retirees, in particular, have an extra reason to celebrate the new year. There’s a huge Social Security increase coming in 2023. How much will your check be?

Image source: Getty Images.

Recommended Reading: When Will We Get 4th Stimulus Check

Did The Federal Government Give Out Too Much Money

The federal government approved three rounds of stimulus checks since the COVID-19 pandemic. The first round of $1,200 was approved in March 2020 under the CARES Act, the second round of $600 in December 2020 under the Coronavirus Relief Act, and the third round of $1,400 was approved in March 2021 under the American Rescue Plan Act.

Many argue that the federal coronavirus stimulus checks could have been more targeted. As per an estimate, about 9% of taxpayers received the stimulus money whether they needed it or not.

There are arguments that the number of people actually spending the stimulus money dropped as more stimulus money was approved. Americans largely used the first stimulus check toward household spending, while the later checks were typically used to pay down debt or put in savings. Such a trend was visible across all income levels.

Many also believe that too much money handed out is also responsible for the current record high inflation rate.

This article originally appeared on ValueWalk

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

If I Used Refund Transfer To File My Tax Return Last Year Or This Year Will There Be Issues With Receiving My Direct Deposit From The Irs

Over the last month, we have been working with the IRS to test their systems to verify any customer who used our refund transfer services should receive their refund directly deposited into their bank accounts. We are confident with how testing went and believe that depositing should work as designed this time.

Read Also: Where Is My 600.00 Stimulus Check

My Stimulus Payment Went To The Wrong Bank Account

If the Get My Payment tool tells you your check will be direct-deposited, it will also provide the last four digits of the number of the bank account into which your stimulus payment will be deposited. For the initial checks, some individuals saw that their deposit was going to an old bank account, or they even saw bank account numbers that they didn’t recognize. Here’s what to do:

- If the tool says that your payment was deposited into your bank account but you haven’t seen it yet, your bank may still be processing it.

- You won’t necessarily get the third check direct deposited, even if the first or second one was direct deposited.

- If your third stimulus payment is sent to a closed bank account, the bank is required to transfer the money back to the IRS. The IRS will not redeposit it to you or mail you a paper check. Instead, you will have to file your 2021 tax return to claim your “Recovery Rebate Credit.” See below for instructions on claiming the rebate on your tax return.

- If H& R Block submitted your last tax return and you signed up for a “refund transfer,” the IRS might deposit your stimulus payment with H& R Block . H& R Block should transfer the money to your bank account within 24 hours.

- Those who submitted their last tax return with Turbo Tax should receive their payments in the same bank accounts through which they received their tax refunds.

Haven’t Received Your December Social Security Check Yet Here’s When It Arrives

The last round of December Social Security checks will be disbursed by the Social Security Administration at the end of the month.

The Social Security Administration will disburse the last of three December checks this week. If you’re wondering when Social Security payments arrive each month, we’ll answer all those questions and more below.

This month, you should also keep an eye out for a letter in the mail about your Social Security cost-of-living benefit increase for 2023. The letter will have details about your individual benefit rate increase for next year — or you can check your benefits online using your My Social Security account. In , you’ll get your first increased benefit amount.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents

Also Check: How Many Stimulus Checks Did We Receive

Will Anyone Receive A Stimulus Check Who Didnt File A Tax Return In 2020 Or 2019

Some people will. Eligible Social Security beneficiaries and railroad retirees who are not typically required to file a tax return will automatically receive a $1,400 stimulus check. The IRS will use information contained in annual SSA-1099 and RRB-1099 tax forms to generate the stimulus checks automatically. Recipients of Social Security Disability Insurance also receive SSA-1099 tax forms and will receive $1,400 stimulus checks automatically. In addition, Veterans Affairs beneficiaries and recipients of Supplemental Security Income will receive automatic $1,400 checks.

Also of Interest

Who Will Get A Third Stimulus Check

Those with an adjusted gross income up to $75,000 are still eligible for a full payment. But under the new law, payments phase out for individuals making more than $80,000 and couples making more than $160,000 payments previously phased out for individuals at $100,000 and couples at $200,000.

This could mean that 11.8 million fewer adults and 4.6 million fewer children will be eligible for stimulus checks, according to the Taxation and Economic Policy.

Read Also: How Much Was The Stimulus Check In March 2021