We Will Likely Learn The Wrong Lessons From The Stimulus

The lessons we draw from the response to the COVID-19 recession are important, because theyll almost certainly shape how we respond to the next economic downturn. In the wake of the Great Recession, policymakers shot too low. Now, they appear to have shot too high. If this were the story of Goldilocks, wed be poised to get things just right next time but politics is not a fairy tale, and its very possible that well overcorrect whenever another recession hits.

In many ways, were still figuring out what the lessons are as the pandemic still isnt over. And its, of course, hard to disentangle what could have happened had the governments response not been so aggressive. One clear lesson of the COVID-19 pandemic, though, is that Americas social safety net wasnt prepared to deal with a crisis of this magnitude, which is a big part of the reason why the response had to be so massive.

Our social safety net wasnt ready to catch everyone who needed it, so it was very difficult to figure out who really needed relief and when the tap should be turned off, according to Sinclair. Rickety state unemployment insurance systems couldnt be recalibrated to replace peoples incomes, so many people ended up being paid much more after they lost their jobs. It wasnt easy to target direct payments to people in specific income brackets, so the payments went out to some families who didnt need them.

Santul Nerkar is a copy editor at FiveThirtyEight. @santulN

Filed under

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |

Don’t Miss: News About The Stimulus Check

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Third Stimulus Check: There’s Still Time To Claim Payment Worth Up To $1400 Per Person

As part of the relief package, all Californians with a registered vehicle would receive $400 tax rebates on a debit card, but when can taxpayers expect to see that money if the plan gets approved?

There’s still time to claim a third stimulus payment worth up to $1,400 per person.

Eligible taxpayers who didn’t receive the payment or may be due more money than they initially received are allowed to claim a tax credit on their 2021 federal tax return by the April 18 deadline.

The vast majority of the third stimulus payments were automatically delivered to taxpayers’ bank accounts or via a check in the mail last spring. The payments were authorized by the American Rescue Plan in March 2021 and were meant to help people struggling financially because of the Covid-19 pandemic.

But the payments were calculated last year based on the most recent federal tax return on file at the time. If a taxpayer’s income or family size changed in 2021, the individual may be eligible for more money.

Other people may have missed out on the stimulus payment altogether. Those with incomes so low they don’t have to file taxes may have never received their payment because the Internal Revenue Service did not have their information.

Read Also: Could There Be Another Stimulus Check

Q How Will I Get My Third Stimulus Check If Im An American Living Overseas

A. There are two ways overseas Americans can get their third stimulus payment: Direct deposit or through the mail.

You should get your check via direct deposit if you received your latest tax refund through direct deposit or if the IRS has your direct deposit info from the last round of stimulus checks and you havent filed yet this year.

You need to have an account with a U.S. bank in order to get direct deposit.

We recommend you update your address if you:

- Dont know what address is on file

- Have moved to a different address

- Want your check sent somewhere other than the address they have on file

In addition to Form 8822, Change of Address, you may be able to update your address via phone, through a written statement, or on your tax return. You can see the IRS most up-to-date address change info on the IRS website.

Q. What happens if I live abroad and my direct deposit payment is returned by my U.S. financial institution?

A. Once your payment is returned, the IRS will issue your payment by mail as a check or U.S. Treasury-issued debit card. Typically, IRS will reissue the payment by mail within two weeks. Once the payment is reissued, the IRS Get My Payment tool will update to reflect your payment status.

Q. What if my third stimulus check was for the wrong amount?

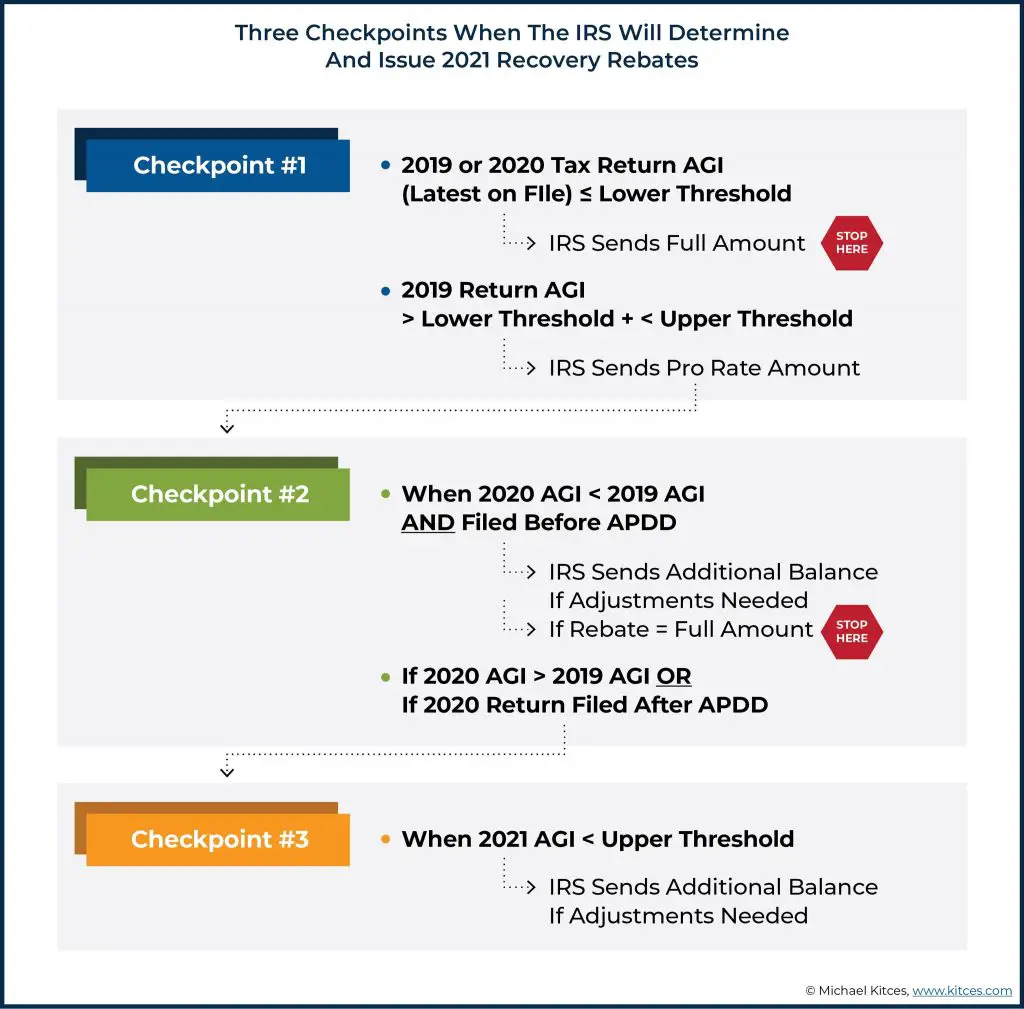

A. If you didnt receive the full amount of the third payment you were owed , there are two times when you may receive additional stimulus money:

Also Check: Didnât Get Stimulus Payment

Who May Be Eligible For More Money

Taxpayers who earned less money in 2021 than the previous year may be eligible for more money than they initially received from the third round of stimulus payments.

Those include single filers who had incomes above $80,000 in 2020 but less than this amount in 2021 married couples who filed a joint return and had incomes above $160,000 in 2020 but less than this amount in 2021 and head of household filers who had incomes above $120,000 in 2020 but less than this amount in 2021, according to the IRS.

Individuals and families who added a child in 2021 through birth, adoption or foster care could be eligible for additional money. Families that added another kind of dependent, such as an aging parent or grandchild, may also be eligible.

Recommended Reading: Is Texas Giving Stimulus Money

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay intro 0% interest into 2023! Plus, there’s no annual fee. Those are a few reasons our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that yearâs income, number of dependents and other qualifying information.

Donât Miss: Someone Stole My Stimulus Check

Read Also: Is Pennsylvania Giving Out Stimulus Checks

How Will I Get My Third Stimulus Check

You dont need to do anything to get your stimulus check. The IRS will determine eligibility based on the last tax return that you filed, either 2019 or 2020, and will likely send your payment to the bank account where your tax refund was deposited.

As part of the income tax filing, the IRS receives accurate banking information for all TurboTax filers who received a tax refund, which the IRS is able to use to quickly and effectively deposit stimulus payments.

Lessons Learned From Economic Impact Payments During Covid

The governments ability to inject cash into the economy quickly, especially when compared to past reliance on mailing paper checks, shows that fiscal policy can be implemented rapidly with minimal transaction costs. The use of electronic disbursement dramatically shortened the period between the signing of the legislation and the initial arrival of payments.

The use of electronic disbursement dramatically shortened the period between the signing of the legislation and the initial arrival of payments.

While coverage gaps and delays in payments did affect some households, the EIP program successfully provided immediate support directly to households, including those waiting on delayed Unemployment Insurance benefits. Investment by federal and state agencies to build better data systems for program participation, administrative earnings records, and tax returns, would provide clarity on how EIPs and other programs worked during the pandemic and would allow better targeting in future episodes. With that information in hand, policymakers can use EIPs as an effective and efficient way to quickly help people for whom other support is delayed or insufficient.

You May Like: Will We Get Another Stimulus Check Soon

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Read Also: Get My Stimulus Payment Phone Number

All Third Economic Impact Payments Issued Parents Of Children Born In 2021 Guardians And Other Eligible People Who Did Not Receive All Of Their Third

IR-2022-19, January 26, 2022

WASHINGTON The Internal Revenue Service announced today that all third-round Economic Impact Payments have been issued and reminds people how to claim any remaining stimulus payment they’re entitled to on their 2021 income tax return as part of the 2021 Recovery Rebate Credit.

Parents of a child born in 2021 or parents and guardians who added a new qualifying child to their family in 2021 did not receive a third-round Economic Impact Payment for that child and may be eligible to receive up to $1,400 for the child by claiming the Recovery Rebate Credit.

While some payments of the Economic Impact Payments from 2021 may still be in the mail, including, supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. The IRS is no longer issuing payments as required by law. Through December 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021.

The American Rescue Plan Act of 2021, signed into law on March 11, 2021, authorized a third round of Economic Impact Payments and required them to be issued by December 31, 2021. The IRS began issuing these payments on March 12, 2021 and continued through the end of the year.

Understanding A Stimulus Check

Stimulus checks have been mailed out to U.S. taxpayers on several occasions. These checks vary in amount according to the taxpayers filing status. Joint taxpayers generally receive twice as much as those filing singly. In some instances, those who had unpaid back taxes saw their stimulus checks automatically applied to their outstanding balance.

Research posted on the National Bureau of Economic Research found that the means of delivery of fiscal stimulus makes a difference to the overall spending patterns of consumers. Implementing fiscal stimulus by sending checks resulted in an increase inconsumer spending activity. However, applying tax credits equal to the amount of money provided in a stimulus check did not result in an equivalent increase in consumer spending activity.

You May Like: Where My Golden State Stimulus

Don’t Miss: Where’s My First Stimulus Check

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Heres How To Claim The Payment On Your Tax Return

Those who believe they are due more money must file a 2021 tax return, even if they dont usually file taxes, and claim whats called the Recovery Rebate Credit. If a taxpayer is eligible for more money, it will either reduce any tax the personowes for 2021 or be included in a tax refund.

In order to claim the Recovery Rebate Credit, a taxpayer will need information that was sent in a letter from the IRS in the past couple of months. Known as Letter 6475, it confirms whether a taxpayer was sent a third stimulus payment and the amount. Alternatively, that information can be obtained by accessing your IRS online account.

For most taxpayers, the federal tax return filing deadline is April 18, though its a day later for residents of Maine and Massachusetts. Taxpayers having difficulty meeting the deadline can file for an automatic six-month extension by using Form 4868.

Also Check: How To Check On Stimulus Payment For Non Filers