Funding For Essential Workers Who Keep America Fed

Farm and meatpacking plant workers will be able to receive money through a new Farm and Food Workers Relief grant program, announced last fall.

The U.S. Department of Agriculture says grocery workers also will be eligible for some of the cash.

The Americans wholl qualify for the payments all who work in food-related industries, where sheltering in place or working from home during the pandemic has not been possible.

State agencies, nonprofits and tribal entities have until Feb. 8 to apply to the government for the funds, which those groups will receive in June. Workers will apply to those groups to receive their payments.

Stimulus Check Eligibility: Who Will Get The Stimulus Check

If you were eligible for the full amount of the first and second stimulus checks, you will likely also be eligible for the third stimulus check, but not everyone who got smaller checks in the first two rounds will receive money this time.

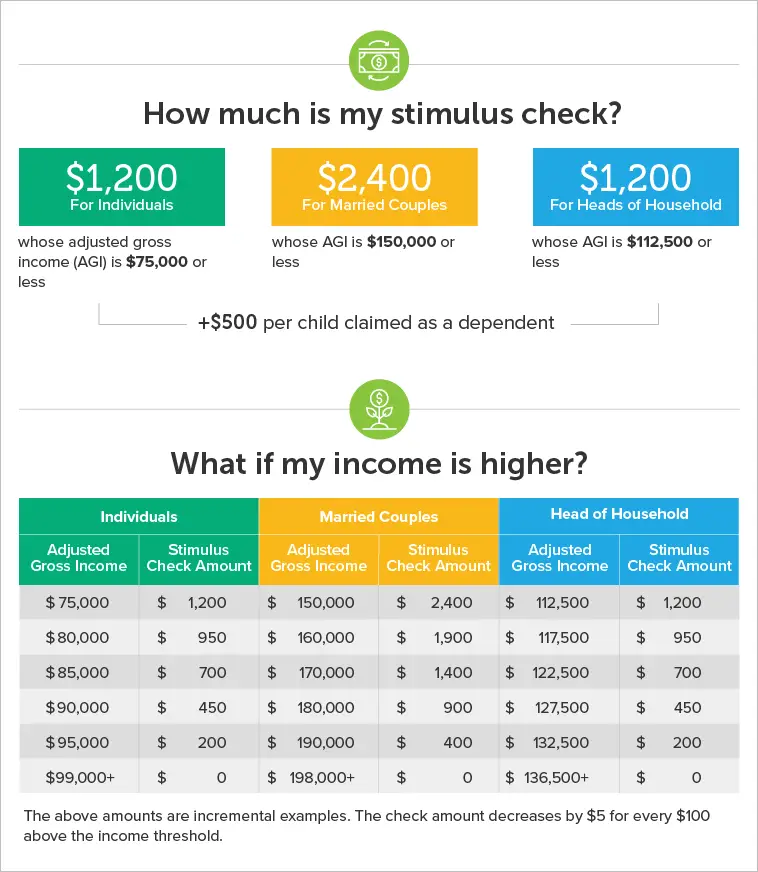

In the first two stimulus bills, people who earned $75,000 or less per year according to their most recent tax returns qualified for the entire stimulus check. Joint filers who earned up to $150,000 per year were also eligible for the entire amount.

People who earned more than those amounts received a prorated amount that was reduced by $5 for every $100 of income above the threshold. This time around, the amount will be reduced by $28 for every $100 of income above the threshold.

If you made between $75,000 and $80,000 on your last tax return, multiply every dollar above $75,000 by 0.28. Take the resulting number and subtract it from $1,400. The result will be the size of your stimulus check.

So if you make $77,000, the amount to multiply by 0.28 would be $2,000. That comes to $560. Subtract that from $1,400 and you get $840. We have a link to a stimulus check calculator.

Because the payment amounts were different between the first two bills, the income cutoff to get any money at all was $99,000 for single filers for the first check, but only $87,000 in the second check. The cutoffs were double those amounts for joint filers.

In the third bill, the cutoff will be $80,000 per year for single filers and $160,000 per year for joint filers.

Here Are Some Questions And Answers Around This New Stimulus Payment:

If I didnt file taxes in 2019/2020 will I receive the stimulus ? Unlike the first stimulus payment where those who didnt need to file a tax return could update the IRS non-filer tool, this time around due to the speed of roll-out of the second stimulus check and with tax season around the corner the IRS has said the non-filer tool is closed for updates.

The IRS will be using information they have as of Nov 21, 2020 or from your first stimulus check payment . Otherwise they are encouraging you to the stimulus by filing a 2020 1040 or 1040-SR tax return. Free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

How will I get paid? Like the first stimulus payment in 2020, the IRS will facilitate payment of these checks based on your 2019 tax information. You will also get the dependent stimulus payment for eligible dependents claimed on your tax return. For other groups who dont file taxes the IRS will work with other government departments or the Get My Payment tool. Direct deposit will still be the fastest way to get your payment.

Dependents in 2020? Households who added dependents in 2020 might not qualify for full payments immediately, since based on 2019 tax return information. But they can request additional money as part of the 2020 tax returns they will file in early 2021. See more in this articles for dependent qualification income thresholds.

Recommended Reading: Can I Still Claim My First Stimulus Check

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

More Stimulus Checks Are Likelyjust Not Until The Next Recession

It took no time for Americans to get on board with stimulus checks. Back in March 2020, a Fortune-SurveyMonkey poll found that 89% of Democrats and 85% of Republicans supported a one-time direct payment. Its popularity didnt stop there: Democrats arguably used the promise of a $2,000 stimulus check to win the two Georgia Senate runoff races in January. Those victories, of course, gave Democrats control of the U.S. Senate and the power to pass the third check in March.

Those direct payments certainly had an impact on the broader economy. Look no further than a study by University of Michigan researchers that found the checks coincided with a drop in financial instability among recipients. However, the economic benefits arent why stimulus checks are poised to be a lasting policy creation of the COVID-19 recession. Instead, its the popularity and political power of the checks.

The politics of it suggest there will be future stimulus checks, Moodys Analytics chief economist Mark Zandi told Fortune this summer. Amid future recessions, Zandi says, lawmakers will surely face pressure from some voters to issue direct payments.

Read Also: Amount Of The 3rd Stimulus Check

How Will The Stimulus Check Payments Be Made

The IRS has confirmed that payments for most working Americans are expected to be calculated and deposited or mailed via check based on 2018 or 2019 federal tax filing payment details. Most people wont need to take any action and the IRS will calculate and automatically send the economic stimulus payment to those eligible. The Treasury department, under which the IRS falls has also created a website/portal for those who are not required to file U.S. income taxes or who have to change payment information .

For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the last valid return filed. So if your 2018 information is out of date or your income situation changed in 2019, make sure you file, even if you have no taxes due .

Will The Payments Cause Inflation

California is not the only state to deploy one-time rebates amid budget surpluses. Florida, for example, is sending $450 to certain families with kids.

A big question prompted by the checks sent by California and other states is whether they will exacerbate inflation.

While California “on net will come out ahead,” it may be impacted as other states export inflation with their refunds, Harvard University economics professor Jason Furman recently tweeted.

“Californians are going to come out behind from any ‘inflation relief payments’ made by Florida and other states,” he wrote.

States are sitting on record surpluses and many individuals are struggling under the weight of extremely high inflation.Jared Walczakvice president of state projects at the Tax Foundation

While states have been deploying one-time payments all year, there has been an uptick as Election Day approaches, noted Jared Walczak, vice president of state projects at the Tax Foundation.

“States are sitting on record surpluses and many individuals are struggling under the weight of extremely high inflation,” Walczak said.

That’s prompting policymakers to put the two together and want to write checks.

“Unfortunately, that’s only fueling further inflation by injecting more money in an overheated economy,” Walczak said.

Don’t Miss: Amount Of 3rd Stimulus Check 2021

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Third Stimulus Check Dependents: Who Qualifies

Under the American Rescue Plan Act, more dependents will be eligible for stimulus checks than in previous relief legislation. Dependents age 23 or younger and elderly parents living with their adult children all qualify.

If you meet the complete stimulus check income limit requirements and claim a dependent, you’ll receive an additional $1,400. A family of four could get $5,600, for example.

Don’t Miss: Can H& r Block Help With Stimulus Checks

Stimulus Checks: What You Need To Know

On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. The United States swiftly responded. Individual states put a series of lockdowns in place to slow the spread, and as unemployment climbed, the federal government sprang into action. It passed relief bills that included an Economic Impact Payment — better known as a coronavirus stimulus check.

Following the first stimulus payment, demand grew for more direct relief to American families as the pandemic raged on. In December 2020, the U.S. government again took action to provide a second stimulus check.

However, many on the left felt the second check was insufficient, leading numerous Democrats to campaign on providing additional stimulus funds. Voters delivered Democrats control of the White House, the U.S. House of Representatives, and the U.S. Senate.

As a result, shortly after taking office, President Joe Biden signed a bill authorizing a third stimulus check. The American Rescue Plan Act was signed into law on March 11, 2021. The legislation passed on a partisan basis with no Republican support. It’s widely expected to be the last direct payment Americans receive.

Here’s what you need to know about these direct payments, including who is eligible, how much money was available in the stimulus checks, and how to check the status of your payment.

Stimulus Update: Inflation Stimulus Check

12 Min Read | Nov 17, 2022

Social distancing, remote learning, stimulus paymentsthe COVID-19 pandemic introduced us all to lots of new concepts.

And while the 6-foot rule has gone out the window , stimulus checks have hung around. But instead of a stimulus for pandemic relief, state politicians are now cutting stimulus checks to help ease the pain of record-high inflation and gas prices. And theres even talk of a federal inflation stimulus check.

So, is more stimulus money coming your way? Lets take a look.

Also Check: Who Qualifies For The 1400 Stimulus Check

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card can allow you to pay intro 0% interest into 2023! Plus, there’s no annual fee. Those are a few reasons our experts rate this card as a top pick to help get control of your debt. Read our full review for free and apply in just 2 minutes.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Irs Sending Letters To Over 9 Million Potentially Eligible Families Who Did Not Claim Stimulus Payments Eitc Child Tax Credit And Other Benefits Free File To Stay Open Until Nov 17

IR-2022-178, October 13, 2022

WASHINGTON Starting this week, the Internal Revenue Service is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021 federal income tax return. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation.

The special reminder letters, which will be arriving in mailboxes over the next few weeks, are being sent to people who appear to qualify for the Child Tax Credit , Recovery Rebate Credit or Earned Income Tax Credit but havent yet filed a 2021 return to claim them. The letter, printed in both English and Spanish, provides a brief overview of each of these three credits.

The IRS wants to remind potentially eligible people, especially families, that they may qualify for these valuable tax credits, said IRS Commissioner Chuck Rettig. We encourage people who havent filed a tax return yet for 2021 to review these options. Even if they arent required to file a tax return, they may still qualify for several important credits. We dont want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.

Don’t Miss: Who Received The 3rd Stimulus Check

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

Recommended Reading: Veterans To Receive Stimulus Payment

Democrats And Republicans Are Discussing New Covid

A stimulus check issued by the IRS to help combat the adverse economic effects of the COVID-19 outbreak is seen in San Antonio on Jan. 28, 2021. A new round of coronavirus stimulus could be on the way.

Eric Gay, Associated Press

A new round of coronavirus stimulus could be on the way.

Democratic and Republican lawmakers have held early discussions about a new round of potential coronavirus stimulus spending, especially with the omicron variant surging through the United States, according to The Washington Post.

- The relief would specifically help businesses such as restaurants, performance venues, gyms and even minor league sports teams that could face a trouble from another wave of COVID-19, The Washington Post reports.

- The spending would be a mix of new spending and repurposing of previous unused spending.

- Its unclear if the new round of spending would include stimulus checks to the American people.

The White House said it is in constant communication with lawmakers about a new round of stimulus, per Reuters.

- However, the White House said the economy appears to be strong enough to handle the omicron wave.

What Is The Status Of The Paper Stimulus Checks

If you’re waiting for a paper check to land in your mailbox for the third stimulus payment, the good news is that you may not have to wait long. More than 150,000 paper checks were mailed out on Wednesday, according to the IRS.

Between the direct deposits and the paper checks mailed Wednesday, an estimated $442 million in stimulus relief money has already been sent out, with more on the way in the coming weeks.

As with the last two rounds of stimulus payments, the wait will be slightly longer for those recipients who are slated to receive a paper check. That said, this third round of paper payments appears to be on a much faster path than the first two.

It took about three weeks for paper checks to start rolling out to those who qualified for the first round of stimulus payments this round has taken about a week for the paper check process to begin.

The process of issuing paper checks is also much faster than the IRS initially anticipated. The government agency was slated to start sending out paper checks at the end of March, which means that the 150,000 paper checks that were sent out yesterday were a couple of weeks ahead of schedule.

That’s a big win for the 150,000 Americans who will receive their money in the mail in the coming days. Millions of Americans are in desperate need of the stimulus payments to cover bills and other expenses as the national economy struggles to recover from the COVID-19 pandemic.

Read Also: Where’s My Second Stimulus Check