Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

How To Return A Paper Check You Have Not Cashed Or Deposited

If youre one of those folks who has to send the money backand you havent cashed or deposited your check yetheres what you need to do:

- Write Void in the endorsement section of the check, but dont fold or staple itdont even put a paper clip on it.

- On a sticky note or sheet of paper, write down the reason youre sending the check back.

- Mail the check and the explanation back to your local IRS office .

Will There Be Another Stimulus Check From The Federal Government

Most people agree that getting another big stimulus check from the federal government is a long shot at this point. Still, some lawmakers keep pushing for another stimulus check to help Americans who are struggling to rebuild thanks to COVID-19 and its economic impact. And with the Delta and Omicron variants out therewould another stimulus check happen for everyone? You never know. Only time will tell, really. A lot of people didnt think wed see a third stimulus check eitherbut it happened.

With the economy and jobs both on the upswing, the need for a stimulus check is way less than its been since the start of the pandemic. Not to mention, a lot of people have been getting extra cash each month from the Child Tax Credit. Add all of that up and its easy to see that there might not be another stimulus check. But if there is one, dont worrywell let you know.

Don’t Miss: Where’s My Stimulus Check Ca

When Will A Second Stimulus Check Be Issued

The government began sending direct deposit payments on December 28, 2020. Paper checks were sent out starting on December 30, 2020.

Payments are automatically sent to:

- Eligible individuals who filed a 2019 tax return.

- Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security and Veteran Affairs beneficiaries.

- Individuals who successfully registered for the first stimulus check online using the IRS Non-Filers tool or who submitted a simplified tax return that has been processed by the IRS

There is no action that you have to take to get your second stimulus check. People who provided their banking information with the IRS shouldve received their stimulus checks by direct deposit. Social Security and Veterans Affairs beneficiaries who received the first payment via Direct Express shouldve received the second payment the same way.

The IRS sent paper checks or prepaid debit cards to people who did not provide their banking information. Mailed payments may be delivered in a different format than the first stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Will We Get Another Federal Stimulus Check

The third payment was probably the last one you will get for the foreseeable future. Democrats passed the third stimulus check through budget reconciliation, which allowed them to pass it with a simple majority vote in the Senate.

There is a limit on the number of times Democrats can use reconciliation and the Republicans have made it clear theyre not going to provide further COVID relief. Therefore, it is unlikely that a fourth stimulus check will be authorized.

Also Check: New Round Of Stimulus Checks

No Extra Deduction For Charitable Giving

The Coronavirus Aid, Relief and Economic Security Act, or CARES Act, had a provision that allowed taxpayers to deduct an extra $300 for single taxpayers or $600 for married couples on their 2020 and 2021 taxes.

This provision allowed people who rely on the standard deduction, which represents the majority of taxpayers, to take an extra deduction for charitable giving. But that above-the-line charitable deduction wasn’t renewed in 2022, which means that taxpayers who don’t itemize won’t get an extra deduction for their charitable gifts this year.

Third Stimulus Checks: Everything You Need To Know

One of the more notable and broadly popular congressional pandemic relief measures has been direct payments to millions of households. More are on their way soon: On March 11, a day after the House passed the final version of the American Rescue Plan, President Biden signed the $1.9 trillion stimulus plan into law. Now many Americans will receive a third $1,400 stimulus check in a matter of days. Here are the latest updates on who is getting a third stimulus check and when they may arrive.

Don’t Miss: Stimulus Check Lost In Mail

Many Households Are Getting A Much Larger Payment This Time

A $1,400 maximum total per person is an obvious way your household would see more money from a third check . But there’s more to it than that. Since the upper limit for the second check was $600 per adult with an extra $600 per child dependent , more people hit the upper income limit for receiving a second payment. And that means they didn’t actually qualify to get any stimulus money at all.

A third stimulus check makes more groups of people eligible to receive money and bring a larger total check to qualified individuals and their families, including $1,400 payments to dependents. A change in your circumstances can also mean you qualify for more money this time. Here are other ways a third stimulus check could put more money in your pocket.

Stimulus check money could add up fast — as long as you’re qualified to receive it.

Who Voted For The Stimulus Package

In addition to a third round of checks, the $1.9 trillion American Rescue Plan has many other elements, including $300 a week in federal supplemental unemployment insurance through September $350 billion in aid to state and local governments $170 billion for schools and universities $25 billion in rental assistance and $5 billion for those threatened with homelessness big increases in the child tax credit and the earned income tax credit paid leave for 109 million Americans $40 billion for child care $50 billion for COVID-19 testing and $20 billion for COVID-19 vaccine distribution.

The decision to move the massive spending package through Congress via the budget reconciliation process meant that it could remain virtually intact, but it would require the support of nearly all Democrats in both chambers. Ultimately, only two Democrats voted against the House bill, and not a single Republican supported it. The exclusion of the minimum wage provisions by the Senate parliamentarian eliminated the one issue on which Senate Democrats had been publicly divided . On March 6, the Senate passed the bill on a party-line vote of 50 to 49 Republican Dan Sullivan of Alaska was not present. The final version then went back to the House, where it passed on a 220-211 vote, with no Republicans voting for it and just one Democrat voting against it.

Read Also: Wheres My Golden State Stimulus

Fourth Stimulus Check Amount

The fourth stimulus check amount depends on several factors. If passed, it would probably look similar to the previous checks, although that’s not guaranteed.

For reference, the first stimulus check amounted to as much as $1,200, while the second stimulus check brought $600 to eligible Americans. The third stimulus check, which the IRS is still in the process of distributing, is worth up to $1,400 per person, although the eligibility requirements are narrower.

All three checks gave the full amounts to taxpayers who made up to $75,000 a year, according to their most recent tax returns. Couples filing jointly got the full payment if they had a joint total income of $150,000 or less.

With the first two checks, those making up to $99,000 alone or $198,000 as a couple received prorated payments. With the third check, individuals who earned more than $80,000 per year or $160,000 per year as joint filers got nothing. Our guide to the stimulus check calculator can show you what your own eligibility looks like.

Other Benefits For California Residents

The budget contains a handful of additional measures to try to relieve inflationâs impact on residents:

- $1.95 billion for emergency rental assistance for qualified low-income tenants who requested assistance before March 31, 2022

- $1.4 billion in funds to help residents cover past-due utility bills

The budget also includes a $14.8 billion infrastructure and transportation package, as well as more than $200 million in additional funding that will go toward reproductive health care services.

Californiaâs 2022-2023 budget also provides universal access to health coverage for low-income residents aged 26 to 49, regardless of immigration status, becoming the first state to do so.

Also Check: Do We Pay The Stimulus Check Back In 2021

If I Take The Advance Payment How Does This Affect Next Years Taxes

Good question, you guys. The biggest thing here is if your income increases in 2021, then you might get more money in the Child Tax Credit than you actually should get. Remember, guys, theyre basing the amount they think you should get on your 2020 tax return . So,if you or your spouse got a raise at work and it bumped you over the qualifying amount, the IRS doesnt know about it.

If youre super confused by all of this, youre not alone. The State of Personal Finance study found that 70% of parents who qualify for the Child Tax Credit money say theyre afraid to spend it because they dont know how it will impact their taxes next year. That totally makes sense, guysbut dont stay in the dark here. Its so important to be in the know about these changes and how they affect you.

With all these tax changes, its a good idea to call in the folks who live and breathe this stuff. If you want your taxes done the right way, check in with a RamseyTrusted tax pro. Theyre the experts who can walk you through this new Child Tax Credit change and how it impacts your money. And theyll help you make the right call on whether you should take the advance payments or leave them alone. They can also show you the best way to plan out your taxesyou know, so you dont end up with a huge scary bill or a crazy high refund. When it comes to your tax questions, leave it to the pros.

About the author

Rachel Cruze

Will There Be Income Restrictions

Yes. Your adjusted gross income will be used to determine whether you qualify, and if so, how much you will get.

- If your AGI for 2019 or 2020 is $75,000 , then you will get the full amount. For AGIs above those amounts, your payment will be reduced proportionately until it reaches zero at $80,000 and $160,000, respectively.

- For Heads of Households, the amounts will be $112,500 and $120,000.

Don’t Miss: Is 2021 Stimulus Check Taxable

Focus On What Goes On At Your Housenot The White House

Its hard not to worry as you watch billions and trillions of dollars fly out the window in Washington, D.C. And while those things matter, the truth is, you have ultimate control over your money and what choices are made in your house. You have the power to improve your money situation right nowtodaywithout having to rely on the government.

And it all starts with a budget. Because when you make a plan for your money, you’re more likely to make progress and hit your financial goalsstimulus check or not. So, go ahead and create your budget with EveryDollar today! Take control of your future and get the hope you need.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How Many Stimulus Checks Have There Been

If youre like most people, everything thats happened since March 2020 is a blurincluding how many stimulus checks there were and when the checks went out. Heres a quick reminder.

First stimulus check: March 2020 $1,200

Second stimulus check: December 2020 to January 2021 $600

Third stimulus check: March 2021 $1,4004

Recommended Reading: Stimulus Check Round 3 Release Date Direct Deposit

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

What If I Was Underpaid Or Overpaid

First, double-check how much money you should be getting and make sure the amount you think youre supposed to get is right. You can do this on the IRSs Child Tax Credit Eligibility Tool or by checking to see what amount is on the letter that the IRS sent to you at the beginning of July .

If it still looks a little weird to you guys, then head over to the IRS Portal and make sure they have your latest information.

Don’t Miss: How Do I Qualify For $600 Stimulus In California

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Don’t Miss: Are Stimulus Checks Part Of The Cares Act

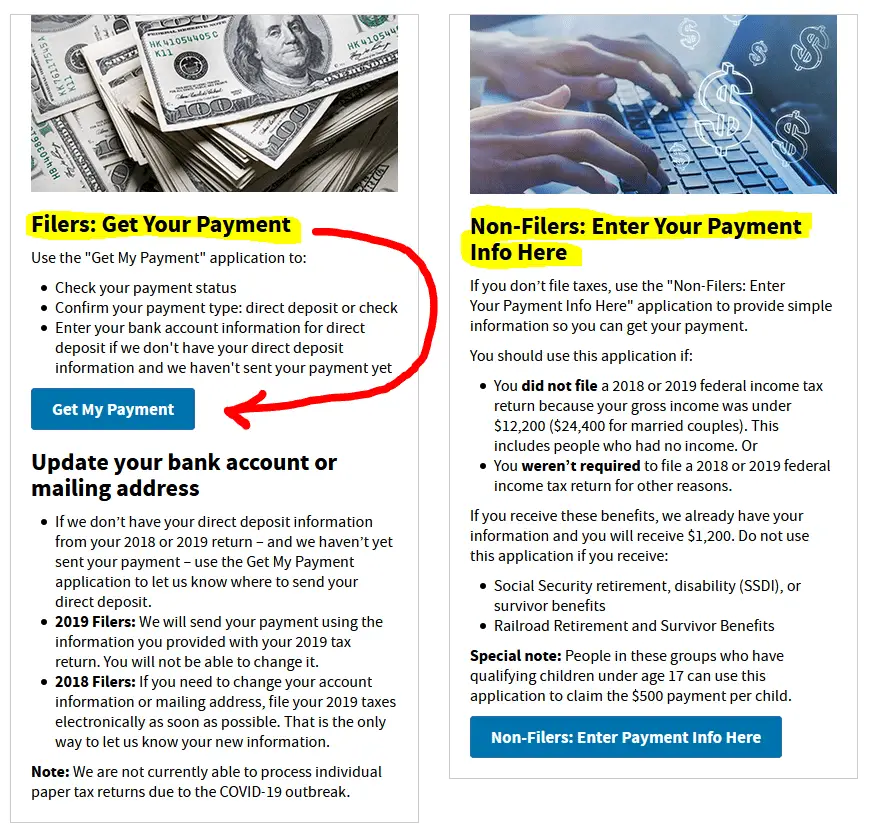

What About On Social Security Or Ssdi

Social Security recipients, disability , Survivor Beneficiaries and Railroad Retirees who are not otherwise required to file a tax return will also be eligible for the stimulus payments, as long as their total income does not exceed the eligibility income limits above. The IRS in conjunction with the Treasury and Social Security Administration announced that recipients of Supplemental Security Income will automatically receive the $1200 Stimulus Check . See details here. This group of recipients will receive the stimulus check the same way they currently get their federal benefits in early May with no further action needed on their part.

However note that because the IRS has no information regarding dependent data for this group of recipients, the $500 kid dependent stimulus payment would not be automatically paid to this group. They need to use the non-filers tool on the IRS website to claim this.