Direct Payments Round : December 2020

President Trump signed a $900 billion assistance package into law on December 27, 2020, as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021. It offered a lump-sum payment of up to $600, with an extra $600 available for households with children under the age of 16 who were dependents.

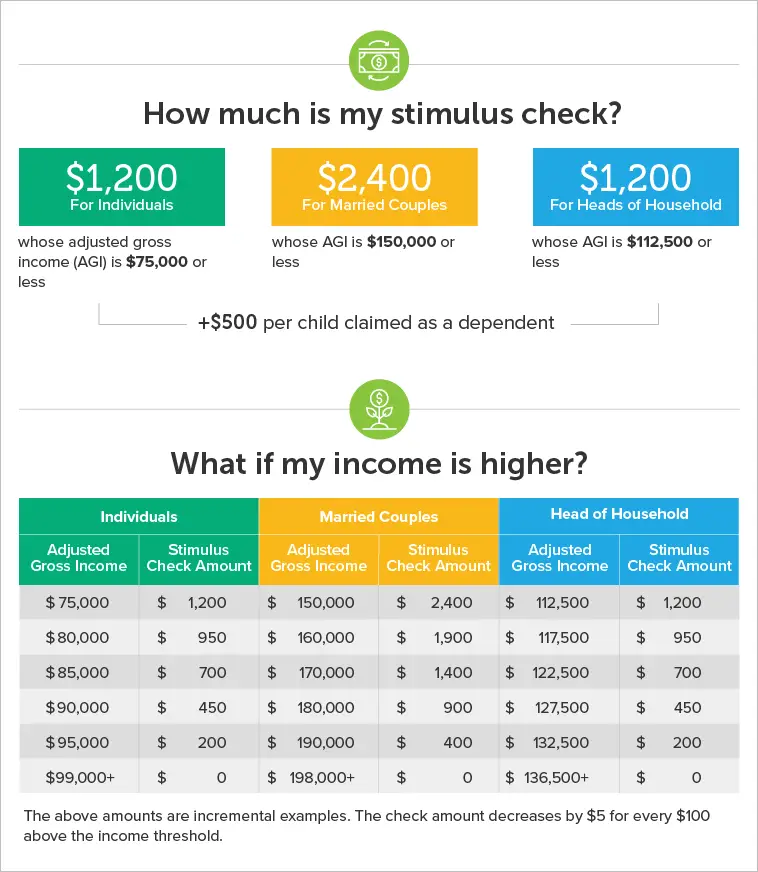

People making less than $75,000 received the full stimulus payment, but those making more than that received a gradually lower amount, up to a maximum phase-out limit of $87,000 for 2019. Direct deposit and paper checks were the primary methods of payment, with EIP 2 Cards being used for certain subsequent payments. Payments were made between December 29, 2020, and January 15, 2021.

If you didnt get a stimulus payment from either the Covid-19 Relief bill in December or the CARES Act, you can claim it retroactively when you file your federal tax returns for 2020.

Irs Has Sent $6 Billion In Stimulus Payments Just In June Heres How To Track Your Money

Your stimulus check could be on its way, along with child tax credit money and unemployment tax refunds. Well explain the state of the payments today.

Stimulus check payments arent over yet for everyone.

Dont think that the child tax credit payments going out in just over two weeks are all the IRS is focused on. The tax agency continues to send weekly batches of the third stimulus checks, with more than $6 billion in stimulus payments going out just in June. Some of that money includes plus-up adjustments for people who received less money than they were supposed to get in earlier checks.

Even though many of us got our stimulus money in the earlier batches in spring, some have had to wait weeks or months for their checks. The IRS sent money first to people whod already filed their 2019 or 2020 tax returns because those were the easiest to verify. So if youre still waiting for your stimulus check up to $1,400 or think you might be due a plus-up payment well tell you what to do next.

In the meantime, many experts say a fourth stimulus check is unlikely, but millions of families will be getting a good chunk of money with Julys first child tax credit payment. We can tell you how to know if you qualify and how much money you could expect over the course of the year. The IRS is also issuing unemployment tax refunds to millions of people who received jobless benefits last year, though payments are taking longer than expected. This story was updated recently.

Where Is My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can request a trace of your stimulus check. You should only request a payment trace if you received IRS Notice 1444-B showing that your second stimulus check was issued or if your IRS account shows your payment amount and you havent received your second stimulus check.

Dont Miss: Do You Have To Claim Stimulus Check On 2022 Taxes

You May Like: When Was The Third Stimulus Check Sent Out In 2021

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayers latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

The state is sending out payments in two ways: direct deposit and debit card in the mail.

If you filed your 2020 taxes electronically and you received a tax refund by direct deposit, then you can expect to receive your Middle Class Tax Refund by direct deposit as well, the Franchise Tax Board said.

Pretty much everyone else will be getting a debit card, the agency said.

Stimulus Checks: See If Your State Is Mailing Out Payments In November

Stimulus payments have been one of the hallmarks of the coronavirus pandemic, with the federal governments trillions of dollars capturing the biggest headlines. But states have been doling out payments as well. While much of the stimulus has already been dispersed, a number of states are still mailing out payments in November and beyond. Heres a quick overview of state stimulus payments that are still on the way.

Dont Miss: Can Stimulus Check Be Taken For Back Taxes

You May Like: How Can I Cash My Stimulus Check Without An Id

How Can I File My Taxes

If you know you need to file a 2020 tax return, you should do so as soon as possible to get your Economic Impact Payment and any tax refund that you are eligible for.

Online: If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software. MyFreeTaxes is an online tool that helps you file your taxes for free. You can use these online programs until November 20, 2021.

What To Do With Your Stimulus Check

No matter how small or large your relief check is, the arrival of an unexpected sum of money can be a great incentive to move forward in your financial journey.

Whether you receive a stimulus check of $50 or $1,000, you should consider using it to pay down any high-interest debt such as or personal loans, investing it in a Roth IRA or traditional IRA or saving it for a future home purchase. Select ranked Charles Schwab and Fidelity as some of the best brokers who offer Roth IRAs.

If your emergency fund is low or you’re saving for a big purchase, put your new stimulus money into a savings account. And if you’re currently earning a low interest rate on these funds, think about opening a high-yield savings account which can pay you more on your money each month the American Express® High Yield Savings Account and the Sallie Mae High-Yield Savings Account are two good ones to consider.

You May Like: Irs Stimulus Payment Phone Number

Stimulus Check 1 2020

This is when the first stimulus check was delivered:

- The CARES Act, which authorized the payment, was signed into law.

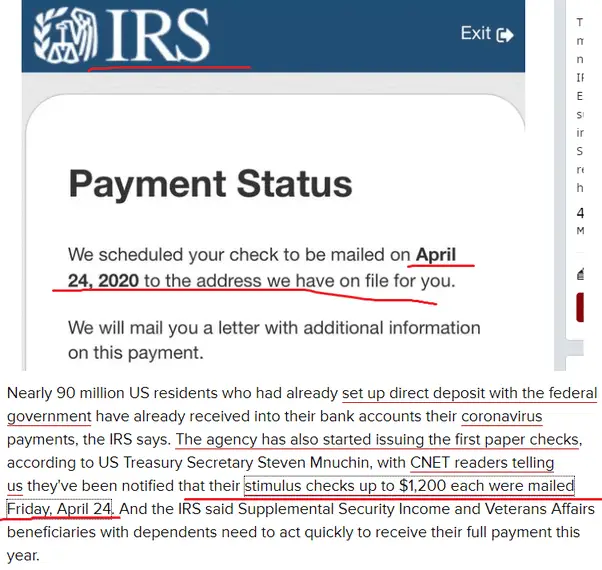

- The IRS began making direct deposits to those with bank information on file. Most were delivered by April 15.

- Paper stimulus checks started going out at a rate of around 5 million per week. Payments continued through early summer.

- End of April: Beneficiaries of certain benefits, such as Social Security retirement benefits, began receiving payments at the end of April via direct deposit.

- May: SSI beneficiaries began receiving checks, as did Social Security beneficiaries who use representative payees to manage their benefits.

- May 18: IRS started to send payments via prepaid debit card, also known as Economic Impact Payment Cards.

- Eligible individuals in U.S. territories started to receive stimulus payments.

- Individuals who used the Get My Payment tool to report eligible dependents prior to May 17 began to receive checks if they’d missed out on dependent funds.

- Mid-September: Individuals who lost payments because spouses owed past-due child support began receiving catch-up stimulus checks.

- Extended deadline for non-filers to use online tool to register and get their stimulus payment by Dec. 31, 2020.

How Have Americans Spent Their Stimulus Checks

There have been threecount themthree wide-reaching stimulus checks from the government since the pandemic hit. And now that a good chunk of time has gone by since they dished out the first one, were starting to see how people spent that money. Our State of Personal Finance study found that of those who got a stimulus check:

- 41% used it to pay for necessities like food and bills

- 38% saved the money

- 11% spent it on things not considered necessities

- 5% invested the money

And on top of that, heres some good news: Data from the Census Bureau shows that food shortages went down by 40% and financial instability shrank by 45% after the last two stimulus checks.25 Thats a big deal. But the question here isif people are in a better spot now, will they be more likely to manage their money to make sure things stay that way?

Recommended Reading: Irs Says I Got Stimulus But I Didn’t

Why Isnt A Third Stimulus Check Guaranteed

Whether a third stimulus check will happen or not is up to Congress. As per the current discussion in Washington and Bidens Campaign, they promise to help everyday Americans with some direct payment.

A third stimulus check, under Present Bidens plan, the $600 second-round stimulus check would be increased by $2,000. Biden calls for $1,400 payments as part of the $1.9 trillion relief package.

Now, who will qualify for the $1400 stimulus check? This would include elderly parents staying with their adult children, college students aged 23 years or even younger, and children over 16 years of age. Thus, these people will qualify for the next stimulus check.

Read Also: Will Seniors Get A Third Stimulus Check

Parents Are More Likely Than Non

Although thereâs little appetite in Washington D.C. for a fourth stimulus check to be distributed to everyone, there is some bipartisan support for an expanded Child Tax Credit.

The last stimulus bill, the American Rescue Plan Act, made more money available to parents by changing the current rules for the existing Child Tax Credit. Parents were eligible to receive up to $3,600 for children under age 6 and up to $3,000 for kids aged 6 to 17.

While Republicans arenât in favor of doing exactly what the American Rescue Plan Act did for parents, those on the right have put forth various proposals to also expand this tax credit. And thereâs broad support on the left for more financial help to parents.

Don’t Miss: How To Get Stimulus Check On Taxes

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Recommended Reading: How Much Was The Stimulus Payments In 2021

Stimulus Payments 202: Your State Could Still Owe You A Check

South Carolina and Massachusetts are just two of the states issuing payments to taxpayers.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

As the holidays roll in, we could all use some extra money. South Carolina has started issuing for up to $800 to eligible taxpayers. The income tax rebates were approved by state lawmakers as part of this year’s $8.4 billion budget, according to the state Department of Revenue, and payments will continue to go out through December.

South Carolina isn’t the only state issuing residents tax refunds, though: Illinois is still sending out $50 and $100 rebates and Massachusetts began returning $3 billion in surplus tax revenue this month.

Your state could be sending out a rebate or stimulus check, too. Below, see if you qualify and how much you could be owed. For more on taxes, see if you qualify for additional stimulus or child tax credit money.

You May Like: Irs Customer Service For Stimulus Check

Havent Received Your Third Stimulus Payment Yet

The IRS will continue to send checks via the Treasury. The majority who have received a first or second payment dont need to do anything more to get the third payment, which often will be sent out automatically. Following the model of the second round of checks, payments should be issued automatically to people who:

- Filed 2019 or 2020 federal tax returns. The IRS will use the taxpayers latest processed return.

- Registered for the first round of stimulus payments through the non-filer portal on IRS.gov by Nov. 21, 2020.

- Receive Social Security , Supplemental Security Income , or Railroad Retirement Board or Veterans Affairs benefits.

Those receiving Social Security and other federal benefits will generally receive this third payment the same way as their regular benefits.

The IRS Get My Payment Tool allows you to provide information to the agency for a stimulus check and to track payment status.

If you got your payment based on your 2019 return and find that youre entitled to more based on your 2020 return, the IRS will compute the additional amount owed to you.

With Unemployment Numbers Improving Dont Expect A Fourth Stimulus Check

The stimulus checks were sent out at a time when the economy was stagnant, as a result of coronavirus restrictions. There was a need for a boost, but now the economy is recovering naturally.

The pre-coronavirus pandemic unemployment rate was 3.7% and it got all the way down to 3.8% in February 2022, so itâs basically back to what it was.

This is good news in general as more and more Americans are earning an income again, which reduces the need for another stimulus check in the view of politicians.

Also Check: I Haven’t Received Any Stimulus Check Yet

More Third Stimulus Payment Money For Some In 2022

Parents who added a child in 2021 could be getting up to $1,400 after they file their 2021 taxes this coming spring thanks to the American Rescue Plan. The money won’t come as a direct check but will be part of the overall tax return.

The 2021 Economic Impact Payment — colloquially known as the third stimulus check — was actually an advance on what is called the 2021 Recovery Rebate Credit. What that means is that the $1,400 stimulus check most individual Americans received in 2021 is, in fact, money they would have gotten after filing their taxes in the spring of 2022 as a Recovery Rebate Credit.

In other words, millions of Americans already got part of their tax refund 12 months early.

“The bottom line is that’s money that’s going out almost immediately to millions of people as a tax credit in advance of putting it on a tax return in the next year,” said Raphael Tulino, IRS spokesman.

However, the IRS was going off of 2019 or 2020 tax returns for its information on the third EIP. It was using that information to determine if taxpayers would get stimulus money for their dependents. If eligible parents had a child born into their family in 2021, they can request the Recovery Rebate Credit on their taxes to get the payment for that child.

It gets more complicated with adoption because all the paperwork and processes to finalize the adoption must be completed first.

This does not pertain to the first or second stimulus payments that were paid in 2020.

Will There Be More Stimulus Checks In Future

As things currently stand, a fourth federal stimulus round appears to be unlikely.

Currently, Mr Bidens Build Back Better Agenda does not include stimulus payments.

And in May, White House secretary Jen Psaki told reporters that the stimulus checks were not free and that another round wasnt in Bidens plans.

Along with getting Biden on board, two corporate Democrats Joe Manchin and Kyrsten Sinema would need to get convinced as well.

This is unlikely because the US is no longer in the heights of the pandemic and is dealing with inflation, as there is huge consumer demand that the supply is not meeting.

Stimulus checks serve the purpose of giving taxpayers a financial boost during an economic downturn.

And that isnt happening at the moment.

But there has been some mounting pressure to do so 50 Democratic members of the House of Representatives wrote a letter suggesting recurring direct checks, also known as universal basic income.

It read: Another one-time round of checks would provide a temporary lifeline, but when that money runs out, families will once again struggle to pay for basic necessities.

One more check is not enough during this public health and economic crisis.

It was backed by US Representative for New York Alexandria Ocasio-Cortez and Minnesotas Ilhan Omar.

Democrats have backed a figure of $2,000, although there arent currently any official bills debating a fourth round of checks.

We explain how to track down the latest $1,400 stimulus check.

Read Also: Will We Be Getting Another Stimulus Check In 2022

Idaho: $75 Rebate Payments

In February, Idaho Gov. Brad Little signed a bill that allocated $350 million for tax rebates to Idahoans. There were two criteria for eligibility:

- Full-time Idaho residency and filed 2020 and 2021 tax year returns, OR

- Full-time Idaho residency and filed grocery-credit refund returns.

The payments began in March. Each taxpayer received either $75 or 12% of their 2020 Idaho state taxes, whichever was greater . The rebate was applicable to each taxpayer and dependent.

The tax commission first issued rebates to taxpayers who received tax refunds via direct deposit, then sent paper rebate checks. The majority of the rebates have been issued.

In a special session on September 1, Idaho lawmakers voted to authorize another tax rebate for all residents who filed state tax returns in 2020. Individual filers will receive $300, and couples filing jointly will get $600.

Those payments started processing in late September, and about 75,000 payments will be sent out each week throughout the end of the year and into early 2023.

State residents can check their rebate status on the Idaho State Tax Commission website.