How To Notify The Irs Of An Issue With Your Check

The IRS doesn’t want you to call if you encounter a problem with the delivery or amount of your stimulus check. So what to do instead? Our guide walks you through how to report stimulus check problems, including checks that never arrived , direct deposit payments that went to the wrong account and other issues.

Amid High Costs $850 Relief Checks Are Being Sent To An Estimated 858000 Maine People

Maine people are grappling with the increased costs as a result of pandemic-driven inflation, ranging from higher energy costs to increased prices of everyday goods.

While the Governor cannot control the impact of COVID-19 on global markets, she can make sure that we deliver to Maine people the resources they need to deal with these higher costs.

To help, Governor Mills proposed giving back more than half the budget surplus to the taxpayers of Maine, in the form of $850 direct checks.

The Governors proposal was supported by the Legislature and $850 checks will be sent to an estimated 858,000 Mainers, for a total of $729.3 million returned to taxpayers.

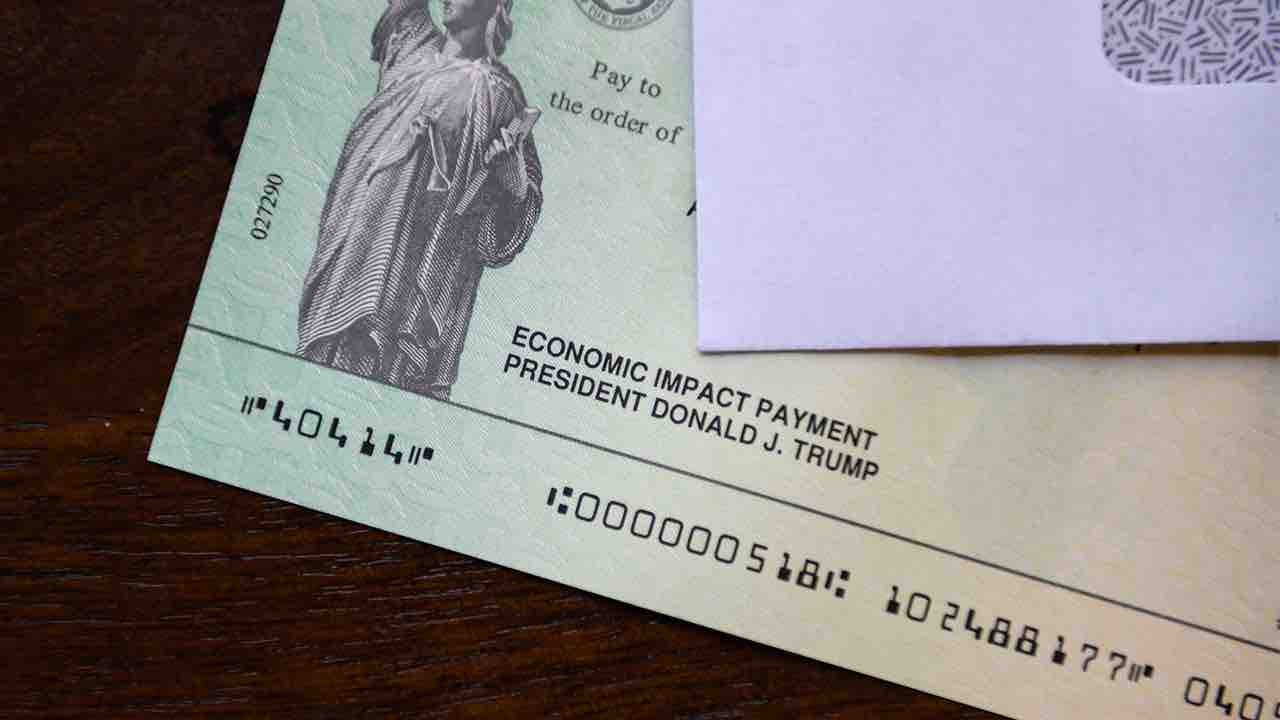

Your Payment Is Being Mailed

The IRS says if it has direct deposit information on file for you, thats how youll receive the third stimulus payment. However, even if the IRS has a current bank account on file, you still may not receive your stimulus payment as a direct deposit.

Due to the pressure of tax season and the complexity of 2020 tax returns as a result of pandemic-related tax breaks and other types of governmental aid, if the direct deposit returns an error of any kind, your stimulus payment will be sent as a check or in some cases, as a debit card.

If the IRS doesnt have direct deposit information on file for you, it will send the payments by check or a prepaid debit card . The Get My Payment tool will say that your payment has been mailed, but it wont say whether youll receive a check or debit card.

Recommended Reading: 4th Stimulus Check For Single Person

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you don’t spend it within 12 months, the Social Security Administration will count the money as a resource.

Who Would Be Eligible For The Third Stimulus Check

Families earning less than $150,000 a year and individuals earning less than $75,000 a year should get the full $1,400 per person. Families earning up to $160,000 per year and individuals earning up to $80,000 per year will receive prorated stimulus checks for less than $1,400 max.

Unlike the previous two rounds, you will receive stimulus payments for all your dependents, including adult dependents and college students.

You also dont need a permanent address, a bank account, or even a job to get these payments. Individuals may qualify for this money if they have a Social Security number and are not being supported by someone else who can claim them as a dependent.

Don’t Miss: When Will The $1400 Stimulus Checks Be Mailed Out

Don’t Throw Away The Irs Letter About Your Stimulus Payment

Hold on to that IRS letter that confirms your stimulus payment, including giving the amount and how the IRS sent your money. That letter from the IRS — Notice 1444-C — is your proof that the IRS sent a payment in case you don’t actually receive it or if you received less than you qualify for and need to claim the missing amount later. Here’s more on what to do with that IRS letter.

Youre Getting An Actual Check Or A Debit Card

Americans in line for direct deposits will almost surely receive their payments before those slated to get debit cards or good ol paper checks, which can take weeks to reach their intended recipients.

Not sure how your payment will be distributed? You can use the IRS “Get My Payment” tool to see how your money is being delivered and whether it has been sent.

If the tax people have you down to receive a check or debit card, be careful you don’t accidentally throw away your envelope from the IRS. When the first $1,200 stimulus checks went out last year, some recipients mistook their mailed checks or debit cards for junk mail and tossed them.

Recommended Reading: How To Sign Up For The Stimulus Check

If I Am Experiencing Homelessness Or Do Not Have A Permanent Address How Can I Get A Stimulus Check

The IRS is working to help those without a permanent address get stimulus checks and tax credits. The IRS cant issue a payment to eligible Americans when information about them is not available in the IRS system. If eligible, you dont need a permanent address, a bank account, or even a job to get a stimulus payment or check . Individuals may qualify for this money if they have a Social Security number and are not being supported by someone else who can claim them as a dependent.

Eligible people who havent received these payments should file a 2020 tax return, even if they dont usually file. Filing a 2020 tax return will give the IRS information needed to send a payment. Those experiencing homelessness may list the address of a friend, relative or trusted service provider, such as a shelter, drop-in day center or transitional housing program, on their tax return.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Read Also: File For Missing Stimulus Check

You Dont Qualify For A Stimulus Check Anymore

After already spending trillions of dollars on propping up the U.S. economy during COVID-19, Congress took a more measured approach when debating what should be included in this latest round of stimulus.

This time around, individuals making more than $80,000 and couples earning over $160,000 get bupkus. Eligibility is based on adjusted gross income, which is a household’s taxable income before subtracting the standard deduction or itemized deductions.

The previous thresholds for getting a stimulus check were $100,000 for single taxpayers and $200,000 for couples who file jointly.

How Can I Find The Bank Information Where My Stimulus Is Being Sent

The account number and routing number where your tax refund are being direct deposited can be found on the printable .pdf version of your tax return.

The last four digits of the bank account being used for direct deposit can be found in your account under Transaction History.

To find the last four digits of your bank account on file:

Log in to your account > My Account > Transaction History

If theres no bank information on my transaction history but on my copy of my taxes theres some bank info what does that mean? Does the IRS have my bank information to send my stimulus?

If you paid your filing fees out of your tax refund and got the rest of your refund by direct deposit, the account number where your funds were deposited is on the printed copy of your tax return. This is the account information the IRS has on file, and your stimulus payment will be sent to this same account.

Recommended Reading: Irs.gov Stimulus Check Sign Up

How Much Does The Third Stimulus Check Pay

The $1.9 trillion coronavirus relief plan includes a third round of $1,400 stimulus payments, topping off the $600 checks that were , and adding up to $2,000.

Congress passed the coronavirus relief plan with targeted income limits for maximum stimulus payments to individual taxpayers earning under $75,000 and joint filers making up to $150,000. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples.

Eligibility for the third stimulus checks is based on your tax filing status. For more information on who qualifies for a third stimulus check, our tables below will help you calculate different payment options.

First 2020 Stimulus Check Payment Schedule

The IRS has issued the majority of stimulus check that were due to be paid via direct deposit. They are now mailing checks to those who didnt have or provide banking details, or where issues were identified when paying the stimulus check electronically. The following is the planned weekly stimulus check mailing schedule based on annual adjusted gross income, as first reported by The Washington Post. All dates represent the week ending and the IRS could change this schedule at any time.

- Less than $10,000: April 24

- $10,001 $20,000: May 1

- $190,001 $198,000: September 4

- Remaining checks: September 11

The IRS has confirmed that the distribution of economic impact payments has begun. Payments for most working Americans are have been calculated and deposited or mailed via check based on 2018 or 2019 federal tax filing payment details. Check payments may take a week or two more. The IRS has also launching several tools to help people track their stimulus check payment and/or update direct deposit details. See FAQs and further updates below.

Most people wont need to take any action and the IRS will calculate and automatically send the economic stimulus payment to those eligible. A dependent stimulus is also available.

SSDI beneficiaries will automatically get the $1,200 payment from April 17th based on their payment information with the Social Security administration, unlike other workers who have to have a recent tax filing to get the stimulus payment.

Read Also: When Can Social Security Recipients Expect The Stimulus Check

The Stimulus Checks Are Going Out In ‘batches’

The IRS has been doing a colossal bit of multitasking up to its eyeballs in both tax returns and the millions of stimulus checks.

Rather than completely overwhelm itself and risk creating an ugly backlog of payments, the tax agency has opted to deliver the stimulus funds in batches.

The ninth batch, totaling $1.8 billion, were officially paid out to Americans on May 12. This latest wave of payments included nearly half a million direct deposits, plus approximately 460,000 paper checks that had to be mailed. Which takes more time.

Here’s What Veterans And Ssi Ssdi Beneficiaries Should Know

The IRS tracking tool Get My Payment is designed to tell you the status of your third stimulus check. People who receive Social Security benefits like SSDI and SSI and veterans who don’t file taxes can also see their payment status in the tracker tool. Tens of millions of Social Security recipients and veterans should have already received their $1,400 payment.

For more stimulus check details, here’s everything to know about the third check. And here’s what we know so far about whether a fourth stimulus check could happen.

Get the CNET How To newsletter

Don’t Miss: How To Check For Stimulus Checks

Is My Stimulus Payment Being Mailed Or Sent Direct Deposit

The IRS will send payments by direct deposit, paper check, and prepaid debit cards. They will likely deliver your third stimulus the same way you received the previous stimulus or your tax refund.

To ensure you receive the stimulus payment by direct deposit, file your 2020 tax return and choose direct deposit for your refund delivery method. If youve received your refund by direct deposit in prior years, filing your 2020 return now gives you the opportunity to verify your bank account information .

When the second stimulus checks were delivered, an IRS error caused some payments to be returned. This issue has been resolved and will not impact how your third stimulus is delivered.

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Also Check: Get My Stimulus Payment 1400

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Don’t Miss: H& r Block Stimulus Check

Can I Find My Irs Account Information Online

The IRS online registration process can take about 15 minutes. During the setup process, the IRS will first email and then text you two activation codes. If the codes don’t come through, the agency will mail you a letter with an activation code, which can take five to 10 days to get to you. If you want to track the letter, you can use this free service from the USPS.

Once you’ve set up your online account with the IRS, you can check your account for the information contained in the notice. If your stimulus payment information is not available when you check, the IRS said it should be in the coming weeks.

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

Don’t Miss: Can Unemployed Get Stimulus Check

How Come My Payment Is Showing Up Early Or In Provisional Status

This is normal given that the processing/start date of the given payment batch and payment could be a few days apart. Generally the payment date is 5 days after the processing date, so the payment is classified as provisional until the official payment date. That is why many eligible recipients see the direct deposit stimulus payments as pending or as provisional payments in their accounts before the official payment date.