Am I More Likely To Receive My Payment As A Direct Deposit This Time

Yes. By increasing the use of direct deposit and using prepaid debit cards, people will see an increase in the number of electronic stimulus payments to Americans affected by the pandemic.

Increasing the number of Economic Impact Payments made electronically gets relief to more people in the fastest and most secure way possible. It will also help recipients avoid the time needed and the potential expense of depositing or cashing checks.

To accomplish this, Treasury is drawing upon its records of electronic payments to and from the federal government and converting to direct deposits payments that would have otherwise been paid as checks.

Taxpayers should note that the form of payment for the EIP3 may be different than earlier stimulus payments. Those receiving EIP3 in the mail may get either a paper check or an EIP Card. This may be different than how they received their previous stimulus payments.

All Third Economic Impact Payments Issued Parents Of Children Born In 2021 Guardians And Other Eligible People Who Did Not Receive All Of Their Third

IR-2022-19, January 26, 2022

WASHINGTON The Internal Revenue Service announced today that all third-round Economic Impact Payments have been issued and reminds people how to claim any remaining stimulus payment they’re entitled to on their 2021 income tax return as part of the 2021 Recovery Rebate Credit.

Parents of a child born in 2021 or parents and guardians who added a new qualifying child to their family in 2021 did not receive a third-round Economic Impact Payment for that child and may be eligible to receive up to $1,400 for the child by claiming the Recovery Rebate Credit.

While some payments of the Economic Impact Payments from 2021 may still be in the mail, including, supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. The IRS is no longer issuing payments as required by law. Through December 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021.

The American Rescue Plan Act of 2021, signed into law on March 11, 2021, authorized a third round of Economic Impact Payments and required them to be issued by December 31, 2021. The IRS began issuing these payments on March 12, 2021 and continued through the end of the year.

Will People Receive A Paper Check Or A Debit Card

The IRS encourages people to check Get My Payment for additional information the tool on IRS.gov will be updated on a regular basis starting Monday, March 15. People who don’t receive a direct deposit should watch their mail for either a paper check or a debit card. To speed delivery of the payments to reach as many people as soon as possible, some payments will be sent in the mail as a debit card. The form of payment for the third stimulus payment may differ from the first two.

People should watch their mail carefully. The Economic Impact Payment Card, or EIP Card, will come in a white envelope prominently displaying the U.S. Department of the Treasury seal. It has the Visa name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card. Information included with the card will explain that this is an Economic Impact Payment. More information about these cards is available at EIPcard.com.

Also Check: Earned Income Tax Credit Stimulus

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Does The American Rescue Plan Provide Additional Unemployment Benefits

Continuing the expanded unemployment aid established by the CARES Act and the Covid-19 Economic Relief Bill, this new pandemic relief legislation extends unemployment benefits through early September 2021. Those filing for unemployment benefits will remain eligible for $300 in aid per week on top of normal payments. The additional benefits are automatic, and recipients need only to continue filing biweekly claims with their state unemployment insurance agency.

The act also includes a new benefit for unemployed Americans in the form of a significant tax break. Individuals who collected unemployment during the 2020 tax year may waive federal income taxes on up to $10,200 of that money , provided they earned less than $150,000 in 2020.

Read Also: Where’s My Stimulus Check Nj

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Irs Begins Delivering Third Round Of Economic Impact Payments To Americans

IR-2021-54, March 12, 2021

WASHINGTON The Internal Revenue Service announced today that the third round of Economic Impact Payments will begin reaching Americans over the next week.

Following approval of the American Rescue Plan Act, the first batch of payments will be sent by direct deposit, which some recipients will start receiving as early as this weekend, and with more receiving this coming week.

Additional batches of payments will be sent in the coming weeks by direct deposit and through the mail as a check or debit card. The vast majority of these payments will be by direct deposit.

No action is needed by most taxpayers the payments will be automatic and, in many cases, similar to how people received the first and second round of Economic Impact Payments in 2020. People can check the Get My Payment tool on IRS.gov on Monday to see the payment status of the third stimulus payment.

“Even though the tax season is in full swing, IRS employees again worked around the clock to quickly deliver help to millions of Americans struggling to cope with this historic pandemic,” said IRS Commissioner Chuck Rettig. “The payments will be delivered automatically to taxpayers even as the IRS continues delivering regular tax refunds. We urge people to visit IRS.gov for the latest details on the stimulus payments, other new tax law provisions and tax season updates.”

Also Check: Get My Payment Stimulus Checks

More Money For Certain Families

One big change with third stimulus checks was that an extra $1,400 was tacked on to your payment for any dependent in the family. For the first- and second-round payments, the additional amount allowed $500 for first-round payments and $600 in the second round was only given for dependent children age 16 or younger. As a result, families with older children, including college students age 23 or younger, or with elderly parents living with them, didn’t get the extra money added to their previous stimulus payments. That’s not the case for third-round stimulus checks.

Who Qualifies For The Third Stimulus Payments

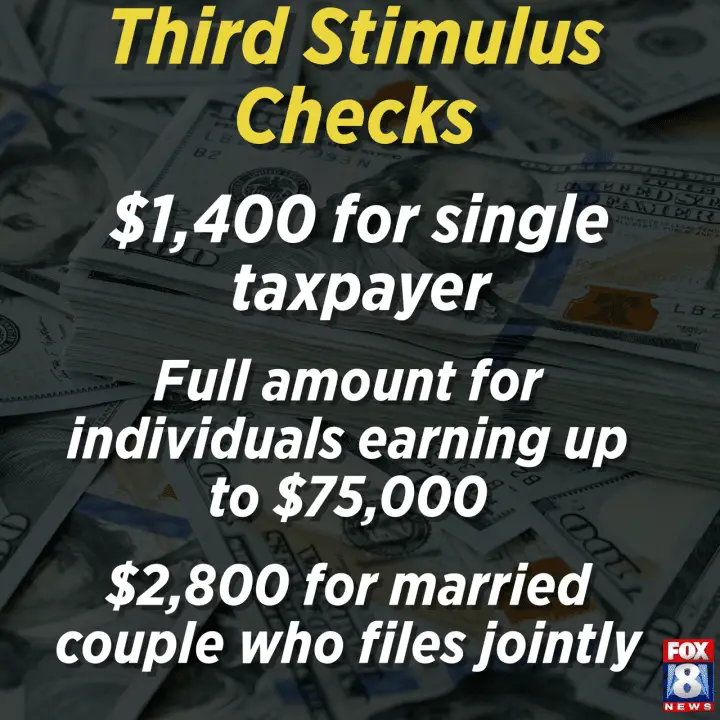

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Read Also: Irs Stimulus Check Tax Return

What If I Reported My Stimulus Money Incorrectly

If you’ve already filed your 2021 tax return and realized that you reported the wrong information for your stimulus check payments, do not file an amended return. The IRS says that it will correct any mistakes and send you a notification indicating the changes it has made to your return.

Even though you won’t need to file an amended return, making a mistake when reporting stimulus money will definitely delay the processing of your return and any potential tax refund. As mentioned above, stimulus payment errors were one of the biggest reasons for IRS delays last year.

If, however, you filed your 2021 tax return and reported $0 for your recovery rebate credit and you do want to claim more stimulus money, you will need to file an amended return, using IRS Form 1040 X

Who Qualifies For Receiving A Stimulus Payment

Anyone with a Social Security number, who meets the income requirements, is eligible.

The income limits are:

- Eligible individuals earning between $75,000 and $100,000

- Head-of-household filers earning between $112,500 and $150,000

The amount is based on your adjusted gross income on your 2019 tax return, unless the IRS processes your 2020 return by the time payments are sent.

Also different from the previous stimulus payments, is taxpayers with an adjusted gross income less than $75,000 to get the full $1,400 payment, including dependents of any age. Previous payments did not include money for dependents age 17 and older, but rather included smaller amounts for children.

Those who are not required to file income tax returns could receive payments. The IRS has a non-filers tool to gather information for these recipients. In addition, Social Security retirement, disability beneficiaries, and Supplemental Security Income recipients are likely eligible for payments.

Also Check: When Is The Next Stimulus Check Going Out

How Will The Irs Know Where To Send My Payment What If I Changed Bank Accounts

Taxpayers with direct deposit information on file with the IRS will receive the payment that way. For those without direct deposit information on file with the IRS, the IRS will use federal records of recent payments to or from the government, where available, to make the payment as a direct deposit. This helps to expedite payment delivery. Otherwise, taxpayers will receive their payment as a check or debit card in the mail. If the direct deposit information is sent to a closed bank account, the payment will be reissued by mail to the address on file with the IRS. The IRS encourages taxpayers to check the Get My Payment tool for additional information.

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for stimulus payments. This includes those without a permanent address, an income or bank account.

If you’re eligible and didn’t get a first, second or third Economic Impact Payment or got less than the full amounts, you may be eligible for a Recovery Rebate Credit, but you’ll need to file a tax return.

Recommended Reading: Stimulus Checks Status Phone Number

Stimulus Update: Irs Announces All Third

The IRS announced on Thursday, Jan. 26 that all third-round Economic Impact Payments have been sent out. However, people can still claim any remaining stimulus money theyre owed on their 2021 income tax return as part of their 2021 Recovery Rebate Credit.

Find: Child Tax Credit Update: White House Announces Website Update to Help Families Collect Full Benefits

The IRS noted that some Economic Impact Payments from 2021, which were advance payments of the 2021 Recovery Rebate Credit, may still be in the mail but the IRS is no longer issuing payments as required by law. Through Dec. 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families.

The IRS began issuing Letter 6475, Your Third Economic Impact Payment, in late January to recipients of the third-round Economic Impact Payment. This letter will help recipients determine if they should claim the Recovery Rebate Credit on their 2021 tax returns.

According to the IRS, some families may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. Reasons include:

The IRS began accepting tax returns on Jan. 24 and you must claim the 2021 Recovery Rebate Credit on your 2021 income tax return to get this money.

If I’m Receiving A Payment By Mail What Should I Do

IRS and Treasury urge eligible people who don’t receive a direct deposit to watch their mail carefully during this period.

Some taxpayers will receive an envelope from the U.S. Department of the Treasury containing a paper check. For people who receive tax refunds by mail, this check will look similar, though it will note that it is an Economic Impact Payment.

Others will receive a prepaid debit called, called the EIP Card. This card will come in a white envelope prominently displaying the U.S. Department of the Treasury seal. The card has the Visa name on the front of the card and the issuing bank, MetaBank, N.A. on the back of the card. Information included with the card will explain that this is an Economic Impact Payment. Each mailing will include instructions on how to securely activate and use the card. It is important to note that none of the EIP cards issued for any of the three rounds is reloadable recipients will receive a separate card and will not be able to reload funds onto an existing card.

The IRS does not determine who receives a prepaid debit card. More information about these cards is available at EIPcard.com.

Increasing the use of direct deposit payments and prepaid debit cards will provide more recipients with their stimulus payments more rapidly than would otherwise be the case. It will provide faster relief to millions of Americans during the pandemic. Recipients may check the status of their payment at IRS.gov/getmypayment.

Don’t Miss: What Is Congress Mortgage Stimulus Program

Moved Or Changed Your Bank Account Information

If your bank account has changed, the bank will return the money and the IRS will issue a paper check to your last known address. If you have moved, make sure you set up mail forwarding with the United States Postal Service so you can receive any mailed check at your current address:

Learn more about free resources to help you file your taxes on our Tax Help page. Entering a bank account when you file taxes will help you receive your stimulus check faster. Learn more on our Banking Help page.

Was There A Stimulus Check In 2021

Stimulus Update | 2021 $1,400 stimulus payment can be claimed for dead people in 2022. BALTIMORE The American Rescue Plan signed into law by President Joe Biden in March of 2021 delivered $1,400 stimulus checks to most Americans. The money was intended to help people get through the COVID-19 pandemic.

Don’t Miss: Who Do I Contact About My Stimulus Check

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Does The Act Provide Student Loan Relief

The legislation does not provide much additional aid for students however it maintains President Biden’s earlier executive order stating that federal student loans will remain in forbearance through September 30, 2021. Although this federal relief is not applicable to private student loans, individual lenders may offer some sort of assistance at their discretion.

You can find further details about the American Rescue Plan, as well as the full text of the legislation, here.

Also Check: When Will Nc Stimulus Checks Arrive 2021

How Do I Know If I’m Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, you’re due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.