Are Adult Dependents Getting Third Stimulus Checks

The new stimulus plan expands eligibility to adult dependents, including college students, elderly relatives and disabled adults.

The text of the plan redefines the term dependent according to section 152 of the tax code, which includes both qualifying children and adults: Section 152 provides that the term dependent means a qualifying child ) or a qualifying relative ).

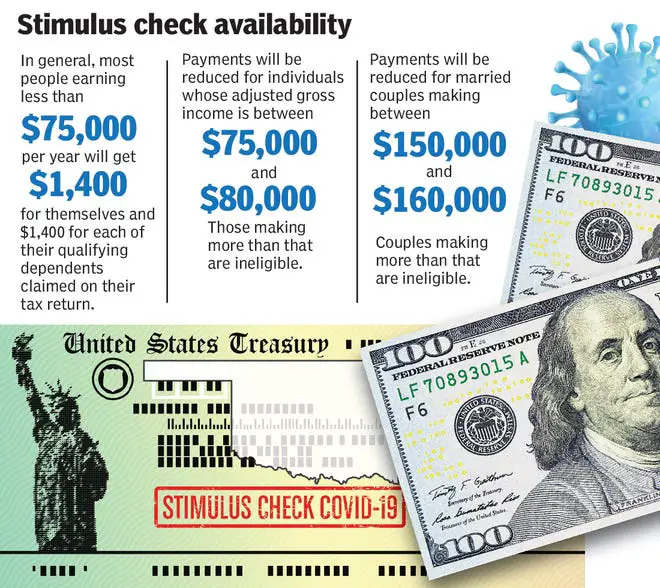

While the plan pays out $1,400 for each qualifying dependent, families should keep in mind that the targeted lower income ranges exclude them if they earn over $160,000.

For reference, the second stimulus checks provided additional $600 payments for qualifying dependents under the age of 17. So a couple filing jointly with three eligible children could get a maximum second payment of $3,000 .

Under the first and second rounds of stimulus checks, children and adult dependents over the age limit could not get an additional payment, and they did not qualify for a stimulus check of their own either.

With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. The table below breaks down the third stimulus checks for heads of household with one dependent:

| Stimulus Checks for Heads of Household & 1 Dependent |

| AGI |

| $120,000 and up | $0 |

Why Is There A Third Stimulus Package

Despite nearly constant discussion of stimulus checks throughout the pandemic, Congress and the Trump administration only agreed on two. The first, offering $1,200 checks to adults with an additional $500 for children, was enacted in March of 2020 via the CARES Act. The second check provided $600 for adults and another $600 for children and was authorized by the omnibus appropriations and stimulus bill enacted at the end of December.

Nearly all Democrats and even some Republicans thought the December legislation was inadequate in size and scope . Meanwhile, the pandemics winter surge reached frightening new levels, vaccine distribution needs a major boost, and the economy, as reflected in the and jobs reports, is looking anemic.

Joe Biden made it clear since before the election that he would favor a new and expanded stimulus package upon taking office. Since there was significant bipartisan support for making that second check $2,000 instead of $600, the new Biden administration decided to plus up the direct payments with a third $1,400 check.

How Will We Ensure That You Get Full Access To Your Stimulus Payment When It Arrives

We understand that these are unusual times and that many families are struggling. In preparation for the next stimulus payment, we want to be sure that our clients have access to the full amount of their stimulus payment regardless of their account balance. For instance, if you have a negative balance at the time the stimulus payment is deposited, we may apply a temporary credit to cover the negative balance so that you may have full access to your stimulus payment. As an example:

Account balance before stimulus payment: -$150

Stimulus payment deposit: +$600

Also Check: Apply For Stimulus Check Indiana

What About Student Loan Forgiveness

Lawmakers proposed a separate plan to forgive $50,000 of federal student loan debt per person. This would cancel out the debt of roughly 80% of federal student loan debtors.

We will continue to update this article as we receive information. We encourage you to consult government websites for the most up-to-date information.

Read Also: Didnt Get Any Stimulus Checks

What Happens If You Dont Receive Your Payment Or Only Receive A Partial Amount

If you havent received your payment yet, dont panic, although its easier said than done. Compared with the first round of stimulus checks, the IRS and Treasury Department have significantly shrunk the delivery timeline by weeks, if not months. However, the text of the American Relief Plan still gives both agencies until Dec. 31, 2021, to distribute all funds, meaning the last round of checks might not hit consumers mailboxes until January 2022.

Consider signing up for the U.S. Postal Services informed delivery service, so you know in advance of any mail youll be receiving on a given day. If the IRS says it already mailed your check but you didnt receive one, down the road you might also decide to order a stimulus check payment trace. You can arrange one by calling a hotline at the IRS or submitting a completed Form 3911, Taxpayer Statement Regarding Refund by mail or fax. But be prepared: This process can take weeks. The IRS may also ask that you sit tight for the time being in some cases, for a period as long as nine weeks.

Recommended Reading: Is Maine Getting Another Stimulus Check

Yes Your Third Check Might Be Seized To Pay Certain Debts Here’s Why

Under the bill governing the second stimulus check, your funds could not be garnished to pay debts like child support, banks or private creditors. However, part of this rule changed with the third check.

The bill authorizing the third payout was pushed through using a process called budget reconciliation. Congressional Democrats used this legislative tool to more quickly pass the new COVID-19 relief bill and the third stimulus check that comes with it, since it allowed them to pass it with fewer votes. But because this process was used, the third checks aren’t protected from all garnishment, although lawmakers are moving to fix this now.

There are three types of unpaid debt that could be paid through garnishment: unpaid IRS tax debt, other government debt like child support payments or private debt, according to Garrett Watson, a senior policy analyst at the Tax Foundation. Your third stimulus payment will be protected from outstanding tax debt and child support, but not from private debts, such as debt accrued due to a civil judgment, ranging from civil damages to consumer debt in default, Watson said.

Several banking groups sent a letter to Congress on March 9 asking lawmakers to pass stand-alone legislation to prevent the third check from being garnished for private debts.

South Carolina Stimulus Checks

South Carolina is sending tax rebate payments this year to people who file a 2021 South Carolina income tax return showing a state tax liability by February 15, 2023. The amount you receive depends on your 2021 South Carolina income tax liability, but it wont be more than $800.

If you filed your 2021 South Carolina tax return by October 17, 2022, your rebate will be issued by the end of 2022. If you file after October 17 but before February 15, 2023, your payment will be issued by March 31, 2023.

The South Carolina Department of Revenue has an online tool to track the status of your rebate.

For South Carolina taxes in general, see the South Carolina State Tax Guide.

Read Also: New Stimulus Check For Seniors

Third Stimulus Check: Why You Might Want To Spend This One Differently

Stack of 100 dollar bills with illustrative coronavirus stimulus payment check to show the virus stimulus payment to Americans

Congress has passed the third stimulus check relief package, and President Joe Biden promptly signed it into law Thursday.

Here are the details of the American Rescue Plan Act of 2021, plus an actionable priority list of the best ways to use the money based on your current financial circumstances.

Read Also: Latest Update On Stimulus Check

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Also Check: How To Get Unclaimed Stimulus Checks

Your Stimulus Payments Won’t Be Taxed But There Is One Exception

The IRS doesn’t consider stimulus payments to be income, which means you won’t be taxed on your stimulus money. That also means a direct payment you get this year won’t reduce your tax refund in 2021 or increase the amount you owe when you file your 2020 tax return. You also won’t have to repay part of your stimulus check if you qualify for a lower amount in 2021. If you didn’t receive everything you were owed this year, you can claim your full stimulus check amount as a Recovery Rebate Credit on your 2020 federal income tax return when you file this month .

However, another big caveat here: If you are filing for any missing stimulus money as a Recovery Rebate Credit on your tax return this year, the IRS can potentially garnish that money to pay for any back taxes you owe. Again, an independent taxpayer advocacy group within the IRS is working with the agency to address this issue to protect those funds for vulnerable taxpayers.

Is the stimulus money really yours? That depends.

All Third Economic Impact Payments Issued Parents Of Children Born In 2021 Guardians And Other Eligible People Who Did Not Receive All Of Their Third

IR-2022-19, January 26, 2022

WASHINGTON The Internal Revenue Service announced today that all third-round Economic Impact Payments have been issued and reminds people how to claim any remaining stimulus payment they’re entitled to on their 2021 income tax return as part of the 2021 Recovery Rebate Credit.

Parents of a child born in 2021 or parents and guardians who added a new qualifying child to their family in 2021 did not receive a third-round Economic Impact Payment for that child and may be eligible to receive up to $1,400 for the child by claiming the Recovery Rebate Credit.

While some payments of the Economic Impact Payments from 2021 may still be in the mail, including, supplemental payments for people who earlier this year received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns. The IRS is no longer issuing payments as required by law. Through December 31, the IRS issued more than 175 million third-round payments totaling over $400 billion to individuals and families across the country while simultaneously managing an extended filing season in 2021.

The American Rescue Plan Act of 2021, signed into law on March 11, 2021, authorized a third round of Economic Impact Payments and required them to be issued by December 31, 2021. The IRS began issuing these payments on March 12, 2021 and continued through the end of the year.

Also Check: When Will Arizona Get Stimulus Checks

Incarcerated Individuals And Mixed Status Families Eligibility For Third Stimulus Checks

For the third stimulus check, anyone with a Social Security number can receive the stimulus check for themselves and their family members. This is different from the last bill and ensures that mixed families will receive the third stimulus checks too.

Its important to note that if you are incarcerated, you can still receive your check. And if you lost work or wages in 2020, you could get a higher amount than you did with the first or second stimulus checks.

And if you normally arent required to file taxes, either because of your income level or for other reasons, you are probably eligible for a stimulus payment.

Reminder: File your taxes by April 15!

Tip: If you havent yet filed your taxes, read about how to file your taxes for free and whether you should take a Refund Anticipation Loan.

The intention behind this stimulus check, as with the last two, is to support Americans during this difficult time. This may also be a good time to consider establishing savings habits to create a financial buffer for you and your family.

At SaverLife, our mission is to make saving money easier and more rewarding. We receive donations to give you cash rewards and prizes for building up your rainy day fund.

We invite you to visit our Forum, where you can raise questions, share experiences, and connect with SaverLife members. And !

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

You May Like: How To Get My 3rd Stimulus Check

You Will Be Able To Claim Missing Stimulus Money

Although stimulus checks are well on their way, the IRS will have until Dec. 31, 2021, to automatically send the payments. That leeway would allow for the agency to potentially fix any direct deposit errors, calculation problems or issues including the right amount of money for dependents. Any discrepancy between 2019 and 2020 taxes could also be claimed in this time period, presumably.

Rd Stimulus Check Eligibility: Who Gets The Third Stimulus Check

The American Rescue Plan is a $1.9 trillion relief package to help alleviate the hardship that millions of Americans feel right now including checks directly to families and individuals like you. Here are the details about who qualifies for the third stimulus checks. Visit our other blog post for more details about other benefits.

Also Check: Stimulus Checks Status Phone Number

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Recommended Reading: Irs Customer Service For Stimulus Check

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Also Check: Get My Stimulus Payment 1400

File Electronically And Choose Direct Deposit

The amount of the 2021 Recovery Rebate Credit will reduce the amount of tax owed for 2021, or, if it’s more than the tax owed, it will be included as part of the individual’s 2021 tax refund. Individuals will receive their 2021 Recovery Rebate Credit included in their refund after the 2021 tax return is processed. The 2021 Recovery Rebate Credit will not be issued separately from the tax refund.

To avoid processing delays, the IRS urges people to file a complete and accurate tax return. Filing electronically allows tax software to figure credits and deductions, including the 2021 Recovery Rebate Credit. The 2021 Recovery Rebate Credit Worksheet on Form 1040 and Form 1040-SR instructions can also help.

The fastest and most secure way for eligible individuals to get their 2021 tax refund that will include their allowable 2021 Recovery Rebate Credit is by filing electronically and choosing direct deposit.

Anyone with income of $73,000 or less, including those who don’t have a tax return filing requirement, can file their federal tax return electronically for free through the IRS Free File program. The fastest and most secure way to get a tax refund is to file electronically and have it direct deposited contactless and free into the individual’s financial account. Bank accounts, many prepaid debit cards, and several mobile apps can be used for direct deposit when taxpayers provide a routing and account number.

The Us Federal Government Sent Out Three Waves Of Stimulus Payments Since The Start Of The Covid

The US is in the throes of another wave of covid-19 infections with case numbers surpassing all previous peaks. In the past this led to the federal government stepping up to help Americans left struggling in the disruption the pandemic has wrought on livelihoods and household finances. However, this time despite workers out sick or quarantining no new federal stimulus checks look set to be sent out.

In a recent press release the Internal Revenue Service put out its annual report highlighting the efforts of its employees in 2021. One of the accomplishments touted by the agency has been successfully delivering more than $1.5 trillion to people across the nation through Economic Impact Payments, tax refunds and advance Child Tax Credit payments. Here’s a look at the three Economic Impact Payments, better known as stimulus checks.

Recommended Reading: Apply For Stimulus Check Online