What Is The New Child Tax Credit Amount

Heres how the numbers break down: The American Rescue Plan bumps the Child Tax Credit up to $3,000 for children ages 617 and $3,600 for children under age 6.3 Expecting a baby in 2021? First of all, congrats! And heres some more good news for youbabies born in 2021 will qualify for the full $3,600. Have a college student? Parents can receive a one-time payment of $500 for each full-time college kid ages 1824.4

So, for a family that has three children , heres how it all breaks down:

Lets say they have three kids that are ages 12, 7 and 4 and a household income of $72,000 a year. Their new Child Tax Credit would be $9,600.

But remember, instead of applying the full amount of the credit to income taxes they might owe or getting a refund after they file their taxes, parents can get the credit up front in monthly payments of $250 for each qualifying child .5 So that family of three in our example would get $800 a month from July through December. Wow!

Right now, this change would be only for 2021but theres talk in Congress and the White House to make it a permanent thing for the next five years under Bidens American Families Plan. Yep, there are a lot of plans and acts to keep straight these days.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Amount Of Your Third Stimulus Check

Every eligible American will receive a $1,400 third stimulus check base amount. The base amount jumps to $2,800 for married couples filing a joint tax return. You also get an extra $1,400 for each dependent in your family .

Not everyone will receive the full amount, though. As with the first two stimulus payments, third-round stimulus checks will be reduced potentially to zero for people reporting an adjusted gross income above a certain amount on their latest tax return. If you filed your most recent tax return as a single filer, your third stimulus check will be phased-out if your AGI is $75,000 or more. That threshold jumps to $112,500 for head-of-household filers, and to $150,000 for married couples filing a joint return. Third-round stimulus checks will be completely phased out for single filers with an AGI above $80,000, head-of-household filers with an AGI over $120,000, and joint filers with an AGI exceeding $160,000.

You can use our handy Third Stimulus Check Calculator to get a customized estimated payment amount. All you have to do is answer three easy questions.

Recommended Reading: Claiming Stimulus Check On Taxes 2021

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Residents To Receive Tax Rebate Of Up To $500

Stimulus Update: Will There Be A Stimulus Check For Inflation

Hey, weve all felt the pain of high prices on gas, groceries and just about everything else. To combat inflation, nearly 20 states have decided to give out inflation stimulus checks.

Each state has different guidelines for its inflation stimulus plans. Some states are offering tax rebates while others are sending direct payments that range from $50 up to more than $1,000.

Congress is also considering sending out a $100 gas rebate check to everyone in every month the national average gas price is $4 or more. But so far, the Gas Rebate Act of 2022 hasnt picked up much speedand neither has the idea for a federal gas tax holiday.

Also Check: Are Stimulus Checks Still Going Out

Are Permanent Fund Dividends Taxable

Dividends from the Permanent Fund, as well as any other resource rebate, are taxable by the federal government.

The State of Alaska provides a 1099-MISC form which can be used for reporting the income to the federal government. This form is available to print or view in your myPFD account. If youre unable to access your account, you can contact the states Permanent Fund Dividend Division for assistance.

Who Gets A Stimulus Check

Stimulus checks are available to eligible U.S. individuals with Social Security numbers. However, eligibility rules vary depending on the checks.

For the first two payments, anyone claimed as a dependent wasn’t eligible for their own check. However, individuals who claimed dependents under 17 could receive a payment for them. The third check still prohibits dependents from claiming their own checks. However, individuals who claim dependents can now receive a payment for adult dependents as well as for dependent children over age 17.

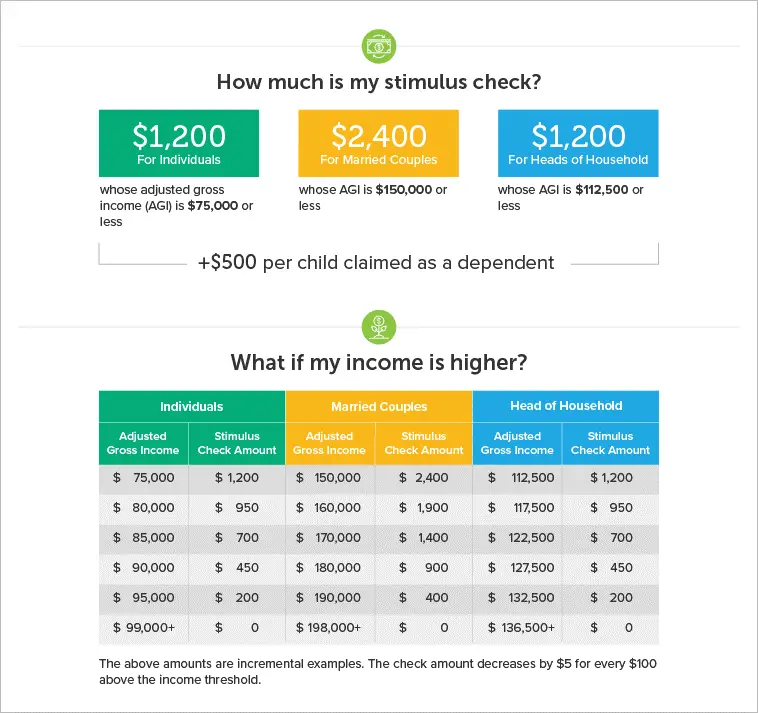

There are also income limits. Each of the three checks is available in full to single tax filers with an income under $75,00. Heads of house with an income under $112,500 are also eligible, as are married joint filers with an income under $150,000. However, phase-out rules — the level at which high earners lose eligibility for checks — differ for each payment, as we’ll discuss in more detail below.

The IRS utilized tax return information from 2018 or 2019 to determine income and eligibility for the first two checks. It will use tax return information from 2019 or 2020 to determine income and eligibility for the third payment. The agency also obtained information from the Social Security Administration and VA to send payments to benefits recipients who don’t file tax returns. And it established an online form for non-filers to claim their payments.

Don’t Miss: I Havent Received My Stimulus Check

Is Congress Talking About A Fourth Stimulus Check

There are no signs that lawmakers in Washington, D.C. are in serious discussions about a fourth direct payment stimulus check. While there have been calls by the public and from some lawmakers for recurring payments, there has been practically nothing in terms of action.

Emails and phone calls to the White House, Sen. Bernie Sanders, I-Vt., who is chair of the Senate Budget Committee, and Rep. John Yarmuth, D-Ky., chair of the House Budget Committee, asking if such payments are under discussion were not returned.

One pandemic-related stimulus that is being considered for an extension is the monthly advance child tax credit. It raised the previous tax credit from $2,000 at tax time to $3,000-$3,600 with the option of monthly payments. A one-year extension is part of the Build Back Better bill that passed the House. But Sen. Joe Manchin, D-W.V., announced Sunday he would not vote for it. With no Republicans on board, passage of the bill is doomed unless an alternative is found.

A group of Democrats sent a letter to Biden in back in May , but the letter did not get into specifics and nothing else came of it.

A change.org petition started by Denver restaurant owner Stephanie Bonin in 2020 called on Congress to pass regular checks of $2,000 for adults and $1,000 for kids for the duration of the pandemic crisis.

As of late December, the petition has reached nearly 3 million signatures.

What Is A Stimulus Check

Stimulus checks are direct payments to American families that the U.S. government provided in response to COVID-19. Three stimulus checks have been paid out during the pandemic:

- The Coronavirus Aid, Relief, and Economic Security Act authorized the first check. It provided up to $1,200 per eligible adult and $500 per eligible dependent child.

- An additional stimulus check was authorized in December of 2020, providing up to $600 per eligible adult and dependent child.

- A third stimulus check of up to $1,400 per adult and dependent was made available by the American Rescue Plan Act on March 11, 2021.

Recommended Reading: Get My Stimulus Payment Phone Number

How Will I Get My Third Stimulus Check

You dont need to do anything to get your stimulus check. The IRS will determine eligibility based on the last tax return that you filed, either 2019 or 2020, and will likely send your payment to the bank account where your tax refund was deposited.

As part of the income tax filing, the IRS receives accurate banking information for all TurboTax filers who received a tax refund, which the IRS is able to use to quickly and effectively deposit stimulus payments.

How Can I File My Taxes

If you know you need to file a 2020 tax return, you should do so as soon as possible to get your Economic Impact Payment and any tax refund that you are eligible for.

Online: If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software. MyFreeTaxes is an online tool that helps you file your taxes for free. You can use these online programs until November 20, 2021.

Also Check: Stimulus Checks For Social Security Disability

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

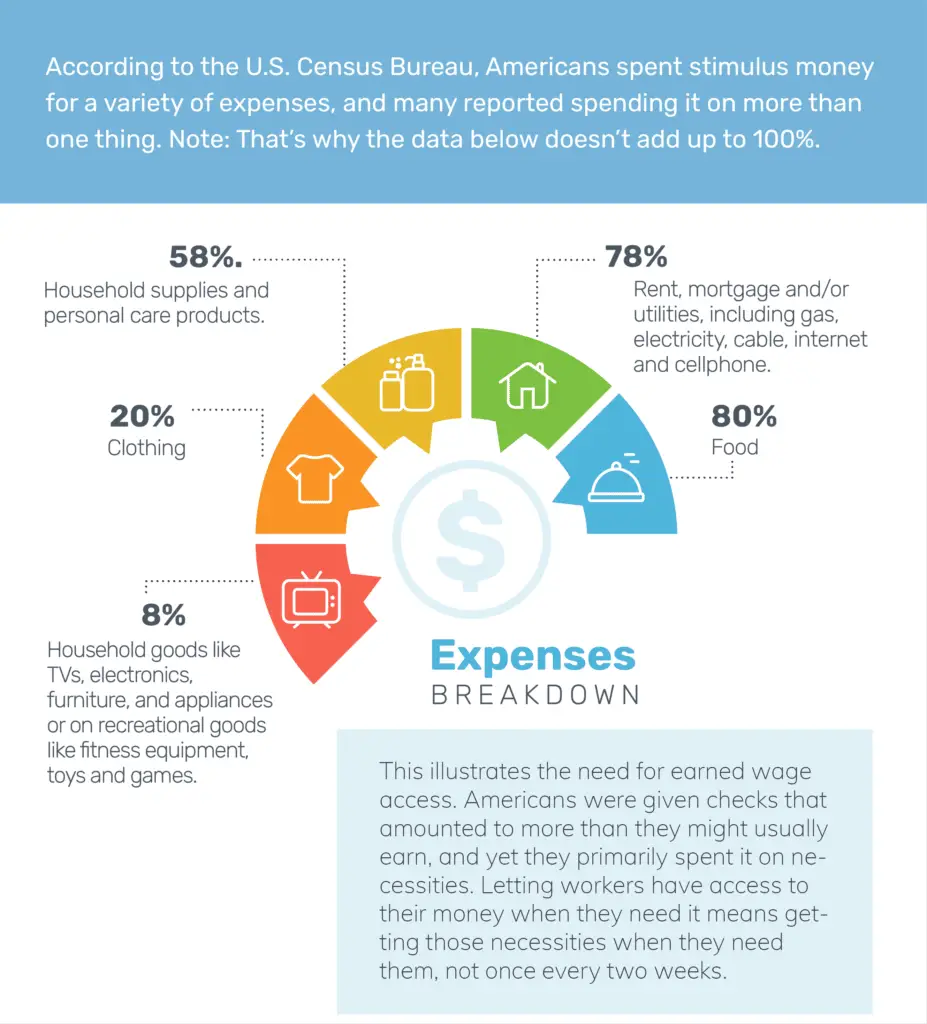

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

Donât Miss: Amount Of Stimulus Checks 2021

Social Security Schedule: When To Anticipate December 2022 Benefits

Theres only one more payment left to go until Social Security recipients receive bigger checks next year. In October, the Social Security Administration announced that the 2023 cost-of-living adjustment will be 8.7% the biggest boost in 41 years.

Explore: 5 Things You Must Do When Your Savings Reach $50,000

When you get your December 2022 payment, it will still reflect this years 5.9% COLA. This adjustment has done little to help seniors deal with the inflated cost of living.

As usual, Social Security payments in December will be made according to the same monthly schedule, with payments going out on the second, third and fourth Wednesdays of the month. Heres a quick rundown:

-

If your birth date is on the 1st-10th of the month, your payment will be distributed on Wednesday, Dec. 14.

-

If your birth date is on the 11th-20th, your payment will be distributed on Wednesday, Dec. 21.

-

If your birth date is on the 21st-31st, your payment will be distributed on Wednesday, Dec. 28.

If you dont receive your payment on the expected date, the SSA advises allowing three additional mailing days before contacting Social Security.

Seniors who also qualify for Supplemental Security Income benefits will also receive two SSI payments in December. According to the SSA website, SSI benefits are usually paid on the first of the month unless the date falls on a weekend, in which case payments will be issued the Friday before the first.

More From GOBankingRates

You May Like: Check My Stimulus Check History

What If I Get Government Benefits Will These Payments Count Against Eligibility Or Unemployment Insurance

Economic Impact Payments dont count against means-tested programs like SNAP, TANF, or Medicaid. The payments are not counted as income during the month they are received and the following month and they are not counted as a resource for 12 months.

You will receive the check regardless of your employment status. The check will not impact your eligibility for unemployment payments.

More Third Stimulus Payment Money For Some In 2022

Parents who added a child in 2021 could be getting up to $1,400 after they file their 2021 taxes this coming spring thanks to the American Rescue Plan. The money won’t come as a direct check but will be part of the overall tax return.

The 2021 Economic Impact Payment — colloquially known as the third stimulus check — was actually an advance on what is called the 2021 Recovery Rebate Credit. What that means is that the $1,400 stimulus check most individual Americans received in 2021 is, in fact, money they would have gotten after filing their taxes in the spring of 2022 as a Recovery Rebate Credit.

In other words, millions of Americans already got part of their tax refund 12 months early.

“The bottom line is that’s money that’s going out almost immediately to millions of people as a tax credit in advance of putting it on a tax return in the next year,” said Raphael Tulino, IRS spokesman.

However, the IRS was going off of 2019 or 2020 tax returns for its information on the third EIP. It was using that information to determine if taxpayers would get stimulus money for their dependents. If eligible parents had a child born into their family in 2021, they can request the Recovery Rebate Credit on their taxes to get the payment for that child.

It gets more complicated with adoption because all the paperwork and processes to finalize the adoption must be completed first.

This does not pertain to the first or second stimulus payments that were paid in 2020.

You May Like: How Much Was Last Stimulus Check

Why Is The Irs Sending Me Letter 6475

The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return,the IRS said in a release, including personal information like your name and address and the total amount sent in your third stimulus payment.

This could include plus-up payments additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but thats not what you want to use to prepare your 2021 return.

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

You May Like: Sign Up For Stimulus Check

Social Security Disability Insurance Payment: When Will You Get Your November Check

If you havenât received your SSDI payment for November, hereâs when it could arrive.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When sheâs not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The last Social Security Disability Insurance of November is scheduled to go out to beneficiaries this week. Whether your money has arrived or not depends on two things: your date of birth and the year you first started receiving SSDI money. Each month, checks are disbursed on four different dates, and it can get confusing to parse â even if youâve been receiving benefits for many years. But if youâre expecting a payment, itâs good to know exactly when it should arrive.

SSDI follows a similar schedule to Social Security payments unless youâve been getting SSDI checks for several decades. Weâll explain below. Also, be aware that the amount you receive will be more, starting January 2023, because of the cost of living adjustment.

Hereâs when youâll get your Social Security Disability Insurance payment in November. For more, hereâs why Supplemental Security Income recipients will get their COLA increase in December.