$600 For Each Dependent Child

Aside from the smaller stimulus checks for adults, the other major change under the bill passed by Congress is the amount provided for dependent children: $600 for each child, up from $500 in the CARES Act.

However, the bill states the $600 would be directed toward each dependent child under age 17, which means that adults who are nevertheless claimed as dependents such as college students and older high school studentswouldnât qualify for the checks.

Adult dependents, such as seniors who are claimed as dependents on their adult childrenâs tax returns, also wouldnât qualify for the checks. Excluding college students and other adult dependents was a matter of debate with the first round of checks, with some families arguing that older dependents should also qualify for the payments.

A family of two parents with two child dependents could receive up to $2,400 under the provision, lawmakers said.

Also Check: Who Sends The Stimulus Checks

How Do I Know If Im Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, youre due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

Who Is Getting The 1400 Stimulus Checks

The full payment is available to single tax filers with income under $75,000 and married joint filers with an income under $150,000. Payments phase out once income exceeds these thresholds, and single filers with an income above $80,000 or married joint filers with an income above $160,000 aren’t eligible.

Recommended Reading: Irs Stimulus Payment Phone Number

Stimulus Checks: Parents Who Expanded Families In 2021 Could Be Eligible For A $5000 Payment

As the pandemic enters its third year, there appears to be little momentum for another round of stimulus checks. However, there may be payments waiting for people whose family grew in 2021.

According to a report on Nasdaq.com, folks who added a child to their family in 2021, could be in line for a $5,000 check.

The total goes back to a stimulus payment that was meant for children under the age of 6, but was never paid.

Heres how it works, according to the report.

There was a stimulus payment of $1,400 per dependent from 2021 and an expanded Child Tax Credit worth $3,600 per child for children under the age of 6. That number is $3,000 for children ages 6-to-17.

For a child born last year, he or she would count as a dependent for both the stimulus check and the Child Tax Credit. Parents who adopted a child are also eligible.

For children born in 2021, its likely the IRS wouldnt have known about the child, even though the family was eligible for the payments. They are still eligible for the payments, just in 2022.

The same is true for parents who had twins or triplets, according to the report. That family would be eligible for $10,000 or $15,000.

To receive the stimulus money, new parents only have to file their tax returns.

Related Content:

If You Miss Out This Year

If you receive no $1,400 payment or a reduced check, but your income changes, you may be able to claim the money you are due when you file your taxes next year.

Any change, either a slight reduction in earnings or even just putting more money in a traditional IRA or a 401 could yield a much bigger total payment when they do their 2021 taxes, said Garrett Watson, senior policy analyst at the Tax Foundation.

Theres a subset of folks who will be in that situation, Watson said.

That also goes for this years tax-filing season for people who missed out on the previous $1,200 or $600 payments. You can claim a recovery rebate credit to recoup any money you were possibly owed. This is also available to people who typically do not file tax returns because their income is too low.

Don’t Miss: Is Ohio Giving Out Stimulus Checks

Proposals For A Second Bill

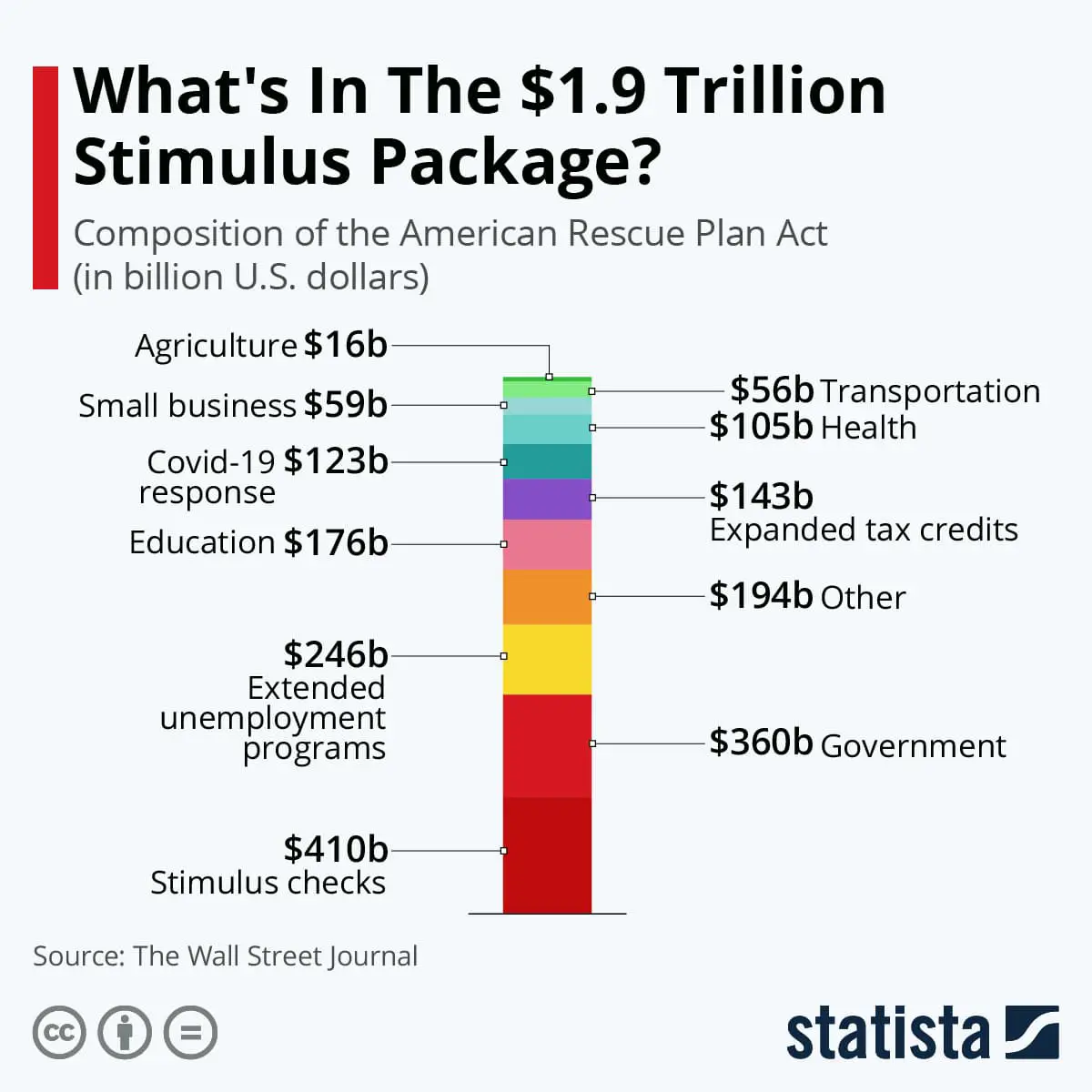

By July, there were proposals for a second stimulus bill, the CARES 2 package was reviewed by the administration and an agreement in principle was reached on the basic points outlined in the package but it was never passed. Nor was the HEROES Act, a $3 trillion economic stimulus bill which was passed by the House by a vote of 208199 on 15 May 15 2020 but never reached a Senate vote.

The 2021 tax filing season begins Feb. 12 IRS outlines steps to help speed refunds during pandemic. See:

IRSnews

The IRS has created a website where you can check the status of your stimulus payment.

The Get My Payment tool is no longer updating for either the first or second stimulus check. However, you can use it to see the status of your third check.

- If your payment has been processed. the IRS will specify its status including whether it has been sent, the date issued, and whether the money will be directly deposited or mailed.

- If your status reads Payment Not Available. The IRS either hasnt yet processed your payment or you arent eligible for one.

- If it reads Need More Information. Your check was returned to the IRS after an attempted delivery. Give the IRS your bank information to receive your money.

If you did not get your first or second check, youll need to file a 2020 tax return to get the payment.

Second Round Of Direct Payments: December 2020

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

You May Like: Who Gets 500 Stimulus Check

If I Owe Someone Money Can They Take My Stimulus Checks

Maybe. Anyone filing a 2020 or 2021 income tax return to claim stimulus checks will receive the money as a tax refund. Stimulus checks should not be kept by the IRS for back tax debt.

If you owe a debt to a different federal or state agency your tax refund could be taken by that agency before you get it. This is sometimes called a garnishment or offset

If you have a question about a garnishment or offset for a student loan debt, a debt related to public benefits , or a federal tax debt you can .

What should I do if I didnt get the full amount I am owed or if I have another problem with my Stimulus Checks?

If you didnt get your stimulus checks, even after filing your 2020 and 2021 tax returns, or if you have another problem with your Stimulus Checks you can . We may be able to help.

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

Recommended Reading: When Are The New Stimulus Checks Coming Out

How Do Renters Apply For Housing Relief Under The American Rescue Plan

This aid is being distributed at the state and city levels, with eligible renters able to apply in their area. In an effort to reach the most at-need Americans, one or more individuals in the renter’s household must fall into one of the following categories:

- Qualify for unemployment

- Experienced a reduction in household income

- Incurred significant costs or experienced a financial hardship due to the Covid-19 pandemic

- Demonstrate a risk of experiencing homelessness or housing instability

- Have household income at or below 80 percent of the area median

Priority will be given to low-income households and renters who have been laid off due to the pandemic.

Indiana: $325 Rebate Payments

Indiana found itself with a healthy budget surplus at the end of 2021, and it authorized two rebates to its residents.

In December 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by January 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to the state.

Taxpayers who filed jointly could receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit and the second payments started rolling out in late August. If you changed banks or didnt have direct deposit information on file, you should have received a paper check.

Individuals who are only eligible for the $200 payment will not receive them at this time. They will have to file a 2022 tax return before January 1, 2024 to claim the credit.

For more information, visit the state Department of Revenue website.

Also Check: When Will We Get Stimulus Check

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a Recovery Rebate Credit. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Stimulus Checks : These States Are Sending Out Tax Rebates In December

Taxpayers in numerous states are still receiving special one-time refunds. Are you one of them?

Many states decided to give residents a bonus tax refund or stimulus check this year to help with ongoing inflation. Some have finished issuing payments already but, elsewhere, checks are still rolling in.

South Carolina started issuing for up to $800 in October and will continue through the end of December. The income tax rebates were approved by state lawmakers as part of this years $8.4 billion budget.

Massachusetts only began returning $3 billion in surplus tax revenue in November. The payments, equal to about 14% of a individuals 2021 state income tax liability, are expected to continue to be issued at least through about Dec 15.

Your state could be sending out a rebate or stimulus check, too. Below, see if you qualify and how much you could be owed. For more on taxes, see if you qualify for additional stimulus or child tax credit money.

Read Also: Second And Third Stimulus Checks

Will I Get A Stimulus Payment For My Spouse Who Died Last Year

A spouse who died in 2020 is not eligible for a stimulus payment under the American Rescue Plan. According to the IRS website, “a payment made to someone who died before they received the payment should be returned to the IRS.If the payment was issued to both spouses, and one spouse has died, the check should be returned, and the IRS will issue a new Economic Impact Payment to the surviving spouse.”

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

Also Check: Stimulus Checks For Healthcare Workers

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Also Check: When Did They Send Out The Third Stimulus Check

I Got My Stimulus Check On A Debit Card And Lost It Or Threw It Out How Can I Get A New One

You can request a replacement by calling 800-240-8100. Select option 2 from the main menu. Your card will arrive in a plain envelope which displays the U.S. Treasury seal and Economic Impact Payment Card in the return address. It will be issued by Meta Bank, N.A. The envelope will include instructions to activate the card, information on fees, and a note from the U.S. Treasury.

Are More People Eligible Now For A Payment Than Before

Under the earlier CARES Act, joint returns of couples where only one member of the couple had a Social Security number were generally ineligible for a payment unless they were a member of the military. But this months new law changes and expands that provision, and more people are now eligible. In this situation, these families will now be eligible to receive payments for the taxpayers and qualifying children of the family who have work-eligible SSNs. People in this group who dont receive an Economic Impact Payment can claim this when they file their 2020 taxes under the Recovery Rebate Credit.

Read Also: Irs Social Security Stimulus Checks Direct Deposit 2022

Do My Unemployment Benefits Count Toward My Annual Income

The IRS recently clarified that benefits paid to unemployed Americans will not count toward the $150,000 income threshold. According to the IRS, you should use the Unemployment Compensation Exclusion Worksheet to calculate your unemployment compensation exclusion.

Keep in mind that these tax breaks only apply at the federal level, and individual states will determine whether to offer similar assistance. For additional details, check with the department or office that regulates tax policy in your state.

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Read Also: Give Me The Latest On The Stimulus