How Will The Irs Know Where To Send My Payment What If I Changed Bank Accounts

The IRS will use the data already in our systems to send the new payments. Taxpayers with direct deposit information on file will receive the payment that way. For those without current direct deposit information on file, they will receive the payment as a check or debit card in the mail. For those eligible but who dont receive the payment for any reason, it can be claimed by filing a 2020 tax return in 2021. Remember, the Economic Impact Payments are an advance payment of what will be called the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR.

Is There A Deadline To Get My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If youre required to file taxes:

The deadline to file your 2020 tax return was May 17, 2021. The tax filing extension deadline is October 15, 2021. Many tax filing software programs close after this date. If you can find an online tax filing program that is still accepting 2020 tax returns, you can file a tax return to get your stimulus checks even though the deadline has passed.

If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

If youre not required to file taxes:

The deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Read Also: When Were The 3 Stimulus Checks Sent Out

Will There Be Another Stimulus Check From The Federal Government

Most people agree that getting another big stimulus check from the federal government is a long shot at this point. Still, some lawmakers keep pushing for another stimulus check to help Americans who are struggling to rebuild thanks to COVID-19 and its economic impact. And with the Delta and Omicron variants out therewould another stimulus check happen for everyone? You never know. Only time will tell, really. A lot of people didnt think wed see a third stimulus check eitherbut it happened.

With the economy and jobs both on the upswing, the need for a stimulus check is way less than its been since the start of the pandemic. Not to mention, a lot of people have been getting extra cash each month from the Child Tax Credit. Add all of that up and its easy to see that there might not be another stimulus check. But if there is one, dont worrywell let you know.

Dont Miss: Wheres My Stimulus Check Ca

How Can You Check On The Status Of A Missing Stimulus Payment

It’s easy to check the status of your third stimulus check through the Get My Payment tool. You’ll need to request a payment trace if the IRS portal shows your payment was issued but you haven’t received it within the time frame outlined in the chart above.

To use the tool, you need to plug in your Social Security number or Individual Taxpayer Identification Number, date of birth, street address and ZIP or postal code. The portal will show your payment status, if your money has been scheduled and the payment method and date. You might also see a different message or an error.

You May Like: Haven’t Got My Stimulus Check

When Will I Get My Stimulus Payment

Last spring, most people who filed 2019 tax returns showing they were eligible for a stimulus check received their money by direct deposit or mail within weeks of when the law was passed. For many others, however, it took months as the government sorted out how to get people who didn’t file tax returns their payments.

There is reason to think there will be fewer and shorterdelays this time. In most cases, the government will be able to reuse the payment information it has already gathered. On Dec. 29, the IRS and Treasury Department announced that the first batch of direct deposits for these payments were being issued on that day and paper checks would start to be mailed on Dec. 30.

While the Treasury Department generally will send a paper check to those people who are not receiving the payment through direct deposit, in some cases the agency may send a debit card instead of a check. Some people who received a paper check in the first round of payments may get a debit card this time and vice versa. If you receive a debit card, it will have the Visa name on the front of the card and the issuing bank, MetaBank®, N.A. on the back.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Didnt Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, well also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

You May Like: Washington State Stimulus Checks 2022

What Does The Get My Payment Tell You About Your Stimulus Check

If the Get My Payment tool works the same as the first and second stimulus checks , the Get My Payment tool will show you one of two messages:

Will There Be A Third Stimulus Check Of $2000

Maybe. The CASH Act bill, which included $2,000 stimulus checks for qualifying individuals, passed in the House in December but was blocked from reaching the Senate floor by Senate Majority Leader Mitch McConnell .

But with Democrats almost certainly taking a slim majority in the Senate, a third stimulus check is back on the table. On Tuesday, Joe Biden said that if Democrats Jon Ossoff and Raphael Warnock won their respective Senate races in Georgia, he would send $2,000 checks to qualifying Americans. Its unclear if this would be an additional $2,000 on top of the $600 checks that have already been sent out, or that Americans would be sent the difference between the two amounts.

Read Also: Irs Stimulus For Seniors On Social Security

Tracking Your Second Stimulus Check

You can check the status of both your first and second stimulus checks using the IRS’s online “Get My Payment” tool . The tool, which was used for first-round payments, was recently updated with new information regarding second-round payments. For more information on the tool, see Where’s My Stimulus Check? Use the IRS’s “Get My Payment” Portal to Get an Answer.

Third Stimulus Checks: Everything You Need To Know

One of the more notable and broadly popular congressional pandemic relief measures has been direct payments to millions of households. More are on their way soon: On March 11, a day after the House passed the final version of the American Rescue Plan, President Biden signed the $1.9 trillion stimulus plan into law. Now many Americans will receive a third $1,400 stimulus check in a matter of days. Here are the latest updates on who is getting a third stimulus check and when they may arrive.

Dont Miss: Stimulus Check Lost In Mail

Also Check: News About The Stimulus Check

When Will I Get The Third Stimulus Check

You may get a stimulus check starting as early as this weekend. However, stimulus payments will not be distributed all at once. Similar to the first and second stimulus checks, the IRS will send stimulus payments in this order:

- First to individuals with direct deposit who have bank account information on file and

- Second, paper stimulus checks and prepaid debit cards sent via mail.

When Will I Get My Check

Payment distribution began on December 29. The Treasury Department and the IRS plan to distribute most payments to eligible taxpayers by Jan. 15. On Jan. 5, the Wall Street Journal reported that more than $112 billion of second stimulus payments had already been sent.

You can check the status of your payment by using the IRS Get My Payment tool.

Will My Stimulus Check Be Taxed?

No. Similar to the CARES Act stimulus checks, this payment is an advance refundable tax credit, and is not taxable income.

You May Like: Non Filers 4th Stimulus Check

Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

When Will Second Stimulus Checks Be Sent

The IRS is expected to start sending second stimulus checks before the end of 2020. From there, it will be a sprint to January 15, 2021, which is the IRSs deadline for sending payments. If you dont receive a second stimulus check by then, you can claim it as a recovery rebate credit on your 2020 federal income tax return.

Don’t Miss: Total Stimulus Payments In 2021

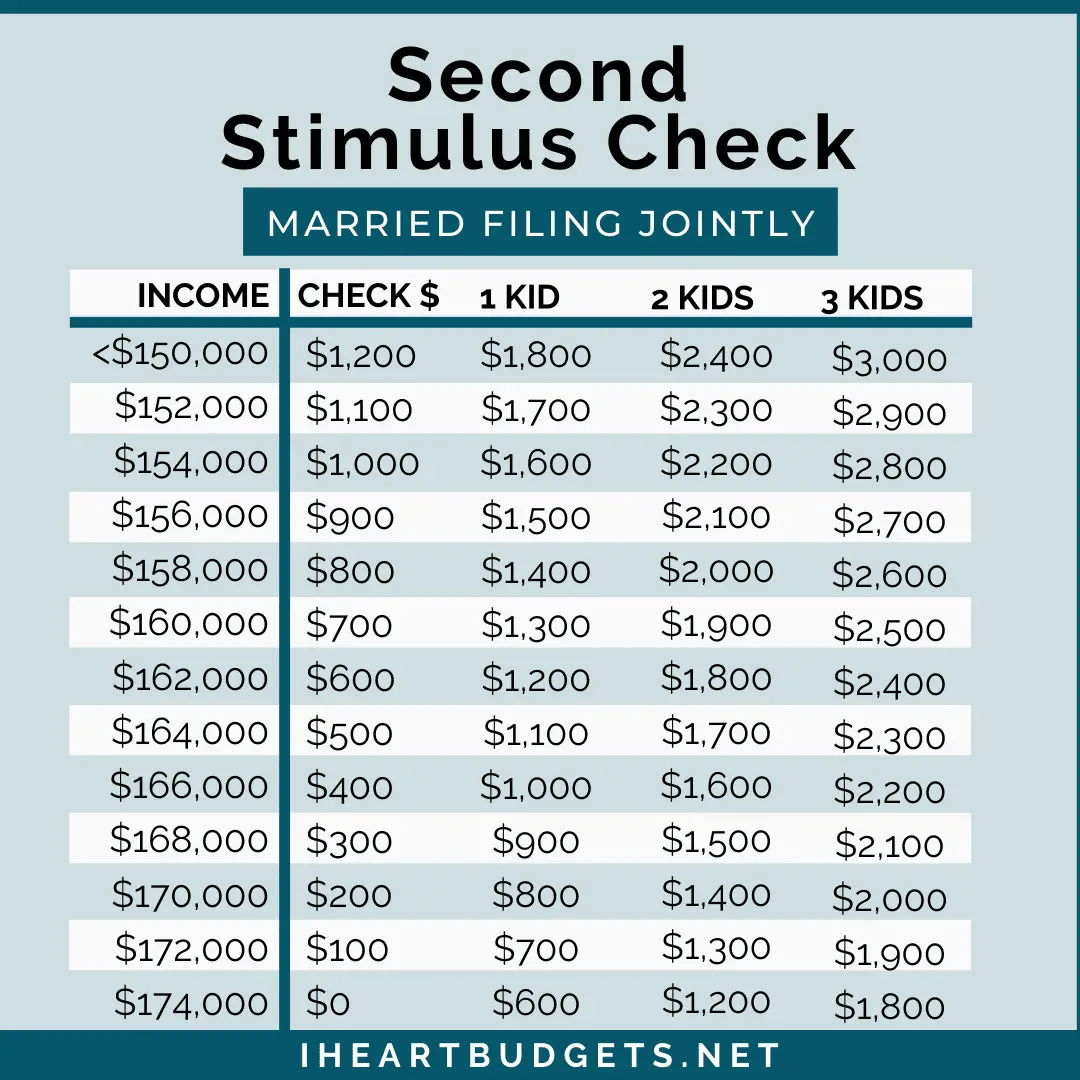

How Much Will I Get And Who Is Eligible

The maximum amount for this second round of stimulus checks is $600 for any eligible individual or $1,200 per eligible couple who file taxes jointly. For a family of four, that would include $600 for each eligible dependent, or $2,400 in total. Individuals who reported adjusted gross income of $75,000 or less on their 2019 tax returns will receive the full $600 . For people who earned more than those amounts, the size of the check will gradually decrease by $5 for every $100 earned over that threshold.

You can figure out the size of your payment by using AARPs Second Stimulus Check Calculator.

Because the maximum size of a stimulus check this time is half the size of the first round, some people who earn more than $75,000 per year and got a check in the spring may not get one in the second round. Roughly estimated, individuals who earned more than $87,000 in 2019, couples that made more than $174,000, and head of households who earned more than $124,500 may not get payments in the second round.

This second round uses similar criteria to determine which dependents are eligible. That means only children age 16 and younger claimed on a 2019 tax return qualify. But this time, each eligible child dependent will receive a payment worth $100 more than the first round. Adult dependents are not eligible for a stimulus check if they were claimed as a dependent on a 2019 tax return.

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

Recommended Reading: What If I Never Got Any Stimulus Checks

When You’ll Receive Your Payment

The final date to qualify has already passed for filers other than those with pending ITINs. If you have already filed, you don’t have to do anything.

If you have not received a payment by now, you will most likely receive a paper check. In addition, if you did not receive a refund with your tax return or owed money at the time of filing, you will receive a paper check.

Payments will go out based on the last 3 digits of the ZIP code on your 2020 tax return. Some payments may need extra time to process for accuracy and completeness. If your tax return is processed during or after the date of your scheduled ZIP code payment, allow up to 60 days after your return has processed. Please allow up to three weeks to receive the paper checks once they are mailed out.

| Last 3 digits of ZIP code | Mailing timeframes |

|---|

What If I Am Not Required To File A Tax Return Can I Still Track My Stimulus Check

To use the Get My Payment tool to check the payment status of your stimulus check, the IRS needs enough information to verify your identity. The IRS may be unable to verify your identity if:

- You didnt file an income tax return

- You didnt use the IRSs Non-Filers tool by November 21, 2020 to register for a payment or

- You receive federal benefits and the IRS doesnt have enough information.

Also Check: How Much Were The Stimulus Checks In 2021

Your Second Stimulus Check How Much When And Other Faqs Change

Here s how much your second stimulus check might be iheartradio to get direct auto ways use during the downturn endurance faster and other will iheart

Do you like cookies?WarningUnknown0WarningUnknown0

No Extra Deduction For Charitable Giving

The Coronavirus Aid, Relief and Economic Security Act, or CARES Act, had a provision that allowed taxpayers to deduct an extra $300 for single taxpayers or $600 for married couples on their 2020 and 2021 taxes.

This provision allowed people who rely on the standard deduction, which represents the majority of taxpayers, to take an extra deduction for charitable giving. But that above-the-line charitable deduction wasnt renewed in 2022, which means that taxpayers who dont itemize wont get an extra deduction for their charitable gifts this year.

Also Check: Stimulus Check How To Qualify