Whats Next For State Stimulus Checks

Even with all these measures making their way through various legislatures, Americans remain crunched between what they need and what they can afford.

And while gas rebates and stimulus checks can help buffer the blow of rising prices, there are those who remain leery of sending out additional payments, especially with past pandemic relief programs believed to have contributed to our current rate of inflation.

Jaime Peters, assistant dean and assistant professor of finance at Maryville University in St. Louis, explains that for some lawmakers, inflation-related stimulus payments will simply feed the beast, putting even more money into the market where the supply of goods cant meet demand.

This creates a conundrum for families who are coming up short on the supply of funds to get the goods they need each day.

Who Is Eligible For The Third Stimulus Check

For the first two stimulus payments, single taxpayers earning up to $75,000 a year and couples earning up to $150,000 a year were able to get the full amount. Parents also received stimulus payments for each dependent child under age 17.9,10

Those income limits didnt change for the third stimulus payment even though it targeted the payments to lower income earners. Under the American Rescue Plan, payments phased out for single filers making between $75,000 and $80,000 and couples making between $150,000 and $160,000.11

Eligibility for the third stimulus check also expanded to cover any non-child dependents. That means taxpayers who supported certain eligible dependents age 17 and older might have received more money too.12

Inflation Remains Enemy #1 For The Fed

Inflation has been the Federal Reserves enemy number one in 2022. The Federal Open Market Committee has made aggressive changes to U.S. monetary policy to bring inflation down to its long-term target of around 2%.

In July, the FOMC raised its target range for the federal funds rate by 75 basis points for a consecutive month.

It looks like the Fed wont raise rates so high when it reconvenes on Sept 20-21. Market observers are expecting the Fed hikes rates by 50 bps, according to the CME Groups FedWatch tool.

The Fed will have another inflation report before Septembers FOMC meeting and if Augusts inflation report is as good as this one, we could expect a 50 basis point hike instead of a more aggressive increase in rates, said Jeffrey Roach, chief economist for LPL Financial.

Read Also: I Never Received Any Stimulus Check

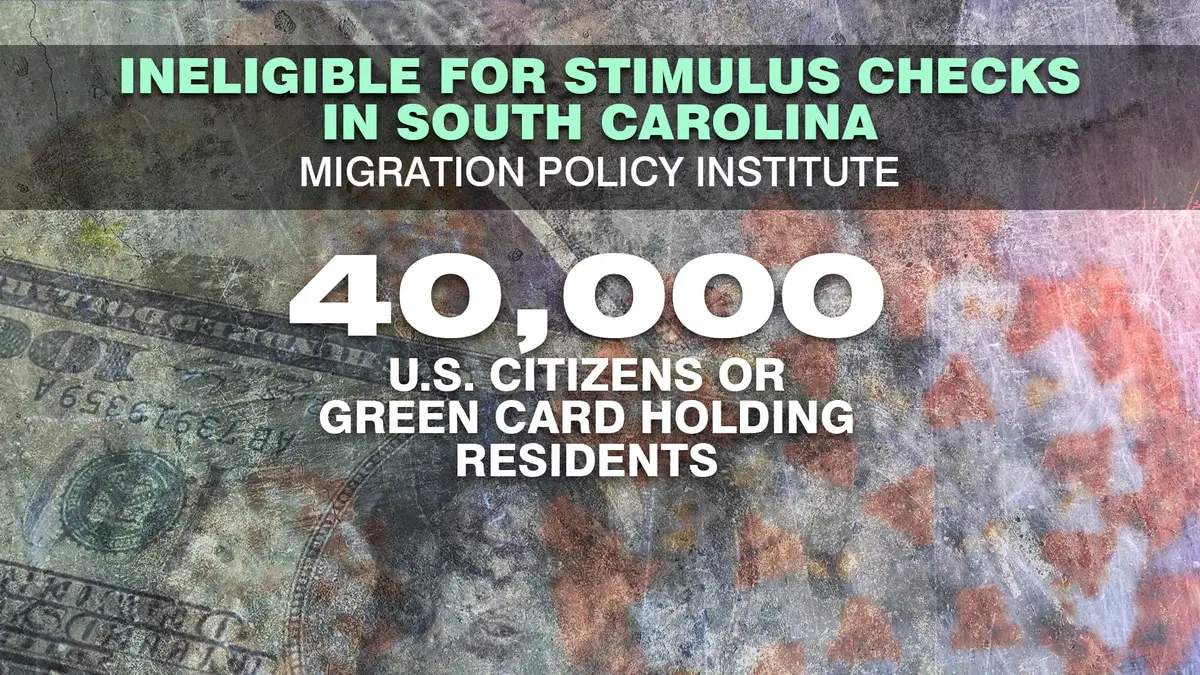

South Carolina Announced Stimulus Checks For Eligible Taxpayers:

Some states are already funding their resident payments for inflation alleviation using the surpluses from their budget. In 2022, Colorado, Maine, and California citizens will also receive stimulus checks.

A $1 billion tax rebate for citizens is included in South Carolinas 14 billion USDs budget. The budget includes cash subsidies to households and a 6.5 percent tax rate reduction from 7 percent. The rate of income tax will continue to decrease until it reaches 6 percent in 5 years.

This budget increases teachers beginning pay from $36,000 to $40,000 and gives other public servants a 3 percent pay raise in addition to a $1,500 bonus. The state already has reduced the property manufacturing tax from 9 percent to 6 percent, which should just save manufacturers roughly $100 million. The budget also includes funding for institutions that freeze tuition costs.

Stimulus Check Update 202: Here’s When To Expect Your Rebate

Having hit a peak of 9.1 percent in June, has dropped to 8.5 percent last month, an encouraging sign that the Federal Reserve’s efforts to cool down surging prices might be working. But millions in the U.S. are still struggling, with the cost of living continuing to increase.

To help residents whose household budgets have been severely dented by rising food, gas and housing prices, several states including Delaware, Florida, Georgia, Hawaii, Indiana, Minnesota and New Mexico have already started rolling out direct payments. Others are preparing to do so.

Check out which states and residents are eligible for a stimulus check in the coming months below:

Read Also: When Did The 1st Stimulus Checks Go Out

Focus On What Goes On At Your Housenot The White House

Its hard not to worry as you watch billions and trillions of dollars fly out the window in Washington, D.C. And while those things matter, the truth is, you have ultimate control over your money and what choices are made in your house. You have the power to improve your money situation right nowtodaywithout having to rely on the government.

And it all starts with a budget. Because when you make a plan for your money, you’re more likely to make progress and hit your financial goalsstimulus check or not. So, go ahead and create your budget with EveryDollar today! Take control of your future and get the hope you need.

14-Day Money Finder

Learn how to find more money each month. The average person finds $2,000 for the year!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

How To Return A Paper Check You Have Cashed Or Deposited

If you have already cashed or deposited the check , heres how you can return the money:

- Make a personal check or money order payable to U.S. Treasury.

- Write 2020EIP on the payment and include either the taxpayer identification number or Social Security number of the person whose name was on the stimulus payment.

- On a sticky note or sheet of paper, write down the reason youre sending back the check or money order.

- Mail the check or money order and the explanation to your local IRS office .15

You May Like: What Month Was The Third Stimulus Check

What To Read Next

-

Mitt Romney says a billionaire tax will trigger demand for these two physical assets get in now before the super-rich swarm

-

High prices, rising interest rates and a volatile stock market heres why you need a financial advisor as a recession looms

-

You could be the landlord of Walmart, Whole Foods and Kroger

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Could Inflation Help Spark A Recession

The Fed is facing a difficult balancing act, needing to raise interest rates aggressively to bring down inflation without triggering a U.S. recession.

Rising interest rates increase borrowing costs for companies and consumers, weighing on economic activity. Up to this point, the U.S. labor market has been solid, but the S& P 500s 13.5% year-to-date decline reflects concerns on Wall Street that the economy may not take spiking interest rates in stride.

Growth stocks are particularly sensitive to rising interest rates because fund managers typically use discounted cash flow models to determine their price targets for growth stocks. Future cash flows are considered less valuable when the discounted rate is higher.

So far in 2022, the Russell 1000 Growth Index is down 19.2%, while the Russell 1000 Value Index is down 7.3%.

Inflation isnt necessarily bad news for every stock market sector, however. Soaring oil, natural gas and other commodity prices have helped energy sector stocks generate record profits in 2022. The Energy Select Sector SPDR Fund is up 37.8% so far this year amid broad-based market weakness.

Todays report may buoy traders animal spirits.

Stock markets will be cheered by news that the worlds largest economys headline inflation rate seems to have peaked, said Nigel Green of deVere Group. It means the Federal Reserve has more scope not to hike interest rates so aggressively to fight rising prices.

Don’t Miss: Where’s My Stimulus Check 2021 Tracker

With A Potential Recession Hanging Over The Country More States Issue Stimulus Checks Is Yours One Of Them

Financial experts and economists see a dangerous storm brewing thanks to a volatile combination of high inflation, rising interest rates and supply-chain issues.

And while the Federal Reserve is doing what it can to control inflation, its moves could be pushing the country closer to a recession.

Inflation dropped slightly from its decades-high rate to a still-scorching 8.5% in July, the S& P 500 has entered bear market territory and the U.S. economy shrunk for the second quarter in a row usually a clear sign a recession has hit. However, the National Bureau of Economic Research still has to officially determine whether this is a recession or not.

With all this uncertainty, what is clear is that American households are struggling and could use some extra support right now. Some experts are speculating that a coming recession could push the federal government to issue a new round of stimulus checks as they did during the pandemic and in past economic downturns.

And though the federal government hasnt yet answered the call for more funding yet, several states are stepping in to provide money for residents.

Other Tax Relief For New Mexico Residents

The tax rebates and economic relief payments are one part of larger tax reform enacted in New Mexico. Tax cuts, which went into effect in July, include the following:

- Refundable child tax credit of up to $175 per child

- Five-year income tax exemption for armed forces retirees

- Exemption of most Social Security income from state taxation

- Reduction in the stateâs gross receipts tax rate to 5%

- One-time refundable income tax credit of $1,000 for 2022 full-time hospital nurses

Don’t Miss: New York Stimulus Check 4

What Is A Plus

A plus-up payment is basically just a bonus amount that you probably should have gotten the first time. The IRS actually owes more money to some people based on their tax returns. If they used your 2019 tax information to dish out your stimulus payment but your 2020 taxes show they underpaid youyou might be in for a plus-up payment based on your income. But remember, this isnt for everyoneonly those who had a change in income or dependents would qualify for more stimulus money.

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who were eligible to receive the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check between June 23 and July, 1 2022.

The Oregon Department of Revenue website contains FAQs for residents with concerns about receiving their payment.

You May Like: Stimulus Check 2022 Who Qualifies

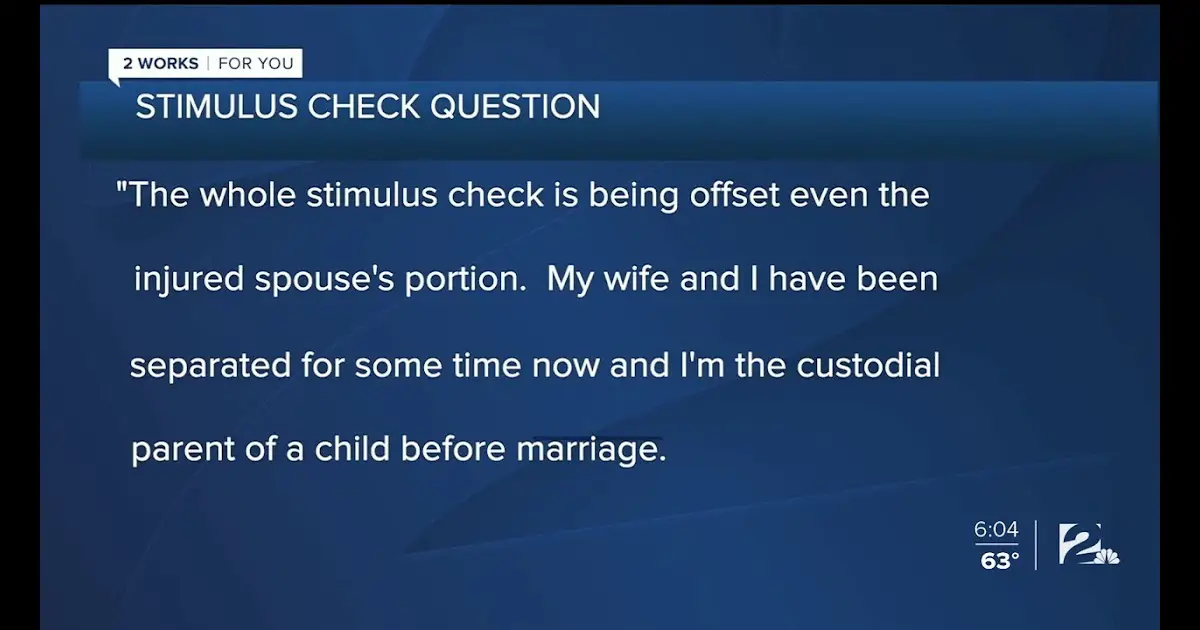

Will You Have To Pay Back Money From A Previous Stimulus Check

You might. Heres why: Some people were sent stimulus checks by accident. Whoops! We knowimagine the government making a mistake, right? Heres why you might need to send your money back:

- You make more than the income limit required to receive the stimulus money.

- You were given a check for someone who has died.

- Youre a nonresident alien.

- You dont have a Social Security number.

- You were claimed as a dependent on someone elses tax return.

If you know one of these applies to you, the IRS expects you to find the error and send the money back to them.14 So go ahead and be honest . You dont want any surprises when you go to file your taxes.

Stimulus Checks: South Carolina To Be The Newest State To Offer

One of the couple dozen prepared payment checks for citizens in 2022 in South Carolina. How much will the stimulus checks be worth for South Carolinas inflation relief cheques, and who will receive them? When are the checks being issued?

Due to increased inflation, Americans are finding it difficult to afford gas, food, and other home necessities. When the COVID-19 epidemic struck, Washington intervened and provided 3 sets of stimulus payments, but those stimulus checks have since ceased.

As many continue to struggle with money, requests for a further round of these payments have been submitted. Some organizations have even requested a special assistance payment for elders receiving social security. There is little chance that the capital will offer more free money, though. The great news is that several jurisdictions are assisting citizens in coping with the pressure of inflation.

Read Also: Free File Taxes For Stimulus

South Carolina Gov Mcmaster Signs Tax Cut Bill That Includes Refund Checks

South Carolina Gov, Henry McMaster releases his budget proposal along with Lt. Gov. Pamela Evette on Monday, Jan. 10, 2022, in Columbia, S.C.

South Carolina taxpayers will be receiving income tax refund checks by the end of the year after Gov. Henry McMaster signed a bill to approve both refunds this year and an income tax rate cut for the future.

The legislation will result in income tax refund checks being sent in late November or December for those who paid taxes this year. It will be a full refund for those who paid $800 or less, which includes 33% of taxpayers.

Any South Carolina taxpayer who paid $100 in taxes will receive the $100 rebate and that rebate will grow along with tax liability up to a cap of $800 per tax filing. Those who did not pay income taxes will not receive a rebate.

The states top income tax rate will now drop from 7% to 6.5% for the 2022 tax year, for income taxes paid in 2023. The bill also would lower that top rate by 0.1 percentage points each year, starting in 2023, until it reaches 6%.

Ultimately, the legislation will reduce the state from its current six income tax brackets to three of 6%, 3% and 0%. The bill will result in a $600 million impact in the first year and ultimately a $1 billion impact.

The bill also includes a 33% cut in manufacturing property taxes from 9% to 6% starting this tax year in what will amount to $100 million in savings statewide for manufacturers.

Which States Are Sending Out Payments In September

According to CNET, California residents will receive checks worth up to 1,050 dollars, which will begin going out in October. Colorado will send out checks worth 1,500 dollars for joint filers, while Delaware residents who filed their 2020 tax returns will receive 300 dollars.

The 60,000 families that already received TANF, or had a foster child, in Florida received 450 dollars for each kid. Meanwhile, Georgia eligible residents got up to 500 dollars and Hawaii residents could receive 300 dollars per person and dependent.

Eligible citizens from Idaho, Illinois, Indiana, Maine, Massachusetts, Minnesota, New Jersey, New Mexico, New York, South Carolina and Virginia will also receive a financial boost in the state governments’ bid to help citizens make ends meet.

Read Also: What Were The Three Stimulus Payments

Maine: $850 Direct Relief Payments

Gov. Janet Mills signed a supplemental budget on April 20 to authorize direct relief payments of $850 for Maine taxpayers.

Full-time residents with a federal adjusted gross income of less than $100,000 are eligible. Couples filing jointly will receive one relief check per taxpayer for a total of $1,700.

Taxpayers are eligible for the payment regardless of whether they owe income tax to the state.

Residents who did not file a state tax return for 2021 can file through Oct. 31 to claim their payment.

The one-time payments, which are being funded by the states surplus, started rolling out via mail in June to the address on your 2021 Maine tax return.

The supplemental budget also includes an increased benefit for Maines earned income tax credit recipients.

Read more: Everything You Need To Know About Maine Stimulus Checks

Getting Help With Child Care

The North Carolina Department of Health and Human Services launched a hotline to provide child care options for children of critical workers who do not have access to typical care because of COVID-19 closures. Workers who need care may call 1-888-600-1685 to receive information about local options for children from infants through age 12. More information is available here.

You May Like: How To Recover Stimulus Check

Who Will Get A New Mexico Tax Rebate

The July rebates went out to taxpayers who filed a 2021 New Mexico tax return and meet the following income guidelines:

- $500 to married couples filing jointly, heads of household and surviving spouses with an adjusted gross income of up to $150,000

- $250 to single taxpayers and married couples filing separately with an adjusted gross income of up to $75,000

âOne thing we are stressing is for people to be patient, especially those receiving a paper check,â says Charlie Moore, director of communications for the New Mexico Department of Taxation and Revenue. âWe can only print 14,000 a day, so it takes the full month to get rebates fully distributed.â

The July rebates were one of three payments going out to New Mexico taxpayers. The stateâs second rebate is being split into two payments: one that was sent in May and June and a second in August. Those rebates donât have income restrictions and have been issued as follows:

- $1,000 to married couples filing jointly, heads of household and surviving spouses, distributed as two $500 payments in June and August

- $500 to single taxpayers and married couples filing separately, distributed as two $250 payments in June and August

How To Get A New Mexico Tax Rebate

Taxpayers donât have to do anything to receive a rebate. The Department of Taxation and Revenue will automatically send payments to those who have filed a 2021 state tax return. Those who provided direct deposit information when filing their return will receive their payments directly to that account. . Everyone else will receive a paper check by mail.

Rebates are available to taxpayers regardless of whether they filed with a Social Security number or an Individual Tax Identification Number , making them available to New Mexicoâs sizable immigrant population. Immigration documentation is not required for those with an ITIN.

âThe way New Mexico structured this was to give access to the broadest array of residents possible,â Wallin says.

Don’t Miss: Where Is My 2nd Stimulus Check