Illinois: $50 And $300 Rebates

There are two rebates available to 2021 Illinois residents.

The first rebate is the individual income tax rebate, available for residents whose adjusted gross income is less than $200,000 per year . Each individual will receive $50, with an additional $100 per eligible dependent .

The second rebate is a property tax rebate, available for residents making $250,000 or less . The rebate is equal to the property tax credit you qualified to claim on your tax return, up to a maximum of $300.

The state started issuing rebates the week of September 12 it will take several months to issue them all, according to the Illinois Department of Revenue.

Georgia: $250 Rebate Payments

Thanks to a historic state budget surplus, Georgia residents who filed both their 2020 and 2021 tax returns were eligible to receive rebate payments based on their tax filing status:

- Single filers: Maximum $250

- Head of household: Maximum $375

If you owed income tax or other payments to the state, such as delinquent child support payments, you may have received a smaller rebate. Partial-year residents may also have received a smaller rebate.

Eligible recipients who filed their 2021 taxes by April 18 should have received their refund in August.

Georgia taxpayers can learn more via the Georgia Department of Revenue.

New Mexico Stimulus Checks

New Mexico “stimulus” payments for eligible residents come in the form of two tax rebates in 2022. The first tax rebate amount is $500 for joint filers, head-of-household filers, and surviving spouses with incomes under $150,000, and $250 for single filers and married people filing separate tax returns. The second tax rebate is worth $1,000 for joint filers, head-of-household filers, and surviving spouses, and $500 for single filers and married residents filing separately.

The first-round of tax rebates began in July, while the second-round payments began in June. However, payments will continue to be sent to people who file a 2021 New Mexico tax return by May 23, 2023. As a result, some New Mexicans will receive rebate checks in December. If you filed a 2021 return but haven’t received a rebate, you can all the New Mexico Department of Taxation and Revenue at 866-285-2996.

For New Mexico taxes in general, see the New Mexico State Tax Guide.

Also Check: Stimulus Check For Expecting Mothers 2022

When Will The New Stimulus Check Arrive

The next payment will be sent both by direct deposit and by paper check through the postal mail on September 15, however, people who have chosen the second method will have to wait a couple of days more because the mail is usually sent delay a bit.

The new stimulus check payment is the third in a series of six payments that will be issued monthly through December. The IRS is distributing the first half of the Child Tax Credit in this way to most eligible families, the other half will be given to the families in 2022 when they file their 2021 tax return.

Will I Be Able To Call The Irs With Issues

You will need to wait for the IRS to finish normal processing of the recovery rebate payments . Until then you will have to rely on the Get My Payment IRS tool to track the status of your payment. And given the IRS will be closing out 2021 tax season and refund processing, I expect will be very challenging to get through to an IRS agent to speak about your missing or delayed payment.

Read Also: When Did Americans Receive Stimulus Checks

Stimulus Checks Batch Payment Schedule Now Ended

If youre were eligible to receive the stimulus payment and getting it via direct deposit , it will be automatically deposited into the same account used in your most recent, 2019 or 2020, IRS processed tax return.

The payment appeared in your account summary as IRS TREAS 310 XXTAXEIP3 or something similar. Those who dont have bank details on file with the IRS and prefer paper check will get the stimulus checks mailed to them in 2 to 4 weeks. You can always check the IRS Get My Payment tool for the latest status of your payment.

| Stimulus Check Activity | |

|---|---|

| Batch 10 and Subsequent Batches | May 14th and then weekly until the end of 2021 |

How Do I Check The Status Of My Payment

Get updates on the status of your next stimulus payment using the IRS “Get My Payment” tool. To use it, enter your full Social Security number or tax ID number, date of birth, street address and ZIP code.

But the Get My Payment tool won’t be updated until this weekend with information for VA beneficiaries expecting payments next week, the agency said.

For those who are eligible, the tool will show a “Payment Status” of when the payment has been issued and the payment date for direct deposit or mail, according to the IRS’s frequently asked questions.

Don’t Miss: 4th Stimulus Check Latest News

Was There A Stimulus Check In 2021

Stimulus Update | 2021 $1,400 stimulus payment can be claimed for dead people in 2022. BALTIMORE The American Rescue Plan signed into law by President Joe Biden in March of 2021 delivered $1,400 stimulus checks to most Americans. The money was intended to help people get through the COVID-19 pandemic.

You May Like: How To Claim 2021 Stimulus Check

Mailed Paper Checks Or Debit Cards

The form of payment for the third stimulus may be different than the first or second one. Some people who received a paper check last time might receive a prepaid debit card this time, and some people who received a prepaid debit card last time may receive a paper check. The IRS has emphasized the payments are automatic, and they should not contact their financial institutions or the IRS with payment timing questions, unless after the first round processing is complete.

Also note, third stimulus check payments will not be added to an existing debit card that was mailed for the first or second round of stimulus payments. Under the legislation a new card must be issued.

You May Like: Will We Be Getting Another Stimulus

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Rhode Island: $250 Rebate Per Child

Rhode Island is sending a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children, for a maximum of $750. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate check distribution began in October. Taxpayers who filed their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December. You can check your rebate status on Rhode Islands Division of Taxation website.

Don’t Miss: Irs.gov Direct Deposit Form Stimulus Check

Review Steps To Know When Your Third Stimulus Check Arrives

Many Americans are expecting to receive a third stimulus check as part of a $1.9 trillion COVID-19 relief package in 2021. Some details may change before the bill actually passes, such as who qualifies, how large are the payments, and when will stimulus checks arrive. However, as soon as the bill passes the payment process will begin right away.

Lets review some helpful tips and information you can use to monitor the arrival of your stimulus payment. Well also address a common account question you may have.

Do Federal Beneficiaries Qualify For A Check

Yes. Following delays, the largest chunk of payments in the fourth batch made under President Joe Bidens American Rescue Plan went to Social Security beneficiaries who didnt file a 2020 or 2019 tax return and didnt use the Non-Filers tool last year, the IRS said.

More than 19 million payments, totaling more than $26 billion, went to these beneficiaries, including Social Security retirement, survivor, or disability beneficiaries, according to the agency.

More than 3 million payments, worth nearly $5 billion, went to Supplemental Security Income beneficiaries. And nearly 85,000 payments, worth more than $119 million, went to Railroad Retirement Board beneficiaries.

You May Like: Irs Says I Got Stimulus But I Didn’t

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment was possible due to a budget surplus. Couples filing jointly received $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

If youre eligible but didnt receive a rebate yet, you can apply online starting November 1. The application period will only last 30 days and will close on November 30, 2022.

Applicants must provide their Social Security number, active Delaware drivers license that was issued before December 31, 2021 and a valid Delaware residential mailing address. Payments will be sent out to qualifying applicants after the application period closes and all applications are reviewed.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

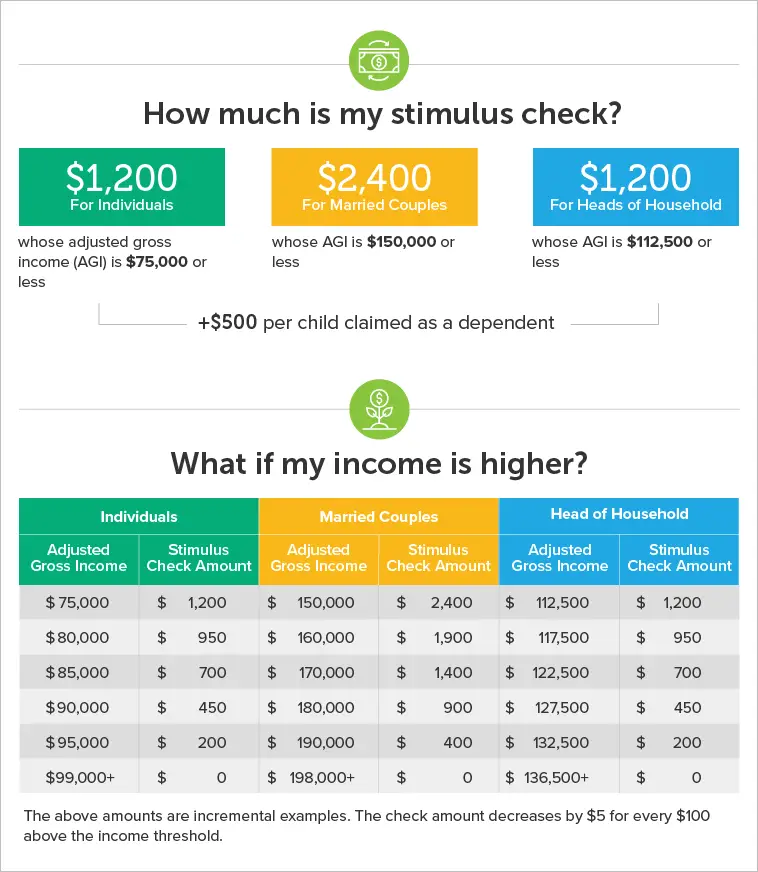

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Read Also: When Was The First Round Of Stimulus Checks Sent Out

Do I Still Have A Shot At Qualifying For A Third Check If I File Now

If you didnt qualify for the third round of stimulus checks based on 2019, but you do qualify based on 2020, the next best step is to file your 2020 taxes as soon as possible, tax experts say.

If the IRS processes it in time, theyll use the most recent year to qualify taxpayers for the third round of economic stimulus payments, says Meredith Tucker, tax principal at Kaufman Rossin, one of the largest CPA and advisory firms in the U.S.

Steber agrees.

Filing a tax return early is always a best practice and proven this year with the stimulus checks to those who have already filed, says Steber. As to filing now and still getting a check, the IRS has not detailed timing and impact, but it is certainly possible, especially if your tax situation changed from 2019 to 2020.

What If My Income Is Lower Than When I Filed My Last Tax Return

If you had decreased income in 2020 due to starting disability benefits and/or losing a job, you might be eligible for the money but you might not get a third stimulus check in 2021. This might happen if you filed a tax return for 2019 income thatâs above the $75,000 or $150,000 thresholds, but you made less income in 2020. You should be able to get the stimulus payment as a rebate if you file a 2020 tax return.

Recommended Reading: Irs Social Security Stimulus Checks Direct Deposit 2022

Colorado: $750 Rebate Payments

Colorado sent tax rebates of $750 to individual tax filers and $1,500 for joint filers. Colorado residents for the entire 2021 tax year who are 18 or older and filed their 2021 state income tax return were eligible for the payment.

Only physical checks were sent out in an effort to prevent fraud. Residents who filed their state tax returns by June 30 should have received a refund by September 30. Taxpayers who filed an extension can expect their check by January 31, 2023.

Read more: Everything You Need To Know About The Colorado Stimulus Check

What If I Havent Filed Yet

The IRS worked with the tax preparation software industry to reflect these updates so that those who file electronically need to respond to the related questions when preparing their returns, the agency said.

The IRS has stressed that taxpayers shouldnt file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return.

If you filed your return and you actually paid tax on the full amount, dont amend your return, says Pyron. The IRS said theyre going to give that refund back to you.

You May Like: Netspend All Access Stimulus Check 2021

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Idaho: $75 Rebate Payments

In February, Idaho Gov. Brad Little signed a bill that allocated $350 million for tax rebates to Idahoans. There were two criteria for eligibility:

- Full-time Idaho residency and filed 2020 and 2021 tax year returns, OR

- Full-time Idaho residency and filed grocery-credit refund returns.

The payments began in March. Each taxpayer received either $75 or 12% of their 2020 Idaho state taxes, whichever was greater . The rebate was applicable to each taxpayer and dependent.

The tax commission first issued rebates to taxpayers who received tax refunds via direct deposit, then sent paper rebate checks. The majority of the rebates have been issued.

In a special session on September 1, Idaho lawmakers voted to authorize another tax rebate for all residents who filed state tax returns in 2020. Individual filers will receive $300, and couples filing jointly will get $600.

Those payments started processing in late September, and about 75,000 payments will be sent out each week throughout the end of the year and into early 2023.

State residents can check their rebate status on the Idaho State Tax Commission website.

Also Check: When Was The 3rd Stimulus Payment Issued

Is The Child Tax Credit Expanded

Yes, the American Rescue Plan includes a temporary increase for the child tax credit for 2021.

The credit is worth $2,000 per child under 17 that can be claimed as a dependent.

It temporarily boosts the credit to $3,000 per child, or $3,600 per child under 6. It allows 17-year-old children to qualify for the first time.

The credit will begin to phase out for those earning more than $75,000 a year, or $150,000 for those married filing jointly. The IRS will look to prior-year tax returns to determine who qualifies for the higher credit. If a return for 2020 hasnt been filed yet, the agency will look to 2019 returns.

Families who aren’t eligible for the higher child credit may still be able to claim $2,000 credit per child.

This credit is for tax year 2021, says Greene-Lewis. The IRS hasnt issued full guidance yet, but theyre expected to start issuing advanced payments sometime in July so that people dont have to wait until they file their 2021 returns.

State Gas Tax Holidays In 2022

One reason why many states can afford a gas tax cut is because they have budget surpluses, due to recent economic growth and/or federal pandemic-relief funds. Five states have already temporarily suspended their gas tax but two of the gas tax holidays are already over. A few other states have provided other forms of gas tax relief, such as delaying gas tax increases.

was the first state in the country to suspend its gas tax this year. Gov. Larry Hogan signed a bill on March 18 that authorized a 30-day gas tax holiday, which saved Marylanders about 36¢ per gallon at the pump for gasoline and approximately 37¢ per gallon for diesel. However, the suspension expired at midnight on April 16. Hogan and other Maryland officials tried unsuccessfully to extend the holiday for an additional 60 days . for more information on Maryland taxes.)

Florida has also seen its gas tax holiday come and go. It joined the list of states to enact a gas tax holiday on May 6, when Gov. Ron DeSantis signed a budget bill with a provision to save drivers in the Sunshine State 25.3¢ per gallon at the pump. However, the gas tax suspension didn’t start until October 1, and it only ran for one month . for more information on Florida taxes.)

Indiana capped its use tax on gasoline at 29.5¢ per gallon through June 2023. This piece of the overall state gas tax is adjusted each month. for more information on Indiana taxes.)

Also Check: How Much In Total Were The Stimulus Checks