Q How Much Will My Third Stimulus Check Be For

A. Your third stimulus check depends on your 2020 or 2019 income .

| Qualifying group | |

| An AGI of $150,500 or less | An AGI $160,000 or more |

| Dependents of all ages: $1,400 | $1,400 apiece, no cap but only if caretakers make under the above limits |

| * This framework by the IRS was designed for taxpayers who are living and working in the U.S., so expats should ensure theyre looking at their AGI and not their gross income when determining their eligibility, especially if theyre claiming the foreign earned income exclusion. |

Additional Payments: If your third stimulus payment is based on their 2019 return and your 2020 return makes you eligible for a larger payment, the IRS will redetermine your eligibility and issue a supplementary payment later this summer.

You can estimate your own payment amount with H& R Blocks Stimulus Check Calculator.

Q. Will I have to pay back my stimulus check?

A. No, you will not have to pay back any amount of your Recovery Rebate Credit, even if you experience a pay hike in 2021.

Q. Will this round of stimulus checks affect my tax return this year?

Q. Will I owe tax on this third stimulus check in 2022 or have to pay it back?

A. No, the third stimulus payment is considered a 2021 tax credit , not income, so you will not need to pay taxes on it or pay it back.

Q. Do I need to sign up for the third stimulus check it or sign off on it?

Q. If I live abroad, when will I get my third stimulus check if I qualify?

What Is The Foreign Tax Credit

The foreign tax credit is a non-refundable credit that will reduce your US tax liability dollar-for-dollar for taxes you paid to a foreign country. Simply put, if you paid taxes to a foreign country, you can claim these foreign taxes as a credit against your US taxes. If you paid more taxes to a foreign country, than usually you will owe no US tax on that income.

What If I Receive Social Security Or Supplemental Security Income

Not everyone needs to file to get a stimulus payment. If you receive Social Security retirement, disability or Railroad Retirement income and are not typically required to file a tax return, you do not need to take any action the IRS will issue your stimulus payment using the information from your Form SSA-1099 or Form RRB-1099 via direct deposit or by paper check, depending on how you normally receive your Social Security income.

If you receive Supplemental Security Income , you will automatically receive a stimulus payment with no further action needed. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive their SSI benefits.

Also Check: Where’s My 2020 Stimulus Check

Will There Be A Second Stimulus Check

The hundreds of millions of Americans who have already received their stimulus checks are curious if another one is on its way.

At this time, its unclear whether you can expect to see another Economic Impact Payment in your bank accounts.

Negotiations on the details of a stimulus package have reached an impasse, with both sides of the aisle failing to agree on the parameters of a bill. Thus, while Democrats, Republicans, and President Donald Trump have all vocalized support for a second round of stimulus checks, they are unable to iron out the details of a package that would make a second check possible.

This week, the Senate proposed a skinny bill, and it did not move forward after failing to receive the 60 votes needed to pass in the senate. Democrats were poised to dismiss the bill even before voting began. On Thursday, Senate Minority Leader Chuck Schumer stated, Here now in September, Republicans finally felt the public pressure to support a bill. But instead of working with Democrats on something that could pass, our friends on the other side tried to find the bare minimum that Senate Republicans could support.

Will negotiations for a second stimulus check continue?

Speaking to the Washington Post, Senator Pat Roberts recently said, Its sort of a dead-end street Very unfortunate, but it is what it is.

And in the words of Forbes, its not clear whether there will be any more federal coronavirus relief any time soon.

What Is Irs Stimulus Check Application & How To Apply

Due to the impact of the Covid-19 outbreak, many US citizens have lost their jobs and means of livelihood since 2020. Thus, the federal government has launched a new program since last year to support the citizens livelihoods by giving them financial aid during these difficult times.

The first and the second Economic Impact Payments have already been released. To claim the Recovery Rebate Credit, the citizens must file the 2020 tax return. Already after paying out two previous stimulus checks, the third Economic Impact Payment was authorized for processing by the American Rescue Plan Act of 2021. The dispatch of payments of the third Economic Impact Payment has already begun since March 12, 2021, every week.

As per the IRS stimulus check application, individuals and families who havent managed to earn adequately will receive $1,200 annually and $2,400 respectively as the Economic Impact Payments from the US government. This is also applicable to those people who havent managed to earn anything at all since last year.

Recommended Reading: Can I Still Get My First Stimulus Check

Other Ways To Get Cash

Although not an offer of government support, there are other ways to supplement one’s income.

Some include a cash-back program that allows people to receive credit for purchasing goods.

For example, major cashback site Ibotta claims its average user earns $150 each year from online purchases and groceries.

And TopCashback claims it gives its average member $345 in cash back.

Other incentives come through banks offering huge sign-up bonuses during the pandemic.

There are even sign-up bonuses for getting a job during the nationwide labor shortage.

Given that there is a massive labor shortage, some companies are paying thousands in hiring bonuses in an effort to lure workers in.

How Inmates Should File For Stimulus Checks

Inmates and their loved ones should move quickly, given the impending deadlines to submit a claim and receive a stimulus check in 2020. Here are some useful tips based on information from a dedicated page, www.caresactprisoncase.org, set up by Lieff Cabraser Heimann & Bernstein, LLP and the Equal Justice Society. Impacted individuals will find resources as well as a contact form to reach out to lawyers at Lieff, who are representing the Plaintiffs and the Class. If you or your loved one is currently serving time in a state or federal facility or was recently released, please contact us for more information about your rights by filling out this form, the site states. Your inquiries in pursuit of legal advice are privileged and confidential, and you will not be charged a fee to speak with us.

If you already filed a claim before September 24: Many inmates filed a claim and were rejected or had their stimulus check intercepted and returned. Based on the court order, the IRS must automatically re-process your claim by October 24, 2020. You can check the status of your payment on the IRSs portal: www.irs.gov/coronavirus/get-my-payment. If you do not receive payment by November 1 and do not see it scheduled on the Get My Payment portal, Lieff recommends reaching out to one of its lawyers.

Dont Miss: How To Check On My Stimulus

Recommended Reading: When Will The $1400 Stimulus Checks Be Mailed Out

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

How To Get Your Stimulus Check

Using stimulus funds can help you manage your entire financial picture, including getting a handle on The guide helps you understand if you are eligible in these cases:

- If you havent filed federal taxes or have no income

- If you dont have a bank account or a pre-paid debit card

- If you have moved since you last filed taxes

- If you receive Social Security Benefits

- If youve already filed taxes and are signed up for direct deposit

The vast majority of Americans will be eligible to receive a third stimulus check from the federal government. Even if you have no income, you are still eligible but need to take action.

Also Check: How To Get Missed Stimulus Check

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascents full review for free and apply in just 2 minutes.

Read Also: Amount Of 3rd Stimulus Check

When Will I Get The Stimulus Check

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Nonfilers Are Likely Eligible To Get Both Of The 2020 Stimulus Checks

Most nonfilers fall below the income limits stipulated by each stimulus package and would be eligible for the full amount in each round $1,200 per person under the 2020 CARES Act passed in March 2020, and $600 per person under the December 2020 stimulus bill. Find the full eligibility rules for each stimulus check here.

If you receive SSI or SSDI, you should have received at least a portion of both of those stimulus checks automatically the IRS obtained the names of Social Security recipients and SSI beneficiaries from the Social Security Administration in the spring and made the payments to them automatically, according to Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center.

If either of your checks are missing, however, youll have to take the extra steps below.

The IRS started processing tax returns on Feb. 12. The federal tax return deadline was extended to May 17.

Don’t Miss: What Is The Stimulus Package

Whether To File Another Irs Form

As was the case with the first and second check, if you filed a 2018, 2019 or 2020 tax return or receive government benefits, the IRS should automatically send your third check without you having to do anything.

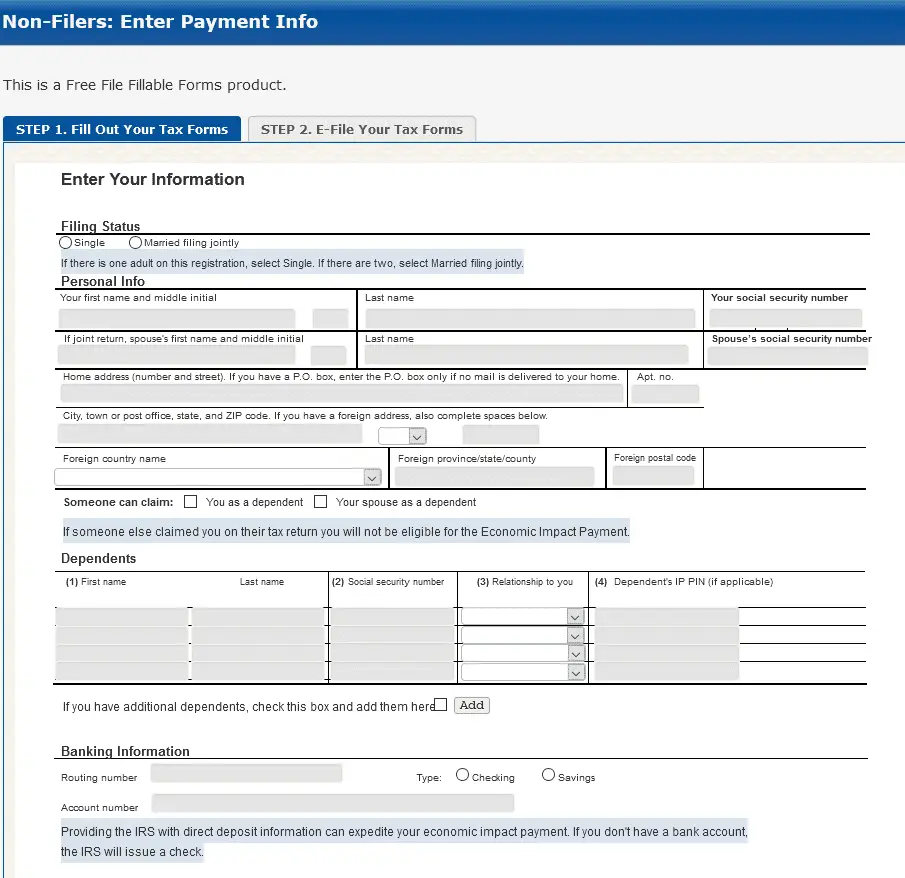

If, however, youre a nonfiler, a US citizen or permanent resident, had a gross income in 2019 under $12,200 or $24,400 as a married couple and didnt file a return for 2018 or 2019, you may need to give the IRS a bit of information before it can process your payment. Since the IRS Non-Filers tool is now closed, you may need to file for that money on a 2021 tax return in the form of a recovery rebate credit, described above.

Heres more information about who should file an amended tax form and who shouldnt.

Receiving your stimulus check money isnt always easy.

Dont Miss: Irs Gov 3rd Stimulus Check

Why You May Not Have Gotten All Your Stimmy Money

The third-round stimulus payments, authorized by the American Rescue Plan Act of 2021 and signed into law on March 11, 2021, were sent from March through December last year. Round 3 of the so-called stimmies provided a maximum credit of $1,400 per person, including all qualifying dependents claimed on a tax return.

A married couple with two qualifying dependents, for example, are eligible to receive a maximum credit of $5,600, depending on income limits. And if you brought a baby into the world last year, youll be able to file for up to $1,400 that youre owed for your new family member if you claim the child as a dependent.

The size of the credit, however, gets reduced for single filers with adjusted gross income of more than $75,000 and for married couples filing jointly with earnings of more than $150,000. For heads of household, the credit is reduced between $120,000 and $112,500.

The credit disappears entirely for individuals with AGI above $80,000 and for married couples filing jointly who earn more than $160,000. Heads of household with incomes of more than $120,000 also dont get the stimulus check. Most eligible Americans have already received the payments, according to the IRS.

You May Like: How Much Was The Stimulus In 2020

How Else Can You Get A Stimulus Check

Of course, not everyone lives in California and wont be eligible for this stimulus check.

Another way you could claim a stimulus check is if you are still owed one from the federal government worth up to $1,400.

This might be the case if any of the following applies:

- Parents who had a baby in 2021

- Families who added a dependent on their 2021 tax return

- Individuals and couples who earned more than $80,000 and $160,000, respectively, in 2020 but less than that amount in 2021

- Eligible family members who passed away in 2021 and did not receive their full stimulus payment

Those eligible for a federal stimulus check can claim the Recovery Rebate Credit on their taxes.

Also, some other states have launched their own stimulus programs.

Applications For Economic Relief Payments For Non

Applications for economic relief payments for non-filers extended until June 10

State to deliver millions in rebates, economic aid this summer

SANTA FE The New Mexico Taxation & Revenue Department and Human Services Department are partnering to deliver income tax rebates and economic relief payments signed into law by Gov. Michelle Lujan Grisham earlier this spring. Applications for non-filers to receive the relief payment are extended until 5 p.m. on June 10, 2022.

Approximately 33,544 applicants are currently eligible for a relief payment and about $18.1 million in relief payments are expected to be issued this July based on the applications approved so far.

In addition to the millions of dollars in automatic rebates allocated to taxpayers, $20 million was appropriated during the 2022 Special Legislative Session for financial relief for New Mexicans who do not file taxes, such as low-income seniors and some individuals with disabilities. New Mexicans who do not file income tax returns are eligible to apply for the economic relief payment.

The deadline to apply for a relief payment was extended to June 10, because there is still approximately $1.9 million in available funding through the program. The original deadline to apply was May 31.

If non-filer funding does run out, a non-filer will still have the option of filing a New Mexico Personal Income Tax return to obtain a rebate as late as May 31, 2023.

Recommended Reading: Filing For Stimulus Check 2021

Eligibility For The Covid

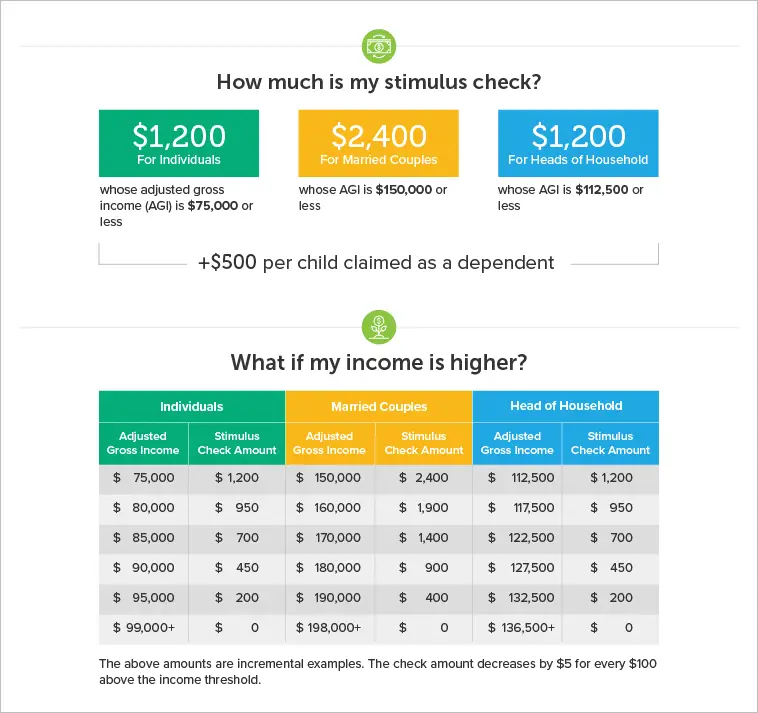

Every individual making $75,000 or less will receive a check for $1,200. Couples making less than $150,000 and that file taxes jointly should each receive $1,200 for a total of $2,400, with an additional $500 for each child. Those making between $75,000 and $99,000 a year should receive reduced checks on a sliding scale. Those making more than $99,000 individually or $198,000 jointly are ineligible.

Eligibility is being determined by 2019 and 2018 tax returns, but for those that are not required to file taxes, the IRS has set up a separate tool. Follow the link in these instructions for non-filers. The government will verify your income for those years and, if you qualify and have a bank account registered for tax refunds, you should receive a direct deposit. If you dont have a bank account registered with the IRS for direct deposits, you should receive a stimulus check in the mail.

$300 Check Due To Be Refunded To Taxpayers Today & Direct Payment Tomorrow

Filers cannot be claimed as a dependent of another taxpayer and have an adjusted gross income of $75,000 or less if single.

If youâre head of the household you must have an income of $112,250 or less, $150,000 or less if married filing a joint return.

Reduced payments are available for those who earn more than the above amounts but still earn less than $99,000 per year or less for individuals.

If youâre the head of the household, you must have an income of $136,500 per year or less and $198,000 per year or less for married filing jointly.

Don’t Miss: California Stimulus 2022 When Will It Come