Option : Your Physical Irs Letters

Remember the confirmation notices that you got in the mail about two weeks after receiving your first and second payments? If you qualified for a check, the IRS would’ve sent the notice to your last known address with information about your payment. Notice 1444 accompanied the first payment and Notice 1444-B followed the second payment.

What If My Bank Account Information Changed How Will I Get My Second Stimulus Check

Unfortunately, if your second stimulus check is sent to an account that is closed or no longer active, the IRS will not reissue the payment to you by mail. Instead, if you are eligible to get a payment, you can claim the stimulus check on your 2020 tax return as the Recovery Rebate Credit or use GetCTC.org if you dont have a filing requirement.

Why You May Not Have Gotten All Your Stimmy Money

The third-round stimulus payments, authorized by the American Rescue Plan Act of 2021 and signed into law on March 11, 2021, were sent from March through December last year. Round 3 of the so-called stimmies provided a maximum credit of $1,400 per person, including all qualifying dependents claimed on a tax return.

A married couple with two qualifying dependents, for example, are eligible to receive a maximum credit of $5,600, depending on income limits. And if you brought a baby into the world last year, youll be able to file for up to $1,400 that youre owed for your new family member if you claim the child as a dependent.

The size of the credit, however, gets reduced for single filers with adjusted gross income of more than $75,000 and for married couples filing jointly with earnings of more than $150,000. For heads of household, the credit is reduced between $120,000 and $112,500.

The credit disappears entirely for individuals with AGI above $80,000 and for married couples filing jointly who earn more than $160,000. Heads of household with incomes of more than $120,000 also dont get the stimulus check. Most eligible Americans have already received the payments, according to the IRS.

Read Also: Did They Pass The Stimulus Check

Are Adult Dependents Eligible For A Payment

No. Only dependent children who are under 17 years old are eligible for an additional $600 stimulus payment, which goes to the taxpayer who claimed them on their 2019 tax return.

Some stimulus proposals have included adult dependents, including approximately five million 17- and 18-year-olds, four million college students aged 19-23 and five million adult dependents like elderly parents. Most recently, Bidenâs American Rescue Plan includes $1,400 payments for adult dependents.

How Much Money Will I Get

Right now, stimulus checks for qualifying individuals are $600. Qualifying couples will receive $1,200 and qualifying dependents get $600.

The size of your stimulus check is based on your adjusted gross income , which is your total income minus adjustments like standard or itemized deductions. Adults with AGIs up to $75,000 per year and couples earning up to $150,000 per year will receive $600 per person. The income cap for heads of households to get the full $600 is $112,500.

Find Out How Much Youll Get With The Forbes Advisor Stimulus Check Calculator

Your payment decreases by $5 per $100 you make above the threshold. If youre an individual who makes more than $87,000, you wont get a payment. If youre a couple with an adjusted gross income of $174,000 or more, or a head of household making more than $124,500, you wont get any money.

And yes: Depending on your income, you could receive a stimulus check for as little as $5.

To determine your adjusted gross income for 2019, look at line 8b of Form 1040 on your 2019 U.S. Individual Income Tax Return.

Don’t Miss: $600 Stimulus Check Not Received

When Can We Expect A Second Stimulus Check To Come Out

How will I get my second stimulus payment? The IRS will send your second stimulus check the same way you received the first payment and/or your tax refund in 2020. If the account information you provided on your most recent tax return is up to date, you should expect to receive your second stimulus by direct deposit.

How Much Will My Check Be

The legislation includes a $600 payment for an adult $1,200 for a married couple filing jointly plus $600 per dependent child under the age of 17 at the end of the tax year. The bill uses the same definition of child as for the child tax credit. There is no cap on the number of children that qualify. Children over the age of 17 that are still dependents as well as adult dependents do not qualify for this round of stimulus payments.

The stimulus payment also includes a phaseout if you made more than $75,000 and several levels of reduction for those who reported making more than that. This, again, is based on your 2019 taxes. So if you reported a considerable income in 2019 but lost your job and have had no income for large portions of 2020, you will not be issued a check automatically. Consult your tax professional to see how this advance on the tax credit will affect your 2020 tax filing.

You can calculate your potential check amount at this Forbes link.

Also Check: New York Stimulus Check 4

Wheres My Stimulus Check

There is, however, at least one benefit related to this thats already guaranteed for 2022.

If you add up all six child tax credit check amounts you got last year? You should have also gotten a tax credit for that same amount this year when you filed your federal taxes. That will represent the second half of your child tax credit. And, for now, that will be the end of the enhanced credit.

Theres always a chance the Senate could revisit the legislation supporting an extension of these checks. For the moment, though, that possibility seems highly unlikely.

Who Is Eligible And How Much Will You Get

According to the IRS: Generally, U.S. citizens and resident aliens who are not eligible to be claimed as a dependent on someone elses income tax return are eligible for this second payment. Eligible individuals will automatically receive an Economic Impact Payment of up to $600 for individuals or $1,200 for married couples and up to $600 for each qualifying child. Generally, if you have adjusted gross income for 2019 up to $75,000 for individuals and up to $150,000 for married couples filing joint returns and surviving spouses, you will receive the full amount of the second payment. For filers with income above those amounts, the payment amount is reduced.

You May Like: I Never Received Any Stimulus Check

Lower Chamber Passed $2000 Stimulus Check

The Democratic-led House of Representatives voted 275-134 to meet President Trump’s demand for $2,000 relief checks late December, before it being blocked decisively by the Republican-controlled Senate. Not even getting a clean vote.

Senate Majority Leader Mitch McConnell said the $2,000 stimulus checks would be “socialism for the rich.”Sen. Bernie Sanders brought in the facts.

AJ+

Despite Trump’s threat to block massive pandemic aid and a spending package if Congress did not boost stimulus payments from $600 to $2,000, he backed down from his demands as a possible government shutdown brought on by the fight with lawmakers loomed.

As 2021 rolls in, and Joe Biden’s inauguration set for 20 January, we will see if more can be done to help needy Americans with a vaccine-aided end to the covid-19 pandemic still expected to be months away.

I Got A Payment Status Not Available Message

Many checking on their second stimulus check were seeing a message that said “Payment Status #2 – Not Available.” The IRS has indicated that these individuals will not receive a stimulus check by direct deposit or mail and they will have to file their 2020 tax return to claim their “Recovery Rebate Credit.” See below for instructions on claiming the rebate on your tax return.

These messages have now disappeared and will be replaced by information about the third payment.

Also Check: How Much 2021 Stimulus Check

Officials Give Reason To People Asking Wheres My Second California Stimulus Check

Controller Betty Yee has stated that the last year was about helping out the vulnerable residents of California.

The latest batch of payout went to residents living in and around the Sacramento area as the checks go according to by ZIP code. Yee said that the team is working non-stop to process the payment working even on weekends to make sure that they can stay within the deadline.

Around 8.1M California stimulus payments have been issued in the 2nd round. The total value comes to nearly $5.8B, as per data released by the FTB.

The spokesperson for FTB, Andrew LePage has said that with most of the payments already dispatched, there are expected to be close to 8.5M payments under the scheme when the last batch of payments have gone out.

Most of the figures given out are estimates, he said, and have not been passed through fraud and eligibility checks. Some individual TIN filers get until the 15th of next month to finally file their pending returns.

The administration of Governor Newsom has stated that two-thirds of Californians should get their share in the $12B being dispatched under the California stimulus payments.

The program was originally intended for low-earning Californians. But subsequently, the reach and scope of the payments were expanded to bring in people earning $75,000 or less into the net. The sole criteria are that they should have filed returns for 2020.

Lawmakers Are Pushing For Ssi Reform

SSI benefits are long overdue for an upgrade, said Rebecca Vallas, senior fellow and co-director of The Century Foundation’s Disability Economic Justice Collaborative.

“Forgetting about SSI for 40-plus years is the poster child of why, it is Exhibit A of why disabled people do not feel that their leaders in Washington care about them,” Vallas said.

That could be poised to change as Washington lawmakers show an increased interest in updating the program.

More from Investor Toolkit:Investors are flocking to green energy funds

This spring, the two U.S. senators from Ohio Democrat Sherrod Brown and Republican Rob Portman introduced a bill that would let beneficiaries set more money aside without jeopardizing their eligibility for benefits.

The proposal has also drawn co-sponsors from both sides of the aisle. That includes Sen. Ron Wyden, D-Ore., chair of the Senate Finance Committee, who has vowed to push for progress on it this year.

Advocates hope it will be just a first step toward modernizing the program.

“I want to do much, much more,” Brown said of SSI reform in an interview with CNBC.com in May.

Read Also: File For Missing Stimulus Check

I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and you’ll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didn’t seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. You’ll be able to claim the rest of the stimulus payment when you file your next tax return.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

Both the first and second stimulus check cannot be reduced to pay any federal or state debts. Unlike the first stimulus check, your second stimulus check cannot be reduced if you owe past-due child support payments and is protected from garnishment by creditors and debt collectors.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first and second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

You May Like: When Did The 1st Stimulus Checks Go Out

What Information Will You Need

To access the tool, you’ll be asked to provide a:

- Street address and

- Five-digit ZIP or postal code.

If you file a joint tax return, either spouse can typically access the portal by providing their own information for the security questions used to verify a taxpayer’s identity. Once verified, the same payment status is shown for both spouses. In some cases, however, married couples who file a joint tax return may get their third stimulus payment as two separate payments half may come as a direct deposit and the other half will be mailed to the address the IRS has on file. If that case, each spouse should check the “Get My Payment” tool separately using their own Social Security number to see the status of their payments.

If you submit information that doesn’t match the IRS’s records three times within a 24-hour period, you’ll be locked out of the portal for 24 hours . You’ll also be locked out if you’ve already accessed the system five times within a 24-hour period. Don’t contact the IRS if you’re shut out. Instead, just wait 24 hours and try again.

Wheres My Second Stimulus Check

This content is for the second stimulus check. For information on the first stimulus check, visit our Wheres My First Stimulus Check? How to Check the Status blog post. For information on the third stimulus check, please visit our Wheres My Third Stimulus Check? blog post.

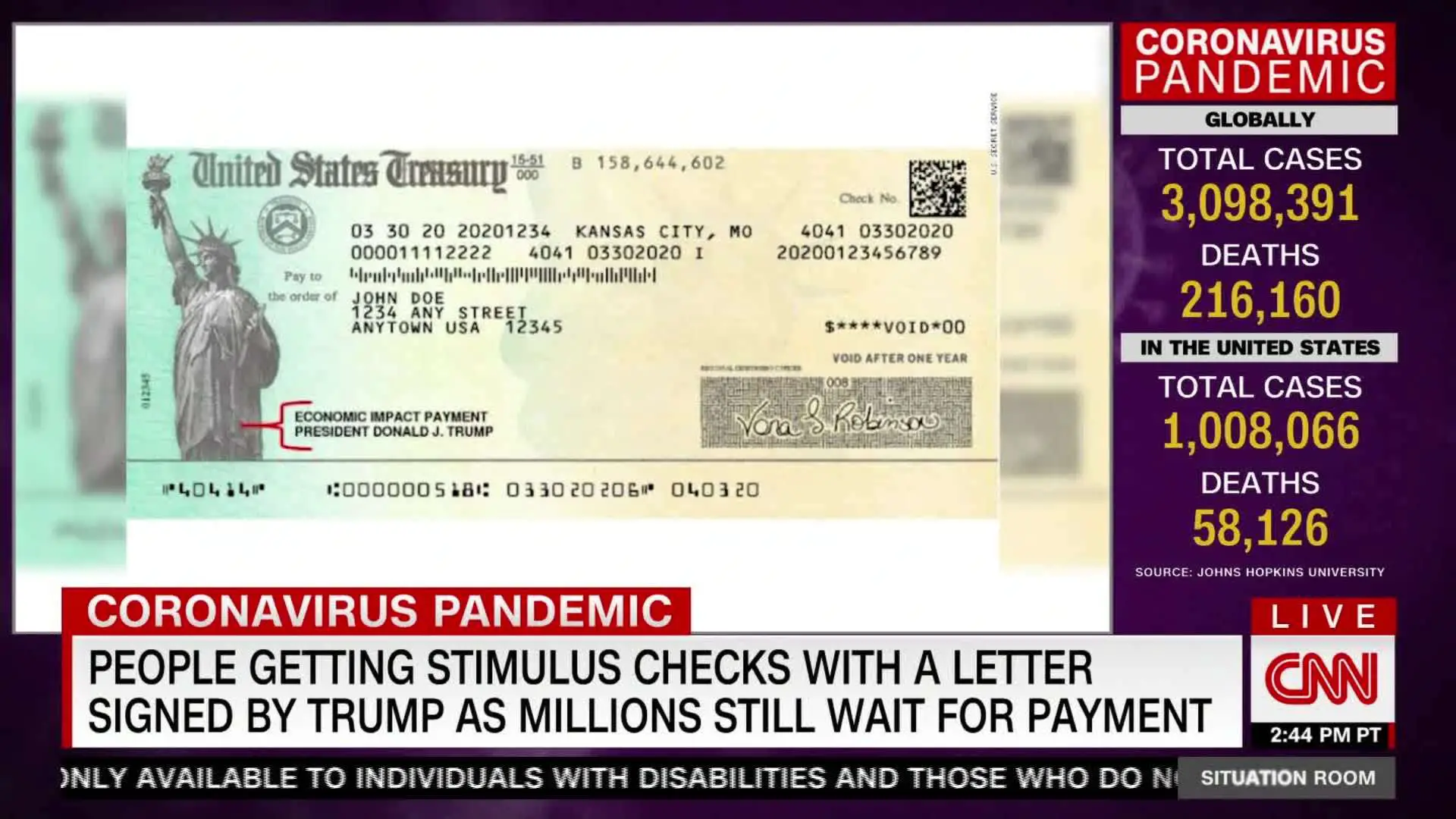

A second stimulus payment is on the way for millions for Americans.

As a part of the Coronavirus Response and Relief Supplemental Appropriations Act recently signed into law, the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers.

Here are answers to some of the top questions you may have about the second stimulus checks:

Read Also: Amount Of Third Stimulus Check

What If I Got Divorced In 2020 Or My Divorce Is Still In Progress

As you likely already learned during the first round of economic impact payments, your stimulus payment is based entirely on your 2019 tax return. If you filed jointly in 2019, your payment will be deposited into the same bank account or your check will be mailed to the same address as your 2019 filing.

If you have access to the bank account that the stimulus is deposited into, but your ex or estranged spouse does not, please consult with your divorce attorney about your next steps before spending or moving the money. If you do not have access to the account and your ex does, your divorce attorney can also give you guidance about how to get your share of the stimulus payment.

If your divorce is not finalized yet, the division of stimulus funds will likely be part of larger financial settlement agreements that must be made regarding your shared property and finances. Make sure that your attorney is aware of all money that you expect from the stimulus payments or any deposits or checks that youve received.

If your divorce is already finalized, tax issues addressed in your marital settlement agreement may govern how the payments are allocated. If your agreement doesnt address taxes, you may need a mediator or your attorneys assistance to bring the matter before the judge for post-divorce judgment. Your legal fees may exceed the amount of the stimulus payment, so mutual agreement, compromise, or mediation may be better first steps than immediately rushing to court.

What If The Irs Sent The Check To A Closed Account

Because people can’t update their bank account information on the “Get My Payment” site, there’s concern that some checks might be sent to accounts that were recently closed. If that’s the case, the IRS says you’ll have to wait until you file your 2020 tax returns.

The stimulus checks are actually a tax rebate that can be applied to your annual tax returns but that means people may be waiting weeks or even months for their stimulus money to show up through their tax refund.

Read Also: Who Receives Third Stimulus Checks

H& r Block Turbotax Problems

Intuit’s TurboTax on Tuesday also tweeted that some customers were having problems receiving their stimulus checks. “The IRS announced yesterday that due to the speed at which they issued this second round of payments, they sent some payments to an account that may be closed or no longer active,” the tax-prep service said.

The IRS said checks sent to closed or inactive accounts can’t by law be held by the financial institutions and redirected to consumers. Instead the funds will be returned to the IRS, and people who didn’t receive a check must wait until they file their 2020 tax returns to get the stimulus money in a refund. Because of that, it’s likely that those customers will face a delay.

Some customers responded on social media that they had panicked after failing to receive their funds as expected, with some expressing concern they had been a victim of fraud.

Meanwhile, the IRS said on Monday that the direct deposits could take “several days” to post to individual accounts after the official payment day of January 4. It added that some people may see their stimulus checks listed as pending or as provisional payments in their accounts.

Here’s what to know about tracking your payment.