How Can I Track My Stimulus Check Online And In The Mail

- 21:16 ET, Jun 24 2021

NEEDY Americans rebounding from the Covid-19 epidemic can still secure a financial jolt as part of the third round of stimulus rollout as checks are still coming in the mail or deposited online.

Both the Internal Revenue Service and the US Postal Service have created their own virtual kiosks to give Americans tracking tools to determine how much, where its going and when its coming.

Read our stimulus checks live blog for the latest updates on Covid-19 relief

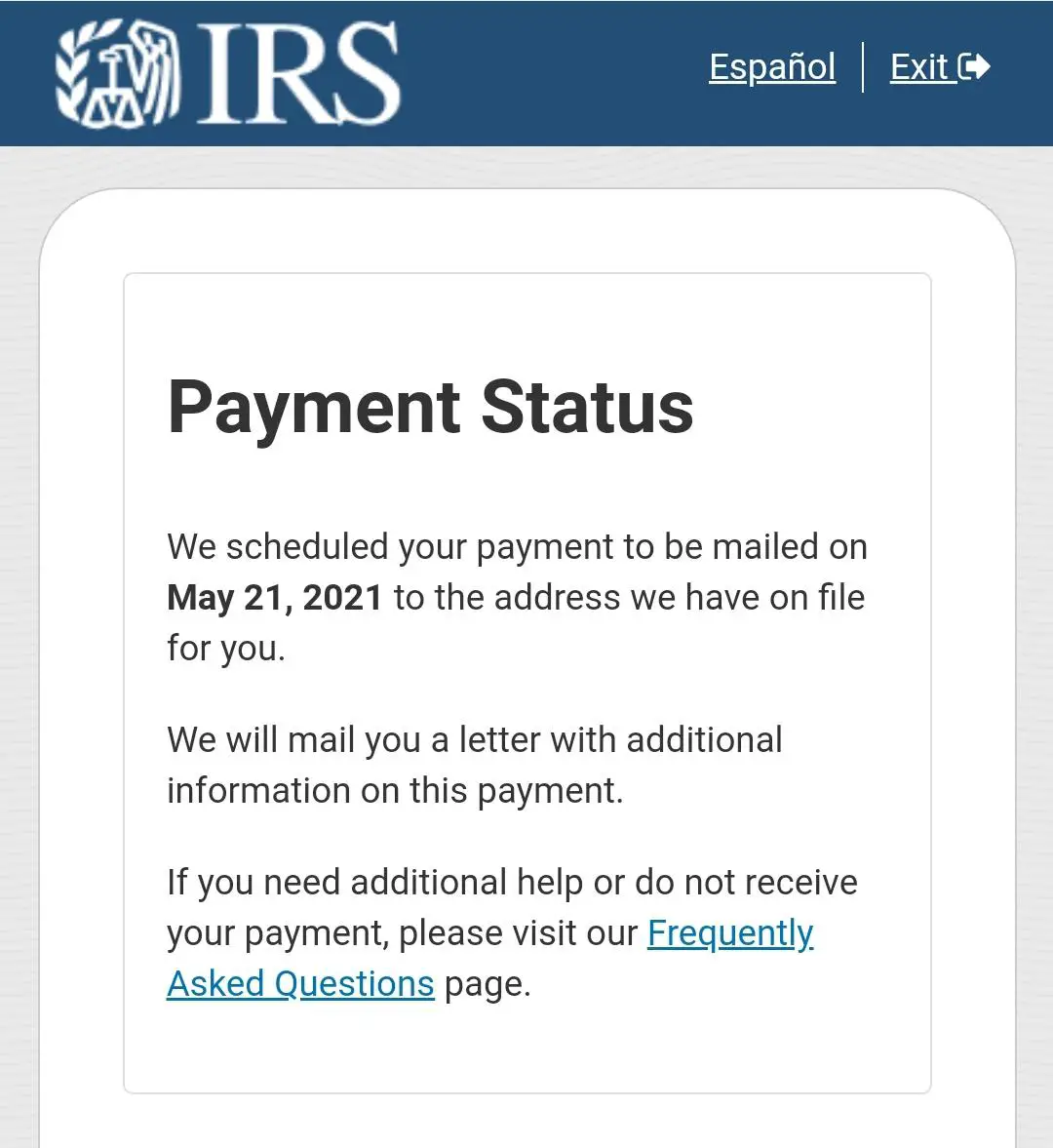

To keep an eye on the dough, IRS created the Get My Payment tool where cash-strapped individuals and families can get daily updates on their payment statuses.

When there is any issue over payment, the site issues alerts and details to help people resolve.

The IRS also allows people to create an IRS account, which opens up a substantial amount of details regarding past and present filings and stimulus statuses as well.

Meanwhile, if payment is expected in the form of a paper check or EIP debit card through snail mail, then theres a nifty tool that the US Postal Office tool called Informed Delivery.

Eligibility is based on the filing of 2019 and 2020 federal tax returns.

Last week, the agency issued another 2.3million payments including plus-up money for people who received less stimulus than they were supposed to.

As of June 9, the IRS has distributed over 169million payments totaling $395billion.

For the third round, more stringent income limits have been put into place.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

How Come My Payment Is Showing Up Early Or In Provisional Status

This is normal given that the processing/start date of the given payment batch and payment could be a few days apart. Generally the payment date is 5 days after the processing date, so the payment is classified as provisional until the official payment date. That is why many eligible recipients see the direct deposit stimulus payments as pending or as provisional payments in their accounts before the official payment date.

Recommended Reading: When Did The 1st Stimulus Checks Go Out

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

What Happens If I Didnt File Taxes In 2021

If an individual taxpayer is owed a refund, theres no penalty for filing late. On the other hand, tax owed and not paid by May 17, 2021 is subject to penalties and interest . Anyone who didnt file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest.

Recommended Reading: Is Texas Giving Stimulus Money

Is There A Cap On The Third Stimulus Check

Theres a strict income limit for the third stimulus payment The third stimulus check comes with a $1,400-per-person maximum. To target or restrict the third check to lower- and middle-income households, the legislation includes eligibility rules that exclude individuals and families at the highest income levels.

Your Second Check Couldn’t Be Taken To Pay Overdue Child Support But Your Tax Refund And Recovery Rebate Credit Can Be

Again, under the bill governing the second stimulus check, your payment couldn’t be taken if you owed money for child support — a shift that’s been widely understood across federal and state agencies.

However, these rules have not necessarily extended to the situation of filing for missing stimulus check money on your 2020 tax return. For certain outstanding debts — including past-due child support and unpaid student loans — the IRS can withhold some or all of your unpaid stimulus payment issued as a Recovery Rebate Credit when you file your taxes. An independent taxpayer advocacy group within the IRS is working with the agency to address this issue.

Here’s everything to know about stimulus checks and child support.

You May Like: Recovery Rebate Credit Third Stimulus

How Much Are The Payments Worth

The third economic impact payment is worth up to $1,400 per individual and dependent.

Single filers earning an adjusted gross income up to $75,000 and heads of household earning up to $112,500 will receive $1,400, and married couples earning up to $150,000 are eligible for $2,800. Those taxpayers will also receive $1,400 for each dependent.

After that, there is a steep income phase out: The payments decrease to zero for single filers at $80,000, for heads of household at $120,000 and for married couples at $160,000 AGI. Taxpayers will receive the same amount for each dependent.

The phase out rate is not uniform for the third round of direct payments, according to the Tax Foundation. It will depend on a taxpayer’s filing status and the number of dependents.

Single filers, for example, will experience a 28% phase out rate, meaning that they will receive $280 less for every $1,000 over $75,000 they earn, says Garrett Watson, a senior policy analyst at the Tax Foundation. An individual with an AGI of $77,000 would receive $840.

At the same time, while a married couple with no dependents would also see a 28% phase out rate, a couple with one dependent would see a 42% phase out rate. A couple with one dependent and an AGI of $155,000 would receive $2,100 total.

To see how much relief you may receive, use this calculator.

Yoga To The People Execs Bent Over Backward To Avoid Paying Taxes: Feds

The feds have created a way to see when your third coronavirus stimulus check will arrive but its far from foolproof.

The Internal Revenue Service reopened its Get My Payment tool so taxpayers can track the status of the $1,400 payments that started hitting bank accounts over the weekend.

The tool should be familiar to anyone who received either of the first two economic impact payments Congress authorized last year. Its a simple online form that should tell you whether your payment has been processed and when to expect it after you enter your Social Security number, birth date, street address and ZIP code.

But the tools latest iteration faced complaints from people who didnt see details about when the much-needed money would arrive.

Get My Payment became a trending topic on Twitter Monday morning as taxpayers griped about the tool spitting out four dreaded words: Payment Status Not Available.

The IRS says there are three reasons you might see that vague message. Its possible that your payment just hasnt been processed yet, or the IRS doesnt have enough information to send it to you.

It may also mean that youre not eligible for the check. Congress tightened the eligibility rules so that anyone making more than $80,000 a year wont receive any money. Full payments are still available to individuals who had an income of up to $75,000 on their 2019 or 2020 tax return.

Read Also: Irs Fourth Stimulus Checks Update

What If I Never Got The 1st Or 2nd Stimulus Checks

If youre missing a first or second stimulus check but believe you qualify, then you can claim the money on your 2020 tax return . The payments are worth up to $1,200 and $600 per person, respectively.

When you prepare your tax return, youll be asked to report the total Economic Impact Payment received to date.

There will be a separate worksheet on your tax return with instructions for calculating any outstanding amount owed to you, if anything. If you file your taxes using online software, the provider will prompt you to enter the required information and do the calculations for you.

The IRS advises filers to only fill out this portion of their return if they received less than the maximum payment amount.

Recommended Reading: How Can I Check For My Stimulus Payment

Don’t Lose The Irs Letter That Confirms Your Stimulus Payment

If the IRS issues you a stimulus check, it sends a notice by mail to your last known address within 15 days after making the payment to confirm delivery. The letter contains information on when and how the payment was made and how to report it to the IRS if you didn’t receive all the money you’re entitled to. You’ll need to reference this information if you don’t receive your full payment and need to claim your money later. Here’s how to recover the information if you lost or tossed the letter.

Also Check: Are There Any New Stimulus Checks Coming Out

If Your First Or Second Stimulus Check Never Arrived You Can Claim A Rebate When You File Your Taxes

If you were eligible for a first or second stimulus check but still haven’t received a direct deposit, check or prepaid EIP debit card from the IRS, you may have mistakenly been overlooked, or you may have a problem that you need to resolve. Certain groups who were eligible for that first payment, such as some older adults, retirees, SSDI recipients, noncitizens and those who are incarcerated, can file a claim for payment.

Even if you don’t typically file taxes, you’ll have to submit a 2020 tax return using a 2020 Form 1040 or 1040SR to claim your money. This credit would either increase the amount of your tax refund or lower the amount of the tax you need to pay by the amount of stimulus money you’re still owed.

Again, just be aware that if you do file for a Recovery Rebate Credit and owe any back taxes, the IRS may garnish that money to pay those debts.

If you got a letter from the IRS confirming either your first or second payment, but never actually got the money, you can try filing a Payment Trace through the IRS to track it down.

If you owe child support, all or part of your stimulus check could be used to cover the expense.

How Are Payment Amounts Determined

The third round of Economic Impact Payments will be based on a taxpayers latest processed tax return from either 2020 or 2019.

The payments would amount to $1,400 for a single person or $2,800 for a married couple filing jointly, plus an additional $1,400 for each dependent child.

Payments start to decline for incomes above $75,000 for single people and $150,000 for married couples until phasing out completely for individuals making above $80,000 and couples making above $160,000.

Find answers to your stimulus questions at USATODAY.com

Also Check: What Is Congress Mortgage Stimulus Program For The Middle Class

What If I Still Haven’t Received The First And/or Second Payment

The IRS has sent all of the first and second stimulus payments to qualifying Americans that the agency has taxpayer information for. If you believe you are eligible and didn’t receive one, or received less than you qualify for, then you will claim a Recovery Rebate Credit on your 2020 tax return. This is line 30 of your 2020 Form 1040 or 1040-SR.

On this line, you will list the difference between what you are owed and what you received . People who don’t earn enough money to file taxes will also need to file a return to get any missing payments.

What To Do About Payment Scams

Though its uncommon, you may believe youve been scammed out of your payment or had it stolen. The Federal Trade Commission has a website where you can report a stolen stimulus check. If youre worried about theft, you can sign up for a free USPS service that will send you a picture of every piece of mail coming your way including your stimulus payment.

You May Like: Wheres My Stimulus Money 2021

Also Check: Can I Still Claim My First Stimulus Check

Which Days Are Stimulus/eip Payments Made And When Will They Be In My Bank Account

The above table shows the date payments are issued by the IRS. It generally takes 2 to 5 business days after the start/issue date for the payment to hit your bank account . So for example in Batch 6, the IRS announced that Friday, April 16 was the start date for processing but that the official payment date was Wednesday, April 21.

However many people have received direct deposit payments in their accounts earlier than the payment date, which would show as provisional or pending deposits. Based on the pattern of past batches stimulus payments are generally hitting most bank accounts on a Monday or Tuesday.

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

Read Also: Where Do I Put Stimulus Money On Tax Return

What Phone Number Is 800 829 0922

If you want to call the IRS, make sure you call the right number: 800-829-0922. The letter says you have 60 days from the date of the letter to appeal or you can sue in federal court. You may want to hire a tax professional and you may qualify for low-income taxpayer clinics. They’re free or close to free.

Where’s My Third Stimulus Check Irs Updates ‘get My Payment’ Tool For Covid Payments

You can now find out when your next stimulus payment is expected to hit your bank account or get mailed.

The IRS has updated the Get My Payment tool on its website with information on the third round of stimulus checks, agency spokesperson Karen Connelly confirmed to USA TODAY. Check for your status at www.irs.gov/coronavirus/get-my-payment.

The third round of Economic Impact Payments will be based on a taxpayers latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

Those who received the first two stimulus checks but didnt receive a payment via direct deposit will receive a check or a prepaid debit card.

Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits, the IRS said. A payment date for this group is expected to be announced soon.

The payments would amount to $1,400 for a single person or $2,800 for a married couple filing jointly, plus an additional $1,400 for each dependent child. Individuals earning up to $75,000 would get the full payments, as would married couples with incomes up to $150,000. Payments would decline for incomes above those thresholds, phasing out above $80,000 for individuals and $160,000 for married couples.

Get My Payment

Recommended Reading: When Did The Government Give Stimulus Checks