How To Cash A Stimulus Check

If you want to take your stimulus check money and use it or simply save it, you need to find a suitable method to cash it. Therefore, after you analyze every detail involving the methods available, you can pick one that is the most convenient for you. Here are the ways you can cash your stimulus check:

What Type Of Id Should I Have To Cash A Check

Before submitting a cashiers check without identifying yourself, its important you see the proper identification documents before completing the form. Most establishments require primary IDs, but others accept secondary IDs. When you cash in your check, the issuance documents include a National Identification Card or a passport.

Whatever you select, verify that the card ID is current. Check if your ID is expired. Even when your photo and the name are accurate, the place cant accept it if the expiration date isnt entered.

How To Cash A Treasury Check

When you receive a paper check from the government, you have several options for cashing it. Regardless of your preferred method, you need to endorse the back of the check and show at least one form of government-issued identification, such as a drivers license, state-issued ID, military ID or passport. You also may have to present an alternate form of ID, such as a Social Security card or credit card.

Read Also: Who’s Eligible For The Third Stimulus Check

Looking For More Stimulus Information

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Learn more about deducting payments made to your spouse with advice from the tax experts at H& R Block.

Also Check: How To Track The Stimulus Check

Where Can I Cash My Stimulus Check For Free

- Wednesday, Dec 29, 2021

Where can i cash my stimulus check for free

Where can i cash my stimulus check for free. The third i just learned was auto deposit to the account my ssa goes to, fialko said. We post the funds as soon as we are receive them from the irs. walmart is allowing you to cash that check or put it on a walmart money card, which is like a stored value card. to cash a check greater than $1,000 at walmart, you must pay a maximum fee of $8, according to its website. These kroger company brands will cash your stimulus check for free:

If you missed out on your coronavirus relief money, you can claim your stimulus checks by filing a 2020 tax return. The irs is sending out hundreds of millions of direct payments, and that can take a bit of time.you can track your stimulus payment on the irs get my payment portal. On friday the illinois department of professional and financial. These kroger company brands will cash your stimulus check for free: These kroger company brands will also cash your stimulus check for free: So, if you cash that $1,200 stimulus check, you would walk away with $1,192.

You May Like: Can I Get All 3 Stimulus Checks

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income thats on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Best Mobile Check Deposit App

At the time of writing, the best mobile check deposit app is Ingo Money. It is related to the information app inGo that scans information, even from newspapers.

The inGO check cashing app assists you with no ID check cashing anywhere, anytime. It makes things very convenient because you dont have to line up at the bank and to wonder if they will accept your requirements or not.

The app not only cashes checks, but it also cashes money orders. It accepts personal checks, payroll checks, federal government checks, and business checks. You could be spending time with your family if you deposit your checks with a mobile deposit app instead of driving over to your bank branch.

Here are alternative mobile check deposit apps to consider:

See if any of the above are compatible with your device.

Don’t Miss: Stimulus Checks Without Filing Taxes

Handling Checks Written Out To Both People

Check With Local Merchants If You Can Cash Your Stimulus Check

Some grocery stores and large retailers will cash stimulus checks up to a certain amount and possibly for a fee. You can check with Kroger affiliated grocery stores with a Money Services counter, to cash your stimulus check for free, however restrictions may apply. Walmart will cash a government check of up to $5,000 but for a fee between $4 and $8. You can also deposit the money onto a prepaid debit card through Walmart MoneyCardbut you may have to pay a monthly fee.

You May Like: How Are Stimulus Checks Distributed

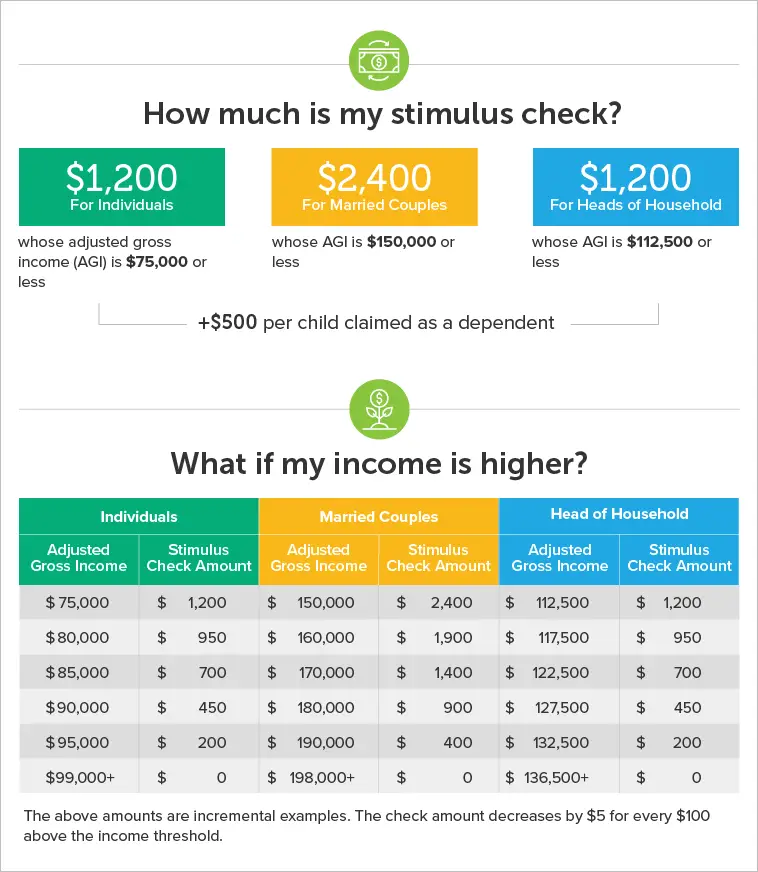

Who Is Eligible For A Stimulus Check

- Adult dependents. Benefits of $1,400 are also paid to eligible dependents.

- Mixed households. As with the checks above, individuals must have a valid Social Security Number to be eligible to participate.

- â â â â . People who were still alive in January.

- People with unpaid debts.

- If you miss this year.

The Latest Stimulus Check Updates

Theres plenty of information in this article, but the situation is always evolving. Check out some of our recent coverage if you want to read the latest information about a potential fourth stimulus check and more along these lines:

Broadly speaking, checks or, at least, the idea of them remain a popular policy concept among voters. Its the increasingly dicey task of bringing new legislation supporting them to fruition thats befuddling lawmakers at the moment.

Read Also: Netspend All-access Stimulus Check

What Are The Requirements

For Social Security recipients who reported earnings of $1 to $75,000 on their 2020 tax return, there are additional requirements.

You must have been a California resident for most of last year and still live in the state.

You must have a Social Security number or an Individual Taxpayer Identification Number.

You cannot be claimed as a dependent by another taxpayer.

The state expects to continue issuing stimulus checks through the beginning of 2022.

Plus, California has a Golden State Stimulus II estimator to find out if you qualify.

Irs Tax Refunds: Where Can You Cash Your Tax Refund Checks

Various places to cash your checks

It is a brilliant feeling to get a large tax refund check in the mail from the United States Treasury. But, not everyone knows how to actually cash it.

Here, in this guide, we run you through the places where you can cash your tax refund checks.

Read Also: Do We Supposed To Get Another Stimulus Check

Can I Cash A Check At An Atm Without An Account

Non-customer checks are not obliged to be cashed by banks and credit unions, although many will accept a check made by a bank account holder, even if it is payable to a non-customer. Its important to note that the payers account must have sufficient funds to cover the check.

If you do not have a bank account, you can cash a check at either the issuing bank or a check cashing establishment. You may still cash a check if you lose your ID by utilizing an ATM or signing it over to someone else.

Do I Need To Have An Id To Cash A Check

When you cash a check, you generally need at least one of your primary IDs. Sometimes the primary ID that a government issues is a passport or a drivers license.

Some places allow the use of two secondary IDs to replace a primary ID, such as an employment ID on top of a student ID. All of these regulations are there for your good. Theyre in place so that no one can commit fraud or thievery over your money.

There are, understandably, moments when you suddenly need to get your cash, but you do not have the ID that you need with you. Occasionally, youll find a place that lets you issue a check into cash with no ID required on your part.

You May Like: When Will Next Stimulus Check Come

What If I Receive A Paper Stimulus Check

If you receive an Economic Impact Payment in the form of a paper check through the mail, a fast and safe way to deposit your money is with mobile check deposit.2 We encourage you to download the U.S. Bank Mobile App and use this free service.

Weve increased mobile deposit limits for many customers and removed the restriction on government checks to make it easier to deposit other checks, such as paychecks and Social Security payments, from home.

Dont Miss: When Are They Sending Out Stimulus Checks

How Can I Cash A Check Online Without A Bank Account

Deposit to a Prepaid Debit Card Prepaid debit cards typically allow you to load funds via mobile check deposit. Prepaid debit cards are relatively easy to get approved for, even if you cant open a checking account. That said, many prepaid cards have up to a 10-day waiting period before you can access your check funds.

Read Also: Stimulus Check 2022 Who Qualifies

Read Also: How To Check On Stimulus Payment For Non Filers

Does Venmo Get A Cut Of My Stimulus Check

No, Venmo said it’s temporarily waiving fees associated with Cash a Check for those who have recently received a government stimulus check, which means that for now, using the service is free and you will keep all of your stimulus money.

Venmo’s new check-cashing feature is meant to make the stimulus check process easier.

Since Venmo is owned by PayPal, the app normally charges a 1% check cashing for government checks that have a preprinted signature, according to PayPal’s terms and conditions. If the check is hand-signed, there’s a 5% fee, with a minimum of $5.

Typically, Venmo’s check-cashing program lets you can select how quickly you’ll need access to your money– the In Minutes or In 10 Days options. In Minutes usually has a fee, but Venmo is waiving the 1% fee for disbursement in minutes for government-issued stimulus checks to enable quick access to stimulus funds.

After Venmo has waived $400,000 in fees, its check-cashing feature will return to normal operations.

Community Financial Service Centers

The Community Financial Service Center is a place where you can cash checks. However, not all CFSC stores offer 24-hour check cashing. Hence, you should check with your nearest store for the opening hours.

You can cash various checks at CFSC, including government checks, payroll checks, stimulus checks, social security checks, SSI checks, unemployment checks, Veterans Benefit Checks, and Income Tax Refund checks.

Its important to note that check cashing fees and limits vary by location.

Also Check: Is It Too Late To Apply For Stimulus Check

Read Also: Are Getting Another Stimulus Check

How Long Can The Bank Place A Hold On Government Checks

Generally, a bank must make funds deposited into an account by a government check available for withdrawal not later than the business day after the banking day on which the funds are deposited into an account held by the payee of the check and in person to an employee of the bank. For U.S. Treasury checks, the same deadline applies when the payee deposits the check at an ATM owned by the bank and is an accountholder on the account into which the deposit is made.

A bank may require that a special deposit slip be used for state or local government checks and for certified, cashier’s, or teller checks to qualify for next-day availability.

The bank may place a longer hold on a check in any of several circumstances:

- The check has been deposited into an account that has been open for less than 30 days.

- The total amount of checks deposited in one day is larger than $5,525, but only for the amount in excess of $5,525.

- The check has been returned unpaid and has then been redeposited.

- The check has been deposited into an account that has been repeatedly overdrawn during the past six months.

- The bank has reasonable cause to doubt that the check is collectible from the paying bank.

- Emergency conditions exist beyond control of the bank, such as an interruption of communication, computer, or other equipment facilities.

Last Reviewed: April 2021

How Youll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return.

- Received your Golden State Stimulus payment by check.

- Received your tax refund by check regardless of filing method.

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number.

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund.

You May Like: What To Do If You Didn’t Receive Your Stimulus Check

Claim Your Golden State Stimulus

The COVID-19 pandemic created tough financial challenges for working families all across California.The Golden State Stimulus programs provides rapid cash support to millions low and middle income Californians.

There are two different Golden State Stimulus. You may qualify for one or both. Visit the page below for more on Golden State Stimulus I & II.

Do I Qualify for the Golden State Stimulus I?

You may qualify for the Golden State Stimulus I if you are a California resident, not claimed as a dependent, and either of the following apply:

-

Claim the CalEITC on your 2020 California tax return be October 15, 2021 to receive $600 or

-

File your 2020 tax return with an Individual Tax Identification Number and up to $75,000 to receive $1,200.

Do I Qualify for the Golden State Stimulus II?

You may qualify for the Golden State Stimulus II if you are a California resident, not claimed as a dependent, and all of the following apply:

-

File your 2020 California tax return by October 15, 2021 and

-

Have a California Adjusted Gross Income of $1 to $75,000 for the 2020 tax year

The Golden State Stimulus II provides $600 to taxpayers that did not qualify for GSS I and an

additional $500 $1,000 if there is a child dependent and reported up to $75,000 for the 2020 tax year.

Recommended Reading: South Carolina Stimulus Check 2021