How Can I Find The Bank Information Where My Stimulus Is Being Sent

The account number and routing number where your tax refund are being direct deposited can be found on the printable .pdf version of your tax return.

The last four digits of the bank account being used for direct deposit can be found in your account under Transaction History.

To find the last four digits of your bank account on file:

Log in to your account > My Account > Transaction History

If theres no bank information on my transaction history but on my copy of my taxes theres some bank info what does that mean? Does the IRS have my bank information to send my stimulus?

If you paid your filing fees out of your tax refund and got the rest of your refund by direct deposit, the account number where your funds were deposited is on the printed copy of your tax return. This is the account information the IRS has on file, and your stimulus payment will be sent to this same account.

Families Will Soon Receive Their December Advance Child Tax Credit Payment Those Not Receiving Payments May Claim Any Missed Payments On The Upcoming 2021 Tax Return

IR-2021-249, December 15, 2021

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their final advance Child Tax Credit payment for the month of December. Eligible families who did not receive advance payments can claim the Child Tax Credit on their 2021 federal tax return to receive missed payments and the other half of the credit.

This final batch of advance monthly payments for 2021, totaling about $16 billion, will reach more than 36 million families across the country. Most payments are being made by direct deposit.

Under the American Rescue Plan, eligible families have received more than 200 million payments totaling more than $93 billion. Most eligible families received payments dated July 15, August 13, September 15, October 15, November 15 and December 15. For eligible families, each payment is up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17.

Here are more details on the December payments:

Dont Miss: Third Stimulus Check For Ssi

Can My Stimulus Payment Be Garnished

Like the last stimulus check payments the third stimulus check cannot be offset to pay various past-due federal debts or back taxes. This does not apply to child support payments that are in arrears. If youre behind on child support your stimulus check can be fully or partially garnished either wont get a stimulus check or will receive a reduced one.

Recommended Reading: Will There Be Another Stimulus Package

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

Don’t Miss: What Is The Third Stimulus Check

You Arent Eligible For A Stimulus Payment

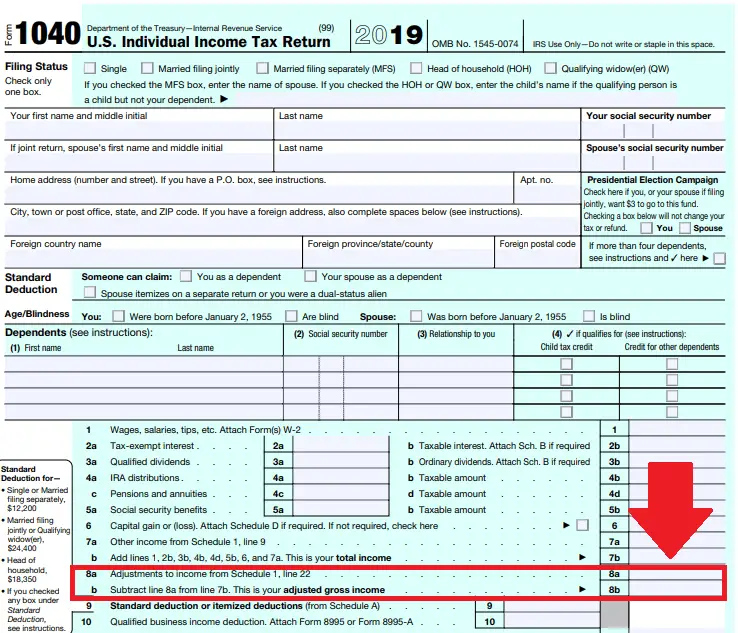

If you arent eligible for a stimulus check , the Get My Payment app wont necessarily explain that. Instead, you may simply find yourself staring at the words Payment Status Not Available. If this is the case, you may want to take a look at your adjusted gross income on your most recent tax return, to see if youre eligible for a payment or not.

Recommended Reading: Can You Claim Stimulus On 2021 Taxes

Missed The Deadline To Claim Your Child Tax Credit Or Stimulus Money What To Know

If you didn’t claim your child tax credit money or third stimulus check by last night’s cutoff, we’ll explain what you need to do.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The deadline for claiming your missing stimulus or child tax credit payments this year has passed — but that doesn’t mean you’ll never get that money. While the IRS Free File form is indeed closed, you can still claim any money owed to you when you file your taxes in 2023.

Some 9 million people who haven’t received their payments never filed a tax return this year, either because they’re not required to file or because they need more time. The IRS used tax returns to determine eligibility for both of these payments.

Keep reading to find out what you can do to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

Recommended Reading: Are There Any Stimulus Checks Coming

Do I Even Really Need Irs Letters 6475 And 6419 To File My Taxes

You certainly need to keep any letters received for your records, and the amounts received need to match what you put on your 2021 tax return. Having these official documents makes accurate information much easier to access.

While you could probably find or calculate those amounts on your own, using the letters themselves reduces the risk of mismatched info, which could cause your return to be rejected.

Also Check: When Is The Third Stimulus Checks Coming Out

How Come My Payment Is Showing Up Early Or In Provisional Status

This is normal given that the processing/start date of the given payment batch and payment could be a few days apart. Generally the payment date is 5 days after the processing date, so the payment is classified as provisional until the official payment date. That is why many eligible recipients see the direct deposit stimulus payments as pending or as provisional payments in their accounts before the official payment date.

Recommended Reading: When Did The 1st Stimulus Checks Go Out

Read Also: When Do We Get The Next Stimulus Checks

How Can I Get Missing Economic Impact Payments And Claim Other Refundable Tax Credits

Date: November 18, 2021

The IRS and the Department of Treasury provided an online Non-Filer Sign-up Tool as a convenient way for people who do not ordinarily file a tax return with the IRS to claim advance CTC payments and missing stimulus payments, or EIPs. The November 15, 2021 deadline to use the tool has passed.

Filing a 2021 Federal tax return in 2022 will allow families eligible to claim the 2021 CTC to receive their remaining benefit. Most families who received advance CTC payments only received half of the value of their credit.

If you didnt file a tax return for 2020 and you did not use the sign-up tool before the deadline passed, you can still claim your full CTC and any amount of the EIPs provided in the American Rescue Plan that you are eligible for but have not yet received, by filing a 2021 Federal tax return in 2022.

Highlights Of The Third Round Of Economic Impact Payments Irs Will Automatically Calculate Amounts

In general, most people will get $1,400 for themselves and $1,400 for each of their qualifying dependents claimed on their tax return. As with the first two Economic Impact Payments in 2020, most Americans will receive their money without having to take any action. Some Americans may see the direct deposit payments as pending or as provisional payments in their accounts before the official payment date of March 17.

Because these payments are automatic for most eligible people, contacting either financial institutions or the IRS on payment timing will not speed up their arrival. Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits. A payment date for this group will be announced shortly.

The third round of Economic Impact Payments will be based on the taxpayer’s latest processed tax return from either 2020 or 2019. This includes anyone who successfully registered online at IRS.gov using the agency’s Non-Filers tool last year, or alternatively, submitted a special simplified tax return to the IRS. If the IRS has received and processed a taxpayer’s 2020 return, the agency will instead make the calculation based on that return.

For those who received EIP1 or EIP2 but don’t receive a payment via direct deposit, they will generally receive a check or, in some instances, a prepaid debit card . A payment will not be added to an existing EIP card mailed for the first or second round of stimulus payments.

Also Check: Irs Didn’t Get Stimulus

Over 170 Million Third Stimulus Checks Sent Out

As of July 2021, the Internal Revenue Service said it had distributed over 171 third-stimulus-check payments totalling more than $400 billion and these figures are now likely to rise during tax season in 2022.

Thats because, while eligibility for the third stimulus check was initially based on Americans 2019 or 2020 tax returns, the information in taxpayers 2021 declarations will now also be used to determine whether they qualify for a payment.

This means that if, for example, a workers earnings were too high in 2019 and 2020 but in 2021 they fell below the income threshold, they will now be able to claim the third stimulus check in the tax declaration they submit this year.

The same is also true of families who in 2021 added dependents to their household. Dependents of all ages are eligible for the $1,400 additional credit.

A further group who can use a 2021 tax return to get their third stimulus check is eligible Americans who did not file a return for the 2019 or 2020 tax years and also did not claim a direct payment by using the IRS online tool for non-filers.

Read Also: Is Everyone Getting A Third Stimulus Check

How Much Is The Third Economic Impact Payment

Those eligible will automatically receive an Economic Impact Payment of up to $1,400 for individuals or $2,800 for married couples, plus $1,400 for each dependent. Unlike EIP1 and EIP2, families will get a payment for all their dependents claimed on a tax return, not just their qualifying children under 17. Normally, a taxpayer will qualify for the full amount if they have an adjusted gross income of up to $75,000 for singles and married persons filing a separate return, up to $112,500 for heads of household and up to $150,000 for married couples filing joint returns and surviving spouses. Payment amounts are reduced for filers with incomes above those levels.

You May Like: Who Receives The Third Stimulus Check

Why Cant I Get On The Get My Payment Site

The IRS said this can happen if people dont provide security answers that match the tax agencys information over the course of several attempts to log in. The IRS asks for personal information such as a Social Security number, birthdate and address.

If you cant verify your identity, you wont be able to use Get My Payment, the IRS said. Dont contact the IRS for assistance with a lockout IRS assisters cant unlock your account.

However, the site will allow you to try again after 24 hours.

Stimulus Checks Could Be Seized To Cover Past Due Debt

If you owe child support or other debts, your first check was seized to cover those debts. The third check is subject to being taken by private debt collectors, but not the state or federal government. The same goes for the second payment, too, if youre claiming missing money in a recovery rebate credit. You may receive a notice from the Bureau of the Fiscal Service or your bank if either of these scenarios happens.

In the case of the third check, we recommend calling your bank to confirm the garnishment request from creditors and ask for details about how long you have to file a request with a local court to stop the garnishment. If you think money has already been mistakenly seized from the first two checks, you can file a recovery rebate credit as part of your 2020 tax return but only if you filed a tax extension.

You can track down your stimulus payment without picking up the phone.

Recommended Reading: When Was The Third Stimulus Payment Issued

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

Read Also: Where Do I Put Stimulus Money On Tax Return

Recommended Reading: Never Received 3rd Stimulus Check

What If I Already Filed My Taxes

An amended return may be needed to claim the credit if IRS records show no payment was issued.

For eligible people who didnt claim a recovery rebate credit on their 2021 tax return , they will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return to claim the remaining amount of stimulus money if IRS records dont show that they were issued a payment.

This includes people who think they didnt get the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

People trying to figure out if they should amend their original tax return can use this online tool.

More details on claim the 2021 Recovery Rebate Credit can be found here.

If Your First Or Second Stimulus Check Never Arrived You Can Claim A Rebate When You File Your Taxes

If you were eligible for a first or second stimulus check but still havent received a direct deposit, check or prepaid EIP debit card from the IRS, you may have mistakenly been overlooked, or you may have a problem that you need to resolve. Certain groups who were eligible for that first payment, such as some older adults, retirees, SSDI recipients, noncitizens and those who are incarcerated, can file a claim for payment.

Even if you dont typically file taxes, youll have to submit a 2020 tax return using a 2020 Form 1040 or 1040SR to claim your money. This credit would either increase the amount of your tax refund or lower the amount of the tax you need to pay by the amount of stimulus money youre still owed.

Again, just be aware that if you do file for a Recovery Rebate Credit and owe any back taxes, the IRS may garnish that money to pay those debts.

If you got a letter from the IRS confirming either your first or second payment, but never actually got the money, you can try filing a Payment Trace through the IRS to track it down.

If you owe child support, all or part of your stimulus check could be used to cover the expense.

Recommended Reading: Track My Golden State Stimulus 2

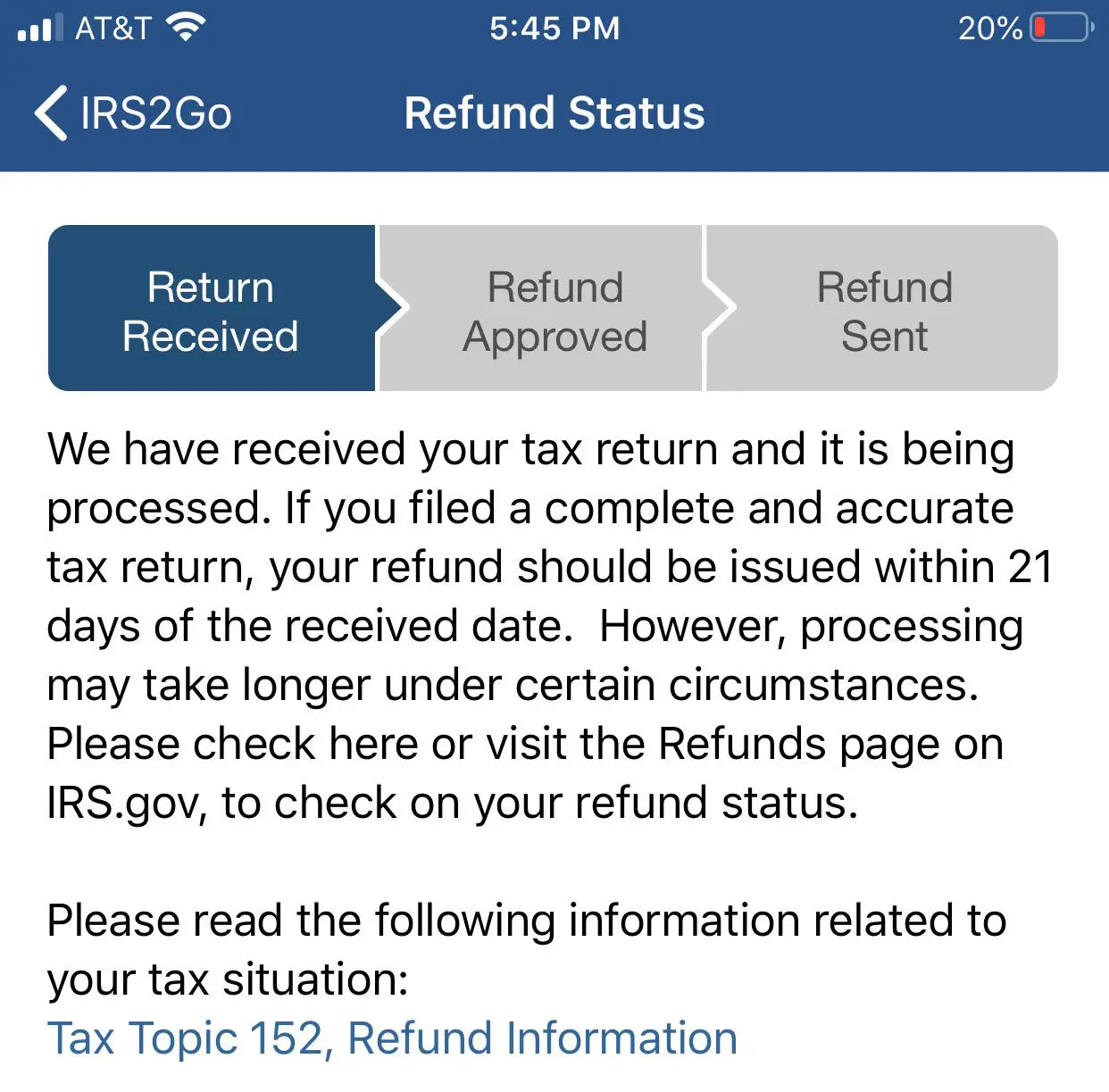

The Irs Has An Online Tool That Lets You Track The Status Of Your Third Stimulus Check

Getty Images IRS.gov

The IRS has already delivered over 100 million third stimulus checks. But if you’re still asking yourself “where’s my stimulus check,” the IRS has an online portal that lets you track your payment. It’s called the “Get My Payment” tool, and it’s an updated version of the popular tool Americans used to track the status of their first- and second-round stimulus checks.

Note that you can’t check the status of your first- or second-round stimulus payments with the updated tool. To find the amounts of these payments, create an online IRS account or refer to IRS Notices 1444 and 1444-B, which the IRS mailed after first- and second-round stimulus checks were issued. If you didn’t get an earlier payment, or your received less than the full amount, you might be able to get what you’re owed by claiming the Recovery Rebate credit on your 2020 tax return. Third-round stimulus payments aren’t used to calculate the 2020 Recovery Rebate credit, but they will be used to figure the credit amount on your 2021 tax return.

The updated “Get My Payment” tool more-or-less works the same way as the portal used for first- and second-round stimulus checks. But here’s a refresher course on what the tool does, what information you need to provide, and what information the tool gives you. Check it out now so you know what to expect before entering the portal on the IRS’s website.