What If Dont Normally File A Tax Return

The IRS said this third round of stimulus will be based on tax year 2019 or 2020 information, or information obtained by the Social Security Administration and Veterans Affairs Administration. If you are a non-filer who also does not receive a SSA or VA benefit, then use the Non-filer Sign-up tool, described below.

The IRS recently launched a new Non-filer Sign-up tool on its website. Although this non-filer portal is labeled as for non-filers claiming advance payments of the child tax credit, it is also available for others, including single individuals and people experiencing homelessness. It will allow individuals to provide their information to the IRS so that they can receive any of the three Economic Impact Payments , also known as stimulus payments, that they may be missing. If an individual did not get the full amounts of the EIPs, they may use this tool if they:

- Are not required to file a 2020 tax return, didnt file a 2020 tax return, and dont plan to, and

- Want to claim the 2020 Recovery Rebate Credit and get their third EIP.

The new Non-filer Sign-up tool is for people who did not file a tax return for 2019 or 2020, and who did not use the IRS Non-filers tool last year to register for Economic Impact Payments.

Who Is Eligible For The Second Stimulus Check

Eligibility is primarily based on four requirements:

1. Income: The income requirements to receive the full payment are the same as the first stimulus check.There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. This stimulus payment starts to phaseout for people with higher earnings. The second stimulus check maximum income limit is lower than the first stimulus check. Single filers who earned more than $87,000 in 2019 are ineligible for the second stimulus check.

View the chart below to compare income requirements for the first and second stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit |

| Single Filer | ||

| $136,500 | $124,500 |

2. Social Security Number: This requirement differs from the original eligibility for the first stimulus check. Originally under the first stimulus check, if you were married filing jointly, both spouses needed valid Social Security numbers . If one spouse had an Individual Taxpayer Identification Number , then both spouses were ineligible for the stimulus check. For married military couples, the spouse with an SSN could still get the stimulus check for themselves but not the other spouse with an ITIN.

Examples

Former first stimulus check rules:

Second stimulus check rules:

Former first and second stimulus check rules for military filers:

Wheres My Stimulus Check

There is, however, at least one benefit related to this thats already guaranteed for 2022.

If you add up all six child tax credit check amounts you got last year? You should have also gotten a tax credit for that same amount this year when you filed your federal taxes. That will represent the second half of your child tax credit. And, for now, that will be the end of the enhanced credit.

Theres always a chance the Senate could revisit the legislation supporting an extension of these checks. For the moment, though, that possibility seems highly unlikely.

Also Check: How Many Stimulus Checks In 2020

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income thats on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Most Americans Support Tax Increases On Corporations

To pay for another major stimulus bill, Democrats are proposing tax increases on corporations to cover the costs. While this measure is not supported by the Republican caucus and some more conservative Democrats, it holds wide support by the public.

The Center on Budget and Policy Priorities found in a new project that around 71% of the public support tax increases for major corporations. Across parities, support is over 50%, while Republicans show the least support with only 51%.

Don’t Miss: How Many Stimulus Checks So Far

Some Updated Info For Californians On Ssi Who Are Waiting For Their Golden State Grant Checks

It seems the California senate budget committee is aware of the federal foot-dragging to get stimulus money out to people on SSI. The feds seem to be also less than forthcoming when it comes to working with the California government to get the Golden State Grant out to California residents on SSI.

You can read a simple summary of the proposed bill below. Its at the end of the PDF.

How Did Government Stimulus Aid Impact Poverty In The United States

The US Census Bureau reported earlier this week, that the poverty rate had fallen to its lowest rate — 9.1% — in recent years. This is down from 11.8% in 2019.

Much of this decline was attributed to the sending of stimulus checks and federal programs to boost incomes for those left without work during the pandemic. These two measures helped to keep more than 11 million from falling into poverty.

Recommended Reading: Stimulus Checks For Seniors On Social Security

Rhode Island Stimulus Checks

Rhode Island families who qualify for a child tax rebate this year will receive $250 for each child who was 18 years old or younger at the end of 2021 up to a maximum of $750 . The state started sending payments on a rolling basis in October to residents who filed their 2021 Rhode Island tax return August 31, 2022. However, for people who file an extended tax return by October 17, 2022, checks will hit mailboxes in December.

If you’re married and filed a joint Rhode Island return for the 2021 tax year, you qualify for a rebate if your federal adjusted gross income can’t exceed $200,000. For everyone else, your federal AGI must be $100,000 or less.

Check out the Rhode Island Division of Taxation’s online tool if you want to see the status of your rebate.

For Rhode Island taxes in general, see the Rhode Island State Tax Guide.

Golden State Stimulus Check Eligibility Requirements:

– You must have filed your 2020 taxes

– You lived in California for more than half of the 2020 tax year

– You’re a California resident on the date the payment is issued

– You’re not eligible to be claimed as a dependent

– You are an individual taxpayer identification number filer who made $75,000 or less OR you are a California earned income tax credit recipient

But there is a deadline. You must file your 2020 tax returns by Oct. 15th, 2021.

According to the California Franchise Tax Board website, they’ve expedited the delivery of this stimulus payment.

If you’re eligible, you should receive the payment within 45 days of filing your taxes.

You May Like: Do We Get Another Stimulus Check This Month

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

Both the first and second stimulus check cannot be reduced to pay any federal or state debts. Unlike the first stimulus check, your second stimulus check cannot be reduced if you owe past-due child support payments and is protected from garnishment by creditors and debt collectors.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first and second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Other Benefits For California Residents

The budget contains a handful of additional measures to try to relieve inflationâs impact on residents:

- $1.95 billion for emergency rental assistance for qualified low-income tenants who requested assistance before March 31, 2022

- $1.4 billion in funds to help residents cover past-due utility bills

The budget also includes a $14.8 billion infrastructure and transportation package, as well as more than $200 million in additional funding that will go toward reproductive health care services.

Californiaâs 2022-2023 budget also provides universal access to health coverage for low-income residents aged 26 to 49, regardless of immigration status, becoming the first state to do so.

You May Like: How Much In Total Were The Stimulus Checks

Stimulus Checks: See If Your State Is Mailing Out Payments In November

Stimulus payments have been one of the hallmarks of the coronavirus pandemic, with the federal governments trillions of dollars capturing the biggest headlines. But states have been doling out payments as well. While much of the stimulus has already been dispersed, a number of states are still mailing out payments in November and beyond. Heres a quick overview of state stimulus payments that are still on the way.

Also Check: Wheres My Stimulus Payments

Why Is Your Refund Different Than You Expected

Errors or missing information

If your tax return had one or more errors, we may need to adjust your return leading to a different refund amount than you claimed on your return. We will send you a letter explaining the adjustments we made and how they affected your refund. If you have questions about the change, please call Customer Services.

Tax refund offsets – applying all or part of your refund toward eligible debts

- If you owe Virginia state taxes for any previous tax years, we will withhold all or part of your refund and apply it to your outstanding tax bills. We will send you a letter explaining the specific bills and how much of your refund was applied. If you have questions or think the refund was reduced in error, please contact us.

- If you owe money to Virginia local governments, courts, other state agencies, the IRS, or certain federal government agencies we will withhold all or part of your refund to help pay these debts. We will send you a letter with the name and contact information of the agency making the claim, and the amount of your refund applied to the debt. We do not have any information about these debts. If you think a claim was made in error or have any questions about the debt your refund was applied to, you’ll need call the agency that made the claim.

If you have a remaining refund balance after your debts are paid, we will send a check to the address on your most recent tax return. We cannot issue reduced refunds by direct deposit.

Read Also: Is There Another Round Of Stimulus Checks Coming Out

Other Problems With Your Payment

If you received payment and have a problem, follow these steps:

Where Is My Second Stimulus Check

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can request a trace of your stimulus check. You should only request a payment trace if you received IRS Notice 1444-B showing that your second stimulus check was issued or if your IRS account shows your payment amount and you havent received your second stimulus check.

Learn more about requesting a payment trace here.

Don’t Miss: Check On Status Of Stimulus Check

If You Did Not Qualify For The Atr

Under Indiana law, the $200 ATR eligibility requirements differ from the $125 ATR.

If you were not eligible for the $125 ATR, you would be eligible for the $200 ATR if you:

- receive Social Security benefits in 2022 and

- are not claimed as a dependent on someone elses tax return.

The General Assembly did not pass legislation proposing an affidavit to apply for the $200 ATR. No form is needed to receive this refund.

If you qualify for only the $200 ATR, you will not receive an additional taxpayer refund in 2022. Instead, you must file a 2022 Indiana resident tax return before Jan. 1, 2024, and claim the $200 ATR as a tax credit.

You must file a 2022 state tax return to claim the credit, even if you do not normally file a tax return due to your income.

Tax credits are not the same as tax deductions. Tax credits are applied dollar-for-dollar as an additional amount to your tax refund or used to reduce the amount of any tax you may owe. Eligible recipients will receive the $200 ATR in the form of a tax credit on their state income tax return.

Tax returns for 2022 will not be accepted until mid- to late-January 2023. You can find information on how to claim the $200 ATR as a credit on this page, in tax instruction booklets and on Form SC-40 by early 2023. In addition, many major tax software vendors are expected to include this information in their products.

Financial Burden Can Fall To Caretakers

Sydney Chandler manages the finances and healthcare of her cousin, Chris Batiste, who is paralyzed. Batiste breathes through an apparatus and communicates with Chandler through a laptop, blinks and head movements.

Chandler, who is a Los Angeles-based writer, said she was livid to learn that SSDI recipients were left out of the state stimulus. To her, it was just another obstacle in the arbitrary and bureaucratic maze that people with disabilities face in trying to attain a liveable income.

Caretakers often carry a significant financial burden. Batiste receives $975 per month in SSDI, and Chandler said she contributes over $1,000 more each month to help cover his rent and full-time nursing.

If it wasnt for me, he would be one of the homeless, Chandler said, and youre telling me that you couldnt set up a portal for SSDI to input their information?

This article is part of the California Divide, a collaboration among newsrooms examining income inequality and economic survival in California.

Recommended Reading: How To Apply For Stimulus Check Online

What Will The Portal Tell You

The Get My Payment tool will tell you:

- Payment method Note: mail means you may be issued an EIP Card or a check

If your payment status is not available, that means the IRS has not yet processed your payment, or you are not eligible for a payment.

If you get a message that says Need More Information, that means your payment was returned to the IRS because the post office was unable to deliver it. The IRS said people who got this message will eventually be able to use the tool to provide additional bank account information.

What More Do You Need To Know About The Golden Stimulus Checks

You might be asking the question that how can you qualify for the Golden State Stimulus checks.

You need to file your 2020 tax returns before the 15th of October and have a California AGI of $75,000 or less. If you had received a check for the first round of Golden State Stimulus, you would not get other checks unless you have dependents. You need to prove that you have been a resident of California for more than half of the 2020 tax year and a resident of the state when the payment is issued. You also need to avoid being claimed as a dependent by someone else.

You May Like: Is The Homeowners Stimulus Real

You May Like: What’s The Update On The 4th Stimulus Checks

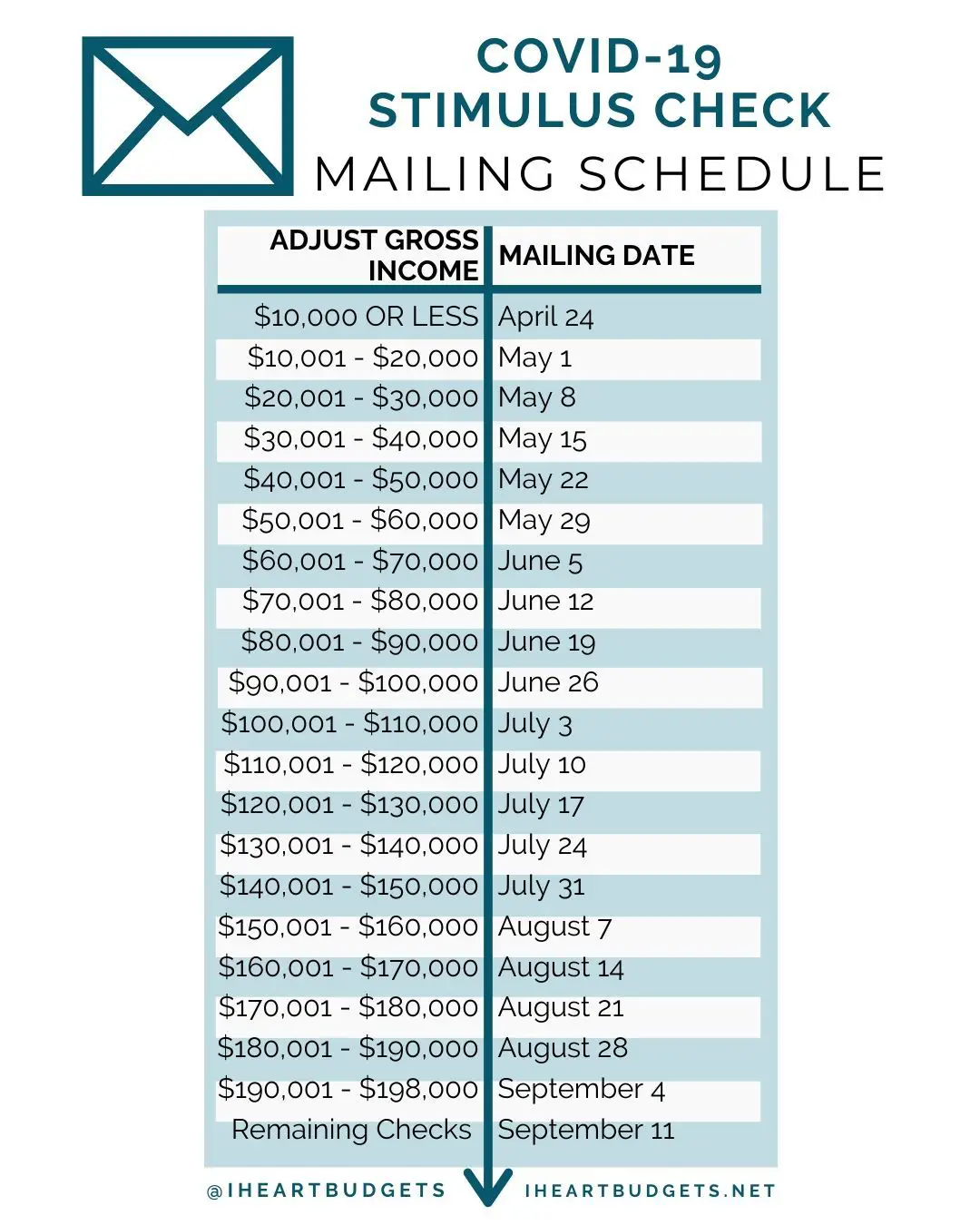

Second Stimulus Check: How You Can Track When Youll Get Your Payment

The $600 stimulus checks that are going out to millions of people can now be individually tracked through the IRSGet My Paymentwebsite, which reopened on Monday afternoon. The site informs people about the date of their payment and whether they will receive it via direct deposit or the mailed payment date.

Still, there are some glitches that are delaying the payments of the stimulus money and creating confusion and questions for consumers. Chief among them: Some people who had their 2020 tax returns filed through tax preparers like H& R Block may have had their stimulus check sent directly to the tax firm, rather than their bank account.

This echoes a glitch that impacted payment of the first stimulus check for some people who used tax prep services and for whom the IRS didnt have direct-deposit information. With the second round of stimulus checks, a similar issue may impact some people, with H& R Block warning its customers who used a service called a refund transfer that they might see an account number you dont recognize on the Get My Payment website. Refund transfers are offered to allow people to tap their refund to pay their tax prep fees, according to H& R Block.

As many as 13 million people may experience a delay in receiving their money after the IRS sent the funds to closed or invalid bank accounts, according to tax-prep company Jackson Hewitt.

Recommended Reading: Who Qualified For Third Stimulus Check