Summary For Ssi & Ssdi Recipients:

If you do not have any dependents, you will receive your payment automatically, and you do not need to do anything. If you are an SSI recipient and have qualifying dependent children under the age of 17, additional action is required at in order to receive the $500 per dependent payment.

Recommended Reading: South Carolina Stimulus Check 2021

What If Your Bank Account Is Negative For Stimulus Check

If your bank account is negative when the stimulus check is deposited, the funds from the check will be put towards your outstanding balance to bring your account back to a positive balance. Depending on your bank, they may hold the funds in your account and charge an overdraft fee, reject the deposit, or automatically transfer the funds to another linked account such as a savings account to pay off the negative balance.

It is important to contact your bank to understand their policy on negative bank balances and stimulus check deposits, and to make sure necessary funds are being transferred or held if needed.

How The Recovery Rebate Might Affect You

If you didnt receive all of the stimulus money you were entitled to receive in 2020, you may be eligible to claim the Recovery Rebate Credit when you file your tax returns. This gives you access to the stimulus money you missed out on last year.

However, the Recovery Rebate Credit is not a check, but a more traditional tax credit. It is a way of decreasing the amount of tax that you pay the government, which means that, in effect, you have more disposable income. If you claim the Recovery Rebate Credit, you will not get a check. The IRS just makes a note that you have paid too much tax. This refund can be used by the IRS to pay outstanding debts.

So if you are receiving a stimulus check, you can receive the full amount even if you owe taxes. But if you are applying for the Recovery Rebate Credit, this rebate will be used to pay off your tax debts. So if you have tax debts you might not see the cash.

Recommended Reading: How Much Was 2021 Stimulus Check

Your Third Stimulus Payment Cant Be Seized To Pay Child Support

Under the CARES Act from March 2020, your first stimulus check could be seized by state and federal agencies to cover past-due child support. That rule changed for the second stimulus check, which couldnât be taken if you owe money for child support. And like the second check, your third check cannot be taken to pay overdue child support.

According to the text of the bill, payments will not be subject to reduction or offset for past-due federal or state debts, or by other assessed federal taxes that would otherwise be subject to collection. However, if you end up having any money missing from your third check and have to claim it on your tax return next year, that money could be subject to garnishment . The best thing to do is to file your 2020 tax return as soon as possible, so the IRS has your most recent information on file.

People with children will benefit from other aspects of the bill outside of the third stimulus check. For example, updates to the Child Tax Credit increase the existing amount to as much as $3,600 per child. There are also some other tax breaks to take advantage of, including for child care.

How Can I Get My First Stimulus Check

For both stimulus payments, the government used tax information from 2018 or 2019 tax returns. If you did not file taxes in either year, and did not report income information on the IRS site to receive your first stimulus payment, you should claim your payments through the Recovery Rebate Credit on your 2020 taxes.

Read Also: Ssi Get Stimulus Check 2022

No Social Security Recipients Should Not Expect A 4th Stimulus Check

With inflation in America at an all-time high, seniors and others on a fixed income have been some of the hardest hit by the rising costs of groceries, utilities and fuel. In these tough financial times, many have been holding on to hope that a recent proposal to Congress calling for a new wave of $1,400 stimulus checks specifically for those receiving Social Security payments might be pushed through to the Presidents desk. However, it doesnt appear theres been any action by Congress to put forth legislation as of yet.

Looking To Diversify in a Bear Market? Consider These 6 Alternative Investments

The proposal was the initiative of Rick Delaney, chairman for The Senior Citizens League , who first addressed Congress about the idea in October 2021. As he shared in his letter to House and Senate representatives, as GOBankingRates previously reported, Delaneys rationale stated, We believe that a special stimulus for Social Security recipients could help defray the higher costs some would face if next years bumps them into a higher tax bracket, causing higher tax rates on their income and surcharges to their Medicare Part B premiums.

Website VERIFY reached out to the Internal Revenue Service, the federal department that issues the checks, to inquire about the status of a fourth round of the Economic Impact Statements. A spokesperson stated that, currently, There are no further stimulus payments authorized by law.

Read Also: I Never Got Any Of The Stimulus Checks

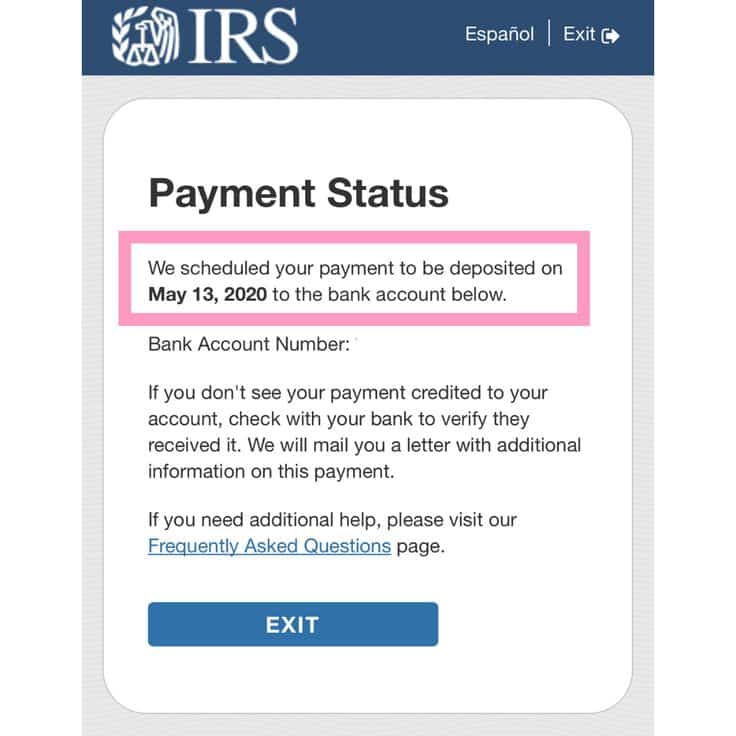

Where Is The Second Stimulus Check Irs

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. IRS EIP Notices: We mailed these notices to the address we have on file.

Don’t Miss: How To File For Stimulus With No Income

How To Keep That Check Safe

There are two ways to make sure that stimulus check reaches you and that you can use it for your needs. The first method is to redirect the payment to another bank account that you know is free of overdrafts and away from any bank where you have an account in arrears. The second is not to have it sent to a bank at all, but to wait the extra time out for a paper check. The first paper checks should be in the mailbox to people making up to $20,000 per year by May 1st, then those making up to $40,000 by May 15th, and so on in higher bands up to September 11th. A paper stimulus check mailed to you cannot be intercepted and thus will go right into whatever need you have for it.

Recommended Reading: How Much Was The 2nd Stimulus Check

Splurge On A Premium Card And Get Luxury Benefits

If youre ready to come out of isolation and start traveling again, you might consider using your stimulus check to pay for the annual fee on a luxury travel rewards card.

For example, The Platinum Card® from American Express offers benefits such as airport lounge access, complimentary elite status with Marriott and Hilton**, and access to luxury hotel perks through the Amex Fine Hotels & Resorts program.

You can use a portion of your stimulus money to pay for its annual fee of $695 , but you can receive much of it back in the form of statement credits. The Platinum Card offers up to $200 in annual airline incidental fee credits**, up to $200 in Uber Cash credits per year toward Uber rides and Uber Eats**, up to $100 in Saks Fifth Avenue credits each year**, and up to $100 credit toward a TSA PreCheck or Global Entry application or renewal fee .

Read Insiders guide to the best premium credit cards and read our comparison of the Amex Platinum and Chase Sapphire Reserve to find out which card is right for you.

Likewise, the Chase Sapphire Reserve® is a top-tier travel rewards card that includes Priority Pass airport lounge access, excellent travel insurance, and purchase protection. You can use your stimulus payment to cover its $550 annual fee, while receiving much of that back in statement credits.

You May Like: Get My Stimulus Payment 1400

What Will Happen To Your Stimulus Payment In Bankruptcy

A new law effective December 27, 2020, protects stimulus checks in bankruptcy. The Office of the U.S. Trustee has issued an opinion finding that the first three stimulus checks issued, along with tax and child credits, are not included in the bankruptcy estate. The new law clarifies that the trustee cannot include these funds for Chapter 7 means test qualification purposes or when evaluating a Chapter 13 plan payment amount.

There is a caveat, however. The law might not cover future stimulus payments under new stimulus laws, so be sure to discuss the current status with your bankruptcy lawyer.

Find out more about protecting your stimulus checks in bankruptcy. Also, consider learning how bankruptcy can help after a layoff or how to file for bankruptcy while quarantined during the coronavirus outbreak.

Can Debt Collectors Take My Stimulus Check

If you want to know if debt collectors can take your stimulus check, youre not alone. One in three adults or approximately 71 million Americans may not get their COVID-19 stimulus checks due to debt collections. If you owe money for spousal or child support, private student loans, credit cards, or medical bills, your CARES Act, COVID-19 stimulus check, may be at risk from debt collectors.

The CARES Act $2 trillion in stimulus money was intended to provide you with financial relief to help you recover from lost jobs, lost wages, or everything unexpected youve been impacted by during the COVID-19 pandemic. To be fair, the government took several steps to ensure there was some federal protection against bill collectors they knew would be attempting to get your stimulus check.

But the stimulus checks, debt collectors, and the laws are all squaring off against each other, so you may be wondering if you do owe a debt will you receive your stimulus check? Or will the debt collectors get their hands on it first? Read on and find out relevant information explained in detail below.

Don’t Miss: When Do The Stimulus Checks Go Out

Can The Government Take Stimulus Check

As for upcoming payments, under the terms of the American Rescue Plan,your $1,400 stimulus check cannot be garnished for unpaid federal or state debt. However, the money may be garnished for unpaid private debts, such as medical bills or credit card debts, provided they are subject to a court order.

Who Can Legally Take Your Stimulus Check Money

Government can withhold stimulus checks bill collectors cant ask for stimulus money to pay off old debt

CLEVELAND, Ohio â 19 News Investigative Reporter Hannah Catlett continues to field viewer questions about stimulus checks.

Do you really have the right to choose how to spend that money?

Turns out, the government is allowed under federal law to withhold some or all of someones stimulus check in some situations.

But, we discovered that debt collectors could get in trouble for settling up on an old bill right now.

Attorney General Dave Yost posted a video to Facebook, assuring people that they are protected from having to fork over their stimulus checks to pay off old debt.

I want you to know that under Ohio law, those payments are protected from bill collectors, he said. The money was meant for an emergency in a time like this.

He says the payments are meant to put food on the table and keep a roof over your familys head.

It wasnt meant to go pay off an old bill, Yost said.

His office wants to know if someone tells you otherwise.

In the event that somebody to nab your stimulus payment for an old debt, let us know. We might be able to help you, Yost said.

While that message is reassuring to most, there is one type of debt that can prevent someone from getting a check.

In fact, just like someones tax return can be taken to put towards back child support, the stimulus check can be intercepted too.

How can I make my child support payments during COVID19?

You May Like: Irs Find My Stimulus Check

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

What If My Stimulus Check Was Lost Destroyed Or Stolen

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund. The IRS will research what happened to your check if the check wasnt cashed, youll need to claim the Recovery Rebate Credit on your tax return. If the IRS finds that the check was cashed, youll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

If you received your stimulus check by mail but then it was destroyed or stolen, make sure you request a payment trace. If you claim the Recovery Rebate Credit on your tax return without filing a payment trace, it will be denied, because the IRS will think that you already received the money.

You May Like: Qualifications For 3rd Stimulus Check

Don’t Miss: Will We Be Getting Another Stimulus Check In 2022

Use It As A Lump Sum For A Mortgage Deposit

Depending on the type of loan you use, you may have to come up with cash or cash-equivalent deposit when you close your loan. If you dont have enough cash on hand to put towards a deposit, you can use your stimulus check as a down payment. If youre buying a home that needs minimal or no repairs, you can use your stimulus check towards a mortgage deposit. If youre buying a home that needs renovations, you can use your stimulus check to offset your mortgage deposit. Your 10% equity in the property may make you eligible for the governments Guaranteed Down Payment program. If you use your stimulus check to cover the deposit, you will want to make sure you have enough cash flow to make the mortgage payments each month.

How To Request Help From Your Credit Card Companies If Youve Been Impacted By The Coronavirus Pandemic

Missing a payment on your credit card or paying it late can result in fees or added interest, but it can also have a negative impact on your credit score. This is why its important to contact your credit card companies immediately if you know you cant pay your bill.

Here are important steps to requesting relief.

You May Like: When Will The Stimulus Checks Be Sent Out

Q How Do I Get Stimulus Money From Renters I Had To Evict

A. You cant, unless you already have a court order in place at their bank.

You have to have a court order in Georgia, Rackliffe said, an order from the court is what a bank is going to look for, because you cant just go to the bank and get money thats from somebody elses account. Clearly, that cant happen.

The garnishment laws on stimulus checks are complex. Some states protect stimulus checks from garnishment. Georgia allows private lenders to use the courts to seize stimulus checks from people with delinquent debt.

It depends on how much you owe, how long youve owed it, and what the court order says youve got to pay, Rackliffe explained. The issue of garnishment only comes about if you are behind. So if you but are current , and you are in good standing, then that is not a problem.

Generally, Professor Rackliffe said, a bank needs to see a court order before letting a private creditor into a debtors bank account to seize their stimulus check.

Can Debt Collectors Take Your Coronavirus Stimulus Payment

With 20.5 million Americans out of work due to coronavirus shutdowns, Congress passed the CARES Act, which gave many people a $1,200 stimulus to help them get by during tough times. As the COVID-19 pandemic drags on, many people are still struggling to pay regular bills those that are deeply in debt are in even worse shape. If this describes your situation, you may wonder if your creditors may swipe that stimulus check out from under you. Are debt collectors authorized to take your coronavirus stimulus payment to pay outstanding debts?

The short answer is maybe.

In this article, well explore situations where that may or may not be the case.

You May Like: Spectrum Stimulus Internet Credit Application