What Are The Income Limits For The $1400 Payments

The income limits for receiving the full $1,400 for single filers and heads of households, or $2,800 for married couples filing a joint return, are the same as they were for the first stimulus check and the second stimulus check. However, for people earning above these amounts, the checks would phase out at a much faster rate compared to the first two rounds.

What If I Dont Need To File A Tax Return And Didnt Get My Stimulus Check

If you are a nonfiler and would otherwise not be required to file a tax return, according to the IRS, you will need to file a Form 1040 or Form 1040-SR to claim stimulus payments if you are eligible in the form of a Recovery Rebate Credit.

No matter what your situation or how you want to file, TurboTax has you covered. With TurboTax you can do your taxes yourself, get help from an expert along the way or hand them off from start to finish to a dedicated tax expert.

When Will Those $1400 Stimulus Checks Go Out

Let’s not get ahead of ourselves — right now, Biden’s proposal is merely that. For those $1,400 payments to get the green light, lawmakers will have to approve Biden’s bill. However, now that Democrats have a majority in the Senate, that’s more likely to happen, and once it does, Americans could see their additional stimulus cash within weeks.

As was the case with the last round of $600 checks, those with direct deposit details on file with the IRS will get their money the soonest. Those who didn’t register bank account details will have to wait for either a paper check or debit card to arrive in the mail with their stimulus funds.

Biden has made a point of stating that he wants to send out additional aid to the public within his first 100 days of office. As such, there’s reason to believe he’ll be pushing for an early vote on his proposal to get that stimulus round out as quickly as possible.

Also Check: Do I Have To Claim Stimulus Check On 2021 Taxes

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Third Stimulus Check Calculator

President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person , plus an additional $1,400 for each dependent. However, as with the first- and second-round payments, the third-round stimulus checks were reduced or eliminated for people with an income above a certain amount.

If you didn’t receive a third stimulus check, or didn’t receive the full amount, you can get any money you’re entitled to by claiming the recovery rebate tax credit on your 2021 tax return. If you’re wondering if you qualify for the credit, comparing what you should have received to what you actually received is a good place to start .

To see how large your third stimulus payment should have been, answer the three questions in the calculator below and we’ll give you a customized estimate.

You May Like: When Was The 3rd Stimulus Check 2021

Ive Never Filed Taxes Before Can I Get The Third Stimulus Check

Yes, but youll need to file a 2020 tax return, even if youre not required to. You can use the IRS website to file for free as long as your income is less than $72,000, or you can use free tax filing software. The important thing is to file online instead of submitting a paper return. The IRS is facing an enormous backlog of mail due to COVID-19. Submitting by mail could add months to your wait time.

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

Also Check: Nc $500 Stimulus Check Update

Fact Check: Prisoners Also Got Relief Checks From The Pandemic Bills Trump Signed And Cotton Voted For

Arkansas Sen. Tom Cotton, a Republican, is attacking Democrats for passing a pandemic relief bill that will send money to prisoners.

Dzhokhar Tsarnaev, the Boston Bomber, murdered three people and terrorized a city. Hell be getting a $1,400 stimulus check as part of the Democrats COVID relief bill, Cotton tweeted on Saturday to his approximately 142,000 followers. Cotton, who voted against the bill, posted a near-identical message on Facebook to his 308,000 followers there.

Cotton tweeted a similar message about Dylann Roof, the perpetrator of a 2015 massacre at a renowned Black church in Charleston, South Carolina. Cotton also asked on Twitter: How will sending stimulus checks to murderers and rapists in prison help solve the pandemic?

Cotton complained again about prisoners getting checks during a Fox News appearance on Monday morning, saying this was a crazy Democratic idea.

Cottons attack on Democrats was echoed by North Carolina Rep. Madison Cawthorn on Twitter on Sunday. Fox News, meanwhile, turned Cottons tweets into an ominous headline on the front page of its website: FUNDING CONVICTED KILLERS. Democratic COVID bill gives mass murderers taxpayer money right out of your pocket.

But Cottons attack left out a highly relevant fact.

The IRS did not try to pull the same stunt with the second bill, said Kelly Dermody, a lawyer for the plaintiffs in the class-action lawsuit.

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for stimulus payments. This includes those without a permanent address, an income or bank account.

If you’re eligible and didn’t get a first, second or third Economic Impact Payment or got less than the full amounts, you may be eligible for a Recovery Rebate Credit, but you’ll need to file a tax return.

You May Like: Will There Be Another Stimulus Package

Im On Social Security And Dont Have To File A Tax Return Do I Have To Do Anything To Get My Check

No. If youre eligible based on the income threshold , you should qualify for a check. The IRS can get the information it needs to cut you a check from Social Security. If you receive Railroad Retirement, SSI, SSDI or VA benefits, the IRS can also get the information it needs from the appropriate agency to process your payment. No action should be required on your part.

What Ssi Ssdi And Veteran Beneficiaries Need To Know

The IRS began sending out stimulus checks for Social Security beneficiaries, including those who are part of the SSI and SSDI programs, on April 7. It began sending payments to people who receive veteran benefits and don’t typically file taxes on April 14. If you’re part of one of these groups and haven’t gotten your check yet, it may be on the way soon.

The Social Security Administration has also advised people not to contact the SSA about problems. It’s possible you may need to use one of the strategies above, depending on what the trouble is.

Don’t Miss: Who’s Eligible For The Third Stimulus Check

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Who Qualified For Stimulus Check 2021

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

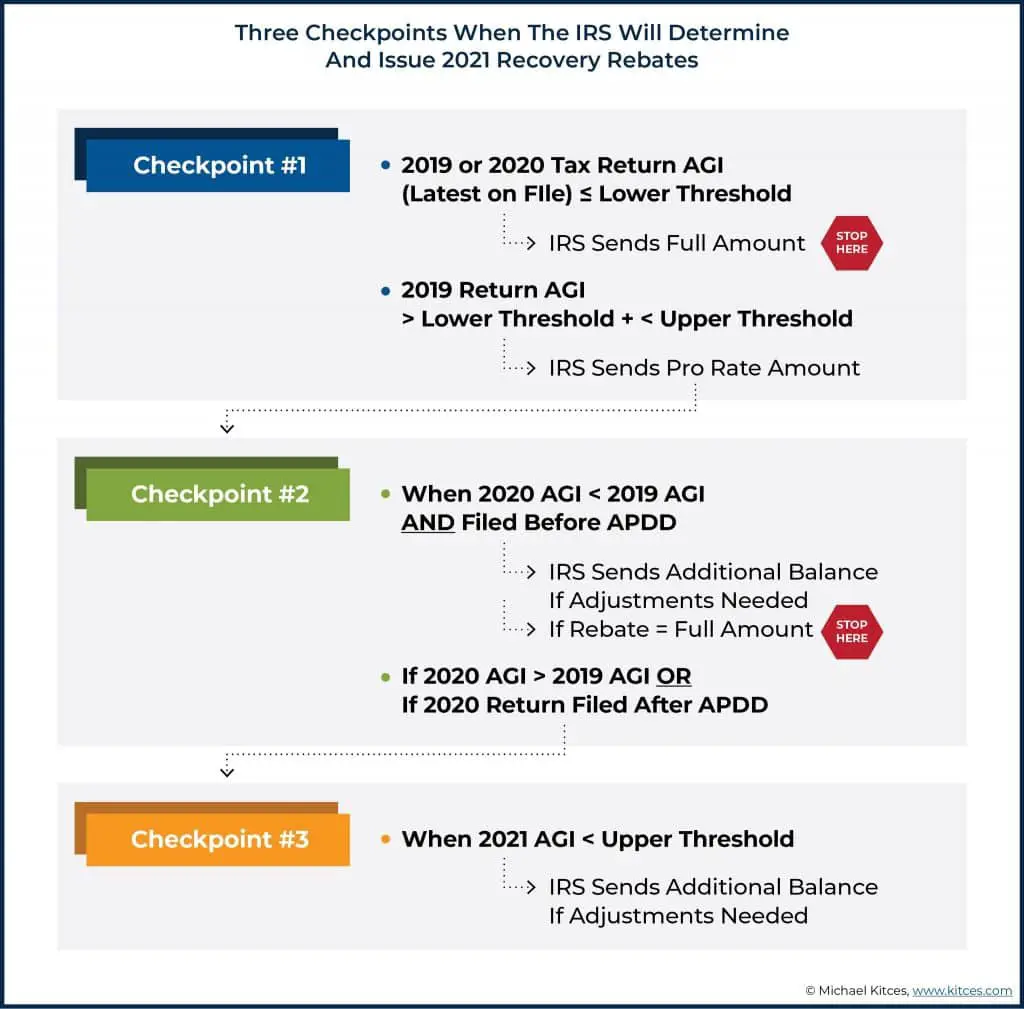

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that year’s income, number of dependents and other qualifying information.

How The Third Stimulus Check Became Law

The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Biden said at the signing of the bill: this historic legislation is about rebuilding the backbone of this country and giving people in this nation working people and middle-class folks, the people who built the country a fighting chance. Thats what the essence of it is.

House Democrats had moved the $1.9 trillion COVID-19 relief bill to Bidens desk with a 220-211 vote just one day earlier. But progressives in the party expressed concern over Senate amendments that excluded higher-earning taxpayers from getting a stimulus payment.

Biden agreed to narrow income level requirements as a concession to moderate Senate Democrats who wanted to cap payments for individual taxpayers at $80,000 and joint tax filers at $160,000.

The Senate bill narrowly passed with a 50-49 vote on March 6 after an overnight marathon of disputed amendments and negotiations. A 50-50 tie between both parties was avoided because Senator Dan Sullivan could not vote after returning to Alaska for a family funeral.

Read Also: H& r Block Stimulus Check

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

If You Miss Out This Year

If you receive no $1,400 payment or a reduced check, but your income changes, you may be able to claim the money you are due when you file your taxes next year.

“Any change, either a slight reduction in earnings or even just putting more money in a traditional IRA or a 401 could yield a much bigger total payment when they do their 2021 taxes,” said Garrett Watson, senior policy analyst at the Tax Foundation.

“There’s a subset of folks who will be in that situation,” Watson said.

That also goes for this year’s tax-filing season for people who missed out on the previous $1,200 or $600 payments. You can claim a recovery rebate credit to recoup any money you were possibly owed. This is also available to people who typically do not file tax returns because their income is too low.

Don’t Miss: Irs Stimulus Check Sign Up

Stimulus Check Update: $1400 Checks Now On The Table

by Maurie Backman |Updated July 25, 2021 – First published on Jan. 15, 2021

Image source: Getty Images

Here’s the latest on stimulus checks — including a brand-new proposal unveiled by President-elect Joe Biden.

Key points

- $1,400 checks would bring most Americans recent stimulus payouts to $2,000.

- More people would be eligible for stimulus checks.

- Nothing is certain as of yet. Legislation still needs to make its way to the Senate and the House, and then to the presidents desk.

- People with direct deposit details on file with the IRS would receive payments faster.

In late December, lawmakers passed a $900 billion coronavirus relief bill — the first measure of its kind to follow the CARES Act, which was signed into law in late March of 2020. Though Americans were no doubt relieved to see that December’s bill included a $600 stimulus check, many felt that that sum fell short — especially in light of the millions of people who are still out of work and who don’t have a savings account to tap during these difficult times.

President-elect Joe Biden made it clear from the start that he’d be looking to push through additional aid to help those impacted most financially during the pandemic. And on Jan. 14, he released the details of his new stimulus proposal.

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

You’re claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

Also Check: Check On Status Of Stimulus Check