Who Is Getting The 1400 Stimulus Checks

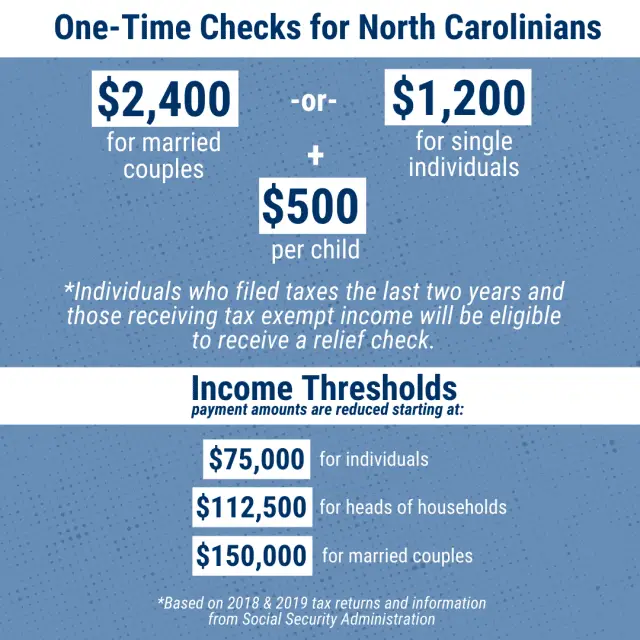

The $1,400 stimulus payments are a part of March’s $1.9 trillion package. Single filers earning up to $75,000 are eligible for $1,400, while couples filing jointly earning up to $150,000 can get $2,800. No payments are being sent to single filers earnings above $80,000, or couples earning jointly above $160,000.

I Am Not Typically Required To File A Tax Return Can I Still Receive My Payment

Yes. The IRS will use the information on the Form SSA-1099 or Form RRB-1099 to generate Economic Impact Payments to recipients of benefits reflected in the Form SSA-1099 or Form RRB-1099 who are not required to file a tax return and did not file a return for 2018 or 2019. This includes senior citizens, Social Security recipients and railroad retirees who are not otherwise required to file a tax return.

Since the IRS would not have information regarding any dependents for these people, each person would receive $1,200 per person, without the additional amount for any dependents at this time.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

Don’t Miss: I Did Not Receive Third Stimulus Check

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2022.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

Youre Unemployed Now But Your Previous Tax Returns Make You Ineligible

If you already filed your 2019 taxes and are ineligible because you made too much on them, but now are unemployed, youll probably reeling at the idea of not receiving aid in your time of need. Its frustrating, but there is a provision in the stimulus bill that will ensure you get a stimulus checkit just wont be immediate.

If your income suddenly drops this year due to unemployment, or much lower hours or gigs than you worked the year prior, youll be able to claim the stimulus on your 2020 tax return. That means youll have to wait until next year to receive it.

Thats not necessarily helpful for individuals who need cash now. If you need immediate financial assistance, some banks are offering financial assistance to customers experiencing financial hardship due to COVID-19, including payment arrangement programs, mortgage relief and more. Additionally, the Department of Education is suspending federal student loan payments, without interest, until the end of September.

These relief systems wont put money in your pocket now. But they could keep you afloat in the meantime while you search for a work from home job or gig, since most of the country is ordered to shelter in place right now, or successfully file for unemployment.

You May Like: Who Was Eligible For The Third Stimulus Check

Nonfilers: You May Need To File Your 2020 Tax Return This Year To Get The Right Stimulus Check Amount

With the second payment, the IRS used your 2019 tax returns to determine eligibility. Nonfilers, who werenât required to file a federal income tax return in 2018 or 2019, may still be eligible to receive the first stimulus check under the CARES Act. And this group will qualify again. Here are reasons you might not have been required to file:

- Youâre over 24, youâre not claimed as a dependent and your income is less than $12,200.

- Youâre married filing jointly and together your income is less than $24,400.

- You have no income.

- You receive federal benefits, such as Supplemental Security Income or Social Security Disability Insurance. See below for more on SSDI.

Looking For More Stimulus Information

Find out about Social Security stimulus checks or payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

Don’t Miss: Contact Irs About Stimulus Payment

Who Is Eligible For The Next Stimulus Checks

Who Is Eligible For The Next Stimulus Checks. The new stimulus check will begin to phase out after $75,000, per the new targeted stimulus plan. After the federal government sent three rounds of stimulus checks, many lawmakers and.

The maximum amount for the third round of stimulus checks will be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly. Who is not eligible for the next stimulus check? Most of the eligible adults have already received $3,200 so far:

Source: mortaltech.com

Who is not eligible for the next stimulus check? Eligibility for the third round of stimulus checks, issued earlier this year as part of president joe bidens american rescue plan, was based on a familys last tax return filed.

Source: theievoice.com

Some americans could claim a $1,400 stimulus check next year. However, if either spouse is active duty within the u.s.

Source: www.forbes.com

A $1,400 stimulus cheque for the majority of americans was passed by democrats when president joe biden assumed office.

It is unclear who will be eligible for the next round. For example, parents who welcomed a child in 2021 may be eligible for the $1,400 payments as long as they meet income requirements.

Source: lifemoneystuff.com

This means, if you had a baby. After the federal government sent three rounds of stimulus checks, many lawmakers and.

Stimulus Checks: Marriages And Divorce

Q. We got married in 2020 how does that affect the amount we will get?A. Filing as jointly married versus separate for 2020 wont change the total maximum stimulus amount and you wont have to repay any stimulus you already received. However, now that youre married, you should determine whether it makes more sense to file jointly or separately, and its possible that one spouse with a higher income could affect eligibility for the recovery rebate credit.

For example, lets say you and your spouse had AGI amounts of $35,000 and $105,000 respectively. As single filers, youd receive the full stimulus payment because your AGI of $35,000 is below the threshold, but your spouses AGI of $105,000 would be over the limit and wouldnt qualify for a stimulus payment. However, if you file jointly for 2020, your combined AGI of $140,000 is below the threshold for joint filers, so you could claim your spouses portion as the recovery rebate credit.

Those who get married in 2021 will have a similar situation when they file their 2021 return.

Q. How does a recent divorce affect my stimulus check?A. What if you were married and filed jointly on your tax return and have since become separated or divorced? If the IRS issued a payment based on a jointly filed return, you will allocate half of each payment to each spouse when you calculate your credit on your single status returns.

Don’t Miss: Filing 2020 Taxes For Stimulus Check

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Is Everyone Getting A Golden Stimulus Check

Millions of California residents became eligible for a Golden State stimulus check earlier this year when Gov. Gavin Newsom signed the California Comeback Plan into law. The $100 billion package ensured that two-thirds of adult residents could get the direct payment, but not everyone has received one yet.

Read Also: Any More Stimulus Checks Coming

Get My Payment Says Payment Issued But I Havent Received It

The IRS says that it may take three to four weeks to receive a check after its mailed. If it has been weeks since the Get My Payment tool says the payment was mailed, and you havent received it, you can request a payment trace. The IRS will research what happened to your check if the check wasnt cashed, you will need to claim the Recovery Rebate Credit on your next tax return. If the IRS finds that the check was cashed, youll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

Similarly, if the Get My Payment tool says your payment was direct-deposited, but the money doesnt show in your bank account after five days, first check with your bank. If the bank says it hasnt received a payment, you can request a payment trace.

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund.

How A Life Change Affects Your Stimulus Check/payment Eligibility

With the third stimulus check dispersal under way, millions have already received their third stimulus payments. But the more Americans get their checks, the more questions arise specifically about how life changes affect your stimulus payment.

The first, second and now third economic impact payment or stimulus payments can be paid in advance. Your eligibility and amount is based off your most recently filed tax return but what if that information is incorrect?

For example, what if you havent filed taxes yet but got married in July 2020? Or had a baby? What if youre dealing with the aftermath of a divorce or the recent death of a loved one? What if you already received your first and second stimulus checks, but it was for the wrong amount? What if you graduated from college in 2020 and arent a dependent anymore?

For the first and second stimulus payments, if your situation changed, youll claim the rest youre owed through the Recovery Rebate credit on your 2020 return. For the third , youll wait to claim the credit on your 2021 tax return.

The IRS understood the need to get stimulus payments out quickly. As a result, some taxpayers have found differences in the amount they should have received due to tax filing changes and income changes.

Below, well clear things up about who is eligible for a stimulus checks, payment, and the credit and how life changes affect your eligibility.

Read Also: Irs 1044 Form For Stimulus Check

Stimulus Payment Guidance For Internationals

STIMULUS PAYMENT ELIGIBILITY To be eligible for a stimulus payment, you must be a “U.S. person” there are also other eligibility issues regarding level of income, etc. Nonresident aliens are not eligible for stimulus payments. For more information on Economic Impact Payment eligibility, please see .

HOW TO DETERMINE U.S. TAX RESIDENCY An individual who is not a U.S. Citizen or Lawful Permanent Resident, , must take the substantial presence test each year to determine whether he or she is a resident alien for tax purposes or a nonresident alien for tax purposes. If you “pass” the substantial presence test, you are a resident alien for tax purposes. If you “do not pass” the substantial presence test, you are a nonresident alien for tax purposes. There is more information about how to determine U.S. tax residency at this link: .

INCOME TAX FILING REQUIREMENTS The federal income tax return filed by a U.S. person is Form 1040 the federal income tax return filed by a nonresident alien is either Form 1040-NR or Form 1040-NR-EZ. If a nonresident alien incorrectly filed Form 1040, thus presenting himself or herself to the IRS as a U.S. person, the IRS may send the nonresident alien an economic stimulus payment in error.

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

Recommended Reading: Will Social Security Get The Fourth Stimulus Check

Not Everyone Will Get A Third Stimulus Check See If Youre On The List Of People Who Arent Eligible For A Third

Millions of Americans have already received a third stimulus check . But if nothing has shown up in your bank account or mailbox yet, it might be because youâre not eligible for a third payment. Some people may have gotten the impression that everyone is entitled to a third stimulus check. Unfortunately, thatâs just not the case.

There are a few reasons why you could be left without a third stimulus check. It could be because of your income, age, immigration status, or some other disqualifying factor. Hereâs a list of people who wonât be getting a third stimulus check from Uncle Sam. Hopefully, youâre not on the list and youâll get a nice payment soon especially if youâre one of the millions of Americans struggling financially because of the COVID-19 pandemic.

1 of 7

How Will The Irs Know Where To Send My Payment

The vast majority of people do not need to take any action. The IRS will calculate and automatically send the economic impact payment to those eligible.

For people who have already filed their 2019 tax returns, the IRS will use this information to calculate the payment amount. For those who have not yet filed their return for 2019, the IRS will use information from their 2018 tax filing to calculate the payment. The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

You May Like: Get My Stimulus Payment Phone Number