Will There Be A Gas Stimulus In 2022

Under the Gas Rebate Act of 2022, individuals earning less than $75,000 a year would get the full $100, CNET reported. Individuals earning over $80,000 wouldnât be eligible for the rebate. Joint filers earning less than $150,000 would receive the full $100, while those earning $160,000 or more would not be eligible.

They Have A Lot Of Influence: Ex

The IRS has started sending letters to around nine million households nationwide reminding Americans who have not yet filed their tax returns this year that they could be eligible for $1,400 stimulus checks or even $2,800 checks for married couples.

Americans who havent yet claimed the third installment of stimulus payments that were sent out by virtue of the $1.9 trillion American Rescue Plan can still do so if they file a 2021 tax return.

The benefit would be applied to those who have yet to file their returns that were due this past April.

The plan, one of the first major pieces of legislation passed by the Democrat-controlled Congress and signed into law by President Joe Biden, included rental assistance, tax rebates, vaccine distribution funds, and direct payments to Americans who were struggling due to the coronavirus pandemic.

The federal government under the Trump administration began sending direct checks to Americans in the early days of the coronavirus pandemic, when state governors began mandating lockdowns and business closures to mitigate the spread of the virus.

Households should check their mailboxes for letters from the IRS, according to The Washington Post.

Americans can claim the third stimulus check even if they didnt have an income last year though there are income caps.

Those with an adjusted gross income which is gross income minus certain adjustments of $75,000 or less are eligible to get the full $1,400.

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

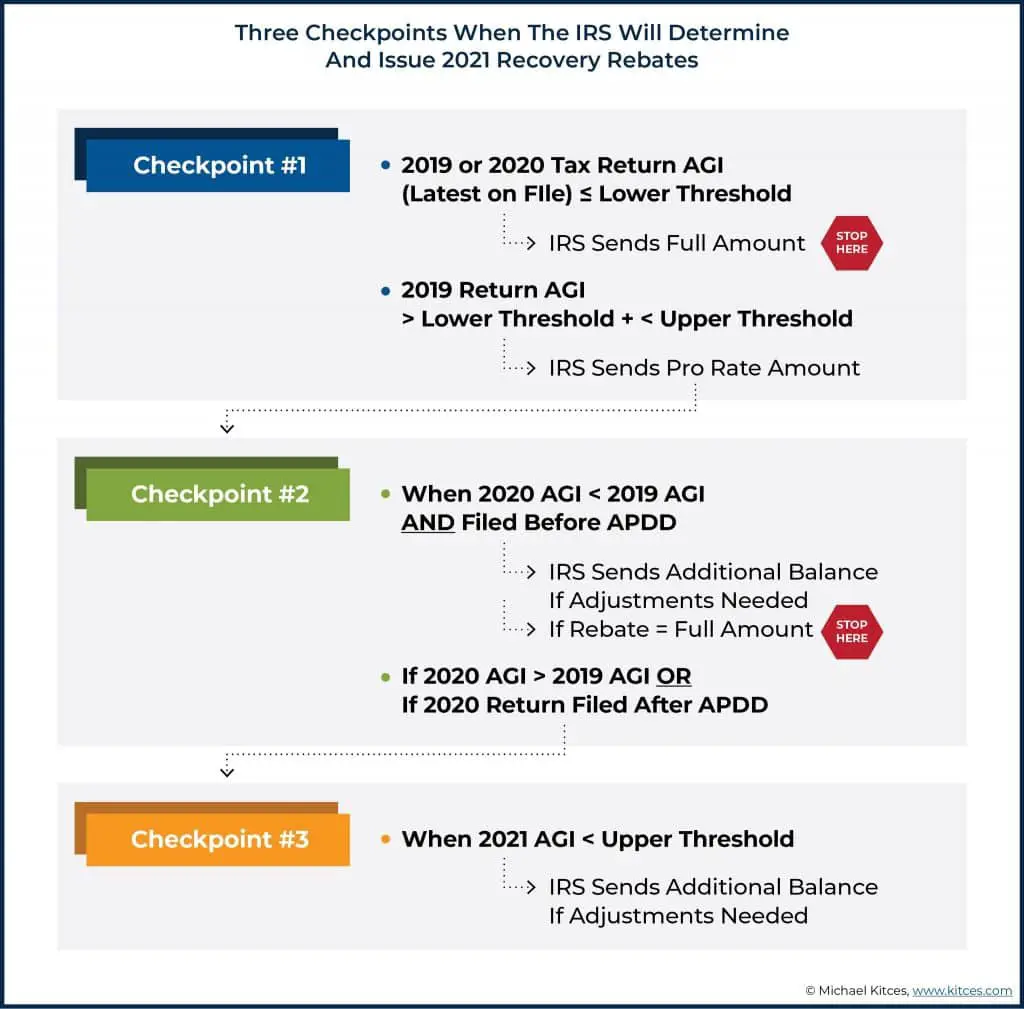

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that yearâs income, number of dependents and other qualifying information.

Don’t Miss: How Do I Get The First Stimulus Check

I Need Help With Rent

I need help with rent.

If you are behind on your rent and at risk of losing your home, apply at a state or local level for emergency rental assistance:

I lost my job.

Get an extra $300 per week andunemployment benefits extended until 9/6/21.

Find your states Unemployment Benefits and sign up:

Search Services By Location or call: 487-2365

Click to close

Are There Child Tax Credits For 2022

Even though you can still file a 2021 tax return by October 17, or November 15, to get your child tax credit , the enhanced 2021 child tax credit program has expired.

There is a chance that Congress could pass legislation to reinstate the enhanced child tax credit, but youll probably have to wait until after the to see if that happens.

Don’t Miss: What Stimulus Was Given In 2021

Important: Third Stimulus Check Qualification Details

The third stimulus checks now going out open up more avenues for people to claim a payment — so long as their yearly earnings in 2019 or 2020 fall within the brackets for receiving the third check. These new payments come with changes to the income limit for individuals and families who’d qualify for a full stimulus payment — it isn’t the same as it was for the first two rounds of checks approved in 2020. Check out the chart below for more and use our stimulus calculator to estimate how much you could get.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Recommended Reading: Irs.gov Stimulus Phone Number

What Qualifies Someone As An Adult Dependent

An important piece of the puzzle, the IRS has a five-part test for determining which adults can be claimed as dependents.

Adult children have to be older than age 17 but younger than 19 to be considered an adult dependent from a tax perspective. If an adult dependent is a full-time student for at least five months of the year, the individual has to be under the age of 24. Most of the time, they have to be related to the adult taxpayer whos claiming them and share the same permanent address. Perhaps even more important: Adult dependents can work a full-time job, as many college students or adult-aged children do, but they cannot have provided more than half of their own support to be considered a dependent. Elderly parents and adults with disabilities who a taxpayer cares for also count.

Where Is My Third Stimulus Check

You can track the status of your third stimulus check by using the IRS Get My Payment tool, available in English and Spanish. You can see whether your third stimulus check has been issued and whether your payment type is direct deposit or mail.

When you use the IRS Get My Payment tool, you will get one of the following messages:

Payment Status, which means:

- A payment has been processed. You will be shown a payment date and whether the payment type is direct deposit or mail or

- Youre eligible, but a payment has not been processed and a payment date is not available.

Payment Status Not Available, which means:

- Your payment has not been processed or

- Youre not eligible for a payment.

Need More Information, which means:

- Your payment was returned to the IRS because the post office was unable to deliver it. If this message is displayed, you will have a chance to enter your banking information and receive your payment as a direct deposit. Otherwise, you will need to update your address before the IRS can send you your payment.

Also Check: New Round Of Stimulus Check

Stimulus Checks: Who Exactly Qualifies For A Payout

Whats the eligibility status if one isnt a U.S. citizen or is currently living in a U.S. territory?

Roughly one hundred fifty-six million coronavirusstimulus checks worth $372 billion have already been sent out to cash-hungry Americans.

And many might believe that these much-needed cash payments are only reserved for American taxpayers residing in the United Statesso whats the eligibility status if one isnt a U.S. citizen or is currently living in a U.S. territory?

According to the Internal Revenue Service, it appears that any lawful permanent resident with a valid Social Security number who pays taxes in the United States is entitled to the stimulus check. These particular residents are individuals who are legally residing permanently in the country as an immigrant, and they are generally given an alien registration card, also known as a green card.

Keep in mind that it is possible, though, to be a qualifying resident alien without having a green card. The IRS says that this includes people who are physically present in the United States on at least thirty-one days during the current year, one hundred eighty-three days in the past three years, including the current year, and possess a Social Security number. They also cannot be claimed as a dependent by another taxpaying individual.

This all means that undocumented immigrants and immigrants who file their annual taxes with an Individual Taxpayer Identification Number are not eligible for the cash.

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

Youre claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

You May Like: Who Is Getting The New Stimulus Checks

How Do You Track Your Payments

You can check the status of your stimulus payment on IRS.gov using the Get My Payment tool. If you receive the notice Payment Status Not Available, it indicates one of the following situations:

- The IRS does not have enough information

- Your payment has not been processed yet

- Youre not eligible for a payment

If you believe you are eligible for a payment, check the Get My Payment tool over the coming weeks, as the IRS continues to process payments.

Are My Dependents Eligible With This Check

As a rule, dependents are not eligible for their own checks, but they do contribute to the total your household can receive. In many cases, it can multiple your family’s total.

In the third stimulus check, dependents of every age count toward $1,400. If you’re a parent of a baby born in 2020, you could be entitled to $1,100 if you never received the first two payments for your new dependent last year. You can also get $1,400 for a baby born in 2021. Note that if your household exceeds the strict income limits, you won’t receive any stimulus check money, even if you have dependents.

With the second stimulus check approved in December, each child dependent — age 16 and younger — added $600 each to the household payment. There was no cap on how many children you could claim a payment. That was an increase in the amount per child from the $500 that was part of the first check approved last March as part of the CARES Act, even as the per-adult maximum decreased from $1,200 per adult to $600 in the December stimulus plan.

The final qualifications for a third stimulus check have been settled.

Also Check: Are They Sending Out Stimulus Checks

Is There Anything I Need To Do To Get A Check

As Voxs Fabiola Cineas and Ella Nilsen explained after Congress passed its previous round of direct payments, most people dont need to do anything to get a stimulus check. If you filed taxes in 2019 or 2020, meet the eligibility requirements, and included your direct deposit information, the payment should show up in your account in the coming weeks.

If your direct deposit information isnt on file with the IRS yet, you can still provide those details using IRSs Get My Payment tool before the latest wave of payments starts going out.

Millions rely on Voxs journalism to understand the coronavirus crisis. We believe it pays off for all of us, as a society and a democracy, when our neighbors and fellow citizens can access clear, concise information on the pandemic. But our distinctive explanatory journalism is expensive. Support from our readers helps us keep it free for everyone. If you have already made a financial contribution to Vox, thank you. If not, please consider making a contribution today from as little as $3.

Stimulus Checks: Children And Dependents

Q. I had a baby in late 2020. Am I eligible for the child stimulus payments?A. If you had a baby in 2020, you are eligible for the $1,400 credit in 2021. This will be paid in an advance third stimulus payment if you filed your 2020 return by the time the payments were issued. If you didnt receive the first or second stimulus payment for your baby, you can claim the recovery rebate credit when you claim the child on your 2020 return.

Q. I have joint custody of my daughter with my ex-spouse, and I claimed her on my 2019 taxes . What do we need to know when my husband claims her?A. For the first and second payments, the spouse claiming the child in 2020 will claim the children and could receive the recovery rebate credit on the 2020 return.

However, for the third payment, divorced parents who alternate claiming their dependents each year, if an advance payment is received by one spouse for the dependent, no additional payment can be made for the same dependent on the other spouses return.

For example, if the payment is issued to Parent 1 because they claimed the child on their 2020 return, Parent 2 cannot claim the credit on their 2021 return even though they didnt receive the payment from Parent 1.

The second way is claiming the Recovery Rebate credit on your 2020 taxes, which you can do for the first or second payments. Youll receive the correct amount in the form of a tax credit that either lowers your tax bill or gets added to your refund.

Also Check: How Much Was Last Stimulus Check

Social Security Ssi Ssdi Veterans: What You Need To Know About Eligibility And Your Stimulus Payment

The majority of people who are part of the SSI or SSDI programs qualify for a check — read our guide for details. This time, many will get their payments on their existing Direct Express card, though some may receive stimulus money a different way. Consult our guide for more on what to know and do, including if you need to claim a dependent by filing a tax return for 2020.

Stimulus money for veterans who don’t usually file taxes are expected to receive their stimulus checks in mid-April, after many Social Security recipients. Here’s more to know about veterans and stimulus eligibility.

Recipients of the first check received their payments through a non-Direct Express bank account or as a paper check sent in the mail. In the , these recipients again qualified to receive payments, along with Railroad Retirement Board and Veterans Administration beneficiaries.

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

Recommended Reading: News About The Stimulus Check

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Nonfilers: You May Need To File Your 2020 Tax Return This Year To Get The Right Stimulus Check Amount

With the second payment, the IRS used your 2019 tax returns to determine eligibility. Nonfilers, who weren’t required to file a federal income tax return in 2018 or 2019, may still be eligible to receive the first stimulus check under the CARES Act. And this group will qualify again. Here are reasons you might not have been required to file:

- You’re over 24, you’re not claimed as a dependent and your income is less than $12,200.

- You’re married filing jointly and together your income is less than $24,400.

- You have no income.

- You receive federal benefits, such as Supplemental Security Income or Social Security Disability Insurance. See below for more on SSDI.

Read Also: Who Qualify For Third Stimulus Check