How Much Money Will I Get

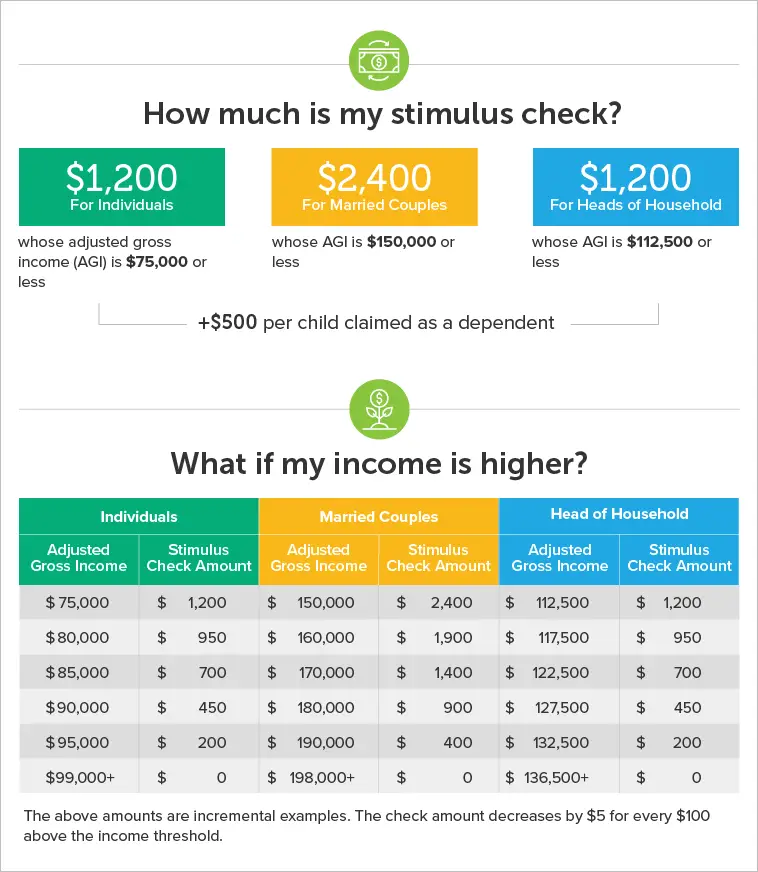

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

You May Like: Veterans To Receive Stimulus Payment

What If My Stimulus Check Was Lost Stolen Or Destroyed

If your payment was direct deposited, first check with your bank, payment app, or debit card company to make sure they didnt receive it.

You can request a trace of your stimulus check to determine if your payment was cashed. Only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check.

How to start a payment trace: You can mail or fax Form 3911 to the IRS or call 800-829-1954. Click here for specific instructions on how to complete Form 3911 for tracking your first stimulus check.

If the IRS discovers that your check was not cashed, your check will be reversed. You can now claim the payment.

If the IRS discovers that your check was cashed, the Treasury Department will send you a claim package with instructions. Upon review of your claim, the Treasury Department will determine if the check can be reversed. If the check is reversed, you can now claim the payment.

If the check is not reversed, contact the tax preparer who filed your return. If you are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

It can take up to 6 weeks to receive a response from the IRS.

If I Still Need To File My 2018 And 2019 Taxes Can I Still Receive The Economic Impact Payment

Yes. The IRS urges anyone with a tax filing obligation and who hasnt yet filed a tax return for 2018 or 2019, to file as soon as they can to receive an Economic Impact Payment. When you file your taxes, include your direct deposit information on the return so that the IRS can send you your payment quickly.

If you are required to file a tax return, there may be free or low-cost options for filing your return. If you need someone to help you to file, its important to choose a reputable tax preparer that will file an accurate return. Mistakes could result in additional costs and complications in the future.

If your 2019 adjusted gross income was less than $69,000, you may be able to find one or more online tools to file your taxes for free. Review each companys offer to make sure you qualify for a free federal return. Some companies offer free state tax returns, but others may charge a fee.

Keep in mind that the IRS has extended the deadline for filing your 2019 taxes until July 15, 2020. If you are concerned about visiting a tax professional or local community organization in person to get help with your tax return, the IRS indicates the Economic Impact Payments will be available throughout the rest of 2020.

Dont Miss: Who Qualify For Third Stimulus Check

Read Also: Is There Another Stimulus Check Coming In 2021

How Do You Track Your Payments

You can check the status of your stimulus payment on IRS.gov using the Get My Payment tool. If you receive the notice Payment Status Not Available, it indicates one of the following situations:

- The IRS does not have enough information

- Your payment has not been processed yet

- Youre not eligible for a payment

If you believe you are eligible for a payment, check the Get My Payment tool over the coming weeks, as the IRS continues to process payments.

Im Not Typically Required To File Taxes Can I Still Receive The Economic Impact Payment

Yes, but you will need to visit IRS.gov and then click on Non-Filers: Enter Payment Info Here. If you didnt file a tax return in 2018 or 2019, this web portal allows you to submit basic personal information to the IRS so that you can receive payments. To receive your payment quickly, enter your account information so that your payment will be directly deposited in your bank or credit union account or prepaid card.

The tool will request the following basic information to check your eligibility, calculate and send the Economic Impact Payments:

- Full names and Social Security numbers, including for spouse and dependents

- Mailing address

- Bank account type, account and routing numbers

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

Recommended Reading: Social Security Stimulus Checks 2022

My Small Business Needs Help

My small business needs help.

The Treasury Department is providing critical assistance to small businesses across the country.

* How to file your taxes with the IRS: Visit IRS.gov for general filing information. Havent filed your taxes? Heres information for non-filers. If your income is less than $72,000 you may be eligible to file your taxes for free, or call 829-1040.

Who Qualifies For The $600 Stimulus Check

Americans who earned less than $75,000 in 2019 will qualify for the $600 check. The benefit amount is reduced for those who earned more than $75,000 in 2019, while people who earned more than $99,000 in 2019 will not qualify.

Children are also eligible for the $600 stimulus check, which is more than the $500 they received earlier this year, meaning a family of four could receive $2,400, for example. However, adult dependents are not expected to qualify for the stimulus checks.

Additionally, there is no limit on the amount of money that a single household could receive.

Families that include a parent who is not a U.S. citizen would qualify, though undocumented immigrants themselves would not.

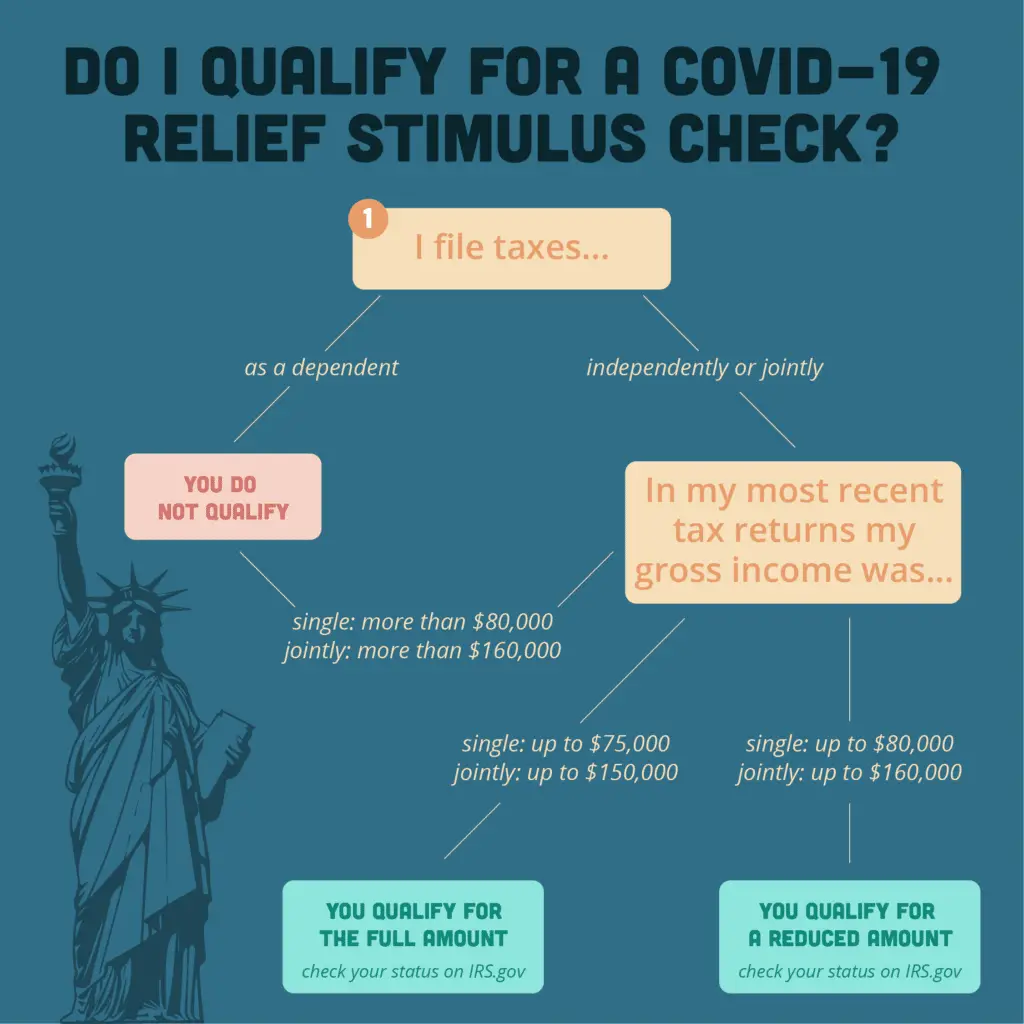

Some college students will qualify for the $600 stimulus check, but they have to meet certain criteria, such as being an eligible taxpayer and not being claimed on a tax return as a dependent. Generally, if an individual supports more than half of their costs themselves, they cannot be claimed as a dependent.

On Sunday, Senate Majority Leader Mitch McConnell tweeted: “As the American people continue battling the coronavirus this holiday season, they will not be on their own.

“Congress has just reached an agreement. We will pass another rescue package ASAP. More help is on the way.”

Don’t Miss: Are Stimulus Checks Part Of The Cares Act

If You Provided Information Using The Irs Non

If you provided your personal information to the IRS using the non-filers portal, your money will be direct deposited into the bank or credit union account or prepaid card that you provided when you submitted your information. If you did not provide payment account information, a check will be mailed to you to the address you provided.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, including if you havent received the payment.

Was There A 3rd Stimulus Check

The vast majority of the third stimulus payments were automatically delivered to taxpayers’ bank accounts or via a check in the mail last spring. The payments were authorized by the American Rescue Plan in March 2021 and were meant to help people struggling financially because of the Covid-19 pandemic.

You May Like: Stimulus Check 1 And 2

How Will I Receive My Stimulus Check

If you filed a tax return for tax year 2019 or 2018 or used the 2020 IRS Non-filer portal, the IRS used your information to determine the amount of your payment and delivered it using the direct deposit information , or mailing address you provided. Social Security recipients, railroad retirees, and SSDI, SSI, and VA beneficiaries were sent the payment using the information the Social Security Administration currently has on file.

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Don’t Miss: Stimulus Checks Status Phone Number

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

I Got My Stimulus Check On A Debit Card And Lost It Or Threw It Out How Can I Get A New One

You can request a replacement by calling 800-240-8100. Select option 2 from the main menu. Your card will arrive in a plain envelope which displays the U.S. Treasury seal and Economic Impact Payment Card in the return address. It will be issued by Meta Bank, N.A. The envelope will include instructions to activate the card, information on fees, and a note from the U.S. Treasury.

You May Like: Filing For Stimulus Check 2021

What Can I Do If The Amount Of My Stimulus Payment Is Wrong

If you didnt get the additional $500 for your children or didnt get the full payment amount that you expected based on your eligibility, you can get the additional amount by filing a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, and didnt get the first stimulus check or the full amount you are eligible for, you will also have to file a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

There’s Still Time To Claim

There is some good news: There’s still time for people who missed out on their stimulus checks to claim them, the report noted.

“Individuals with little or no income, and therefore not required to pay taxes, have until November 15 to complete a simplified tax return to get their payments,” the GAO said.

There’s also still time for people to claim the expanded Child Tax Credit, which was provided last year to eligible families. That credit provided as much as $3,600 to families with children under 17, but parents who didn’t receive the payments last year have only until November 15 to claim them.

To claim a missing stimulus payment, people should go to the IRS website for “Economic Impact Payments,” the official name for the program, and follow the instructions there. You’ll have to file a simplified tax return to receive the money.

Parents who still have missing Child Tax Credits from 2021 can go to the GetCTC.org website to claim them.

However, people who are required to file taxes due to their income and who missed the April 15 tax filing deadline have until October 17 to claim the payments, the GAO said. October 17 is the deadline for filing 2021 tax returns if you requested an extension from the IRS.

Also Check: How Much Was Last Stimulus Check

Will There Be A Gas Stimulus In 2022

Under the Gas Rebate Act of 2022, individuals earning less than $75,000 a year would get the full $100, CNET reported. Individuals earning over $80,000 wouldn’t be eligible for the rebate. Joint filers earning less than $150,000 would receive the full $100, while those earning $160,000 or more would not be eligible.

When Will I Get The Stimulus Check

All first stimulus checks were issued by December 31, 2020. If you are missing your stimulus check or didnt get the full amount that you are eligible for, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Recommended Reading: First Second And Third Stimulus Checks

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that yearâs income, number of dependents and other qualifying information.

Which States Are Sending New Stimulus Checks

California announced the Golden Gate Stimulus deal, which will provide a payment to 5.7 million people. The aid is already being distributed. Taxpayers earning between $30,000 and $75,000 per year will receive one-time payments of $600. Households with dependents will receive an additional $500.

New Mexico has issued payments to low-income households, who for whatever reason didn’t receive the first three rounds of stimulus checks. There will be one-time payments of $750 per household.

In Texas, some local school districts are providing their employees with stimulus checks in the form of retention bonuses.

In Maryland, taxpayers with qualifying income could receive up to $500. Income caps vary from $21,710$56,844. In Colorado, anyone who receives unemployment benefits between March and October 2020 automatically received a one-time payment of $375.

Through its unique offer, Vermont is trying to lure people to move to the state. It will reimburse people up to $7,500 for qualifying moving expenses if you’re ready to work in certain industries.

In Georgia, Florida, Tennessee, Texas, and Colorado, teachers will be receiving a lot of stimulus money. As part of the American Rescue Plan, state and local governments have received $350 billion in assistance. Most of this aid will go to schools, which will pay their teachers and other school staff a bonus of up to $1,000. In Minnesota, grocery store workers and medical center staffers received bonus checks.

You May Like: What To Do If You Didn’t Receive Your Stimulus Check

What Is The Stimulus Check

As part of several different COVID-19 relief packages, the federal government issued three payments – by check or direct deposit to millions of income-qualified Americans. This is what we mean by stimulus check or stimulus payment. The purpose of the payments was to help people cover basic needs when many people were told to stay home and lost income because of the pandemic.

An Expansion To The Child Tax Credit Means Millions Could Get Even More Money

One way families will get even more stimulus money is through a temporary expansion of the 2020 child tax credit. Age is critical here: The new CTC rules bring the credit up to $3,600 per child under age 6, and $3,000 per child between age 6 and 17 for qualifying families.

Payments will begin phasing out for individuals who make more than $75,000 and married couples who make more than $150,000. Payments will occur periodically from July through December 2021. Hereâs what to know about child tax credit qualifications, who is a qualified dependent for the CTC and what parents with shared custody should know.

Stimulus checks and the child tax credit aim to help lift kids out of poverty.

Don’t Miss: Track My Golden State Stimulus 2

Are You Entitled To A $1400 Check In 2022

The American Rescue Plan Act authorized payments of $1,400 per adult and $1,400 per dependent. President Joe Biden signed the Act into law at the end of March and the vast majority of Americans have already received the full amount of stimulus money due.

However, people who had a baby or otherwise added a new dependent may not have received all the money that they were supposed to get this year. The problem is, the IRS determined how many dependents were entitled to the $1,400 payments by reviewing past tax returns. And if you added a dependent only in 2021, then this information would not have been available to the IRS when your payment was calculated.

If you missed out on a payment for any new dependents you added in 2021, you can claim $1,400 per dependent in 2022. So, for example, if you added twin babies to your family this year, you would be entitled to $2,800 for them. You’ll simply have to claim the money by filing a tax return. The payments that were sent out were an advance on a tax credit, so the tax credit should be available to you when you file your 1040 form with the IRS for 2021.

The IRS will begin accepting tax returns in late January of 2022, so the sooner you file your return for 2021, the faster you can get the $1,400 payment that you’re owed.