Here’s How To Claim The Payment On Your Tax Return

Those who believe they are due more money must file a 2021 tax return, even if they don’t usually file taxes, and claim what’s called the Recovery Rebate Credit. If a taxpayer is eligible for more money, it will either reduce any tax the person owes for 2021 or be included in a tax refund.

In order to claim the Recovery Rebate Credit, a taxpayer will need information that was sent in a letter from the IRS in the past couple of months. Known as Letter 6475, it confirms whether a taxpayer was sent a third stimulus payment and the amount. Alternatively, that information can be obtained by accessing your IRS online account.

For most taxpayers, the federal tax return filing deadline is April 18, though it’s a day later for residents of Maine and Massachusetts. Taxpayers having difficulty meeting the deadline can file for an automatic six-month extension by using Form 4868.

I Think I’m Eligible What Do I Need To Do To Get A Stimulus Check

Nothing. The first two rounds were issued automatically, and the third will be, as well.

The fastest way to get your stimulus check is via direct deposit. Without that information, the IRS will mail you either a debit card or paper check. You can track your money using the IRS Get My Payment tool.

If you believe you qualify for the third stimulus check but don’t receive one â or you believe it’s in the wrong amount â there are options. Either the IRS will send you the money you deserve after you file your 2020 taxes or you’ll be able to claim the Recovery Rebate Credit on your 2021 return, according to The Wall Street Journal.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

You May Like: Irs Fourth Stimulus Checks Update

What Are The Basic Requirements To Obtain A Third Stimulus Check

Bidens stimulus bill could pass the House of Representatives this week, however, there are still questions about eligibility for the third stimulus check.

President Joe Biden has promised a third $1,400 stimulus check that could be approved as early as this week by the House of Representatives. Nancy Pelosi confirmed on Feb. 18 that the House will vote on Bidens $1.9 billion stimulus bill by the end of February and then send the package to the Senate and finally to the president for his signature.

The third round of stimulus checks is not the only urgency. Federal unemployment benefits expire on March 14 and Democrats have expressed that the bill must be signed before the benefits expire.

Democrats are using a legislative tool called budget reconciliation that would remove barriers Republicans could use to delay the vote. With Congress fast-tracking the new law, the Internal Revenue Service could begin sending out third stimulus check payments as soon as the second or third week of March, however, the date could still be in jeopardy.

In the meantime, millions of Americans continue to wait for their first and second stimulus check payments that were approved in 2020. Tax season is in full swing and in case you never received your check you will be able to claim that missing money as a tax credit when you file your 2020 return.

Stimulus Check Qualifications: Find Out If You’re Eligible For $1400 Or More

The rules aren’t the same for who qualifies for a third stimulus check this time around. Here’s how to find out if you’re eligible to receive the $1,400 payment.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Associate Producer

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

The third stimulus checks are hitting the 130 million mark by direct deposit and as paper checks and EIP cards. A third wave of checks is ramping up for this weekend and next week. If your check for up to $1,400 per household member hasn’t come yet, it’s a good idea to triple-check your eligibility. If you do, here’s how to track your payment and what to do if there’s a problem with your check.

The requirements for the third payment have changed significantly from the first and second checks. For example, there are new income limits and rules for age, citizenship and tax status that can affect the size of your payment. We’ll walk you through what those qualifications are to help you determine whether you should expect a check — or whether you’ll be completely left out.

Recommended Reading: How Are Stimulus Checks Distributed

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

What About Partial Payments

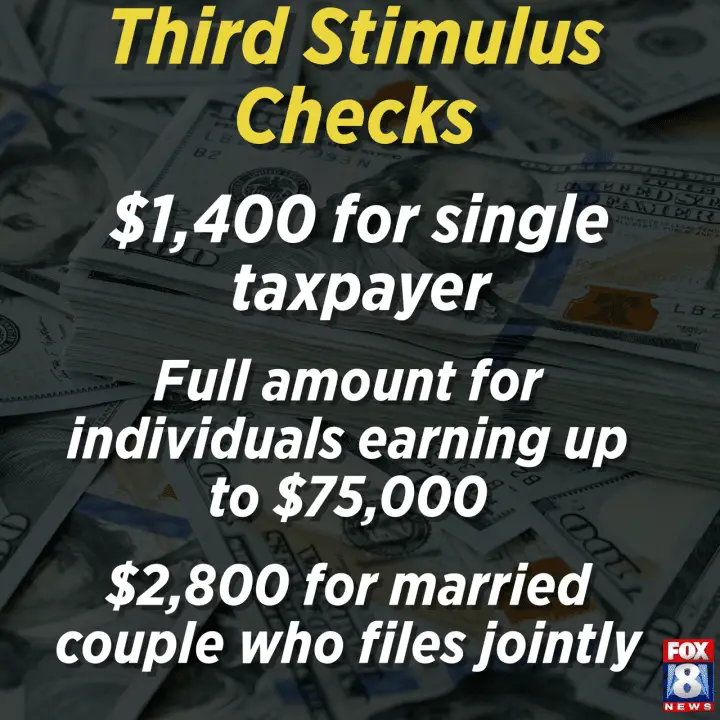

In this round of stimulus payments, partial payments will be available for those just slightly above the limits. Brummond says, “Taxpayers above these thresholds may receive a partial payment if they have an AGI of less than $80,000 for a single filer, less than $160,000 for married filing jointly, or less than $120,000 for head-of-households.”

Also Check: Irs.gov Stimulus Check Deceased Person

Looking For More Stimulus Information

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

How To Lower Your Adjusted Gross Income For 2020 Now

Your AGI is taxable income minus selected deductions.

One way to lower your AGI is by contributing to a traditional individual retirement account , says Harvey Bezozi, a certified public accountant and founder of YourFinancialWizard.com. You can contribute to your IRA for 2020 by April 15, 2021 . For 2020, you can contribute up to $6,000 to your IRA, or $7,000 if youre 50 or older.

If you haven’t already filed your 2020 return, the law includes a look-back provision that will capture your 2020 income after you file. This “additional payment determination date will fall either 90 days after the tax filing deadline or Sept. 1. If you receive a lower payment or no payment based on your 2019 return, but are eligible for more money based on your 2020 return, you may get what you’re owed through this process, says Garrett Watson, a senior policy analyst at the Tax Foundation.

Here’s where lowering your taxable income now could make sense: Say you made $80,000 in 2020, but contribute $6,000 to traditional IRA, your AGI would fall to $74,000, making you eligible for a full stimulus payment, Bezozi says.

Keep in mind that Roth IRAs are not deductible, since theyre funded by after-tax dollars, so contributing to one now wont lower your AGI. And contributions to 401s typically need to be made by the end of the year.

Don’t Miss: Are We Getting More Stimulus Money

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Read Also: New Home Purchase Stimulus Program

Dependent Eligibility For Stimulus Checks Keeps Changing

The American Rescue Plan for single filers to receive $1,400 and joint filers to receive $2,800, if they meet certain income requirements. They also get “$1,400 multiplied by the number of dependents of the taxpayer.”

This was a departure from previous stimulus checks.

The first round of payments, passed as part of the March 2020 CARES Act, provided taxpayers with $1,200 plus $500 per qualifying child. That category included any “child, stepchild, eligible foster child, sibling, half sibling, step sibling” or descendant claimed as a dependent. But there was an age limit. They had to be “younger than 17 at the end of the 2019 tax year.”

The second round of payments, approved in late December, provided $600 for single filers plus $600 per qualifying child. Again, dependents over 17 didn’t qualify.

The rules boxed out millions from aid. Parents can generally claim kids who live with them half of the year, students between 19 and 24, children with disabilities, and certain relatives for whom they provide financial support. But these dependents didn’t qualify for the stimulus checks, leading to outcry among families. Some high school seniors didn’t even make the cut.

The American Rescue Plan, though, nixed the age restriction. Kids and students as well as adult dependents like parents and grandparents were all included.

Imagine a family of three. Mom and Dad qualify for the full payment, as does their 20-year-old dependent daughter in college.

Which Dependents Qualify For A Stimulus Check

Unlike the first and second round of checks, payments for dependents in the third round are not restricted to only children under 17.

According to the IRS website: “Eligible families will get a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.”

You May Like: What’s The Update On The 4th Stimulus Checks

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

Older Adults And Third Stimulus Checks: Eligibility Rules And What They Mean For You

The IRS continues to send batches of the third stimulus check. If you’re 65 or older, here’s what to know about qualifications, income, SSI, SSDI and retirement, and what to do if you’re still missing stimulus money from the first two checks.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

The IRS is in the middle of sending the next wave of third stimulus payments to those who are eligible for the payment. And if you’re age 65 or older, you receive Social Security benefits or you’re a veteran, you will likely receive a $1,400 check . It may be different, however, for individuals with “high” income levels from investments or other sources.

The total amount of this third check also depends on how many dependents you’re claiming this year , or if you’re claimed as a dependent on someone else’s taxes. Tax season may also be a deciding factor this time if you filed a tax return in early 2021 and it’s already been processed by the IRS.

You May Like: When Will South Carolina Receive Stimulus Checks

Who Is Eligible For This Stimulus

While each adult and dependent will receive a $1400 check this round, unlike the previous stimulus payments where dependents only qualified for $500 and $600 respectively, the income limits for this round of stimulus payments are stricter than the previous one. Kari Brummond, a tax preparer and financial writer for TaxDebtHelp, says, “To qualify for the full payment, individuals must have an adjusted gross income of $75,000 or less, while couples filing jointly need an AGI of $150,000 or less and head-of-households need an AGI of $112,500 or less.”

How Is Your Income Calculated For The Stimulus Payments

The IRS will use the AGI on your most recent processed tax return on file. While 55.7 million Americans have already filed their taxes for 2020, millions still havent filedand the IRS is also significantly behind on processing tax returns.

The IRS will use your 2020 tax return if it has been processed by the date they submit your check. If your 2020 return is not available yet, they will use the information from your 2019 tax return.

Note: On March 17, the IRS announced an extension to file your 2020 taxes. Tax returns will now be due by May 17. But if you expect that you may receive more in stimulus money based on your 2020 taxes, and you have not yet received confirmation of your stimulus payment status , you should file as soon as possible.

If you are not required to file your taxes and successfully used the IRSs non-filers tool or completed a special simplified tax return in 2020, no action is needed on your part to receive your payment.

If you do not qualify based on your 2019 income, but you will qualify based upon your 2020 income, consider filing your taxes as soon as possible. Depending on your timing, your stimulus eligibility may be determined before your 2020 tax return is processed. However, the law includes a provision to make supplemental payments in September to ensure people who qualify do not need to wait until the 2021 tax season.

Read Also: When Was 3rd Stimulus Check Mailed