Who May Be Eligible For More Money

Taxpayers who earned less money in 2021 than the previous year may be eligible for more money than they initially received from the third round of stimulus payments.

Those include single filers who had incomes above $80,000 in 2020 but less than this amount in 2021 married couples who filed a joint return and had incomes above $160,000 in 2020 but less than this amount in 2021 and head of household filers who had incomes above $120,000 in 2020 but less than this amount in 2021, according to the IRS.

Individuals and families who added a child in 2021 through birth, adoption or foster care could be eligible for additional money. Families that added another kind of dependent, such as an aging parent or grandchild, may also be eligible.

Will I Get An Eip Card

For the first and second stimulus checks, the Treasury Department sent millions of taxpayers an economic impact payment debit card. For the first stimulus check, EIP cards were sent to individuals who had not received a tax return by direct deposit in the past and who had their tax returns processed by certain IRS service centers. For the second stimulus check, the Treasury Department sent EIP cards to a majority of taxpayers.

If you received an EIP card for the second stimulus payment, you will probably receive a new EIP card for the third stimulus payment. If you receive an EIP card, read the material that comes with it carefully they come with fees for checking your balance, using a teller for withdrawals, or using an out-of-network ATM.

You May Like: Stimulus Check 2 Status Not Available

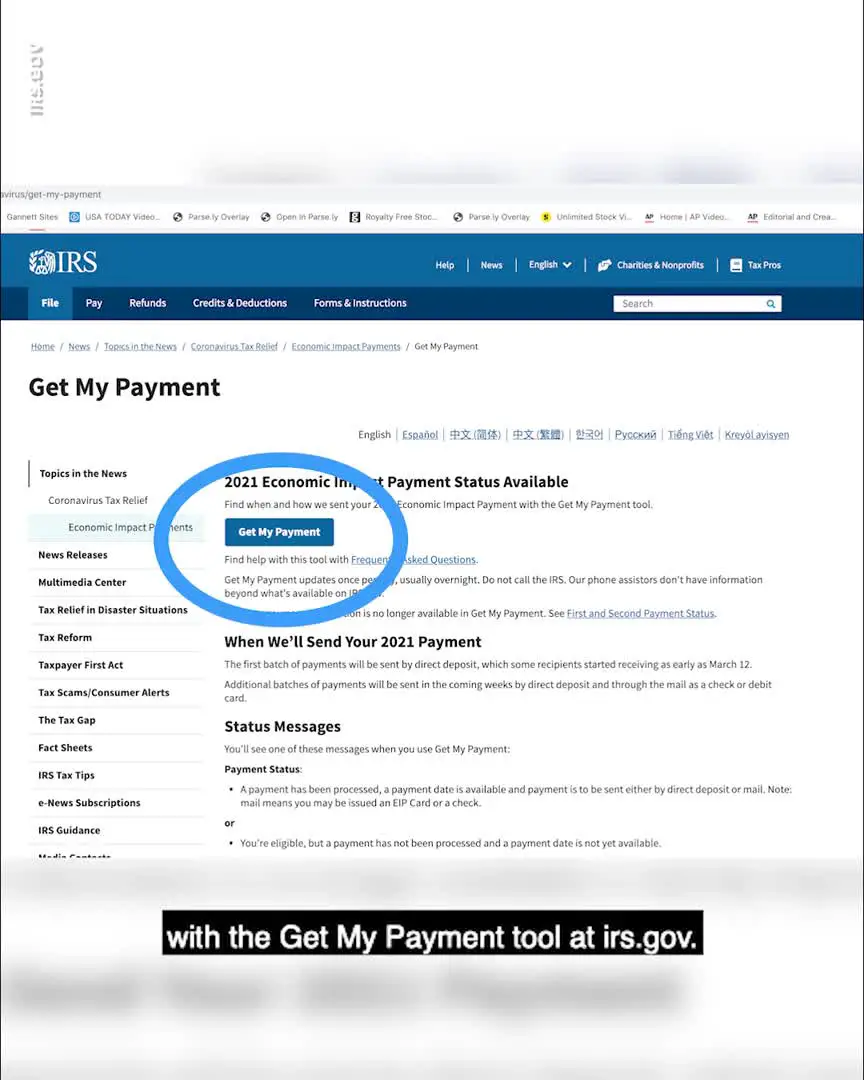

How Do I Check The Status Of My Stimulus Payment

But waiting on your stimulus check can be an anxiety-ridden process, especially at a time when nearly 10 million Americans are out of work. Use the Treasury Departments tracker:

If youre seeing a payment status not available error message on the platform, the IRS says one of the following issues might be occurring:

The platform is typically updated overnight, meaning you wont see a new message if youre checking for updates more regularly than once a day.

Don’t Miss: Are There Any New Stimulus Checks Coming Out

I Received A Second Payment But My Spouse Didnt

There have been cases where a couple submit their tax returns as married filing jointly, and both spouses are eligible for a $1,400 stimulus check, but one spouse received a payment and the other did not . This is an error on the IRSs part. Unfortunately, the spouse who didnt receive a check will have to claim a Recovery Rebate Credit on his or her 2020 tax return. See below for instructions on claiming the rebate on your tax return.

Also Check: Stimulus For 65 And Older

I Didn’t File A 2019 Or 2020 Tax Return And Didn’t Register With The Irsgov Non

Yes, if you meet the eligibility requirements. While you won’t receive an automatic payment now, you can still get all three payments. File a 2020 return and claim the Recovery Rebate Credit.

The IRS urges people who don’t normally file a tax return and haven’t received any stimulus payments to look into their filing options. The IRS will continue reaching out to non-filers so that as many eligible people as possible receive the stimulus payments they’re entitled to.

The IRS encourages people to file electronically, and the tax software will help figure the correct stimulus amount, which is called the Recovery Rebate Credit on 2020 tax forms. Visit IRS.gov/filing for details about IRS Free File, Free File Fillable Forms, free VITA or TCE tax preparation sites in the community or finding a trusted tax professional.

Also Check: Update On 4th Stimulus Check For Ssi

How The Third Stimulus Check Became Law

The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Biden said at the signing of the bill: this historic legislation is about rebuilding the backbone of this country and giving people in this nation working people and middle-class folks, the people who built the country a fighting chance. Thats what the essence of it is.

House Democrats had moved the $1.9 trillion COVID-19 relief bill to Bidens desk with a 220-211 vote just one day earlier. But progressives in the party expressed concern over Senate amendments that excluded higher-earning taxpayers from getting a stimulus payment.

Biden agreed to narrow income level requirements as a concession to moderate Senate Democrats who wanted to cap payments for individual taxpayers at $80,000 and joint tax filers at $160,000.

The Senate bill narrowly passed with a 50-49 vote on March 6 after an overnight marathon of disputed amendments and negotiations. A 50-50 tie between both parties was avoided because Senator Dan Sullivan could not vote after returning to Alaska for a family funeral.

People Who The Irs Doesnt Know About

The IRS will automatically send a third stimulus payment to people who filed a 2019 or 2020 federal income tax return. People who receive Social Security, Supplemental Security Income, Railroad Retirement benefits, or veterans benefits will receive a third payment automatically, too. However, if the IRS cant get the information it needs from your tax records, or from the Social Security Administration, Railroad Retirement Board, or Veterans Administration, then it cant send you a check.

However, if you dont get a third stimulus check now, you wont lose out on the money if youre eligible for a payment but youll have to wait until next year to get it. Youll be able to claim the proper amount as a Recovery Rebate tax credit when you file your 2021 tax return, which is due by April 18, 2022 .

Recommended Reading: When Are The Next Stimulus Checks Going Out

Changes Increase Electronic Payments Speed Relief To Americans Answers To Common Questions

FS-2021-05, March 2021

WASHINGTON The Internal Revenue Service and the Treasury Department are disbursing the third round of Economic Impact Payments to the public as rapidly and securely as possible.

These payments were authorized by Congress in the American Rescue Plan Act, enacted on March 11, 2021. For those who haven’t received a payment yet, here are answers to some common questions about this set of stimulus payments, which differ in some ways from the first two sets of stimulus payments in 2020, referred to as EIP1 and EIP2.

What Is The Third Stimulus Check

The third Economic Impact Payment was a provision of a piece of legislation meant to distribute stimulus funds to eligible individuals in the U.S., the American Rescue Act. In response to the unprecedented economic consequences of COVID-19, the U.S. government disbursed these funds to help offset some of the financial burdens people encountered during the pandemic. Recipients could use this money to help replace depleted savings accounts, continue making rent or mortgage payments, buy groceries or accomplish anything else they decided to do with the money.

People who paid taxes in 2019 and made up to $75,000 as single taxpayers or up to $150,000 as married filing jointly taxpayers were eligible to receive the full stimulus payment, which amounted to $1,400 per person in each household. A single person could receive $1,400. A married couple could receive $2,800, and a married couple with two kids could receive $5,600. The IRS issued the first round of checks and direct deposits in .

Read Also: What Stimulus Payments Did I Receive

Stimulus Checks For Dependents Va Beneficiaries

Payments to Department of Veterans Affairs beneficiaries who dont normally file taxes and who didnt use the IRS online Non-Filers tool last year started going out April 9, with a payable date of April 14. The batch of 2 million stimulus payments, worth more than $3.4 million, also went to eligible people who had not filed a tax return until this year and didnt use the IRS Non-Filers Tool last year. Some of these payments were what the IRS calls plus-up payments to those who got stimulus payments based on their 2019 returns and then filed 2020 returns.

The third round of stimulus checks, authorized by the American Rescue Plan Act, provides a maximum of $1,400 to eligible individuals, $2,800 to couples and $1,400 to dependents. Unlike the previous two rounds, theres no age limit on stimulus checks for dependents, so its possible to get a check for a dependent college-age student or an aged parent. Because dependents are claimed on tax returns, the IRS can use that information to send out stimulus payments for dependents to tax filers.

AARP Membership $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

Democrats Are Working On The Details Of A Massive Stimulus Bill With A Third Stimulus Check What Can You Do To Get Paid The Maximum Possible Fast

President Joe Bidens $1.9 trillion American Rescue Plan , the coronavirus economic relief package is very likely to include a booster $1,400 third stimulus check to add to the bipartisan $600 pay out in December, for eligible individuals.

With lawmakers set to negotiate another round of coronavirus relief aid, many Americans are growing restless to when they might get their third stimulus check, and how much it might be . However, what you might not know is that your 2020 tax returns will also affect stimulus payments alongside Congress own time frame for passing the legislation.

Nancy Pelosi has emphasised that shes keen to push through Democrats stimulus bill by mid-March more on this below. In tandem, the IRS officially started accepting tax returns on 12 February, with the filing window closing on its usual date of 15 April.

So depending on Congress eventual timeline, the IRS may start distributing stimulus checks in the middle of tax season, which could affect how much Americans get especially households that lost income last year or who had a child in 2020 for instance, say CBS.

This is because the IRS relies on each individuals most recent tax filing to determine the size of stimulus payment they are entitled to.

How Filing Your Tax Return Early Could Boost Your Third Stimulus Check | Kiplinger

Kiplinger

Don’t Miss: Stimulus Checks For Social Security Disability

How Can You Request An Irs Trace For Missing Stimulus Money

To request a payment trace, call the IRS at 800-919-9835 or mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund . Note: If you call the number, youll have to listen through the recorded content before you can connect with an agent.

To complete Form 3911 for your third stimulus check, the IRS provides the following instructions:

1. Write EIP3 on the top of the form

2. Complete the form answering all refund questions as they relate to your payment.

3. When completing item 7 under Section 1:

- Check the box for Individual as the Type ofreturn.

- Enter 2021 as the TaxPeriod.

- Do not write anything for the DateFiled.

- Sign the form. If youre married and filing together, both spouses must sign the form.

You should not mail Form 3911 if youve already requested a trace by phone. And the IRS said you shouldnot request a payment trace to determine if you were eligible to get a check or confirm the amount you should have received.

How Do I Identify The Covid

The EIP Card is a debit card sent by U.S. Mail in a white envelope with the U.S. Department of the Treasury seal and a return address from Economic Impact Payment Card.

The card has the Visa name on the front and the issuing bank, MetaBank®, N.A., on the back. Information included with the EIP Card explains that this is your Economic Impact Payment. If you receive an EIP Card, visit EIPcard.com for more information.

Read Also: When Does The Unemployment Stimulus Start

Don’t Miss: Irs Didn’t Get Stimulus

The Irs Has Distributed Three Rounds Of Economic Impact Payments To Date But Not Everyone Has Had The Full Entitlement Heres How To Check How Much You Have Received

During 2020 and 2021 the federal government sent out three rounds of stimulus check payments for eligible households, with a maximum of $3,200 available per person.

Previously it was possible to claim any missing payments using the IRS Get My Payment online portal, but that option has now expired. To request payment of any outstanding stimulus check money you must now claim a Recovery Rebate Credit on your federal tax returns.

If you did not receive the Economic Impact Payments issued in 2020 or 2021, you may be able to claim a Recovery Rebate Credit from #IRS by filing a tax return. Learn more at

Heres how to work out how much you are owed

How to find your stimulus check history online

The easiest way to check which Economic Impact Payments, also known as stimulus checks, you have received is by heading over to the IRS website.

You can view your Online Account using your IRS username or ID.me account, giving you access your payment history. As well as information about the stimulus checks, you can also find your history of advance Child Tax Credit payments and data from your most recently filed tax return.

Read Also: How To Apply For Stimulus Check Online

Alert: Highest Cash Back Card Weve Seen Now Has 0% Intro Apr Until Nearly 2024

If youre using the wrong credit or debit card, it could be costing you serious money. Our expert loves this top pick, which features a 0% intro APR until nearly 2024, an insane cash back rate of up to 5%, and all somehow for no annual fee.

In fact, this card is so good that our expert even uses it personally. for free and apply in just 2 minutes.

Recommended Reading: I Didnt Get The 1400 Stimulus Check

Also Check: Who’s Getting Another Stimulus Check

When Will I Get My December Social Security Check

Here’s the for when you could get your Social Security check and/or SSI money:

- Payment for those who receive SSI.

- Social Security payment for those who receive both SSI and Social Security, or have received Social Security since before May 1997.

- 14: Social Security payment for those with birthdays falling between the first and 10th of any given month.

- 21: Social Security payment for those with birthdays falling between the 11th and 20th of any given month.

- 28: Social Security payment for those with birthdays falling between the 21st and 31st of any given month.

- January SSI payment. This check will have the COLA increase.

What To Do If One Of The Three Stimulus Checks Hasn’t Arrived

About 15 days after the IRS sends out your check, you should receive a letter from the agency confirming the payment. When the first round of stimulus checks went out last year, that letter included two hotline phone numbers because thousands of agents were available to help. But with the second and third rounds of checks, the IRS changed its tune, and these phone numbers may be disconnected.

Here are common scenarios that might indicate you need to look into your stimulus payment:

- If you’re one of the millions of people who qualified for the first stimulus check but never got it.

- If your second stimulus check has still not arrived.

- If you got a letter from the IRS saying your third check was sent, but never received the payment. Or, if the IRS Get My Payment portal said your payment was sent, but you didn’t get it.

- If you got some of your stimulus money from any payment, but not all of it.

You should also confirm you’re qualified to get the stimulus payment, since not everyone who received a previous check is qualified this time. If you think it’s time to take action, read for more options.

Read Also: Who Qualifies For The Stimulus Check

Get The Information You Need

The stimulus guide includes an FAQ section for understanding important info, including:

- Who is eligible to receive a stimulus check?

- How will the IRS determine income for the stimulus payment?

- How much money you will receive.

- Will the stimulus money be considered income that has to be claimed on taxes?

- How will you get the stimulus payment?

- The stimulus checks impact on other benefits or if debts are owed to other agencies.

Read Also: Is There A Third Stimulus Check Coming

Stimulus Check: What Can I See On The Tracking Portal

The online portal is called Get My Payment, which is currently offline but instructs you to check back in a couple of days for an update on your 2021 Economic Impact Payment.

With the first two payments, information was updated once a day. Once the tracking portal is live, all you have to do is plug in your Social Security number, date of birth, street address and zip code. The portal will display a message indicating whether the payment was sent, the payment method and the date it was issued. It will also let you know if there are any errors.

Read Also: Stimulus Check 3 Social Security

Recommended Reading: Washington State Stimulus Checks 2022