What About Social Security Beneficiaries

Many federal beneficiaries who filed 2019 or 2020 returns or used the Non-Filers tool last year were included in the first two batches of payments, if eligible, according to the IRS.

For federal beneficiaries who didnt file a 2019 or 2020 tax return or didnt use the Non-Filers tool, the IRS said it is working directly with the Social Security Administration, the Railroad Retirement Board and the Veterans Administration to obtain updated 2021 information to ensure that as many people as possible are sent automatic payments.

Social Security and other federal beneficiaries will generally receive this third payment the same way as their regular benefits, according to the agency.

More information about when these payments will be made will be provided on IRS.gov as soon as it becomes available, the IRS said.

Contributing: Kelly Tyko, USA TODAY

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: Sign Up For Stimulus Check

More $1400 Stimulus Checks Are Sent As The Irs Processes Tax Returns

- About 2 million more $1,400 stimulus checks have been issued.

- This seventh batch brings the total number of payments to approximately 163 million, or about $384 billion.

- Many of the new checks were issued after the IRS processed people’s tax returns.

About 2 million $1,400 stimulus checks have been issued in a seventh batch of payments.

The total number sent to date is now approximately 163 million, or about $384 billion.

This latest round is more than $4.3 billion. It includes approximately 1.1 million direct deposits and about 850,000 paper checks.

The third tranche of Covid stimulus checks was authorized by Congress in March through the American Rescue Plan Act.

More from Personal Finance:How tax-deferred savings can help you get a $1,400 stimulus check

The payments are for up to $1,400 per person, plus $1,400 per dependent, to Americans who fulfill certain income and other requirements.

As with previous disbursements of the third stimulus checks, this batch includes money issued to people whose tax returns have recently been processed by the IRS. That applies to people who the government did not previously have on record, as well as those who are due additional “plus-up” payments based on their 2020 returns.

Over 1.2 million payments, or more than $3 billion, went to people who the government did not previously have on file.

Additionally, this new round included more than 730,000 “plus-up” payments, representing more than $1.3 billion.

How Were The Second Batch Of Payments Sent

The second batch of aid includes about 17 million direct deposit payments, with a total value of more than $38 billion. These payments began processing last Friday, the IRS said. Some Americans may have seen the direct deposit payments as pending or as provisional payments in their accounts before Wednesdays official payment date, the agency added.

The Treasury Department has also mailed nearly 15 million paper checks totaling $34 billion to Americans who dont receive the money by direct deposit, the IRS said. About 5 million prepaid debit cards totaling $11 billion were also sent out.

Paper checks and debit cards began processing last Friday and will continue to be sent by mail over the next few weeks, according to the IRS.

You May Like: Get My Stimulus Payment Phone Number

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

How Can I Check My Stimulus Check Status

The IRS has created a website where you can check the status of your stimulus payment.

The Get My Payment tool is no longer updating for either the first or second stimulus check. However, you can use it to see the status of your third check.

- If your payment has been processed. the IRS will specify its status including whether it has been sent, the date issued, and whether the money will be directly deposited or mailed.

- If your status reads “Payment Not Available.” The IRS either hasn’t yet processed your payment or you aren’t eligible for one.

- If it reads “Need More Information.” Your check was returned to the IRS after an attempted delivery. Give the IRS your bank information to receive your money.

If you did not get your first or second check, you’ll need to file a 2020 tax return to get the payment.

Read Also: Who’s Eligible For 3rd Stimulus Check

Discuss The Economic Impact Payment With The Beneficiary

A representative payee is only responsible for managing Social Security or SSI benefits. The Economic Impact Payment is not an SSA benefit and belongs to the beneficiary. Discuss the payment with the beneficiary, and if they request access to the funds, youre obligated to provide it.

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

Also Check: Are There Any More Stimulus Payments Coming

How Will The Irs Send My Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, your payment will be distributed in the same method as your benefits. Learn more to see if this applies to you.

Economic Impact Payments will either be directly deposited into your bank account or a check or prepaid debit card will be mailed to you.

What Is A Stimulus Check

A stimulus check is a payment made to a taxpayer by the U.S. government. Stimulus checks are made by paper check or through direct deposit. They are intended to encourage spending during times of economic and, thus, give the economy a boost. Stimulus checks can be part of a larger federal stimulus package designed to support the economy, which was the case with the stimulus payments that were part of the CARES Act in 2020 and the American Rescue Plan in 2021.

Also Check: Irs.gov Stimulus Check Sign Up

New Jersey: $500 Rebate Checks

In fall 2021, Gov. Phil Murphy and the New Jersey state legislature approved budget measures to send one-time rebate checks of up to $500 to nearly 1 million families.

New Jersey is also sending $500 payments to those who file taxes using a taxpayer identification number instead of a Social Security number. The Excluded New Jerseyans Fund applies to nonresident and resident aliens, their spouses and dependents.

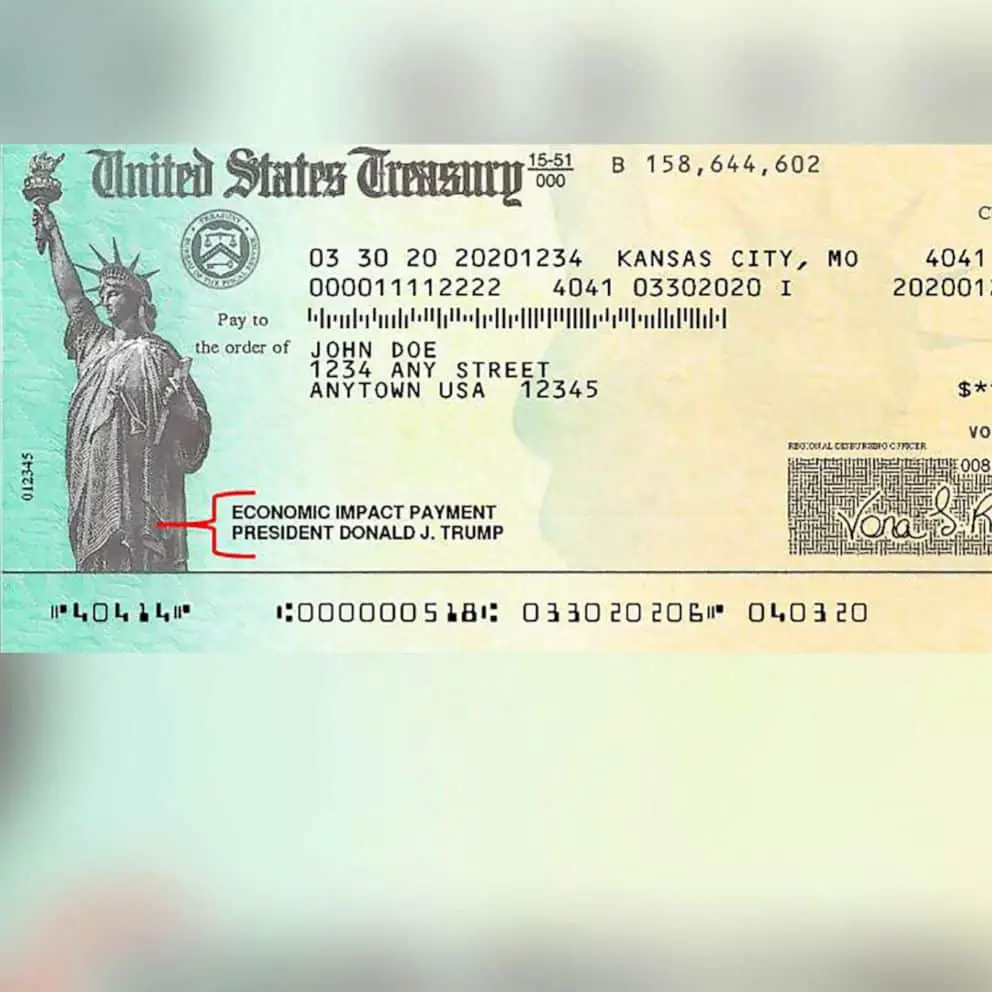

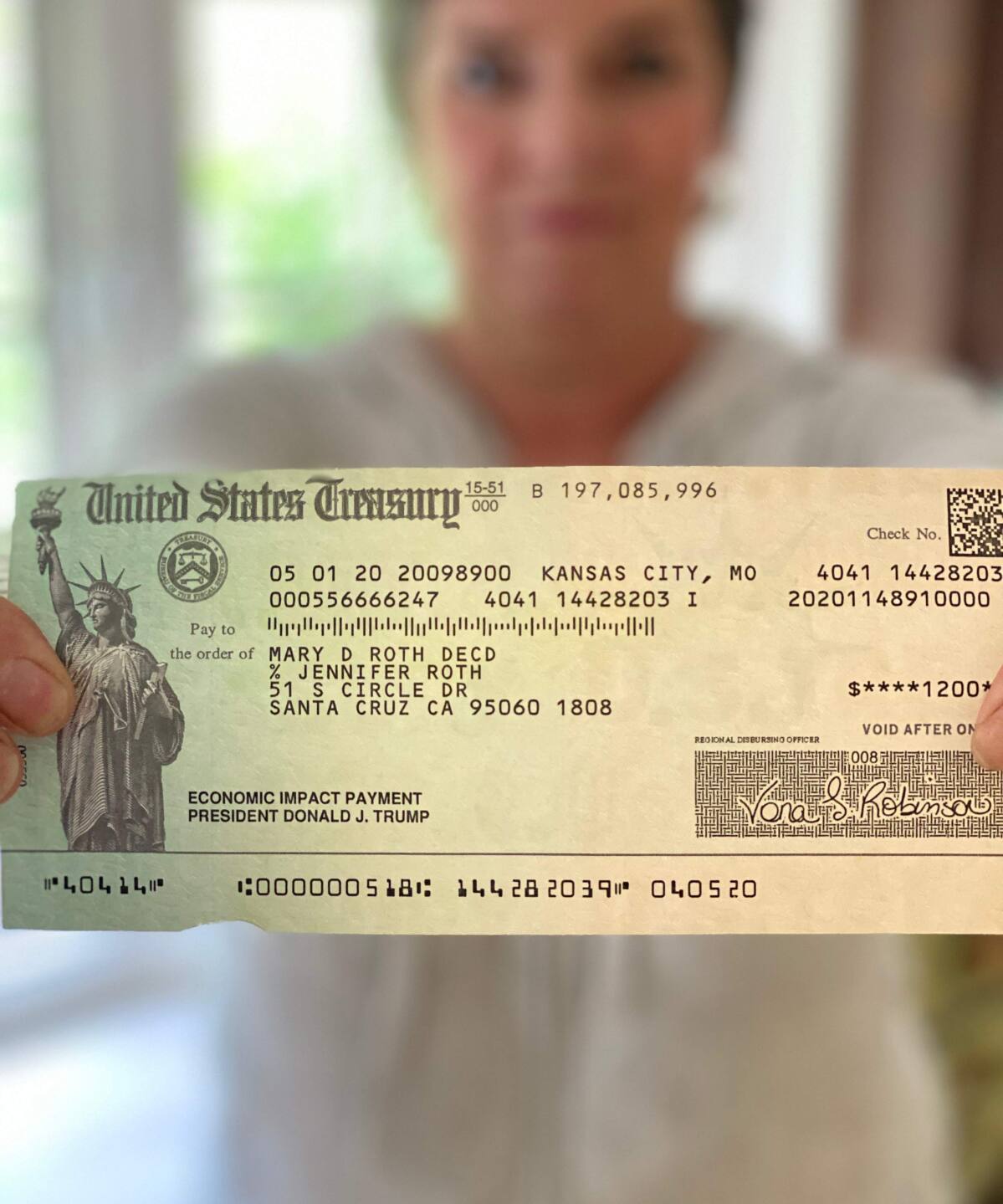

An Inside Look At How Donald Trump’s Name Came To Appear On Stimulus Checks

ABC News obtained images and emails showing the scramble to add his name.

Donald Trump has always liked to put his name on things — in big letters — on towers, hotels, golf resorts — even steaks. As president, his black-marker signature was outsize and famously distinctive.

So, when questions were raised about whether he would want his name on millions of stimulus checks sent to Americans last year, it not only seemed plausible, it also unleashed a firestorm of criticism from Democrats.

Now, internal emails obtained by ABC News give an inside look at the scramble to add Trump’s name just days before payments started going out in the middle of a presidential election year.

The documents provide a glimpse behind the scenes as the Trump administration sought to take credit for the payments. And for the first time, the government has released images showing versions of the checks that did not make the final cut — including those with then-Treasury Secretary Steven Mnuchin’s name alongside Trump’s.

In the end, “President Donald J. Trump” appeared below the words “Economic Impact Payment” on the memo line of the final version of the checks, which were sent to 35 million Americans.

Unlike Trump, President Joe Biden’s name did not appear on a new round of stimulus checks that started going out this spring, although like Trump, Biden did sign a letter mailed to Americans to notify them about the payments.

Then, several days later, Mnuchin said he had thought of it.

Read Also: Where Is My Stimulus Refund

What To Do If You’re Missing Money From The First Two Stimulus Checks

Plus-up payments are going out weekly along with the third round of checks, but they may not be the only money you’re due. For money missing from the first two checks, you need to claim that on your 2020 taxes. We suggest making sure you know how to find out your adjusted gross income. You may be eligible to claim the 2020 Recovery Rebate Credit for claiming missing money from the first two checks.

Also, last week, the IRS launched a new online for familes that don’t file taxes called the “Non-filer Sign-up Tool.” Its purpose is to help eligible families who don’t normally file a tax return enroll in the monthly child tax credit advance payment program, which is slated to begin July 15. However, the tool is also for those who did not file either a 2019 or 2020 tax return and did not use the previous nonfilers tool last year to register for stimulus payments.

In other words, individuals who experience homelessness or make little or no income can use this tool to enter their personal details for the IRS’ records so as to receive the $1,400 stimulus checks or claim the recovery rebate credit for any amount of the first two rounds of payments that might have been missed. Tax nonfilers may need to be proactive about claiming a new dependent, too.

Irs Has Sent $6 Billion In Stimulus Payments Just In June Here’s How To Track Your Money

Your stimulus check could be on its way, along with child tax credit money and unemployment tax refunds. We’ll explain the state of the payments today.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET, where he leads How-To coverage. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland A’s.

Don’t think that the child tax credit payments going out in just over two weeks are all the IRS is focused on. The tax agency continues to send weekly batches of the third stimulus checks, with more than $6 billion in stimulus payments going out just in June. Some of that money includes “plus-up” adjustments for people who received less money than they were supposed to get in earlier checks.

Even though many of us got our stimulus money in the earlier batches in spring, some have had to wait weeks or months for their checks. The IRS sent money first to people who’d already filed their 2019 or 2020 tax returns because those were the easiest to verify. So if you’re still waiting for your stimulus check up to $1,400 — or think you might be due a plus-up payment — we’ll tell you what to do next.

Also Check: How Are Stimulus Checks Distributed

Are Stimulus Checks Effective

Since the ultimate goal of any stimulus package is to restore economic stability, inspire consumer confidence, and increase spending, stimulus checks have to be evaluated on those critera and compared to other forms of stimulus.

As an argument for direct payments over tax credits, a 2011 study by the National Bureau of Economic Research found that the direct payments of 2001 and 2008 were more effective at sparking spending than the withholding reductions. of 2009.

Of course, a complete analysis of the effectiveness of stimulus checks has to include their long-term impact on the federal deficit. A 2012 study by the Mercatus Center at George Mason University found that, from 1950 to 2011, per-capita government spending had increased significantly. Many economists question whether this spending is effective and, ultimately, whether economic stimulus payments result in returns that outweigh the costs.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Recommended Reading: What Was The 2021 Stimulus Check

How Can I Track My Payment

Americans can now check the status of their third stimulus check using the IRSs online tracking tool Get My Payment.

The tool allows Americans to follow the scheduled payment date for either a direct deposit or mailed payment. Its an online app that works on desktops, phones, and tablets and doesnt need to be downloaded from an app store. To use the tool, you need to provide basic information:

-

Social Security number or Individual Tax ID Number

-

Mailing address

The tracking tool will no longer show the status of the first or second round of stimulus checks the $1,200 payment under the CARES Act and the $600 payments under the December $900 billion stimulus deal. To find the status of those previous rounds, you must create an account.

Read more: Here’s how you should use your tax refund in 2021

If your payment is delivered by direct deposit, the tool will show when the direct deposit is expected to be made or when it was delivered along with the bank account it went into.

If you receive the message Payment Status Not Available, the IRS may not have processed your payment yet or you may not be eligible for a payment.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Read Also: Stimulus Checks Gas Prices 2022

What Gaos Work Shows

1. IRS can use data to tailor outreach efforts.

It was challenging for IRS and Treasury to get payments to some peopleespecially nonfilers, or those who are not required to file tax returns. These people were eligible for the payments for a couple of reasons:

- first, there was no earned income requirement, so Americans with no or very little income could receive economic relief and

- second, the payments were refundable tax credits, so eligible individuals can claim the full amount even if it exceeds what they owe in taxes.

In 2020, Treasury and IRS used other data to identify and reach out to around 9 million potentially eligible nonfilers. In May 2021, TIGTA identified potentially 10 million individuals eligible for payments, but IRS has no further plans to reach out to these individuals.

We recommended that Treasury and IRS use available data to develop an updated estimate of total eligible individuals which they could use to better tailor and redirect their ongoing outreach and communications efforts for similar tax credits.

2. Improved collaboration will also help outreach to underserved communities.

We recommended that Treasury and IRS focus on improving interagency collaboration and use data to assess the effectiveness of their efforts to educate more people about refundable tax credits and eligibility requirements.