How To Get The Payment

- There is no need to formally apply.

- If you meet all of the SATC eligibility criteria, you automatically qualify to receive the one-time $500 payment via a cheque sent by mail to the residence listed on your 2021 tax return.

- To update your mailing address, please contact the SATC administration centre by email at or by phone at 1-800-667-6102. To update your address, you must provide the following information:

- Your full legal name

- Your Social Insurance Number and

- Your address as it appears on your 2021 tax return.

You Have A New Bank Account

Your third stimulus check payment will be directly deposited into your bank account if the IRS has your bank information from:

- Your 2019 or 2020 federal income tax return

- The Non-Filers: Enter Payment Info Here tool used for first-round stimulus payments

- The Get My Payment tool, if the information was provided in 2020

- A federal agency that issued benefits to you or

- Federal records of recent payments to or from the government.

Direct deposit is the quickest and easiest method of delivering your payment. However, if you recently closed the bank account that the IRS has on record, then the payment will be delayed. By law, the bank must return the payment to the IRS if the account is inactive or closed. Unfortunately, if you closed your account, theres no way to provide the IRS with your new bank account information for third stimulus check purposes. As a result, you will either receive a paper check or debit card by mail.

If the IRS sends a paper check or debit card, that will take longer than getting a direct deposit payment because it has to go through the regular mail.

If the IRS doesnt send a third-round payment at all, then youll have to claim the third stimulus check money that you should have received as a Recovery Rebate credit on your 2021 income tax return, which you wont file until next year.

2 of 9

Dont Miss: How Soon Will We Get Stimulus Checks

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Read Also: Get My Stimulus Payment 1400

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Track My Second Stimulus Check

I Have Not Filed A 2021 Tax Return How Can Ensure That I Receive The Satc Payment

- You must file a 2021 tax return with the Canada Revenue Agency by October 31, 2022, to be eligible to receive the SATC payment.

- In addition to the SATC payment, tax filers may be automatically eligible for other provincial and federal government support payments just by filing a tax return. We therefore encourage every adult to file an income tax return each year to ensure they receive the full range of benefits that are available to them, regardless of their income level.

If Your Third Stimulus Check Is Lost In The Mail Or Something Else Happens To It Before You Get It You Can Ask The Irs To Trace Your Payment Here’s How It Works

Getty Images

It’s bad enough if a new sweater you ordered on Amazon gets lost in the mail but you’re really going to get mad if the post office loses your $1,400 stimulus check. What do you do then? Or what happens if your bank never receives your direct deposit stimulus payment from the IRS? Are you going to lose that money?

Fortunately, the IRS has a procedure to help. If your third-round stimulus payment is lost, stolen or destroyed, you can ask the IRS to perform a “payment trace” to see if your check was cashed or direct deposit misdirected. Ultimately, if everything goes smoothly, you’ll be issued a new payment. That’s the good news.

But there’s some less than thrilling news, too. First, you have to wait a certain period of time before starting the process, and then it’s going to take some time. So, you won’t get your stimulus money right away. Second, as with any government request, there’s a healthy list of procedures you must follow. Slip up on one of the steps, and you could find yourself in a bureaucratic black hole. But don’t worry. While dealing with the IRS can be intimidating, we’ll help you get through the process.

You May Like: How Do I Get The 3rd Stimulus Check

How Much Will My Tax Refund Be

The money will be returned to eligible taxpayers by the state Department of Revenue in proportion to their personal income tax liability in Massachusetts incurred in the immediately preceding taxable year Tax Year 2021.

The administration said Friday that eligible taxpayers will receive a credit in the form of a refund that is approximately 14% of their Massachusetts Tax Year 2021 personal income tax liability.

The Baker administration set up a website, www.mass.gov/62frefunds, where you can get a preliminary estimate of your refund. A call center is also now available at 877-677-9727 to answer questions about the Chapter 62F taxpayer refunds. It is open Monday through Friday, from 9 a.m. to 4 p.m.

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Read Also: Who Qualifies For The Stimulus Check

What Information Will The Trace Provide Me

The IRS will process your claim for a missing payment in one of two ways:

- If the check was not cashed, they will reverse your payment and notify you. If you find the original check, you must return it as soon as possible. You will need to claim the 2020 Recovery Rebate Credit on your 2020 tax return to receive credit for EIP 1 and EIP 2, and then claim the 2021 Recovery Rebate Credit on your 2021 tax return for EIP 3, if eligible.

- If the check was cashed, the Treasury Departments Bureau of the Fiscal Service will send you a claim package that includes a copy of the cashed check. Follow the instructions. The Treasury Departments Bureau of the Fiscal Service will review your claim and the signature on the canceled check before determining whether the payment can be reversed. If reversed, you will need to claim the Recovery Rebate Credit on your 2020, or 2021 return depending on what EIP payment in reference, if eligible.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Read Also: Washington State Stimulus Checks 2022

Why Am I Being Mailed A Direct Deposit For My Stimulus Check Payment

Your payment may have been sent by mail because the bank rejected the deposit. This could happen because the bank information was invalid or the bank account has been closed.

Note: You cant change your bank information already on file with the IRS for your first or second Economic Impact Payment. Dont call the IRS, our phone assistors wont be able to change your bank information, either.

Still No $14000 Stimulus Check Heres Where To Call

![[Updated] H& R Block Emerald Card Stimulus payments /deposit /check not ... [Updated] H& R Block Emerald Card Stimulus payments /deposit /check not ...](https://www.stimulusinfoclub.com/wp-content/uploads/updated-h-r-block-emerald-card-stimulus-payments-deposit-check-not.jpeg)

If you get this message, either we have not yet processed your payment, or you are not eligible for a payment, the IRS says. We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.

Millions of Americans have already received their coronavirus stimulus checks under President Joe Bidens American Rescue Plan.

But what should you do if youre one of the unfortunate few who are still sitting empty-handed?

If you werent aware already, you can actually speak to a live human regarding your missing or late check. The Internal Revenue Service Economic Impact Payment phone number is 800-919-9835, but you should be aware that IRS live phone assistance is extremely limited at this time, according to the agencys website.

That means that you should be prepared to sit on hold for at least several minutes if youre lucky or even an hour or two. Some individuals have confirmed that they havent been able to get through to a live representative.

If youre still seeking a more concrete date on when the stimulus payment will arrive, there is indeed another way. You can always log on to the IRS Get My Payment tool, which according to the agency, more than thirty-five million people have already used it to get their stimulus payment status.

Also, know that you dont have to waste your days by constantly checking on the site. The IRS says that the tool updates once per day, usually overnight.

Recommended Reading: Is The $1 200 Stimulus Check Taxable

Your Contact Information Has Changed Since Your 2019 Tax Filing

According to moving tools and analysis company MYMOVE study of USPS change-of-address request data, 16 million Americans temporarily moved during the pandemicif thats you, the IRS may not have your latest address on file.

And even if you filed your taxes early this year, the IRS may not have processed your 2020 tax return. About 6.7 million tax returns are stuck in a backlog waiting to be processed, according to a March 12 story from The Washington Post.

If your mailing address has changed, theres several ways you can notify the IRS of your new contact information:

- Include the new address when you file your 2020 taxes and be sure to notify your tax preparer if you use one.

- Fill out Form 8822, Change of Address and/or a Form 8822-B, Change of Address or Responsible Party Business and send them to the address shown on the forms.

- Send a letter with your full name, old and new addresses, Social Security number, Individual Taxpayer Identification Number or Employer Identification Number, and signature to the IRS address on your most recent tax returns.

If the government already sent your payment to an old address, youll have to wait until its returned to the IRS and see if you can update your information via Get My Payment.

See If You Qualify For The Recovery Rebate Credit

The IRS states: “Generally, if you were a U.S. citizen or U.S. resident alien in 2020, were not a dependent of another taxpayer and have a Social Security number that is valid for employment, you are eligible for the Recovery Rebate Credit.”

The credit will be reduced if your adjusted gross income exceeds the following amounts:

- $150,000 if married and filing a joint return or filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals filing as single or as married filing separately.

The payment is reduced by 5 percent of the amount by which a person’s income exceeds the threshold.

Taxpayers can use the IRS Recovery Rebate Credit Worksheet to help determine whether they are eligible.

You are not eligible for the credit if any of the following applies:

- You may be claimed as a dependent on another taxpayer’s 2020 return .

- You do not have a Social Security number that is valid for employment issued before the due date of your 2020 tax return . Some exceptions apply for those who file married filing jointly where only one spouse must have a valid Social Security number.

- You are a nonresident alien.

- You are an estate or trust.

How to calculate the Recovery Rebate Credit due

For those who file their taxes electronically, the software will help calculate the Recovery Rebate Credit amount.

“You will need the amount of any Economic Impact Payments you received to calculate your Recovery Rebate Credit amount,” the IRS said.

You May Like: Are There Any More Stimulus Payments Coming

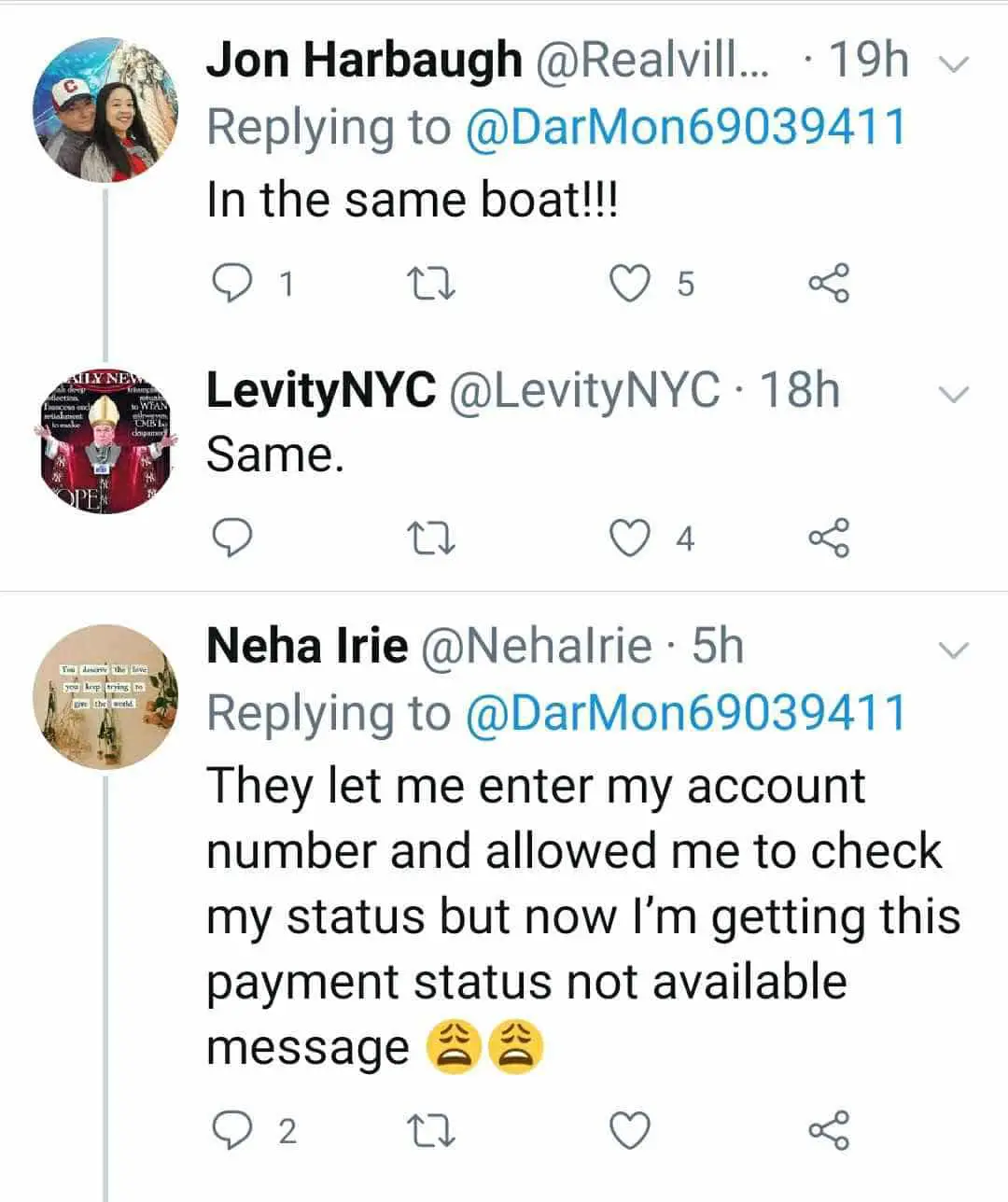

What Does Payment Status Unavailable Mean

- The IRS has not processed your 2019 tax return

- The application doesnt have your bank data and the IRS is working to add it

- You dont usually file a tax return

- You used the Non-Filers section of the website and your entry hasnt been processed yet

- You receive SSI or VA benefits and dont file a tax return

- Youre not eligible for a payment

The information on the Get My Payment portal is updated once per day, overnight so there is no need to check more often than that.

I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and you’ll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didn’t seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. You’ll be able to claim the rest of the stimulus payment when you file your next tax return.

Also Check: How To Check For Stimulus Checks