Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for stimulus payments. This includes those without a permanent address, an income or bank account.

If you’re eligible and didn’t get a first, second or third Economic Impact Payment or got less than the full amounts, you may be eligible for a Recovery Rebate Credit, but you’ll need to file a tax return.

What If I Didn’t File Taxes For 2018 Or 2019

If you’re a US citizen living abroad or a citizen of a US territory and didn’t file taxes for 2018 or 2019 but are eligible for a stimulus check under the CARES Act or the December stimulus package, you can claim that money now in the form of a Recovery Rebate Credit on your tax return from the IRS. Even if you don’t usually have to file taxes, you’ll need to this year to claim that money.

This credit would either increase the amount of your tax refund or lower the amount of the tax you need to pay by the amount of stimulus money the government owes you on the first and second payments. Find out more about how to claim a missing stimulus payment here, as well as everything you need to know about how your taxes impact your stimulus payment.

How Soon Will The Checks Arrive

Hard to say. The Treasury Department hasnt indicated when it will start distributing the money.

Garrett said the timeline will probably be similar to the second round of payments approved in December. Americans who got their checks via direct deposit started to receive the payments about two weeks after the legislation was signed into law. Those who got a paper check had to wait longer.

Biden said last week that many Americans should receive their payments before the end of the month.

The IRS said in mid-February it had distributed all checks to everyone who was eligible in the first two rounds.

More than 160 million payments totaling $270 billion were distributed during the first round last spring, the agency said. More than 147 million payments totaling more than $142 billion were delivered during the second round late last year.

Michael Collins covers the White House. Follow him on Twitter @mcollinsNEWS.

Also Check: Irs.gov Stimulus Check Deceased Person

What Dependents Qualify For The Third Stimulus Check

The American Rescue Plan expands the definition of a dependent to anyone who meets the IRS definition of a dependent on your taxes. So this means if you filed your taxes and claimed a dependentwhether a child or an adultand met the income limits for a payment, your dependent will also qualify for a payment.

Child dependents must be:

- Under 19, or under 24 if that child is a student,

- Or considered permanently and totally disabled

And must:

- Have a valid social security number or an adoption taxpayer identification number included on your tax return,

- And not be claimed as a dependent by anyone else in the qualifying tax year

In cases of split households, the parent or guardian who claimed the child in the tax return on file when the IRS processes your stimulus check will receive the stimulus payment for that child.

- Make less than the gross income requirement, which is $4,300 for 2020, excluding Social Security benefits and tax-exempt income such as services performed by individuals with disabilities at a sheltered workshop

- Receive at least half their total support from you

- Have their SSN included on your tax return

- Not be claimed by anyone else other than you in the qualifying tax year

Note: If you have a baby or adopt a child after you receive your stimulus check, you will be able to claim them as a dependent on your 2021 taxes for the $1,400 tax credit.

Do I Need A Social Security Number

- As with past stimulus payments, those without a valid Social Security number do not qualify. However, eligibility for mixed-status families has been changed. Now, dependents of any age can qualify if they have a valid SSN even if their parents do not. For example, in a household where both parents have ITINs and their children have SSNs, the children may qualify for the third stimulus check, even though the parents dont.

Don’t Miss: What To Do If I Never Got My Stimulus Check

Your Stimulus Check Eligibility Could Depend On Your Taxes

If you’re right on the cusp of the income limits described below, when you file your taxes could make the difference between qualifying for a partial check or not. That’s because a third stimulus check is now arriving during tax season.

The language in the stimulus bill makes it clear that the IRS will base your next stimulus check on your 2019 or 2020 taxes, whichever is on file when it processes your payment. However, the IRS is reportedly delayed in processing new tax returns. If you made more in 2020 than in 2019, time is on your side. The new tax deadline is May 17. If you need more time, you might want to request a tax extension.

At this point of the stimulus check delivery cycle, filing taxes sooner may not be to your advantage. The IRS is prioritizing stimulus check distribution over tax returns, and when the processing happens is outside your control.

If you did already receive your third stimulus check and it was based on your 2019 taxes but you qualified for more with your 2020 return, the IRS will be sending “plus-up payments” to correct the amount between now and Dec. 31, 2021. If you don’t receive your catch-up payment by then, you’ll need to claim it on your taxes next spring.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Recommended Reading: Stimulus Checks For Social Security Disability

Tips For Individuals During The Coronavirus Pandemic

- If you dont need to use your stimulus check for anything urgent, consider investing or saving the money. A financial advisor can help you get started if you need help managing your money or investments. SmartAssets free tool can match you with financial advisors in your area in just five minutes. Get started now.

- If you are struggling to keep up with loan or credit card payments, you can take steps to protect your credit score and speak with your bank directly to see whether you can defer loan payments or waive certain fees.

- If you can afford it, investing in index funds during a recession is a safe option. But if youre looking for a slightly more aggressive approach, check out some free investment classes to learn more.

Do I Have To Be A Us Citizen To Receive A Stimulus Check

Not necessarily. Under the March 2020 CARES Act, all US citizens and non-US citizens with a Social Security number who live and work in America were eligible to receive stimulus payments. That includes people the IRS refers to as “resident aliens,” green card holders and workers using visas such as H-1B and H-2A. This rule was the same in the that governed the second stimulus check as well.

If your citizenship status changed since you first got a Social Security number, you may have to update the IRS’s records to get your check through its online nonfilers tool. US citizens living abroad were also eligible for a first payment .

In the $1.9 trillion stimulus bill that became law in March, families with “mixed status” — or those whose members have different citizenship and immigration classifications — are eligible for a third stimulus check, though they were excluded from the first two checks. The bill also includes stimulus checks for up to $1,400 for dependents of all ages.

Also Check: Irs.gov Stimulus Check Sign Up

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

What Happens If I Didn’t Get A Stimulus Check

If you didn’t get the full amount of the first or second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t normally file. The third Economic Impact Payment will not be used to calculate the 2020 Recovery Rebate Credit.

Don’t Miss: Who Are Getting Stimulus Checks

How Does The Irs Calculate Eligibility For The Third Stimulus Package

To calculate the stimulus payment the IRS will use the information about your income from the 2019 tax return if your 2020 tax return isnt filed and processed yet.

The payment also depends on how many dependents you have, if you file separately or jointly, and on your gross adjusted income .

There is one more thing that the government is trying to do: to target the households that need money the most and to support businesses during the hard times.

What else is new? All dependents can qualify for an additional $1,400 payment. For example, elderly relatives and college students age 23 or younger can qualify for the check.

Who Gets A Third Stimulus Check

The American Rescue Plan provides households with $1,400 for each adult, child and adult dependent, such as college students or elderly relatives.

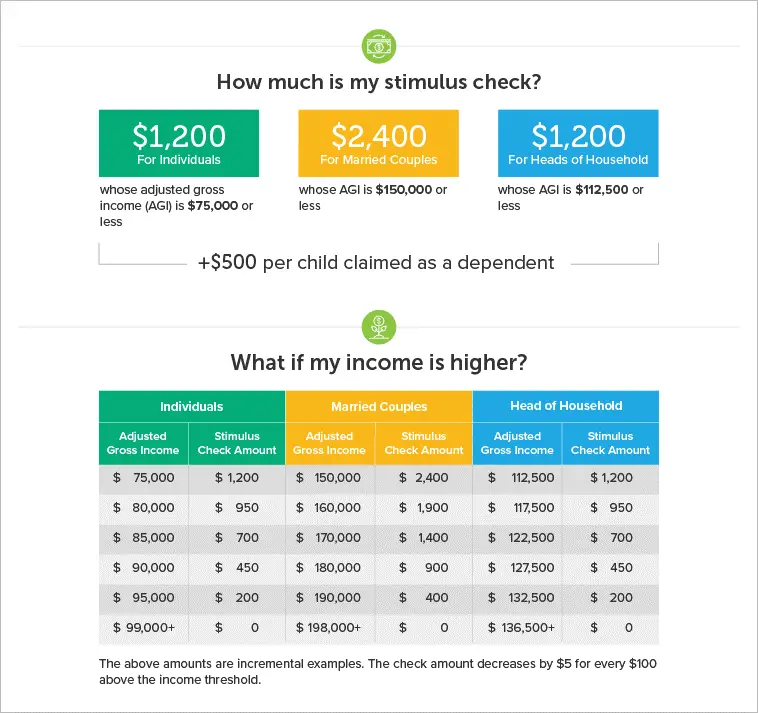

The payments start declining for an individual once adjusted gross income exceeds $75,000 and go to zero once income hits $80,000. The payment starts declining for married couples when income exceeds $150,000 and goes to zero at $160,000.

A qualifying family of four would receive $5,600.

Recommended Reading: How Do I Claim My Third Stimulus Check

Who May Still Be Eligible For More Money

There may be people who are eligible for the full $1,400 payments, or additional partial payments, particularly if their circumstances have changed.

Parents who added a child to their family in 2021 may be eligible for a $1,400 payment. Additionally, families who added a dependent to their family in 2021, such as a parent, niece or nephew or grandchild, may also be eligible for $1,400 on their behalf.

Additionally, people whose incomes have fallen may now be eligible for the money if their 2021 adjusted gross incomes are below the thresholds for full payments. If their incomes are in the phase-out thresholds, they could be eligible for partial payments.

People who do not typically file tax returns, and have not yet done so, need to file this year in order to receive the any potential payments.

The Recovery Rebate Credit money for which you are eligible will either reduce the amount of federal taxes you owe or be included in your refund.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Recommended Reading: N.c. $500 Stimulus Check

Individual Taxpayers With Agi Of $80000 Or More Aren’t Eligible

The new stimulus check will begin to phase out after $75,000, per the new “targeted” stimulus plan. If your adjusted gross income, or AGI, is $80,000 or more, you won’t be eligible for a third payment of any amount. However, if you make between $75,000 and $80,000, you could get a portion of the check. You’d receive the full amount if your yearly income is less than $75,000. Here’s how to estimate the stimulus check total you could receive.

You May Not Receive A Check This Round Even If You Got One Before

The income limits for this new round of stimulus checks have changed. So even if you previously received a stimulus check, you may not qualify for this one.

The adjusted gross income maximum income for the American Rescue Plan Act are:

- Individuals earning $80,000

- Head of households earning $120,000

If your AGI exceeds these amounts, your household will not qualify for the stimulus payment.

Additionally, the phase-out for stimulus reductions is more complicated to calculate this time around. Since the maximum income threshold is fixed, your total stimulus check will be reduced proportionately by the amount earned over $75,000 for individuals, $112,500 for heads of households, or $150,000 for joint filers until it hits the phase-out limits above.

Also Check: I Havent Received My Stimulus Check

Why $1400 Checks And Not $2000

Biden’s plan called for $1,400 checks for most Americans, which on top of the $600 provided in the Dec. 2020 relief plan would bring the total to the $2,000 that Biden called for.

This calculator can help determine how much you can expect from the third stimulus check.

The Associated Press contributed to this report.

What If I’m An Undocumented Us Resident Or Don’t Have A Social Security Number Do I Still Qualify For A Third Stimulus Check

If you’re a “nonresident alien,” you weren’t eligible for a first or second stimulus check. The government defines a nonresident alien as someone who “has not passed the green card test or the substantial presence test.” If you don’t have a valid Social Security number, you likely weren’t eligible for a first or second stimulus payment. If you filed a US tax return but don’t have a Social Security number, you still weren’t eligible.

For the third check, if you are a nonresident alien but are in a mixed-status family — where at least one member has a Social Security number — you are eligible for a payment.

Don’t Miss: Someone Stole My Stimulus Check

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022