How Do I Apply

The National Council of State Housing Agencies has a map where you can find out where to apply in your state. Some states are still in the process of opening their programs.

At the start of March, 24 states, Puerto Rico and Guam had already done so, and almost all programs have been approved by the Treasury Department.

“We expect virtually all programs will be open by June,” Williams said.

How Does The Government Stimulus Package For 2021 Known As The American Rescue Plan Impact Homeowners Heres What To Know

President Joe Biden signed the $1.9 trillion economic stimulus package, called the American Rescue Plan, on Thursday afternoon. The plans goal is to crush the coronavirus and deliver relief to the American people. Heres how it affects homeowners:

- $1,400 stimulus checks issued to qualified adults

- $10 billion sent to states for struggling homeowners who cant pay their mortgages, utilities, and property taxes

Its important to know how this next round will affect you as a homeowner, especially for your finances, new laws, and potential tax implications.

What If I Don’t Get The Money

First, if you’re waiting for an answer on your application from the Homeowner Assistance Fund, you should contact your mortgage servicer and let them know, especially if you’re facing foreclosure, experts say.

All struggling homeowners are encouraged to seek help from a housing counselor approved by the U.S. Department of Housing and Urban Development.

Don’t Miss: How Much Were Stimulus Checks In 2021

Congress Mortgage Relief Programs

Homeowners who have experienced financial hardship during the pandemic have a few options for mortgage relief.

To help borrowers struggling with mortgage payments due to unemployment or illness, Congress enacted mortgage stimulus programs under the CARES Act and the American Rescue Plan.

Many of these mortgage relief programs have been extended into 2022 to help those who are still struggling financially. If you find yourself in need of financial assistance, current options include:

Coronavirus Stimulus Checks For Homeowners

This benefit for homeowners, called Homeowners Assistance Fund , is part of Bidens American Rescue Plan. The $1.9 trillion plan, which was signed into law in March, sets aside $10 billion for the Homeowners Assistance Fund.

The fund ensures at least $50 million to each state, as well as for Puerto Rico and the District of Columbia. Further, it ensures $498 million for the Department of Hawaiian Home Lands and designated housing entities.

This fund aims to support homeowners hit hard by the pandemic and are unable to make their mortgage payments and are facing delinquencies and foreclosures. Eligible homeowners can use the money to cover mortgage payments, cost of utilities, homeowners insurance and other related essentials.

The Treasury Department is responsible for the distribution of the Homeowners Assistance Fund. It has set up many eligibility requirements to ensure that the money reaches those who need it the most.

This program could provide a much needed benefit to millions of homeowners across the nation. Fox News reports that over 3 million households are behind on their mortgage payments and about 1.7 million will exit their forbearance period in September.

Don’t Miss: When Are Stimulus Checks Coming

What Does It Cover

Alaska Housing Homeowner Assistance may include:

- Financial assistance to help homeowners reinstate a mortgage in forbearance, delinquency, or default

- Repaying homeowner expenses including property taxes, hazard insurance premiums, HOA/condominium dues, cooperative maintenance fees, and cooperative maintenance fees for homeowners who continue to experience financial hardships due to COVID-19.

Stimulus Checks: 9 Million People Have Until November 17 To Claim Payments

The IRS last month began alerting 9 million people that they could still claim thousands in stimulus and Child Tax Credit payments. If you are one of those people, you have only one day left to claim the funds, with the tax agency setting a deadline of November 17 to get the money.

The IRS said it began mailing the letters in mid-October to reach millions of people who haven’t claimed benefits such as stimulus checks, the expanded Child Tax Credit and the Earned Income Tax Credit.

People who are eligible must file a tax form by end of day on Thursday, November 17 to claim the money, the IRS said. The filing site will remain open until midnight E.T. on Thursday, but will be closed at 12:01 a.m. ET on Friday, November 18.

In disbursing billions of dollars in stimulus payments to help keep households financially afloat during the pandemic, the IRS relied on tax returns to determine eligibility as well as where to send the payments, as tax returns include bank account information or home addresses for mailing the checks. But about 9 million Americans have yet to claim the funds because they didn’t file a 2021 tax return, according to the agency.

The letters will inform people they may be eligible and how to claim the money, the IRS said.

Don’t Miss: H& r Block Stimulus Check

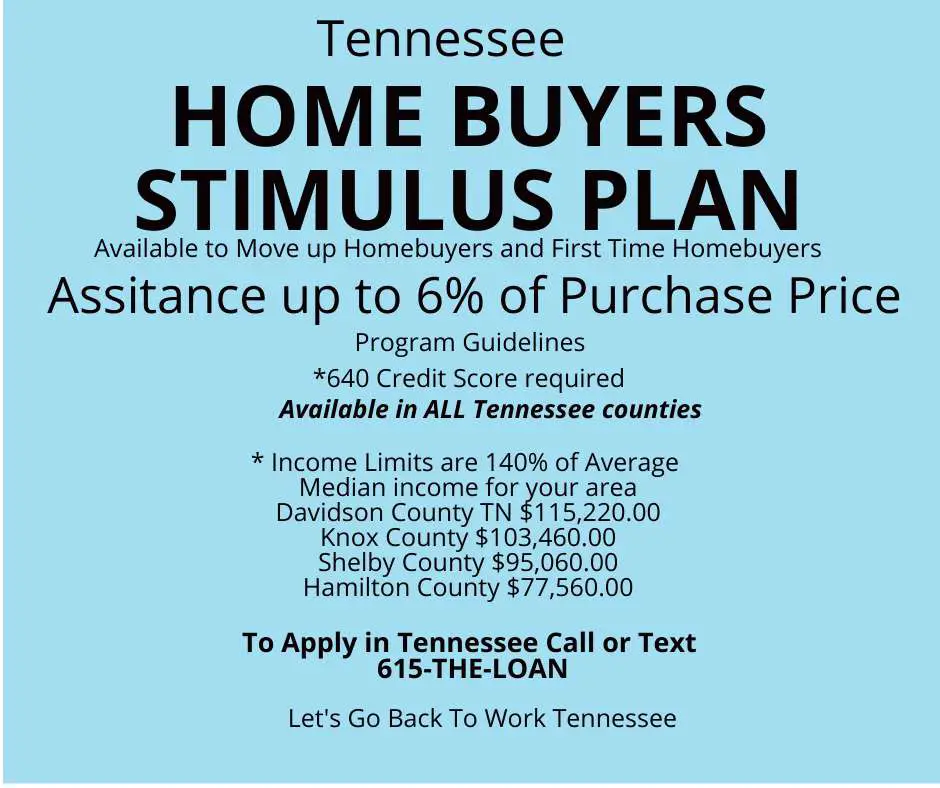

Eligibility For An Fha Loan

To qualify for a loan from the federal housing administration, you need to have an attractive credit score. This will make you eligible for getting a loan with an FHA-approved lender. Additionally, the cost of the home you would like to insure, and its location must be within the loan limit stipulated by the FHA in that location.

As long as you comply with these requirements, you can apply for an FHA loan. The loan is useful for homeowners and is the best form of stimulus for anyone that wants to purchase a new home.

Advance Child Tax Credit

Even if you dont pay any taxes, you may qualify for a refund of the CTC.

The CTC was expanded under the American Rescue Plan Act of 2021 for tax year 2021 only. If you are eligible, you should have begun receiving advance Child Tax Credit payments on July 15. The payments will continue monthly through December 2021. Under ARPA, families are eligible to receive:

- Up to $3,000 per qualifying child between ages 6 and 17

- Up to $3,600 per qualifying child under age 6

The Internal Revenue Service began sending out letters in early June to more than 36 million families who may be eligible for the monthly payments. Most families do not need to do anything to get their payments, as long as theyve filed their 2020 or 2019 tax return. Learn more about the letter and how it can help you determine your eligibility.

You May Like: What To Do If You Havent Received Your Stimulus Check

You May Like: Can You Still Claim Stimulus Check

Refinance To Lower Your Payments

Refinancing can offer homeowners relief by reducing their monthly payments. Most of the time, a refinance will lower your interest rate and extend your loan term both of which result in a more affordable monthly mortgage payment. Borrowers who cant lower their rate may still save money by spreading their remaining loan balance over a longer loan term.

Thanks to rising home values, even homeowners who made a very small down payment or refinanced recently could be eligible for a refi.

Even if you dont think youd qualify for a refinance, its worth talking to a lender. Many homeowners are eligible but dont know it yet.

Whats more, not everyone needs great credit or perfect finances to qualify for a refinance. Select programs, like the government-backed Streamline Refinance, can help borrowers refinance with little, no, or negative home equity.

Even if you dont think youd qualify for a refinance, its worth talking to a lender. Homeowners might be surprised at the amount of equity they gained as housing prices shot up nationwide. This could put refinancing within reach even if you had no home equity quite recently.

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

You May Like: Never Got First Stimulus Check

What Has President Biden Been Doing To Offer Mortgage Relief

According to a White House press release: Shortly after taking office, the Biden-Harris Administration extended the foreclosure moratorium and mortgage forbearance enrollment period for homeowners with government-backed mortgages to provide relief to struggling homeowners. Additionally, as part of President Bidens American Rescue Plan $9.961 has been provided for the Homeowner Assistance Fund, encouraging loan modifications and payment reduction options on all federally backed mortgages.

Read Also: Will I Get A Stimulus Check

Mortgage Assistance Programs: Covid

Several mortgage relief options may be offered. The type of loan you have, the owner or investor requirements of those backing the loan, and the servicer all factor in when determining the agreement youre offered.

- Pause Payment Agreement: Your payments are suspended for up to 180 days but must be paid back in full when payments resume.

- Mortgage Payment Reduction: The servicer agrees to reduce the monthly payment for several months. Once full payments resume, you have a specific period of time to repay the amount that was reduced. Interest accrues until the delinquent amount is paid in full.

- Payback at End of Mortgage: The amounts that were paused are tacked on to the end of your mortgage loan period. Or, the lender issues a second loan for the amount delinquent and considers the repayment a balloon payment. Both loans are due in full at the end of the mortgage period or when the property sells.

Read Also: When Were All The Stimulus Checks Sent Out

Mortgage Refinance Relief Faq

Does Congress have a mortgage stimulus program?

Although theres no current mortgage stimulus from Congress, there is federal help available for homeowners. In March 2021, the American Rescue Plan designated $10 billion to help struggling homeowners. The funds are distributed by individual states and you can locate your states agency and contact information with this lookup tool.

What is the Congress mortgage stimulus program?

Although theres no current mortgage stimulus from Congress, there is federal help available for homeowners. Its called the Homeowner Assistance Fund. This money is intended to help with a variety of homeownership costs, in addition to monthly mortgage payments, including property taxes, homeowners insurance, utility bills and HOA dues.

Is HARP still available?

No. HARP was discontinued on the last day of 2018. HIRO and FMERR were launched in 2021 and serve a similar function.

Are mortgage relief programs real?

Yes, these mortgage relief programs are real and available to help homeowners experiencing financial hardship. Be sure to apply for mortgage assistance directly through your states housing finance agency.

Who is eligible for mortgage relief programs?

You may be eligible for one of several mortgage relief programs, depending on the type of mortgage you have, even if your home value is low compared to your mortgage balance.

Request A Loan Forbearance To Put Your Mortgage Payments On Hold

While youre going through a financial crisis, loan forbearance temporarily suspends your monthly mortgage payments. Although the debt isnt erased youll have to make up the missing payments once the forbearance period expires it may provide you some breathing space while you get your finances back on track.

Also Check: Is It Too Late To Apply For Stimulus Check

What Is The 2021 Recovery Rebate Credit

That’s the official name of the third round of stimulus checks authorized by lawmakers during the pandemic, providing up to $1,400 per eligible person, including qualifying children claimed on a tax return.

That means a family of four could qualify up to $5,600 in stimulus money, assuming they earn under the income limit for the program. Under the law, the full amount is available to single taxpayers who earn less than $75,000 and married couples who earn less than $150,000.

Payments are gradually phased out for people who earn above those thresholds.

Stimulus Check Update: Homeowners Could Be Entitled To More Money

by Christy Bieber | Updated July 25, 2021 First published on June 15, 2021

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

If youre a homeowner, you may not have to wait for a fourth stimulus check to get your hands on more government money.

The American Rescue Plan Act was signed into law by President Joe Biden in March and is best known for the $1,400 stimulus checks that it provided.

Unfortunately, many Americans have long since spent this money and are now left hoping for a fourth stimulus check that will likely never come as Congress and the Biden administration have moved on to other priorities.

But for homeowners, theres actually a possibility of more stimulus money coming even if lawmakers do not pass any further COVID-19 relief legislation. Thats because the American Rescue Plan also provided $10 billion to a Homeowners Assistance Fund.

Unlike the $1,400 stimulus checks, though, you will need to take action to get your part of this money if youre eligible for it. As a result, homeowners need to understand how the HAF works and what criteria they must meet in order to be eligible for additional stimulus money from it.

Heres what you need to know.

Read Also: Irs Phone Number For Stimulus Check 2021

How Will I Be Notified About My Application Status

After completing your eligibility check, you will have received a confirmation email. Throughout the application process, we will send regular email updates about your application status, next steps, and any required documentation. Please check your spam and junk mail folders for the confirmation email. Please also double check your email address and phone number to make sure that there are no accidental typos in your entry.

Who Is Getting The Letters

The IRS said the 9 million people, who were identified by the Treasury’s Office of Tax Analysis, are those who aren’t required to file taxes because they have very low incomes. Single taxpayers under 65 typically don’t have to file a tax return if they earn less than $12,550 a year, for instance, while that goes up to $14,250 for single people over 65.

Recommended Reading: Did I Qualify For The Third Stimulus Check

Allocations And Payments For Tribes

The statute requires the Department of the Treasury to make allocations to Tribes and Tribal entities based on the allocation formulas used for the Emergency Rental Assistance Program under the Consolidated Appropriations Act, 2021.

The Department of the Treasury will publish Tribal allocations after the Tribal consultation process.

Notice Of Funding Availability For 2022 Texas Homeowner Assistance Fund Intake Centers Housing Counseling Services And Legal Services

The Texas Department of Housing and Community Affairs has announced a NOFA making up to $30.5 million of Texas Homeowner Assistance Funds available to subrecipients to provide Intake Centers, Housing Counseling Services, and Legal Services. Interested organizations can apply to provide one, two, or all three of the possible service categories as further described in the NOFA.

Interested applicants must meet the requirements set forth in this NOFA and must submit a complete application. Applications will be reviewed and awarded on a first-come, first-served basis. TDHCA may elect to fund only one organization in a given geographic area. The NOFA and application are available on the TDHCAs webpage at

TDHCAs TXHAF plan has been approved by the US Treasury.

Don’t Miss: The First Stimulus Check Amount

What Homeowners Need To Know

For homeowners who havent been able to pay their mortgage due to financial hardship, the bill calls for funds to be set aside for legal assistance in a foreclosure. The bill proposed to extend the residential eviction ban, which is currently set to March 31, but that didnt pass.

According to Bidens team, 20% of renters are behind on payments, and more than 6 million homeowners failed to make mortgage payments in September of 2020.

Here are details that pertain to the allocation of funds from this stimulus bill:

- $10 billion to states for struggling homeowners who cant pay their mortgages, utilities, and property taxes

- $20 billion to help low-income households cover overdue rent, provide rental assistance, and utility bills

- $30 billion in funds also will be allocated to emergency rentals, energy, and water assistance for those who need it

- $5 billion will go to emergency help for those who are homeless or are at risk for homelessness

The housing crisis has been amplified by the pandemic, with housing advocates warning that the previous stimulus packages werent enough. The problem of mass evictions still looms ahead.

Also, mom and pop property owners struggle with renters not being able to make payments. Housing experts believe a major investment in housing construction will be necessary to jumpstart and help struggling property owners.