The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

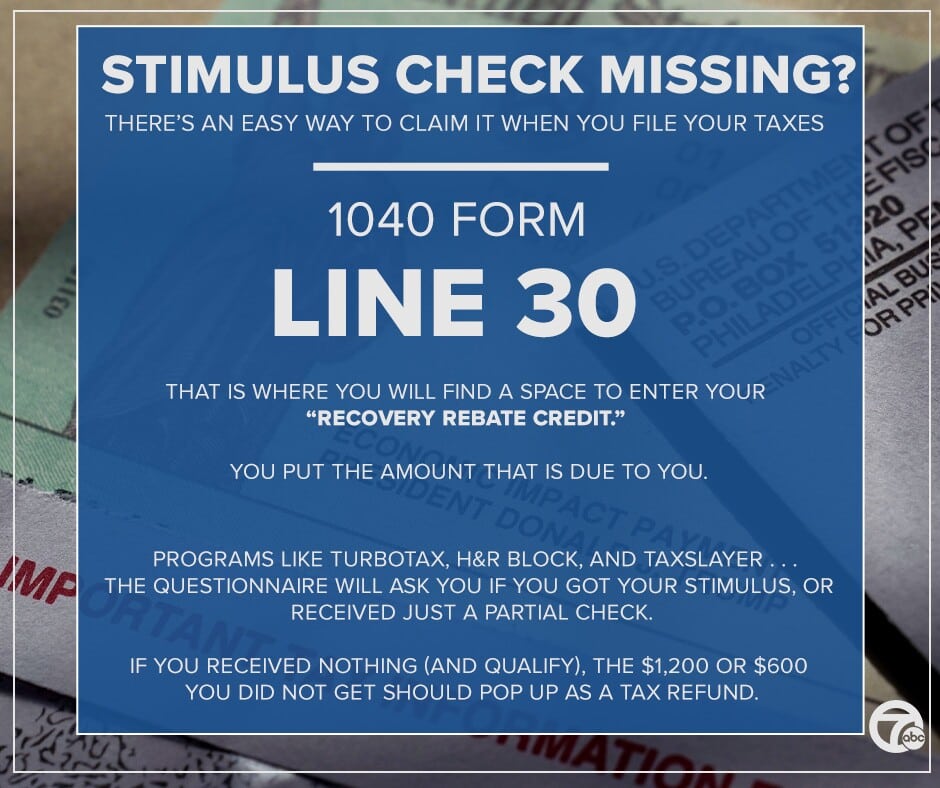

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

What If My Stimulus Check Was Lost Stolen Or Destroyed

If your payment was direct deposited, first check with your bank, payment app, or debit card company to make sure they didnt receive it.

You can request a trace of your stimulus check to determine if your payment was cashed. Only request a payment trace if you received IRS Notice 1444 showing that your first stimulus check was issued or if your IRS account shows your payment amount and you havent received your first stimulus check.

How to start a payment trace: You can mail or fax Form 3911 to the IRS or call 800-829-1954. Click here for specific instructions on how to complete Form 3911 for tracking your first stimulus check.

If the IRS discovers that your check was not cashed, your check will be reversed. You can now claim the payment.

If the IRS discovers that your check was cashed, the Treasury Department will send you a claim package with instructions. Upon review of your claim, the Treasury Department will determine if the check can be reversed. If the check is reversed, you can now claim the payment.

If the check is not reversed, contact the tax preparer who filed your return. If you are unable to reach them, contact your local Low Income Tax Clinic or Taxpayer Advocate Service office for help.

It can take up to 6 weeks to receive a response from the IRS.

What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

Also Check: Earned Income Tax Credit Stimulus

If You Didn’t Get A Third Stimulus Check Last Year Or You Didn’t Get The Full Amount You May Be Able To Cash In When You File Your Tax Return This Year

Getty Images

It was more than a year ago that a third round of stimulus checks was announced. Remember how excited you were to hear the news? An extra $1,400 in your pocket, plus $1,400 more for each dependent, was a big deal and made a huge difference for millions of Americans. But the excitement eventually turned to frustration and disappointment for people who didn’t get a payment or didn’t get the full amount. If that’s you, there’s some good news. You may still be able to claim the third stimulus check money you deservebut you have to act now, because you need to file a 2021 tax return to get paid.

Some people were left high and dry because they simply weren’t eligible for a third stimulus check. However, others were left out or given less than they were entitled to for various other reasons that won’t prevent them from getting paid this year. For example, if you didn’t get a third stimulus check because you didn’t file a 2019 or 2020 tax return, you can still claim a payment when you file a 2021 tax return. If you had a baby in 2021, you can get the extra $1,400-per-dependent for the child that was missing from last year’s third stimulus check payment. You could also be entitled to stimulus check money when you file your 2021 tax return if you experienced other recent changes to your family or financial situation .

Am I Automatically Eligible For The Third Round Of Stimulus Payments If I Received A Check In The First Or Second Round

No. Because stimulus eligibility was different for each round of payments, its possible that you were eligible for some but not all rounds.

For example, if youre a single filer with no dependents whose 2019 income was higher than $87,000, you likely were not eligible for the second or third round of payments.

You May Like: Irs.gov Stimulus Check Deceased Person

Will My 2020 Tax Return Affect My Payment Amount

In some cases, yes. If youâre entitled to a larger payment based on your 2020 tax return compared to your 2019 return, you will be eligible to receive the difference as a tax credit. If you lost your job or saw your income drop this year during the pandemic, this situation may apply to you. But you wonât see any additional funds via a tax credit until 2020 returns are filed this spring.

If the stimulus payment you are due is lower based on your 2020 income, you get to keep the higher payment that was sent to you based on your 2019 return.

You Receive Social Security Ssi Veterans Or Railroad Retirement Benefits But The Irs Still Needs More Information

Initially, individuals receiving Social Security , veterans, Supplemental Security Income , or railroad retirement benefits were told they would receive their stimulus checks automatically in the same way they receive their benefits. However, many still have not received their checks. This may be because the government does not have all the information they need to confirm who should receive it. If you still havent received your check, the IRS is asking that you use their non-filer website to request your check before October 15th. Those with dependents under age 17 should use the non-filer website by September 30th to receive the $500 dependent payment this year. Those who miss these deadlines may also request their check on their 2020 tax return next year.

You May Like: When Did The 1st Stimulus Checks Go Out

How To Determine If You Have Money Coming To You

Starting in late January, the IRS began sending out information via what it dubs Letter 6475. Its something for taxpayers to watch out for, Steber says. At the top of the letter, which the IRS says it will send through March, youll see the words Your Third Economic Impact Payment. The letter, which the agency did not send out last year, provides details about the total amount you received in third-round stimulus payments in 2021 and includes all payments, even if they were issued at separate times.

Keep in mind that the third-round EIPs were advance payments of the 2021 Recovery Rebate Credit. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their 2021 tax returns when they file in 2022, the IRS announced in a.

How Get Your 1st And 2nd Stimulus Check

The only way to get the 1st and/or 2nd stimulus check is to file a 2020 tax return and use the recovery rebate credit in the Federal Review section to get it. If you filed a 2020 return and did not complete that section then you can amend your 2020 return.

If you still need to file a 2020 return:

Online preparation and e-filing for 2018 and 2019 and 2020 is permanently closed.

To file a return for a prior tax year

If you need to prepare a return for 2018, 2019 or 2020 you can purchase and download desktop software to do it, then print, sign, and mail the return

You may also want to explore purchasing the software from various retailers such as Amazon, Costco, Best Buy, Walmart, Sams, etc.

Remember to prepare your state return as wellif you live in a state that has a state income tax.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2s or any 1099s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS/state received the return.

Federal and state returns must be in separate envelopes and they are mailed to different addresses. Read the mailing instructions that print with your tax return carefully so you mail them to the right addresses.

Also Check: Irs.gov Stimulus Check Sign Up

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Check If You Qualify For The Golden State Stimulus

To qualify, you must:

- An ITIN filer who made $75,000 or less

You must include your ITIN on your tax return. Your ITIN cannot be pending. Wait to file your tax return until you have your ITIN. You are eligible for the GSS if you file on or before October 15. If you have applied for your ITIN but have not received it by October 15, 2021, you have until February 15, 2022 to file your 2020 tax return to claim your GSS I.

Don’t Miss: I Still Haven’t Gotten My Stimulus

Can My Stimulus Check Be Garnished

As it currently stands, federal law permits the IRS to garnish the third round of stimulus payments to cover private debts, such as civil judgments.

However, your third check cant be garnished to pay past-due tax debts or other government debts, such as child support.

Congress is working to pass legislation to fix this loophole and prevent garnishments for private debt, but theres no guarantee this will occur before your payment goes out.

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couple’s total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individual’s online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Recommended Reading: How To Check On Stimulus Payment For Non Filers

How Your Return Can Help With A $1400 Stimulus Check

Since March, the government has been deploying new batches of stimulus checks weekly.

Each of those rounds has included payments to people that were prompted by the IRS processing their 2020 tax returns.

That goes for people who do not typically file tax returns, but did so this year in order to get their $1,400 checks. Once those forms were processed, the IRS sent their payments.

In addition, people who already received their third stimulus check, and who are due more money after the IRS completed their latest return, received “plus-up” payments from the agency.

That could happen if their financial circumstances changed since their 2019 return, such as their income declining last year.

Not everyone needs to file a federal return in order to get their stimulus checks. If you receive federal benefits and do not typically file, you should get your payment automatically. However, you may want to file a return in order to submit information on eligible dependents.

In addition, if you used the IRS online non-filer tool last year, you should not have to resubmit your information.

The non-filer tool has not been reopened this year. Instead, the IRS has urged people who it does not already have on record to file tax returns, which can help the agency evaluate whether or not you may be eligible for other tax credits.

How Can I Get My Stimulus Payment Faster

The quickest way to get your payment is through direct deposit. Beware of scams! The IRS will not contact you by phone, email, text message, or social media to request personal information especially banking details or ask you to provide a processing fee. They will send written correspondence with instructions on steps to take and the timeframe for action. Remember, you do not need to pay to get this money.

Additionally, the IRS refers to this money as an Economic Impact Payment. Communications that use stimulus check or recovery rebate are unlikely to be from the IRS. Hang up on phone calls you receive and delete email or text messages that seem too good to be true. You can report scams to the Better Business Bureau to helps protect others.

You May Like: Who Is Getting The New Stimulus Checks

Who Isnt Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you arenât eligible for any more cash. And you canât take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or âresident aliensâ qualify for the recovery rebate credit. If you are a ânonresident alienââ someone who has not passed the green card testâyou do not qualify for the credit.

You also are not eligible if you donât have a Social Security number. But if youâre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youâre not in the Social Security system.

How To Report A Missing Stimulus Check To The Irs

You may still have questions, especially if you havent received a check, or you get the dreaded payment status unavailable notice. To report missing checks or ask other questions, call the IRS at 800-919-9835.

The IRS added 3,500 telephone representatives in May, but dont be surprised if you dont get through immediately. A lot of people have questions. You can go online to find answers to frequently asked questions about Economic Impact Payments and the Get My Payment tool.

One question a lot of people have is whether the stimulus money will affect their 2020 taxes. It wont. It is not considered taxable income, so it wont increase what you owe or reduce your refund when you file next year.

Another question the IRS cant answer: Is a second stimulus check on the way? Possibly. Senate Republicans rejected the plan passed by House Democrats but have said they are drawing up a plan of their own, perhaps to be finished in late July. Stay tuned.

Also Check: When Can Social Security Recipients Expect The Stimulus Check

How To Make Sure You Receive Your Credits As Soon As Possible

The Recovery Rebate Credit worksheet requires that you know the specific amounts you were supposed to receive, according to the IRS. By doing the investigation and calculation work in advance, youll most likely end up getting your stimulus check and tax refund faster.

To get it correct, that cannot be overemphasized, Steber says. These Recovery Rebate Credits are real cash, and they sent out hundreds of millions in the two tranches. If you did in fact receive it and forget about it, it could add weeks to your tax return timeline.

Your tax refund will be passed more quickly and safely if you electronically file and provide a direct deposit, the IRS says.

Typically, the IRS is good at sending out refunds within a couple of weeks within electronically filing, Bronnenkant says.

Not included in 2020s Recovery Rebate Credit is a third stimulus payment worth $1,400 or more, distributed to Americans beginning in mid-March after President Joe Biden signed the $1.9 trillion American Rescue Plan. Taxpayers will most likely have to wait until 2021 to claim those missing relief payments, Jaeger says.