How To Claim Your Rebate Credit

To get your money, youll need to claim the 2021 Recovery Rebate Credit on your 2021 return. Filing electronically can guide you through the form. Dont claim any missing first or second stimulus payments on your 2021 return rather, youll need to file a 2020 return or an amended return to get these payments.

The rebate credit does not count toward your taxable income. And be aware that youll need to fill out your tax return accurately and include the precise amount of stimulus payments the IRS has actually paid you to avoid a delay in your returns processing. If you enter the incorrect amount, it can hold up the processing of your return, Greene-Lewis cautions. The agency will not automatically calculate your 2021 rebate. It is on you, the taxpayer, to claim the Recovery Rebate Credit, Steber says.

Adam Shell is a freelance journalist whose career spans work as a financial market reporter at USA Today and Investors Business Daily and an associate editor and writer at Kiplingers Personal Finance magazine.

Also of Interest

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Requesting A Filing Extension

If you’re unable to file a 2021 tax return by the April 18 deadline , there’s an easy way to buy some more time. Simply request an automatic six-month extension to file your return. That will give you until October 17 to submit your Form 1040 but you’ll still have to pay any tax that you expect to owe by April 18.

To get a filing extension, either submit Form 4868 or make an electronic tax payment to the IRS before the tax return filing deadline. There are also special rules that apply to Americans living abroad and people serving in a combat zone. See How to Get More Time to File Your Tax Return for more information about federal tax filing extensions.

If you’re getting an extension for your federal tax return, you might want to get one for your state tax return, too . Check with your state’s tax agency for information about state tax return filing extensions.

Don’t Miss: Telephone Number For Stimulus Check

I’m A Dollar Tree Fan

For example, parents who welcomed a child in 2021 may be eligible for the $1,400 payments as long as they meet income requirements.

Eligibility for the third round of stimulus checks, issued in 2021 as part of President Joe Biden‘s American Rescue Plan, was based on a family’s last tax return filed.

Since babies born in 2021 were not factored in, the $1,400 checks will be applied to their parent or guardian’s 2021 tax return.

Others may be eligible for more money, as well, due to a change in income or the addition of a dependent.

Payments begin to phase out for people who make more than those income limits.

They completely phase out for individuals who make more than $80,000 and couples who make more than $160,000.

Reconcile Your Advance Payments Total On Your 2021 Tax Return

If you received advance payments of the Child Tax Credit, you need to reconcile the total you received with the amount youre eligible to claim.To reconcile advance payments on your 2021 return:

- Get your advance payments total and number of qualifying children in your online account.

- Enter your information on Schedule 8812 .

You can also refer to Letter 6419.

If Married Filing Jointly

If you received advance payments based on a joint return, each spouse is treated as having received half of the payments, unless one of you unenrolled.

To reconcile your advance payments on your 2021 tax return, add your advance payments total to your spouses advance payments total.

Each of you can find your advance payments total in your online account.

If Letter 6419 Has a Different Advance Payments Total

For the majority of taxpayers, the advance payments total in Letter 6419 will match the total in online account.

If the advance payments total differs between your Letter 6419 and your online account, rely on the total in your online account.

Your online account has the most current advance payment information. Do not rely on Tax Transcripts for the advance payments total.

Keep Letter 6419 for your tax records.

Frequently Asked Questions: Reconciling Your Advance Payments

Recommended Reading: Irs Sign Up For Stimulus

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

How To Claim Stimulus Funds In Your 2021 Tax Return

The third round of stimulus payments is worth up to $1,400 per person if your adjusted gross income is $75,000 or less as a single filer, or $160,000 or less as a joint filer. Families are entitled to $1,400 per dependent for dependents of any age.

Before claiming the funds, make sure they weren’t sent to you already. You can confirm the amount of the third payment and whether it was sent to you by logging into your IRS online account or the Get My Payment app. You can also refer to a letter sent to you by the IRS, known as Notice 1444-C, which will tell you how much is owed to you.

If you lost your stimulus check or suspect it was stolen, you can request the IRS to trace your payment and get the amount automatically reimbursed to you as a tax refund. If you’re filing your 2021 tax return before your trace is complete, do not include the payment amount on the Recovery Rebate Credit Worksheet, the IRS says.

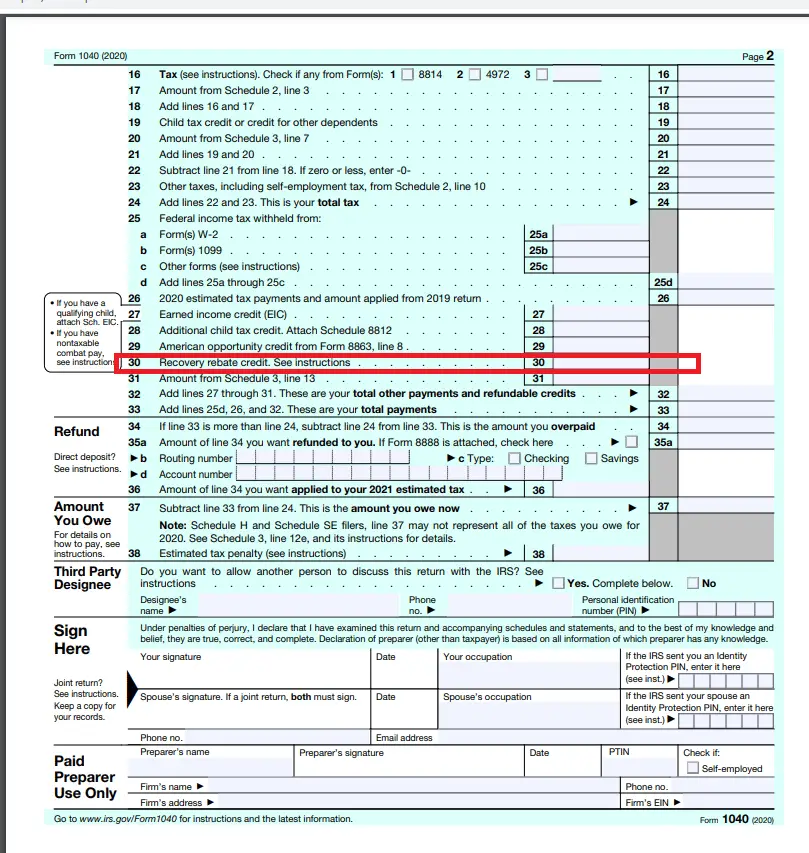

Otherwise, you’ll need to complete the Recovery Rebate Tax Credit worksheet and submit it as part of your 2021 tax return. The worksheet will help you calculate how much you can claim. Then, claim it on line 30 in Form 1040 or Form 1040-SR of your 2021 tax return.

Tax software will also guide you through this process and automatically add all the information to your tax return.

And remember, you can file your tax return for free if your income is $73,000 or less, using the IRS Free File Program.

You May Like: How To Sign Up For The Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

How Do I File For The Recovery Rebate Credit On Freetaxusa’s Website

First, create or login to your FreeTaxUSA account. Then, when you get to the Deductions/Credits section of the federal tax return, we’ll ask some questions including if you received the Economic Impact Payment or stimulus checks, and how much you received. We’ll guide you through this section, help calculate the estimated credit, and help you file for the Recovery Rebate Credit as you file for your 2020 and 2021 tax returns.

Don’t Miss: When Can Social Security Recipients Expect The Stimulus Check

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

You’re claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Recommended Reading: Where Is My 2nd Stimulus Check

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

What If I Never Received Letter 6475 Or Lost It

If you never received a third stimulus check, the IRS didn’t send you Letter 6475. If you were eligible and didn’t get a payment in 2021, you can get those funds now by claiming the recovery rebate tax credit on your 2021 tax return.

If you did get a third stimulus check but never received Letter 6475 or you lost it, you can find the information about the amount of your economic impact payments using your online IRS account. After you log in, click the View Tax Records link and then the plus sign next to 2021 under Economic Impact Payment Information.

If you are married filing a joint tax return, you and your partner both need to log into your online IRS accounts and add the amount of your payments in order to calculate your full stimulus check payments for 2021.

Recommended Reading: How To Recover Stimulus Check

What Phone Number Is 800 829 0922

If you want to call the IRS, make sure you call the right number: 800-829-0922. The letter says you have 60 days from the date of the letter to appeal or you can sue in federal court. You may want to hire a tax professional and you may qualify for low-income taxpayer clinics. They’re free or close to free.

Looking For More Stimulus Information

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Recommended Reading: Who Are Getting Stimulus Checks

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments ended at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

Recommended Reading: New York Stimulus Check 4

Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

How Do I Claim My Stimulus Check Step By Step Guide

- 8:35 ET, Sep 8 2022

AN estimated 10million Americans had not received a stimulus check that they were entitled to, a March report found.

The Treasury Inspector General for Tax Administration conducted the report, revealing several factors as to why payments may be delayed.

Most people received their stimulus checks by check or direct deposit.

Others received them in the form of prepaid debit cards, and some mistook these cards as junk mail and regrettably threw them out.

The report by TIGTA said that manually verifying the stimulus claims and debit card policies has delayed the payments for as many as 10million people.

If you missed out on your payments, you can go to GetYourRefund.org to claim the funds.

You May Like: When Was 3rd Stimulus Check Mailed

Did I Get A Third Stimulus Payment

Most received third stimulus payments in March 2021. The IRS also issued what were called “plus up” payments or extra money in addition to the initial direct deposit or stimulus check issued last year for millions but, not all, of taxpayers who qualified for the stimulus money.

The third stimulus payment was viewed as money you received in advance of the Recovery Rebate Credit that you might be eligible to claim on a 2021 federal income tax return.

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Also Check: How Much Third Stimulus Check