Stimulus Checks For Deceased Taxpayer

So I’ve read dozens of posts/responses on this topic on this Forum as well as the links provided to the pertinent IRS documentation. The prevailing direction here — and on the IRS site as well — seems to be that a taxpayer who died in 2020 is eligible for the two stimulus payments or the credits for them if they were not received. The only thing that gives me pause is the IRS guidance posted midyear 2020 — and which is still on the IRS site — re: returning the initial $1,200 stimulus payment if it was deposited after the taxpayer’s death. That is what happened with my mother-in-law’s situation. She passed in late March and the check showed up in her e checking account a few weeks later. Per the prevailing advice at the time, as the POA for her estate, I returned the $1,200 via a check to the IRS, which they cashed. Now I’m trying to finish up her taxes for 2020, and Turbo Tax, the Community Forum responses and the IRS seem to be suggesting that she is not only is eligible for a credit for the $1,200 stimulus payment in early 2020, but also the $600 stimulus amount that was approved in late 2020. Just asking one last time, is this correct? Thanks in advance for any help.

When Will The Third Stimulus Check Be Issued

The government started sending the third stimulus checks on March 12, 2021. The IRS continues to send third stimulus checks as people submit their information to the IRS either by filing a 2020 tax return or using GetCTC.org. The deadline to use GetCTC.org is November 15, 2021.

If you have your banking information on file, the IRS sent your payment via direct deposit. Otherwise, you will receive your payment as a check or debit card via mail. Mailed checks and debit cards may take longer to deliver.

If you dont fall into any of these categories, youll have to wait to receive your third stimulus check. You will need to file a 2020 federal tax return to get the third stimulus check or use GetCTC.org if you dont have a filing requirement.

You can also get the first and second stimulus check as the Recovery Rebate Credit on your tax return or GetCTC.org if you are eligible.

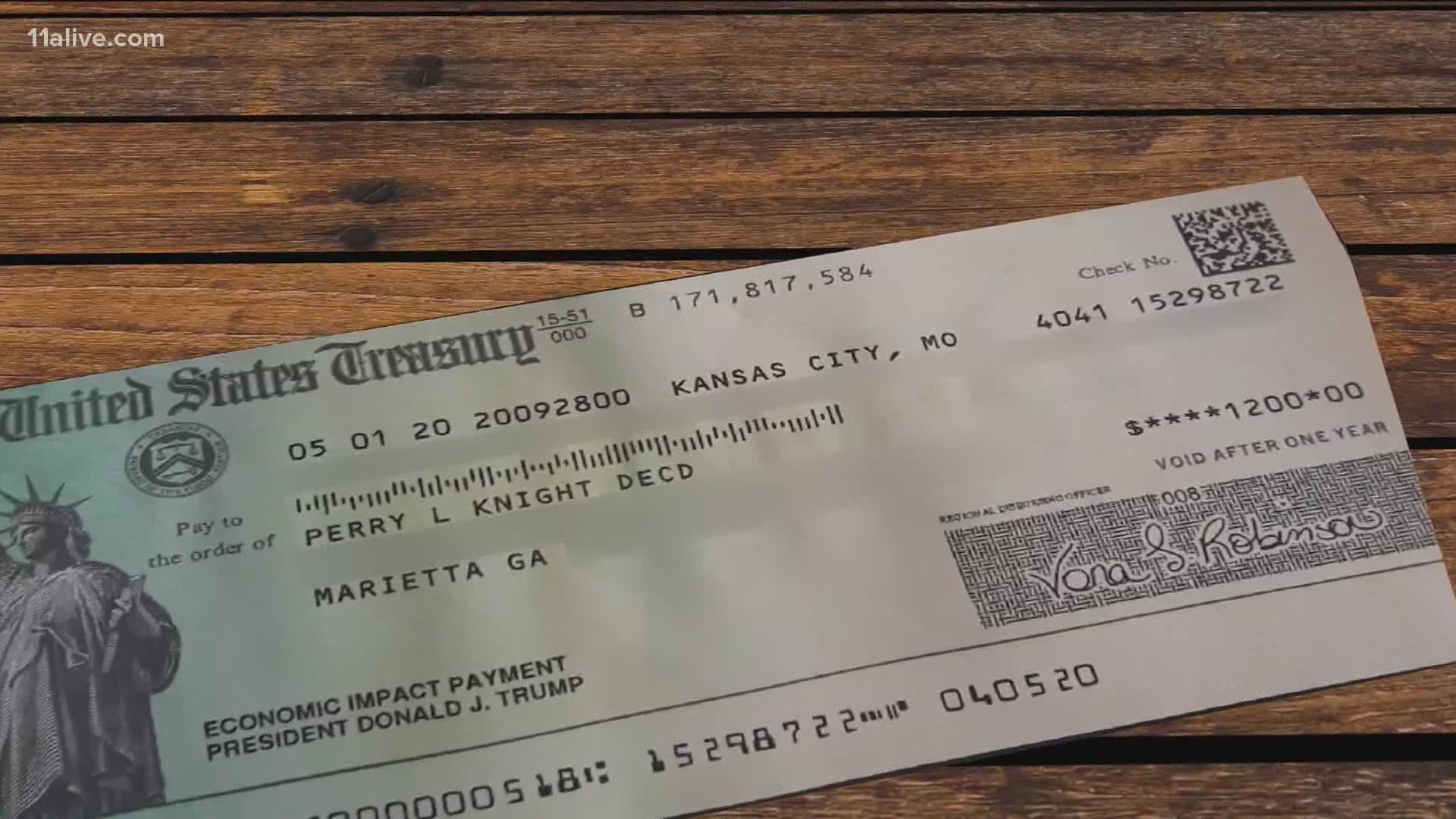

Irs Sends Coronavirus Stimulus Checks To Dead People

- The Internal Revenue Service began depositing coronavirus stimulus payments into Americans’ bank accounts over the past several days.

- Some of that money made its way into the accounts of deceased individuals.

An unlikely group counts itself among the recipients of the coronavirus stimulus checks: the dead.

The IRS began distributing $290 billion in direct cash payments within the past week as part of the $2 trillion CARES Act stimulus bill. As part of the plan, IRS is sending checks of up to $1,200 per individual and $2,400 per married couple over the past several days to weather the economic crisis caused by the coronavirus pandemic.

However, the agency directed some of the one-time payments to bank accounts of deceased individuals, USA Today reported this week.

It’s not immediately clear how many deceased people received the direct deposits.

More from Personal Finance:Scammers looking to steal your stimulus check

Rep. Thomas Massie, a Republican from Kentucky, said Wednesday a friend texted him to say his father, dead since 2018, had just received his $1,200 in stimulus money, according to MarketWatch.

“We’re aware of all the survivor-related questions and we’re still working that issue,” IRS spokesman Eric Smith said. The Treasury Department did not immediately respond to a request for comment.

This isn’t the first time the federal government has issued stimulus checks to the dead.

You May Like: I Never Received Any Stimulus Check

Stimulus Checks To Deceased Person

Stimulus Checks To Deceased Person. Know that the extra $1,400 per dependent is also not available for a parent who died before that date. Trusts and estates are also ineligible to receive a third direct payment, she added.

Stimulus checks for deceased taxpayer at this time, the irs has only indicated that payments would not be issued to anyone who passed before january 1, 2021. 1,100,000 payments were sent to dead people. First published on april 16, 2020 / 4:12 pm

Source: www.boston25news.com

Plus $500 per qualified child, but these amounts are phased out based on income. There was one $1,200 check in april 2020, one $600 check in december 2020, and one $1,400 check in march 2021.

Source: www.kshb.com

The funds sent back totaled $72 million. Stimulus checks for deceased taxpayer at this time, the irs has only indicated that payments would not be issued to anyone who passed before january 1, 2021.

Source: www.cbs19.tv

She told marketwatch the cares act stimulus bill contained no clawback provisions to retrieve money sent to a dead person after it’s been handed out. Even deceased people received the payment as part of the legislation.

Source: www.kplctv.com

Its been almost 11 months since congress approved the third stimulus check of $1,400. Return the entire payment unless the payment was made to joint filers and one spouse had not died before receipt of the payment, in which case, you only need to return the portion of the payment made on account of the decedent.

What Should You Do If You Received A Stimulus Check Made Out To Someone Who Is Deceased

Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, .

The dearly departed were not excluded from the federal governments stimulus check spending spreefar from it.

The Internal Revenue Service sent out more than 1 million stimulus payments, totaling nearly $1.4 billion, to deceased Americans as part of its coronavirus aid package, according to a report released Thursday by the Government Accountability Office.

The watchdog agencys report, which evaluates the federal governments response to the COVID-19 pandemic, notes that the IRS and Treasury Department faced difficulties both in delivering payments to some Americans and denying them to others who were ineligible, such as the deceased.

As a result, the agencies made stimulus payments to deceased recipients during the first three batches of disbursements that went out this spring. Those disbursements accounted for 72% of the total payments handed out as of May 31.

The GAO cited administrative issues as the cause of the oversight. It pointed to the IRSs legal determination of who was eligible for the payments, as well as the Treasury Departments lack of access to Social Security Administration death records typically used by the IRS to detect and prevent erroneous and fraudulent tax refund claims.

Don’t Miss: Where’s My Stimulus Check 2021 Tracker

Q & A: Returning An Economic Impact Payment

According to the Treasury Department, more than 159 million individuals have already received their Economic Impact Payments however, a recent audit found that the IRS sent $1.4 billion in stimulus checks to deceased individuals. As such, many people may have received a payment for a deceased family member or another taxpayer who is not eligible to receive a payment and may have questions about what to do. Here are some answers:

Q: How should an individual return an Economic Impact Payment?

Mail the payment to the correct IRS mailing address listed on the Economic Impact Payment Information Center page at IRS.gov. The mailing address is based on the state that the person lives in and may be different from where you send your tax forms and payments.

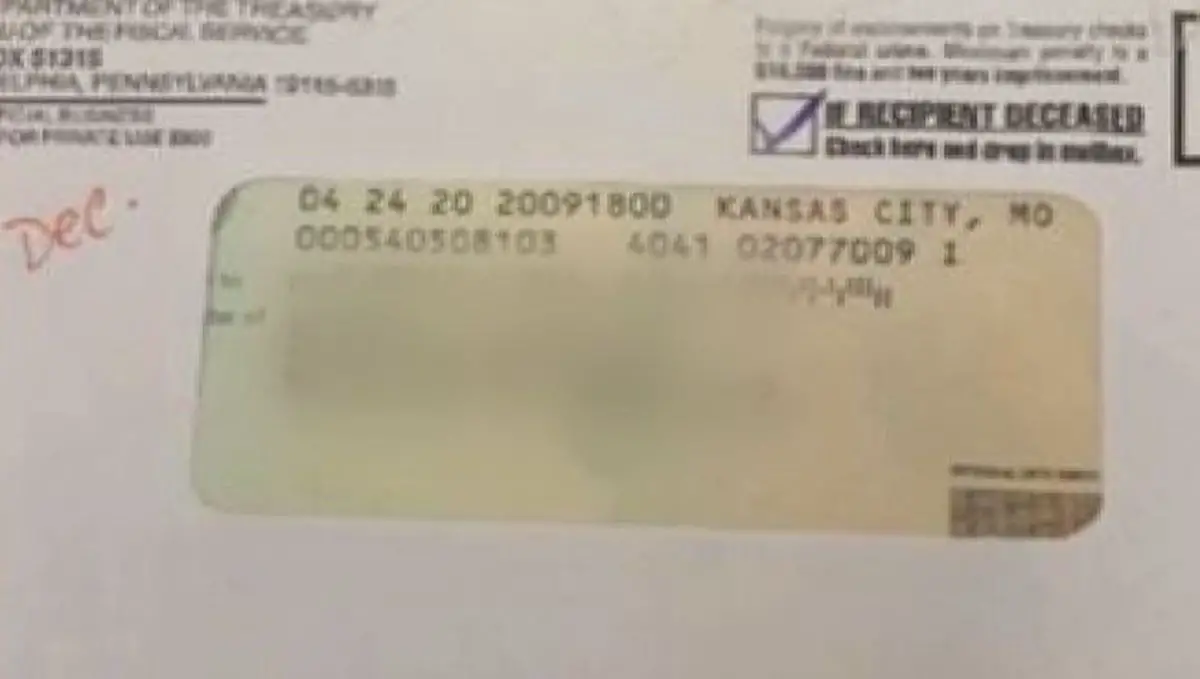

Q: What if a payment was received for someone who has died?

A payment made to someone who died before they received the payment should be returned to the IRS. Return the entire payment unless the check was made out to joint filers and one spouse is still living. In that case, return half the payment, but not more than $1,200.

If someone cant deposit a check because it was issued to both spouses and one spouse has died, the individual should return the check. Once the IRS receives and processes the returned payment, an Economic Impact Payment will be reissued to the surviving spouse.

Q: What if the paper check was not cashed or deposited?

If the paper check was not cashed or deposited take the following steps:

San Jose: 252-1800

When Returning A Direct Deposit Or A Paper Check That Was Cashed Or Deposited Taxpayers Should:

- Mail a personal check, money order, etc., to the appropriate IRS location.

- Make the check or money order payable to U.S. Treasury and write 2020 EIP, and the taxpayer identification number, Social Security number or individual taxpayer identification number of the person whose name is on the check.

- Include a brief explanation of why they are returning the Economic Impact Payment.

Taxpayers should visit Economic Impact Payment Information Center on IRS.gov for information on how to return or request a replacement EIP debt card.

Read Also: What Was The First Stimulus Check Amount

What Is Form 1: Statement Of Person Claiming Refund Due A Deceased Taxpayer

Form 1310 is a tax form that notifies the Internal Revenue Service of the decease of a taxpayer during the tax year and claims any refund that is due to the person’s beneficiaries or estate.

The form is filed as part of a complete tax return. This includes the standard Form 1040, which records the deceased person’s income for the year. In some cases, it is also necessary to file Form 1041, which records any income that an estate or trust received after the taxpayer’s death but before the assets were transferred to the beneficiary.

Form 1310 is usually filed by a beneficiary of the deceased or by the executor of the estate of the deceased.

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Recommended Reading: How Do I Claim My Third Stimulus Check

Stimulus Checks Have Been Sent To Deceased People As The Irs Didn’t Have Time To Cross

US Stimulus checks deliver to deceased relatives need to be returned to the government, says Treasury Secretary Steven Mnuchin. As the US tries to help families during the coronavirus pandemic in which millions of people have been left unemployed, checks have been sent to deceased people in the process.

The US has sent 90 million non-taxable checks to US families but people who filled taxes in 2018 and 2019 but have since passed away were still on the IRS’ registry and received money. “Heirs should be returning that money, Mnuchin said in an interview with The Wall Street Journal on Tuesday. He also sent somewhat of a warning by saying the government were able to track checks sent to deceased people.

Amid High Costs $850 Relief Checks Are Being Sent To An Estimated 858000 Maine People

Maine people are grappling with the increased costs as a result of pandemic-driven inflation, ranging from higher energy costs to increased prices of everyday goods.

While the Governor cannot control the impact of COVID-19 on global markets, she can make sure that we deliver to Maine people the resources they need to deal with these higher costs.

To help, Governor Mills proposed giving back more than half the budget surplus to the taxpayers of Maine, in the form of $850 direct checks.

The Governors proposal was supported by the Legislature and $850 checks will be sent to an estimated 858,000 Mainers, for a total of $729.3 million returned to taxpayers.

Recommended Reading: Do You Have To Claim Stimulus Check On 2022 Taxes

Irs Mailing Addresses To Send Uncashed Stimulus Checks And Reimbursements

If you live in

Maine, Maryland, Massachusetts, New Hampshire, Vermont: Andover Refund Inquiry Unit, 310 Lowell St, Mail Stop 666A, Andover, MA 01810

Georgia, Iowa, Kansas, Kentucky, Virginia: Atlanta Refund Inquiry Unit, 4800 Buford Hwy, Mail Stop 112, Chamblee, GA 30341

Florida, Louisiana, Mississippi, Oklahoma, Texas: Austin Refund Inquiry Unit, 3651 S Interregional Hwy 35, Mail Stop 6542, Austin, TX 78741

New York: Brookhaven Refund Inquiry Unit, 5000 Corporate Ct., Mail Stop 547, Holtsville, NY 11742

Alaska, Arizona, California, Colorado, Hawaii, Nevada, New Mexico, Oregon, Utah, Washington, Wisconsin, Wyoming: Fresno Refund Inquiry Unit, 5045 E Butler Avenue, Mail Stop B2007, Fresno, CA 93888

Arkansas, Connecticut, Delaware, Indiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, Ohio, West Virginia: Kansas City Refund Inquiry Unit, 333 W Pershing Rd, Mail Stop 6800, N-2, Kansas City, MO 64108

Alabama, North Carolina, North Dakota, South Carolina, South Dakota, Tennessee: Memphis Refund Inquiry Unit, 5333 Getwell Rd Mail Stop 8422, Memphis, TN 38118

District of Columbia, Idaho, Illinois, Pennsylvania, Rhode Island: Philadelphia Refund Inquiry Unit, 2970 Market St, DP 3-L08-151, Philadelphia, PA 19104

A foreign country, U.S. possession or territory, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien: Austin Refund Inquiry Unit, 3651 S Interregional Hwy 35, Mail Stop 6542 AUSC, Austin, TX 78741

Also of Interest

How Do You Return A Stimulus Payment

The IRS provided specific instructions for returning an economic impact payment sent to a person who is dead.

If the payment was a paper check and it hasnt been cashed:

- Write “Void” in the endorsement section on the back of the check.

- Mail the voided Treasury check immediately to the appropriate IRS location for your state.

- Don’t staple, bend or paper clip the check.

- Include a note stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was a direct deposit:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location for your state.

- Write on the check/money order made payable to U.S. Treasury and write 2020EIP, and the taxpayer identification number of the recipient of the check.

- Include a brief explanation of the reason for returning the EIP.

Also Check: Irs Stimulus Check Sign Up

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Example Of Irs Form 1310

For example, let’s say a woman has died on March 30th of the year, leaving one daughter. Unfortunately, the deceased did not have a will in place, and no personal representative has been appointed by the court. However, she was due a $500 tax refund from the IRS at the time of her death.

The daughter must file Form 1310, along with a final 1040 tax return, and mail it to the IRS.

In this case, the beneficiary is not a spouse but a daughter. She will check the box for “other” on Form 1310 located in Part One, line C.

Part II contains a few brief questions related to the deceased and her estate.

Part III is the signature of the filer.

The daughter does not need to send a copy of her mother’s death certificate as proof, but she should keep it for her records.

You May Like: Where Is My 2nd Stimulus Check

Questions And Answers About The Third

These updated FAQs were released to the public in Fact Sheet 2022-22PDF, March 25, 2022.

If you didn’t receive, or get the full amount of, the third-round Economic Impact Payment, you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don’t usually file taxes to claim it. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program. The fastest and most secure way to get your tax refund is to file electronically and have it direct deposited, contactless and free, into your financial account. You can have your refund direct deposited into your bank account, prepaid debit card, or mobile app, and will need to provide routing and account numbers.

If you didn’t get the full amounts of the first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t usually file taxes to claim it. DO NOT include any information regarding the first and second Economic Impact Payments or the 2020 Recovery Rebate Credit on your 2021 return.

What can I do if someone else claimed me as a dependent in 2020 and I did not receive the third-round Economic Impact Payment?

Who was eligible for the third-round Economic Impact Payment?