Must Earn Income Thats Above

Eligible home buyers must earn an income thats no more than 20 percent over the median income for a metropolitan area. For example, in Portland, Maine, where the median income is $60,000, home buyers must earn $72,000 per year or less to claim their cash down payment grant.

Income exceptions can be made in high-cost areas, such as New York, Los Angeles, and other cities where the cost of living is high.

In high cost areas, eligible home buyers must earn an income thats no more than 80 percent over the local median income. In San Francisco, eligible home buyers must earn $189,000 per year or less.

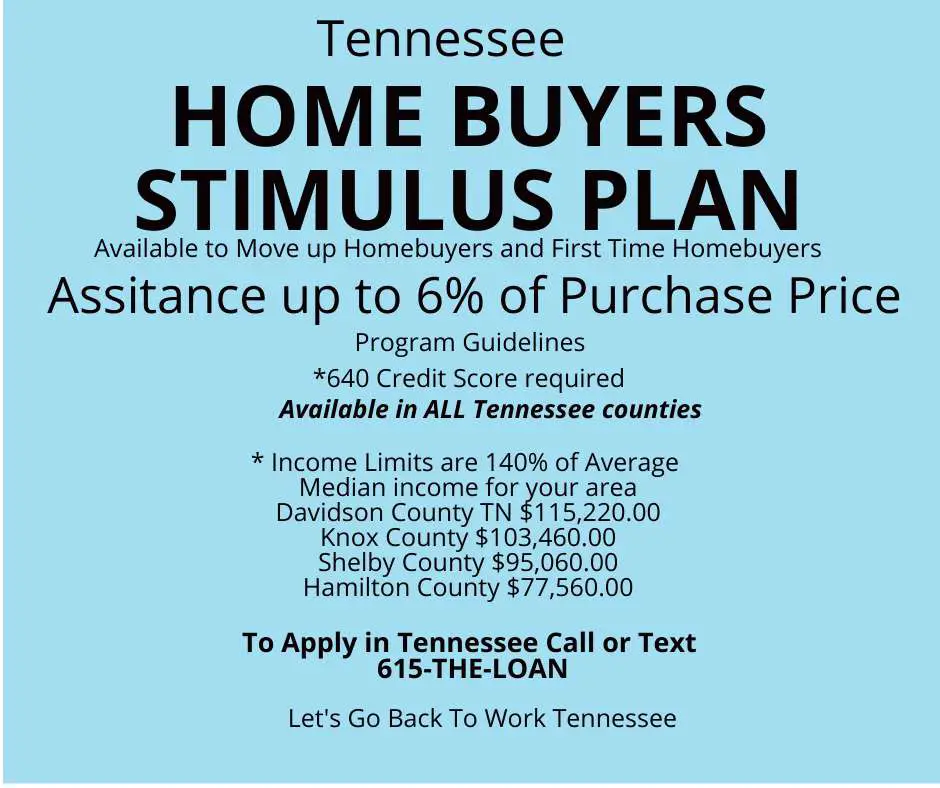

Federal Stimulus For Homeowners

HIRO and FMERR are some of the special stimulus programs put in place by the government for homeowners looking to purchase a new home.

They are special programs that are ideally suited to the current state of the market and the fact that interest rates are at an all-time low. They come with reduced interest rates and minimal monthly payments, which are easier to manage, and more people can afford them.

People buying a home for the first time will find these programs especially useful and suited to their needs. Refinance relief programs can help you make use of the low-interest rates, and in the process, you will also be able to take advantage of low-interest rates.

Even when your mortgage is higher than the value of your home, there are programs in place that are designed to ensure that you can conveniently make payments without worrying about the terms.

Terms have been made easier for new home buyers, and the interest rates and monthly payments have also been reduced. This is the opportunity many people have been looking for, and to start making use of them, start checking your refinance eligibility and the program that suits you best.

What To Know About The Downpayment Toward Equity Act Of 2021

Heres another first-time home buyer program newly introduced in 2021: the Downpayment Toward Equity Act of 2021. This is a program intended to help low-income buyers cover down payment and closing costs with up to $25,000 in grant money.

According to Bitton, these are the current eligibility requirements:

- Eligible homebuyers must make no more than 20 percent higher than the areas median income

- Must use a government-backed mortgage, such as those mentioned above

- Must be a primary residence.

The Bureau of Economic Analysis provides median income information by county and metropolitan area.

Recommended Reading: Recovery Rebate Credit Second Stimulus

How To Find Down Payment Assistance Near You

Down payment assistance programs are usually very localized. There are a few national DPAs and many statewide ones, but the majority are run at a city or county level.

The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out. Theyll also know which programs the lender can accept .

If you want to do some research on your own, you can also Google down payment assistance grants in . This will help you find current programs specific to your area that you might be able to apply for.

Missouri Down Payment Assistance Programs

The Missouri Housing Development Commission provides down payment assistance for both first-time and repeat buyers. This comes in the form of a second mortgage loan of up to 4% of the homes purchase price.

- This loan will be forgiven after 10 years, provided you dont move, sell, refinance, or pay off your first mortgage during that time

- To qualify, your income must be below certain limits, which vary by location. You also cant buy a single-family home with a purchase price over $391,308

Get more information from the MHDCs website. And check out HUDs list of other homeownership assistance programs in Missouri, including one operated by the Delta Area Economic Opportunity Corporation.

Read Also: How Much Was All The Stimulus Checks

What To Know About The First

You may have heard of a new first-time home buyer program in 2021. Its officially called the First-Time Homebuyer Act of 2021, but you may also hear something like Bidens homebuyer tax credit. Instead of a mortgage program that prospective buyers must apply for, this is a tax credit from the federal government. And its not really new its a modification to an existing tax credit.

To put it simply, this program would raise the maximum first-time home buyer tax credit from $8,000 to $15,000. But not everyone qualifies.

To qualify for the credit, Bitton explains that the following conditions must be met:

- Eligible home buyers must not have been co-signed on a mortgage loan or owned a property in the previous 36 months

- Must not exceed 60 percent of the areas median income

- Must be at least 18 years old or married to someone who is at least 18 years old on the date of purchase

- Most not purchase the home from a relative

- Must acquire the home on or after January 1, 2021.

Nevada Down Payment Assistance Programs

The State of Nevadas Home Is Possible Down Payment Assistance Program can provide a grant of up to 5% of your loan amount. And there are no asset limits or first-time purchaser rules.

To be eligible for Nevadas DPA program:

- Your qualifying income must be below $105,000 as a single borrower or $135,000 for two or more borrowers

- Your credit score must be 640 or above

- The purchase price of the home must be under $647,200

- You have to pay a one-time fee of $755

- Teachers and military service members can qualify for better interest rates

For more details, visit the Home is Possible Down Payment Assistance Programs webpage. And check out HUDs list of other homeownership assistance programs in Nevada.

Also Check: $600 Stimulus Check Not Received

Minnesota Down Payment Assistance Programs

The Minnesota Housing Finance Agency provides two types of down payment assistance loans to eligible borrowers:

- Monthly Payment Loan: Borrow up to $17,000 at the same rate you pay on your first mortgage. Pay that down each month over 10 years

- Deferred Payment Loan: First-time buyers can borrow up to $11,000 free of interest. You make no payments, but the balance will come due when you finish paying off the mortgage, refinance, or sell the home

Discover more at the MHFAs website. And check HUDs list of other homeownership assistance programs in Minnesota.

National Homebuyers Fund Down Payment Assistance

Some first-time home buyer programs provide grants, rather than assistance securing a mortgage. The National Homebuyers Fund Down Payment Assistance is one example. The NHF is a nonprofit public benefit corporation that provides grants to qualified borrowers for closing and/or down payment costs, including first-time home buyers and repeat buyers, says Bitton.

The assistance is up to five percent of the mortgage loan amount, and it can be used for down payment or closing costs. The program isnt one-size-fits-all, so the assistance could be forgiven or there could be repayment options, depending on the buyers situation.

Don’t Miss: H& r Block Stimulus Check

Nebraska Down Payment Assistance Programs

The Nebraska Investment Finance Authority offers several options for down payment assistance.

- Homebuyer Assistance Program: When you use $1,000 of your own money, you can get a second mortgage up to $10,000 for 10 years at 1%

- First Home Grant Program: Home buyers who meet their countys median income limits can get up to $5,000 that never has to be repaid. This program has limited funds each year

Download NIFAs Homebuyer Assistance Program brochure for more information. And take a look at HUDs list of other homeownership assistance programs in the state.

New York Down Payment Assistance Programs

The State of New York Mortgage Association offers down payment assistance loans when you use the associations mortgage program to finance your home purchase.

- DPAL: You could borrow 3% of your homes purchase price up to $15,000, with a minimum loan amount of $1,000. This loan would be completely forgiven if you stay in the home loan for 10 years, and theres no interest

- Graduate to Homeownership:SONYMA also offers loans of up to $15,000 for first-time buyers who are recent college graduates and who are purchasing in certain communities in upstate New York

HPD is a New York City assistance program for eligible first-timers. For links to other city and area programs in New York, check HUDs list.

You May Like: Federal Stimulus Pays Off Mortgage

How To Find The Best Mortgage Lender As A First

To find the best mortgage lender for your first home purchase, start by figuring out your budget, deciding what you want in a home, and determining the best type of mortgage loan for your situation. All of these factors can help you make the best choice for which lender to work with. Its advantageous to work with a lender that has experience dealing with the exact type of loan you want. This is especially true when youre taking advantage of a government program, such as a VA loan or FHA loan.

Compare offers from a handful of mortgage lenders. This will help you find the best overall deal on your home loan. Interest rates and loan fees arent fixed, so you can shop around and negotiate both of these costs. It can also be helpful to contact a variety of types of lenders . Communicating with a wide range of lenders will get you access to different mortgage programs and an array of loan terms.

Michigan Down Payment Assistance Programs

The Michigan State Housing Development Authority has two programs that each offer up to $7,500 in down payment assistance. To be eligible, home buyers must get their mortgage loan through MSHDA.

The programs are:

- MI Home Loan: For first-time buyers and those purchasing in target areas whose income and home purchase price are within limits. Youll need a minimum credit score of 640 or 660, depending on your choice of mortgage. Homebuyers in many ZIP codes can get up to $10,000

- MI Home Flex: Open to all who fall within income and home purchase price limits. Youll need a minimum credit score of 660

According to HUD, help comes in the form of an interest-free loan that typically only falls due when you refinance, finish paying down your mortgage, or sell the home. So there are no monthly payments.

Michigan also offers a federal tax credit for home buyers.

To qualify for any of these programs, youd have to take a home buyer education course.

Find out more at the MSHDA website. And find a list of other homeownership assistance programs in Michigan on HUDs website.

Don’t Miss: Did They Pass The Stimulus Check

Utah Down Payment Assistance Programs

The Utah Housing Corporation offers down payment assistance loans for repeat buyers as well as those purchasing for the first time. ThisPDF from UHCs website lays out the details.

- You could get 4% or 6% of your primary loan amount depending on which down payment assistance loan you qualify for

- The loan is a 30-year second mortgage charging a fixed interest rate thats 2 percentage points higher than your primary mortgage rate. To qualify, youd first have to get approved for an FHA or VA loan through UHC

Learn more about these loansat UHCs website. And explore HUDs list of other homeownership assistance programs in Utah.

The $25000 Downpayment Toward Equity Program Expected In 2022

In 2021, Congress introduced a bill titled The Downpayment Toward Equity Act, a home buyer grant for first-generation home buyers with extra grant money available to renters with socially or economically disadvantaged backgrounds.

The Downpayment Toward Equity Act awards up to $25,000 so renters can buy their first home. Grant monies can be used to make a down payment, pay for closing costs, lower your mortgage rate by using discount points, and cover other expenses, too.

Check your eligibility for the $25,000 Grant.

Read Also: How To Check For Stimulus Checks

The Homebuyercom Forgivable Mortgage

The Homebuyer.com forgivable mortgage is a mortgage that behaves like a housing grant. Approved buyers receive cash for a down payment of up to 5% of their purchase price with no interest charged and repayment required.

Not everyone is eligible for the Homebuyer.com forgivable mortgage. At a minimum, recipients must have average credit ratings, qualify for an FHA loan, and agree to accept a 30-year fixed-rate mortgage. Buyers may also be required to attend a 1-hour online educational seminar.

Check your eligibility for the forgivable mortgage here.

Get pre-approved for a mortgage today.

Coronavirus Mortgage Relief Programs

The type of mortgage relief you may be eligible for depends on your loan type and which bank or agency owns your mortgage.

Here are the relief programs currently available for the four major loan programs: conventional, FHA, VA, and USDA.

Mortgage relief for conventional loans

Fannie Mae and Freddie Mac were the first to unveil relief programs for those affected by the coronavirus.

Many homeowners dont realize their mortgages are owned by Fannie or Freddie. You may not have noticed that one of them bought your loan after you closed. But you can easily find out using the lookup tool that each of them provides:

Be sure to use both tools. Either agency could own your mortgage as they own the majority of U.S. home loans.

Providing you agree with your lender on an assistance package, you could be in line for:

- Mortgage forbearance for up to 15 months

- Penalties and late fees waived on issues covered by your forbearance agreement

- No reporting to credit bureaus about late or missing loan payments

- Loan modifications that could allow you the same or lower monthly payments when things return to normal

Under the CARES Act, homeowners do not have to prove theyre in financial distress in order to get mortgage relief. That means no extensive documentation.

Homeowners simply have to claim theyre going through financial hardship by sending in a hardship letter saying theyve been affected by COVID-19.

Mortgage relief for government-backed loans

- FHA loans

- VA loans

- USDA loans

Also Check: Irs.gov Stimulus Check Sign Up

Bank Of Americas Community Homeownership Commitment

Good news for aspiring homeowners! Bank of Americas Community Homeownership Commitment® is bringing together products and resources that can help modest-income borrowers buy homes of their own. By combining down payment assistance and closing cost help with a low down payment mortgage, you may find that a new home is within reach.

Maine Down Payment Assistance Programs

The Maine State Housing Authoritys First Home Loan Program is aimed at first-time buyers and those whove not owned a home within the last three years.

- Advantage down payment and closing cost assistance: You get up to $3,500 toward your down payment and closing costs as a non-repayable grant. But that will be recouped by your lender through a slightly higher mortgage rate

Eligibility criteria include an unspecified minimum credit score and caps on your household income and home purchase price. Youll also need to put 1% of your own cash toward your home purchase. .

Discover more at MSNAs website. And check HUDs list of other homeownership assistance programs in Maine.

Also Check: Who Are Getting Stimulus Checks

Should I Wait Until Mortgage Rates Are Lower To Buy A House

With so much uncertainty surrounding mortgage rates, waiting isnt a strategy thats guaranteed to work in your favor. Inflation remains high and the Federal Reserve has signaled its plans for more hikes to short-term interest rates, two factors that could put pressure on mortgage lenders to continue raising rates.

Although your interest rate impacts how much house you can buy, mortgage rates dont have to drive your decision.If you can afford to buy right now, then go for it if not, just wait, Jones says. Buying a home with an affordable monthly payment is more important than waiting for rates to drop.

Aside from interest rates, you may also want to take home prices into consideration. Experts dont expect home prices to crash thanks to low inventory and strong demand from buyers. Even if rising rates curb demand, stricter lending standards have made todays housing market much more stable than the market leading up to the 2008 collapse.

How Can I Apply

Start by researching what programs are available in your area, if any. HUD has a list of local home buying programs by state. Check with your city and county to see if they offer any loans or grant programs. Search their websites for information on how to apply. Reach out to them via email or phone for specific answers you cant find online. Make sure your mortgage lender works with the program.

Don’t Miss: When Will The $1400 Stimulus Checks Be Mailed Out

Wyoming Down Payment Assistance Programs

The Wyoming Community Development Authority has two down payment assistance programs. Both provide a loan of up to $10,000.

Youll need a FICO score of 620 or better, and must contribute at least $1,500 toward your purchase, though that may be a gift.

The programs are:

- Home$tretch DPA: 0% interest rate with no monthly payments, due only upon sale of the home, refinance or 30-year maturity

- Amortizing DPA: Paid down in full with low monthly payments over 10 years

Both programs work only in conjunction with specific primary mortgage loans from the WCDA.

Find out more at WCDAs website. And check out HUDs list of other homeownership assistance programs in Wyoming.