How Much Were The Stimulus Checks

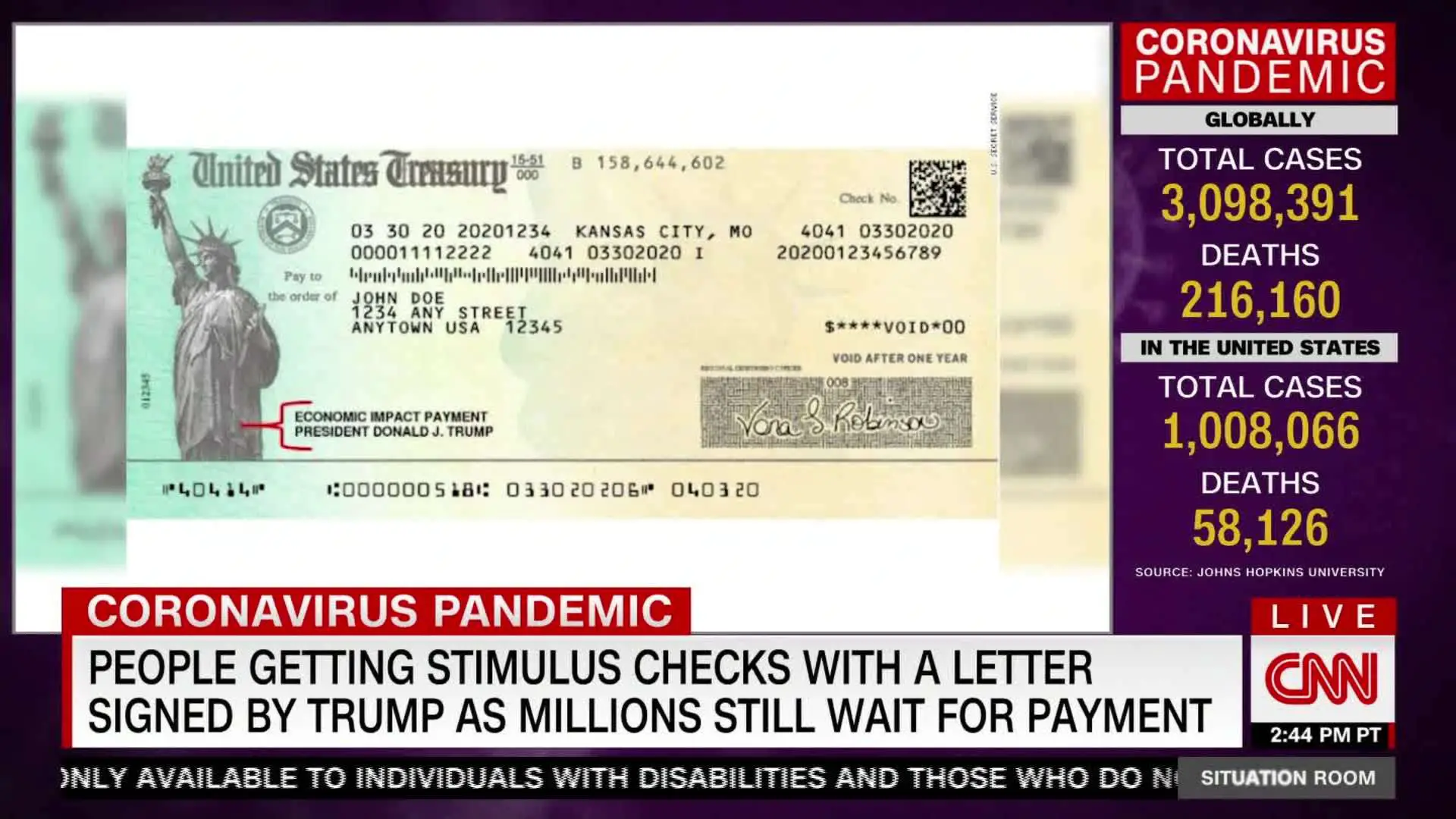

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

Colorado: $400 Rebate Payments

Colorado intends to send payments of at least $500 to taxpayers this year, after Gov. Jared Polis signed a bill in late May.

The exact amount depends on state revenue totals, but lawmakers expect every full-time resident who files a 2021 tax return before June 30 will receive a payment in September.

Th Stimulus Check Update And Payment Status In 2022 Latest News And Developments

This article provides updates, income qualification thresholds and FAQs on the approved and proposed COVID relief stimulus checks, also known as Economic Impact payments.

While multiple rounds of payments have been made over the last two years, many are asking if the government will make another of payments to help folks cope with high inflation and the rising costs of basic goods and services.

Each round of stimulus check payments had slightly different rules so please ensure you review each payment round separately. Click the links below to jump to the relevant stimulus payment.

If you have not received one or more of your stimulus payments, then you will need to claim this as a recovery rebate in your tax return filing this year.

Also Check: Where’s My 1st And 2nd Stimulus Check

Who’s Eligible For The Latest Stimulus Check

THERE is certain criteria that must be met in order to claim your third stimulus check.

You could be entitled to a payment if the following is true:

- You are not a dependent of another taxpayer

- You have a Social Security number valid for employment

Your adjusted gross income must also not exceed:

- $160,000 if married and filing a joint return

- $120,000 if filing as head of household or

- $80,000 for single applicants

When Could The Stimulus Payments Start

Following approval of the bill on March 11th, millions of Americans will start seeing the third stimulus payments by mid-to-late March 2021 per the estimated IRS payment schedule and official Biden administration guidance. Comments below confirm these are going out now. You can also check the IRS Get May Payment tool for the latest status of your payment. See payment FAQs from the second round of payments, which will also apply for the most part this time around.

Due to the fact that payments are going out in the middle of tax season it may be very hard to get a hold of someone in the IRS to help with payment issues and you will likely have to wait until after April 15th to follow up on issues.

You May Like: Get My Stimulus Payment 1400

Here’s How Much Stimulus Money The Average American Has Received

by Lyle Daly | Published on Aug. 16, 2021

Americans at almost every income level have collected sizable stimulus funds.

Since the beginning of the COVID-19 pandemic, the U.S. government has offered different types of stimulus money, including checks and tax credits.

But how much stimulus money has the average American received so far? We know the answer thanks to research from the Institute on Tax and Economic Policy. According to that data, most Americans got over $3,000 in federal funds, and lower-income Americans benefited the most.

How Are Americans Using Stimulus Checks

The Federal Reserve Bank of New York says that households are spending a smaller percentage of their stimulus checks and saving more. The that households set aside just under 25% of their third-round payments for consumption. This share fell from just over 29% of first-round payments reported in June 2020 and almost 26% of second-round payments reported in January 2021.

The table below is based on all three SCE surveys and breaks down the average percentage of stimulus payments spent, saved and used to pay off debt:

| New York Fed SCE Breakdown of Stimulus Check Spending | |

| Payment Round | |

| 37.4% | 33.7% |

The New York Fed also says that households expect to spend an average 13% of the third stimulus check on essential items and an average 8% on non-essential items.

For a comparison, preliminary data collected by the U.S. Census Bureau from shows that the majority of stimulus recipients are almost three times more likely to use checks to pay down debt than add to their savings.

An earlier showed that the majority of recipients who got the first stimulus check spent their payment on household expenses. Adults with incomes between $75,000 and $99,999 told the Census that they would most likely pay off debt or add to their savings. While adults making less than $25,000 said they would use their stimulus to pay for expenses.

For those households that spent their first stimulus checks, the study says:

Read Also: How To Sign Up For The Stimulus Check

What If My Bank Account Information Changed How Will I Get My Second Stimulus Check

Unfortunately, if your second stimulus check is sent to an account that is closed or no longer active, the IRS will not reissue the payment to you by mail. Instead, if you are eligible to get a payment, you can claim the stimulus check on your 2020 tax return as the Recovery Rebate Credit or use GetCTC.org if you dont have a filing requirement.

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Also Check: Irs.gov Stimulus Check Sign Up

If You Miss Out This Year

If you receive no $1,400 payment or a reduced check, but your income changes, you may be able to claim the money you are due when you file your taxes next year.

“Any change, either a slight reduction in earnings or even just putting more money in a traditional IRA or a 401 could yield a much bigger total payment when they do their 2021 taxes,” said Garrett Watson, senior policy analyst at the Tax Foundation.

“There’s a subset of folks who will be in that situation,” Watson said.

That also goes for this year’s tax-filing season for people who missed out on the previous $1,200 or $600 payments. You can claim a recovery rebate credit to recoup any money you were possibly owed. This is also available to people who typically do not file tax returns because their income is too low.

Stimulus Check Update: $3600 Is Coming In 2022 And You Might Qualify To Get It

At this point in 2022, the stimulus check story is actually proceeding down two tracks. The first one to note is the obvious one the one everybody is interested in. It entails the possibility of all-new stimulus checks at some point this year. As in, will we get them or not? And when? Along those lines, everyone is still waiting to see what the Senate will do about the possibility of a year-long child tax credit extension. Something the body left unfinished as 2021 drew to a close, with West Virginia Democrat Joe Manchin saying in an interview that his crucial vote on the package would be a no, throwing the whole process into chaos.

Read Also: 4th Stimulus Check For Single Person

The Us Federal Unemployment Benefit Provided Weekly Payments

While the CARES Act only provided a one-time stimulus payment for qualifying Americans, it did include an additional weekly payment for the unemployed. Americans could apply for a $600 per week federal unemployment benefit, which expires on July 31. House Democrats extended it in their HEROES Act, which is unlikely to become law as Senate Republicans do not plan to take it up, to January 2021. Earlier this month, Larry Kudlow, one of President Donald Trump’s economic advisors, said the administration was not in favor of extending it because it is a “disincentive.”

If I Owe Someone Money Can They Take My Stimulus Checks

Maybe. Anyone filing a 2020 or 2021 income tax return to claim stimulus checks will receive the money as a tax refund. Stimulus checks should not be kept by the IRS for back tax debt.

If you owe a debt to a different federal or state agency your tax refund could be taken by that agency before you get it. This is sometimes called a garnishment or offset

If you have a question about a garnishment or offset for a student loan debt, a debt related to public benefits , or a federal tax debt you can .

What should I do if I didnt get the full amount I am owed or if I have another problem with my Stimulus Checks?

If you didnt get your stimulus checks, even after filing your 2020 and 2021 tax returns, or if you have another problem with your Stimulus Checks you can . We may be able to help.

Also Check: H& r Block Stimulus Tracker

What If I Don’t Receive A Third Stimulus Check

Those who don’t file tax returns, including those who earn little income and recent college graduates, may have to wait until they file a tax return in April 2022 to get their stimulus rebate if they didn’t file a tax return for 2020 taxes or submit “non-filer” information to the IRS last year. Married couples with incomes below $24,400 and individuals with incomes under $12,200 fall into this category.

The IRS is still updating its Get My Payment tool with new payment information. Once it’s loaded with up-to-date information, individuals can check when their stimulus payment went out. If you have any issue with getting your second or third payment, see our article on what to do if you haven’t received your stimulus check.

Filing a tax return for 2020. If you don’t receive government benefits, and you didn’t file a tax return for 2019 or 2020 taxes or submit “non-filer” information to the IRS by November 21, 2020, you may not automatically get a third stimulus check. You might need to wait to file a tax return for the 2021 tax year and request a “Recovery Rebate Credit.” You will fill in the amount you are owed on line 30 of IRS Form 1040 .

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the “Recovery Rebate Credit.” You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds you’re owed.

It’s possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldn’t submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

Recommended Reading: Can Unemployed Get Stimulus Check

How Many Stimulus Checks Did Americans Get

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

Six Stimulus Checks And Direct Payments Worth Up To $1700 Going Out This Month

The latest round of cash begins to be phased out for individual taxpayers who earn $75,000 a year.

But once you hit the $80,000 annual gross income limit, you won’t be eligible for the help at all.

Like the single-taxpayer cut-off, there’s a $120,000 AGI cap on how much heads of households can earn to be eligible for the help.

A head of household is a single taxpayer who claims a dependent.

Don’t Miss: What Was The First Stimulus Check Amount

The Stimulus Had Big Economic Benefits But It Also Fueled Inflation

On the one hand, COVID-19 stimulus undoubtedly helped Americans in some very big, tangible ways. Namely, it reduced poverty beyond merely keeping people afloat during the early days of the pandemic.

According to the U.S. Census Bureaus supplemental poverty measure, the stimulus payments moved 11.7 million people out of poverty in 2020 a drop in the poverty rate from 11.8 to 9.1 percent. And the 2021 poverty rate was estimated to fall even further to 7.7 percent, per a July 2021 report from the Urban Institute. We dont know yet whether this came to fruition, but Laura Wheaton, a senior fellow at the Urban Institute and one of the analysts behind the 2021 numbers, told us that it was clear from their analysis that the stimulus checks were driving a dramatic decline in poverty.

More broadly, the stimulus checks also cushioned workers during one of the worst economic crises in modern history, which likely helped the economy bounce back in record time. In April 2020, when Americans were receiving the first round of checks up to $1,200 with the CARES Act the unemployment rate was at a disastrous 14.7 percent. But two years later, its almost returned to its pre-pandemic levels, with many job openings. I hope we dont forget how awesome it was that we supported people so well, and that we recovered as quickly as we did, said Tara Sinclair, a professor of economics at George Washington University.

RECOMMENDED

Politics

We Will Likely Learn The Wrong Lessons From The Stimulus

The lessons we draw from the response to the COVID-19 recession are important, because theyll almost certainly shape how we respond to the next economic downturn. In the wake of the Great Recession, policymakers shot too low. Now, they appear to have shot too high. If this were the story of Goldilocks, wed be poised to get things just right next time but politics is not a fairy tale, and its very possible that well overcorrect whenever another recession hits.

In many ways, were still figuring out what the lessons are as the pandemic still isnt over. And its, of course, hard to disentangle what could have happened had the governments response not been so aggressive. One clear lesson of the COVID-19 pandemic, though, is that Americas social safety net wasnt prepared to deal with a crisis of this magnitude, which is a big part of the reason why the response had to be so massive.

Our social safety net wasnt ready to catch everyone who needed it, so it was very difficult to figure out who really needed relief and when the tap should be turned off, according to Sinclair. Rickety state unemployment insurance systems couldnt be recalibrated to replace peoples incomes, so many people ended up being paid much more after they lost their jobs. It wasnt easy to target direct payments to people in specific income brackets, so the payments went out to some families who didnt need them.

Santul Nerkar is a copy editor at FiveThirtyEight.

Filed under

Don’t Miss: Recovery Rebate Credit Second Stimulus