Second $600 Stimulus Check Details

While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. The IRS however has confirmed has issued all first and second Economic Impact Payments it is legally permitted to issue, based on information on file for eligible people.

Get My Payment was last updated on Jan. 29, 2021, to reflect the final payments and will not update again for first or second Economic Impact Payments.

If you havent yet received your payment and GMP is not showing payment details then the IRS is recommending you claim this via a recovery rebate credit in your 2020 tax return that you will file this year. Major tax software providers like Turbo Tax and Tax Act have updated their software to allow tax payers to claim their missing first or second stimulus payment as a recovery rebate with their 2020 tax filing.

Under the COVID-related Tax Relief Act of 2020, the IRS has delivered more than 147 million EIPs totaling over $142 billion. Due to the lower income qualification thresholds and smaller payments this was lower than the 160 million payments made via the first stimulus check.

The Second Round Of Stimulus Checks

The second round of stimulus payments were authorized on December 27, 2020 as part of the Consolidated Appropriations Act, 2021. Those payments typically totaled $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child. The payments began phasing out at the same income levels as the current payments, but the maximum income levels to receive a payment were slightly higher. Taxpayers were ineligible for any payment, unless they had a qualifying child, above the following income levels:

- $87,000 for single taxpayers

- $124,500 for taxpayers filing as head of household

- $174,000 for married couples filing jointly

As of March 5, 2021, about $135 billion of the second round of payments have been sent out overall, such payments are expected to cost a total of $164 billion according to the Congressional Budget Office.

If You Provided Information Using The Irs Non

If you provided your personal information to the IRS using the non-filers portal, your money will be direct deposited into the bank or credit union account or prepaid card that you provided when you submitted your information. If you did not provide payment account information, a check will be mailed to you to the address you provided.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, including if you havent received the payment.

Recommended Reading: Third Stimulus Check File Taxes

We Will Likely Learn The Wrong Lessons From The Stimulus

The lessons we draw from the response to the COVID-19 recession are important, because theyll almost certainly shape how we respond to the next economic downturn. In the wake of the Great Recession, policymakers shot too low. Now, they appear to have shot too high. If this were the story of Goldilocks, wed be poised to get things just right next time but politics is not a fairy tale, and its very possible that well overcorrect whenever another recession hits.

In many ways, were still figuring out what the lessons are as the pandemic still isnt over. And its, of course, hard to disentangle what could have happened had the governments response not been so aggressive. One clear lesson of the COVID-19 pandemic, though, is that Americas social safety net wasnt prepared to deal with a crisis of this magnitude, which is a big part of the reason why the response had to be so massive.

Our social safety net wasnt ready to catch everyone who needed it, so it was very difficult to figure out who really needed relief and when the tap should be turned off, according to Sinclair. Rickety state unemployment insurance systems couldnt be recalibrated to replace peoples incomes, so many people ended up being paid much more after they lost their jobs. It wasnt easy to target direct payments to people in specific income brackets, so the payments went out to some families who didnt need them.

Santul Nerkar is a copy editor at FiveThirtyEight.

Filed under

Do People Who Paid Taxes Electronically For Their 2018 Or 2019 Tax Return Need To Provide Their Bank Account Information

Yes. While the IRS retains information used to deposit money into accounts, it is not authorized to use payment information provided to withdraw money from accounts. If someone owed taxes and paid them electronically , they will need to use the IRS Get My Payment tool to provide their bank account information if they dont want to wait for a paper check.

Read Also: Get My Stimulus Payment 1400

What Steps Do I Need To Take To Receive An Economic Impact Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, you will not need to take any action and the IRS will automatically send you your payment. For some people who are eligible for a payment, the IRS will need more information from you first before they can send you money. You will do this using one of two different IRS portals. It is important that you provide this information using the right IRS portal so that the IRS can process your information quickly.

- If you already filed your 2018 or 2019 taxes, go to the IRS Get My Payment portal to check the status of your payment. This portal will let you know if your payment has been processed and let you know if the IRS needs more information before sending you your payment.

- If your payment has already been processed, the IRS does not need any more information from you at this time.

- If you paid additional taxes when you filed your tax return, it is possible that the IRS does not have your payment account information to direct deposit your payment. You can provide that directly in the portal so that they can process this information quickly and send you your payment. If the IRS does not have your direct deposit information and you dont provide it to them, your payment will be sent to you by check to the address they have on file.

If I Haven’t Filed My 2019 Return Yet Should I Do That Now Or Wait

There’s an opportunity to manipulate the amount of your stimulus check if you haven’t already filed your 2019 return. For some people, you could end up with a larger check depending on whether you file your 2019 return right away or wait to file until after you get your stimulus payment. To find out which is better, use the Stimulus Check Calculator to run the numbers using both your 2018 and projected 2019 returns . If you get a higher amount using your 2018 return, wait to file. If the amount is better using 2019 numbers, then file as soon as you can .

Also Check: When Will The $1400 Stimulus Checks Be Mailed Out

Who Was Eligible To Receive A Stimulus Payment

Generally, U.S. citizens and green card holders were eligible for the stimulus payments. Also, a 2021 law expanded who was eligible for a stimulus payment.

In the first round of payments, joint returns of couples where only 1 member of the couple had a Social Security number were not eligible for a payment unless they were a member of the military. Under a 2021 law, these families became eligible to receive a stimulus payment, including the additional payment for their dependent children.

The 2021 law also made this expansion retroactive to the first round of stimulus payments. If your family did not receive the first stimulus payment because only 1 spouse had an SSN, you could claim the Recovery Rebate Credit when you filed your 2020 federal income tax return.

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

Also Check: H& r Block Stimulus Check

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Stimulus Check Scams And Hoaxes

Of course, popular demand for widely distributed stimulus payments, and the confusing political maneuvering that goes into crafting stimulus bills, creates an information gap that’s easily exploited by scammers.

Even with the first wave of stimulus checks in 2020, we saw bogus email messages that pretended to be from the IRS, promising “an important update on your Covid relief fund.” But they just took you to phishing sites that wanted your Social Security number and other sensitive bits of information.

Following the second stimulus bill at the beginning of 2021, those email phishing attempts were joined by scam phone calls demanding your personal details so that you could be “cleared” to receive more stimulus checks.

In March, as President Biden’s American Rescue Plan was making its way through Congress, new phishing emails promised the moon: a $4,000 stimulus check, a boost in the minimum wage, free meals and, best of all, priority treatment that let you skip lines at COVID-19 vaccination sites.

Most recently, cruel pranksters have been passing around posts on Facebook that a fourth stimulus check worth $2,500 is coming by the end of July. Don’t believe it, and don’t believe the phishing websites that claim to register you for child-tax-credit advance payments.

In fact, most parents and legal guardians don’t need to do anything to get the payments they’ll just show up in your mailbox or bank account.

You May Like: H& r Block Stimulus Tracker

Italy Is Paying What It Can Despite A Struggling Economy

Mortgage payments will be suspended across Italy as part of measures to soften the economic blow of coronavirus on households and lenders offering debt holidays to small firms and families:

Ben Adams #BlackLivesMatter

In May, Italy had approved the equivalent of a $59.6 billion stimulus package for businesses and families in economic crisis, Reuters reported. The bill would pay 400-800 euros per month for two months for those not eligible for welfare and who had no income.

According to Business Insider, Italy had announced that it was giving self-employed and seasonal workers the equivalent of $650, and the website received so much traffic that it crashed the measure, which was enacted in April, was trying to handle one hundred people applying per second, The Local reported.

The country, which already had a weak GDP, Forbes reported, has been dealing with food insecurity and an increase in poverty, The Local reported. The government had passed a $28 billion emergency package on health, small businesses, mortgage relief and other measures to combat those issues in March. In May, Breugel reported that the country passed a bill worth billions for tax and rent credits, as well as other measures:

Italy was one of the first European countries hit hard by the coronavirus and has a total of 250,825 cases and 35,209 deaths, according to the New York Times coronavirus dashboard.

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Read Also: Recovery Rebate Credit Second Stimulus

Third Payments Differed From Previous Economic Impact Payments

The third payments differed from the earlier payments in several respects:

- Income phaseout amounts changed. Payments were reduced for individuals with adjusted gross income of more than $75,000 . The reduced payments ended at $80,000 for individuals and $160,000 for married filing jointly. People above these levels did not receive any payment.

- Payment amounts are different. Most families received $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents received $1,400, while married filers with two dependents received $5,600.

- Qualifying dependents expanded. Unlike the first two payments, the third payment was not restricted to children under 17. Eligible individuals received a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

When Will Economic Impact Payments Be Delivered

The IRS started distributing payments to people who already filed a 2019 or 2018 tax return and provided direct deposit information on April 9. Payments continued to be delivered via direct deposit throughout the month. Paper checks started to be mailed to people without direct deposit information at the end of April. Mailed payments are expected to have a significant delivery delay and some people will not receive payments for several months. See the chart at the end of this article for an estimated timetable for the IRS to mail checks.

If people complete the online form themselves, they should allow at least two weeks to get their payment through direct deposit or four weeks or more to receive their check in the mail.

The IRS Get My Payment tool allows one to look up the status of your payment, including the date when the payment is scheduled to be deposited or mailed.

Recommended Reading: What Was The First Stimulus Check Amount

Canada Is Paying People Up To $1400 Per Month To Stay Home

USA: ONE $1200 check. Even though the hardest hit places have an average rent cost well above that per month.

Canada: $2k/mo for 4 months.

I have nothing clever to say. Our country just plain sucks

Jacquis

Many on social media have been up-in-arms about the comparison being made to the U.S.s one-time payment of $1,200 to Canadas $2,000 per month payments. However, its important to note that the $2,000 figure is in Canadian dollars, which is actually equivalent to $1,400 . Also, $1,400 is the maximum people are eligible for, which means not everyone is receiving it.

Business Insider reported that Canadian Prime Minister Justin Trudeau would provide the following residents 15 years old and up with the chance to apply for up to $1,400 in direct monthly payments for four months . Trudeau also said that he would increase the salaries of essential workers who make less than $1,875.80 per month, spending the equivalent of about $2.2 billion to do so.

Canada has managed its virus fairly well and especially when comparing its population size to its rate of deaths , with 120,132 cases and 8,987 deaths, according to the New York Times coronavirus dashboard.

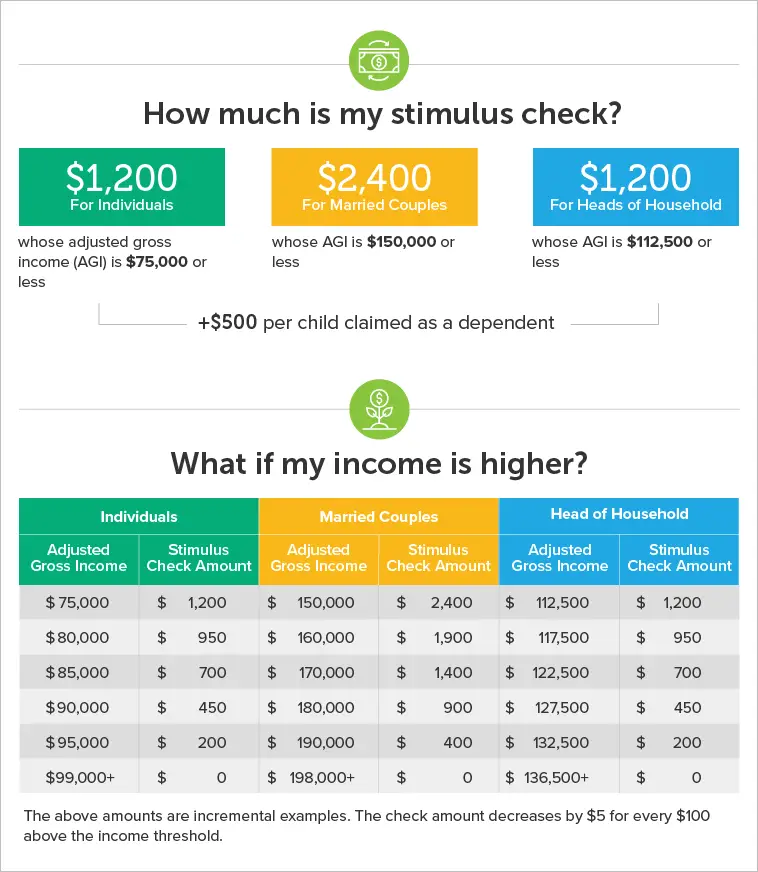

Do I Qualify And How Much Will I Receive

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, the IRS will use information from your 2019 or 2018 tax return or information that you provide to see if you qualify for an Economic Impact Payment.

To qualify for a payment, you must:

- Be a U.S. citizen or U.S. resident alien

- Not be claimed as a dependent on someone elses tax return

- Have a valid Social Security Number . Or if you or your spouse is a member of the military, only one of you needs a valid SSN

- Have an adjusted gross income below a certain amount that is based on your filing status and the number of qualifying children under the age of 17. If you are not required to file taxes because you have limited income, even if you have no income, you are still eligible for payment.

You may be eligible based on the criteria below, even if you arent required to file taxes. If you qualify, your Economic Impact Payment amount will be based on your adjusted gross income, filing status, and the number of qualifying children under age of 17. You will receive either the full payment or a reduced amount at higher incomes.

Recommended Reading: When Can Social Security Recipients Expect The Stimulus Check